Cigar and whisky. Pixabay Image.

This article presents the profits and margins of Altria Group (NYSE: MO) by product category. Altria’s product segments consist of two major category: smokeable products and oral tobacco products. Their definitions are available in this section: Altria’s segments.

Altria’s wine product segment was divested in fiscal year 2021 and is no longer reported as a segment. Furthermore, the profit from Altria’s all-other segment is negligible, and as such, it is not included in this article.

Let’s take a look!

Investors looking for other statistics of Altri Group may find more resources on these pages: Altria profit per employee, Altria revenue by segment, and Altria cash flow.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

- Operating Income By Segment

- Smokeable Products Segment

- Oral Tobacco Products Segment

- E-Vapor Products Segment

- All Other

O2. Can Altria Transform To A Smoke-Free Company?

Operating Income By Product Category

A1. Operating Income From Smokeable Products And Oral Tobacco Products Segments

Profit Growth By Product Category

A2. Profit Growth In Smokeable Products And Oral Tobacco Products Segments

Operating Income Margin By Product Category

A3. Operating Income Margin In Smokeable Products And Oral Tobacco Products Segments

Summary And Reference

S1. Summary

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Operating Income By Segment: Altria’s operating income by product segment is a non-GAAP measure created to evaluate the performance and allocation of resources to a business segment by the management.

According to Altria, operating income by product segments is defined as operating income before general corporate expenses and amortization of intangibles.

Altria said that its interest and other debt expense, net, along with net periodic benefit income, excluding service cost, and provision for income taxes are centrally managed at the corporate level and, accordingly, such items are not presented by segment since they are excluded from the measure of segment profitability reviewed by the management.

Smokeable Products Segment: Altria’s smokeable tobacco products consist of combustible cigarettes manufactured and sold by PM USA and machine-made large cigars and pipe tobacco manufactured and sold by Middleton.

PM USA is the largest cigarette company in the United States and substantially all cigarettes are manufactured and sold to customers in the United States.

Middleton is engaged in the manufacture and sale of machine-made large cigars and pipe tobacco. Middleton contracts with a third-party importer to supply substantially all of its cigars and sells substantially all of its cigars to customers in the United States.

Oral Tobacco Products Segment: Altria’s oral tobacco products consist of MST and snus products manufactured and sold by USSTC and oral nicotine pouches manufactured and sold by Helix.

USSTC is the leading producer and marketer of MST products. The oral tobacco products segment includes the premium brands, Copenhagen and Skoal, and a value brand, Red Seal, sold by USSTC. In addition, the oral tobacco products segment includes on! oral nicotine pouches sold by Helix.

E-Vapor Products Segment: Altria’s e-vapor products segment includes electronic nicotine delivery systems (ENDS), commonly known as e-cigarettes or e-vapor products.

These products heat a liquid containing nicotine, flavorings, propylene glycol, vegetable glycerin, and other ingredients to produce an aerosol that users inhale1.

Unlike traditional cigarettes, e-vapor products do not involve combustion, which reduces exposure to harmful constituents found in cigarette smoke.

Altria participates in this segment through its wholly-owned subsidiary, NJOY, LLC, which offers products like NJOY ACE and NJOY Daily. These products have received marketing granted orders from the FDA for both tobacco and menthol variants.

All Other: Altria’s all other category included (i) the financial results of NJOY (beginning June 1, 2023); (ii) Horizon; (iii) Helix ROW; (iv) Altria’s former financial services business, which completed the wind-down of its portfolio of finance assets in 2022; and (v) the IQOS System heated tobacco business.

Can Altria Transform To A Smoke-Free Company?

Altria Group is actively working towards transforming into a smoke-free company. Its initiative, “Moving Beyond Smoking,” aims to transition adult smokers away from cigarettes and towards potentially less harmful alternatives.

Altria is investing in developing and marketing a variety of smoke-free products, including e-vapor, oral tobacco, and heated tobacco products.

Its goals include growing U.S. smoke-free volumes by at least 35% from the 2022 base and doubling the U.S. smoke-free net revenues to $5 billion by 2028. While the journey is ongoing, Altria is committed to reducing harm and promoting a smoke-free future.

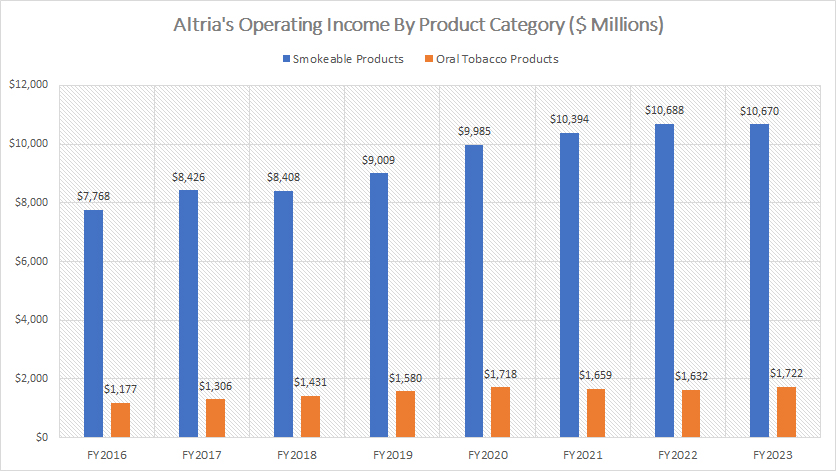

Operating Income From Smokeable Products And Oral Tobacco Products Segments

altria-profit-by-product-category

(click image to expand)

Altria’s smokeable products segment primarily consists of cigarette and cigar sales. In contrast, notable brands in the oral tobacco product category include Copenhagen, Skoal, Red Seal, and on!. The defintions of these segments are available here: smokeable products and oral tobacco products. Altria’s operating income by product category is defined here: operating income by segment.

Altria’s smokeable products segment generates much higher profits than the oral tobacco products segment (formerly refered to as smokeless tobacco products), as depicted in the graph above.

For instance, since fiscal year 2021, the operating income from the smokeable products segment has exceeded $10 billion, whereas the operating income from the oral tobacco products segment has surpassed $1.5 billion during the same timeframe. Therefore, the profit of Altria’s smokeable products segment is about 6 times higher than the profit from the oral tobacco products segment.

In fiscal year 2023, Altria’s smokeable products segment generated $10.7 billion in operating income, approximately six times more than the $1.7 billion operating income produced by the oral tobacco products segment.

A significant trend is that the profits from both product segments have seen substantial growth since fiscal year 2016, reaching record levels in fiscal year 2023.

For instance, since fiscal year 2016, Altria’s operating income from the smokeable products segment has surged by 37%, equating to a $3 billion increase. Likewise, the operating income from the oral tobacco products segment has grown by 42%, representing a $500 million increase during the same period.

Although revenue growth in these segments may have remained stagnant, their profits have remarkably increased, signifying a substantial improvement in overall profitability. This trend underscores the company’s ability to enhance efficiency and reduce costs, driving higher profit margins despite stable revenues.

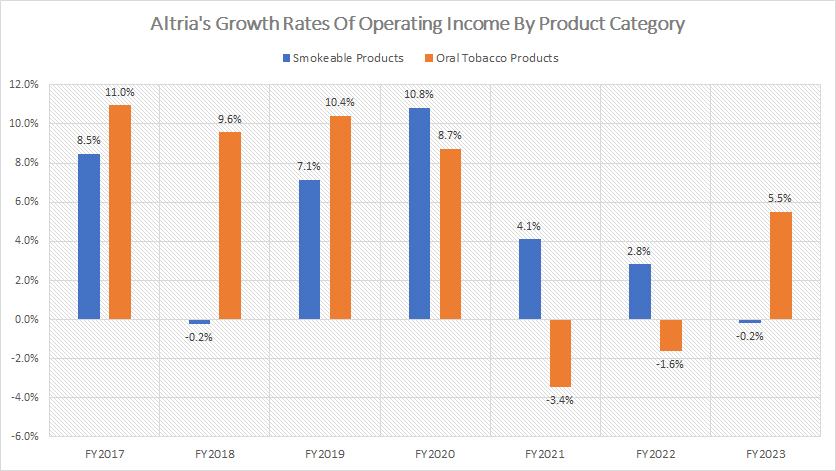

Profit Growth In Smokeable Products And Oral Tobacco Products Segments

altria-growth-rates-of-profit-by-product-category

(click image to expand)

Altria’s smokeable products segment primarily consists of cigarette and cigar sales. In contrast, notable brands in the oral tobacco product category include Copenhagen, Skoal, Red Seal, and on!. The defintions of these segments are available here: smokeable products and oral tobacco products. Altria’s operating income by product category is defined here: operating income by segment.

Altria’s profit growth within the smokeable products segment is slightly better than that of the oral tobacco products segment, as shown in the chart above.

For instance, since fiscal year 2021, the operating income growth within the smokeable products segment has averaged 2.3% annually, whereas the oral tobacco products segment has seen a modest annual growth rate of 0.2% during the same period.

However, in fiscal year 2023, Altria’s operating profit growth in the smokeable products segment remained flat. In contrast, the oral tobacco products segment experienced a notable growth rate of 5.5%.

A notable trend is that the profit growth in Altria’s smokeable products segment has significantly dropped since fiscal year 2020, decreasing from 10.8% in fiscal year 2020 to -0.2% in fiscal year 2023.

On the other hand, the profit growth within Altria’s oral tobacco products segment rebounded to 5.5% in fiscal year 2023, following a decline in the previous two years.

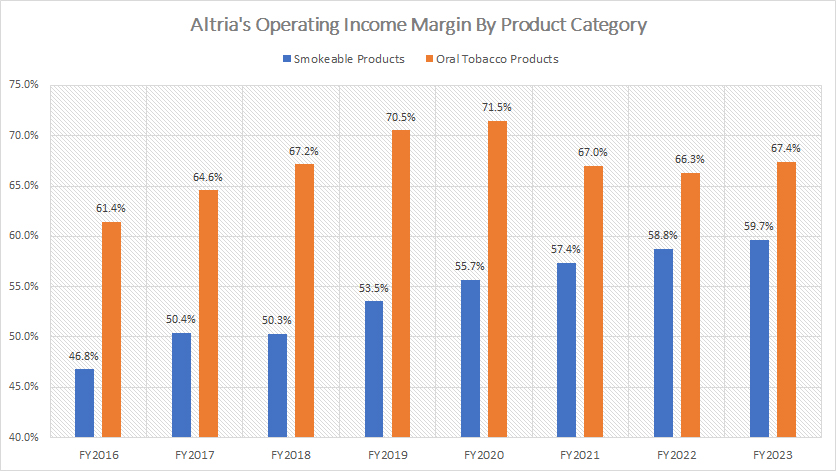

Operating Income Margin In Smokeable Products And Oral Tobacco Products Segments

altria-profit-margin-by-product-category

(click image to expand)

Altria’s smokeable products segment primarily consists of cigarette and cigar sales. In contrast, notable brands in the oral tobacco product category include Copenhagen, Skoal, Red Seal, and on!. The defintions of these segments are available here: smokeable products and oral tobacco products. Altria’s operating income by product category is defined here: operating income by segment.

Despite generating much lower profits, Altria’s oral tobacco products category boasts significantly higher profit margins compared to the smokeable products segment, as illustrated in the graph above.

For instance, over the past three years, the operating income margin for Altria’s oral tobacco products segment has averaged 67%, significantly exceeding the smokeable products segment’s average of 59% during the same period.

In fiscal year 2023, Altria’s operating income margin for the oral tobacco products segment reached 67%, considerably outperforming the 60% margin achieved by the smokeable products segment.

Additionally, the operating income margins for both product segments have seen significant growth since fiscal year 2016. For instance, the operating income margin for Altria’s oral tobacco products segment increased from 61% to 67% over seven years. Meanwhile, the smokeable products segment’s operating income margin rose from 47% to 60% during the same period.

The increasing margins for both product segments indicate that Altria has become more efficient and effective at managing costs and operations, enhancing overall profitability. This improvement reflects the company’s ability to optimize its processes and strategies, resulting in higher profit margins for both the smokeable and oral tobacco products segments.

Summary

Altria’s smokeable products segment remains the major profit driver with higher absolute profits, but the oral tobacco products segment exhibits stronger profit margins.

Additionally, Altria’s increasing margins in both segments indicate improved operational efficiency and cost management.

Overall, Altria’s strategic improvements position both segments well for continued profitability, with the oral tobacco products segment showing promising potential for future growth.

Credits And References

1. All financial data presented in this article was obtained and referenced from Altria’s annual reports published in the company’s investor relation page: Altria’s SEC Filings.

2. Pixabay Images.

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!