Cigar and whisky. Pixabay Image.

This article breaks down Altria Group (NYSE:MO)’s profits by product segment.

Altria’s product segments consist of 3 categories which are:

1. Smokeable Products

2. Oral Tobacco Products

3. Wine Products

Specifically, we are going to explore Altria’s adjusted operating companies income or adjusted OCI by product segment.

The adjusted OCI is a non-GAAP metric adjusted by Altria to evaluate the performance and allocation of resources to a business segment by the management.

According to Altria, OCI for segments is defined as operating income before general corporate expenses and amortization of intangibles.

Adjusted OCI is further refined by Altria’s management to exclude certain income and expense items that management believes are not part of underlying operations.

These special items may include loss on early extinguishment of debt, restructuring charges, asset impairment charges, acquisition-related and disposition-related costs, COVID-19 special items, equity investment-related special items, certain tax items, charges associated with tobacco and health and certain other litigation items, non-participating manufacturer (“NPM”) items, etc.

Altria’s management believes that adjusted financial measures provide useful additional insight into underlying business trends

and results, and provide a more meaningful comparison of year-over-year results.

Again, Altria’s management does not view any of these special items to be part of the company’s underlying results as they may be highly variable, may be unusual or infrequent, are difficult to predict and can distort underlying business trends and results.

That said, let’s have a look at Altria’s profitability by product segments.

Altria Profits By Product Segment Topics

1. Smokeable Products Adjusted OCI

2. Oral Tobacco Products Adjusted OCI

3. Wine Products Adjusted OCI

4. Summary

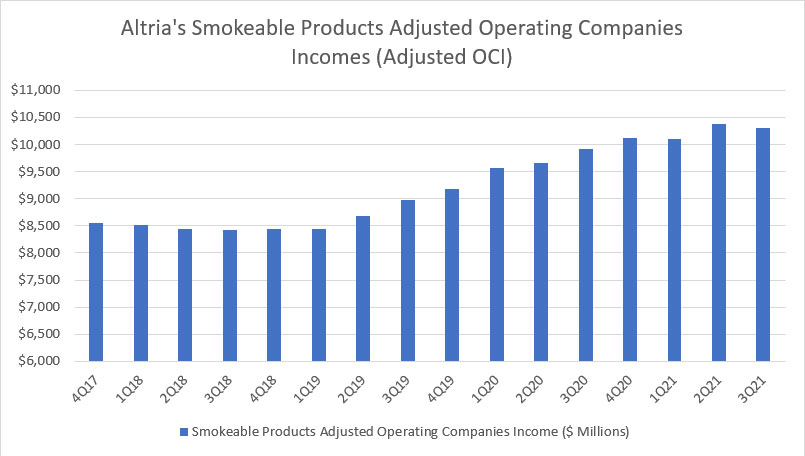

Smokeable Products Adjusted OCI

Altria’s smokeable products adjusted OCI

Altria’s smokeable products segment includes primarily the sales of cigarettes and cigars.

Some popular brand names for cigarettes and cigars are Marlboro and Black & Mild.

Moreover, the smokeable products segment is the most important segment and also the largest profit contributor, delivering 85% of the total adjusted OCI to the company as of fiscal 3Q 2021 on a TTM basis.

All told, Altria’s smokeable products adjusted OCI has been on a growing trend since fiscal 2017 as seen in the chart above.

In particular, Altria’s adjusted OCI for cigarettes and cigars grew exceptionally well in fiscal 2019 and 2020.

As of fiscal Q3 2021, Altria’s adjusted OCI for the smokeable products segment came in at $10.3 billion USD on a TTM basis, a record high and was up 4% from a year ago.

On a long-term basis, Altria’s smokeable products adjusted OCI has been on a steady rise, indicating that this particular product segment has been doing quite well.

Since fiscal 2017, Altria’s smokeable products adjusted OCI has grown from $8.5 billion to slightly over $10 billion as of fiscal 2021, representing a compounded annual growth rate (CAGR) of around 5%.

In short, Altria’s smokeable product segment has been performing quite well as reflected in the growing adjusted OCI.

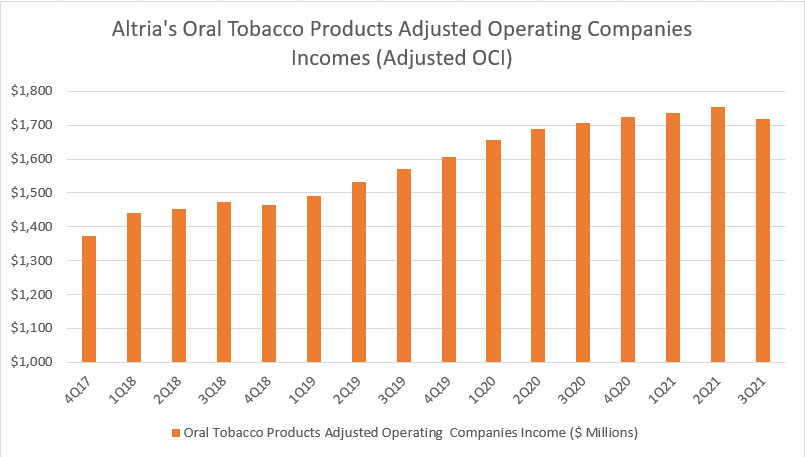

Oral Tobacco Products Adjusted OCI

Altria’s oral tobacco products adjusted OCI

The oral tobacco product is another important segment for Altria and is used to be called the smokeless tobacco product segment.

That said, Altria’s oral tobacco product contributed about 14% of the company’s total adjusted OCI as of fiscal 3Q 2021 on a TTM basis.

Some notable brand names under the oral tobacco product category are Copenhagen, Skoal, Red Seal and on!.

According to the chart above, Altria’s oral tobacco products adjusted OCI has been rising since fiscal 2017 and reached as much as $1.7 billion USD on a TTM basis as of fiscal 2021 Q3, one of the highest figures ever reported.

The Q3 2021 result represents a growth rate of about 1% year-over-year or a decline of about 2% from the prior quarter.

Despite having a moderate result in fiscal Q3 2021, Altria’s adjusted OCI for the oral tobacco products segment has been on a steady rise on a long-term basis, and it grew particularly well in fiscal 2019 and 2020.

Since fiscal 2017, Altria’s oral tobacco products adjusted OCI has grown from $1.4 billion to the latest $1.7 billion USD, representing a compounded annual growth rate (CAGR) of around 6%.

Similarly, Altria’s oral tobacco product segment also has been performing quite well in view of the growing adjuted OCI.

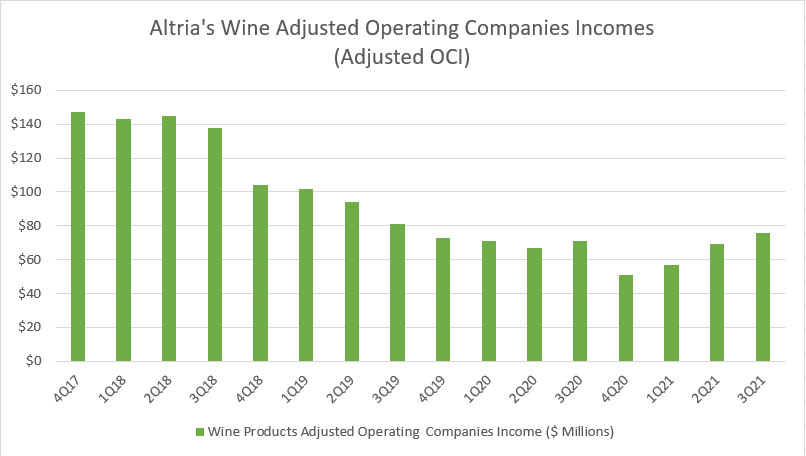

Wine Products Adjusted OCI

Altria’s wine products adjusted OCI

Apart from cigarettes and cigars, Altria is also involved in producing and distributing wine products through Ste. Michelle.

Ste. Michelle Wine Estates Ltd. or Ste. Michelle is a wholly-owned subsidiary of Altria and is engaged in the production and sale of wine.

According to the chart above, Altria’s wine products adjusted OCI has not been as good as its other product segments adjusted OCI.

As seen, Altria’s wine products adjusted OCI has been declining since fiscal 2017, reaching only $76 million as of fiscal 3Q 2021 on a TTM basis, one of the lowest figures ever reported.

Despite the declining profits, Altria’s adjusted OCI for the wine segment has recovered significantly in fiscal 2021 compared to fiscal 2020 as reflected in the rising adjusted OCI figures.

On a long-term basis, Altria’s wine products adjusted OCI is still declining and reached multiple lows as of fiscal 2021.

Since fiscal 2017, Altria’s adjusted OCI for the wine segment has declined from $147 million to only $76 million in the latest quarter, representing a CAGR of about -16% over the last 4 years.

In short, Altria’s wine business has not been doing so well.

Summary

To recap, Altria has done particularly well in the smokeable and oral tobacco products segments in terms of the adjusted OCI.

However, the company has been seeing the adjusted OCI for the wine segment slipping since fiscal 2017 and reached record lows in fiscal 2021.

Therefore, Altria’s core business segments, particularly the smokeable and oral tobacco products segments, have been having strong performance and profits are still growing in both of these product segments.

While the growth rates are not anywhere considered stellar, the steady performance is what counts in Altria’s businesses.

Moreover, Altria’s stocks are all about dividend income.

Therefore, dividend investors in Altria’s stock should be glad to know that the company’s cigarette and cigar businesses are still performing quite well despite the continuous decline of cigarette sales all these years.

In this aspect, dividend investors can expect to have a growing dividend from Altria given that the current trend of profit growth is expected to persist into the future.

Credits And References

1. All financial data in this article was obtained and referenced from Altria’s annual and quarterly filings which are available in Altria’s SEC Filings.

2. Featured images in this article are used under free commercial license and no attributions are required – Pixabay.

Top Statistics That May Help

- Tesla vs Chinese EV companies in vehicle sales and market valuation

- Mahindra’s commercial and passenger vehicle market share

- Explore 3D Systems’ cash metrics – operating cash flow and cash on hand

- Is Ford Motor Company making any profit?

- Tesla’s vehicle production and vehicle delivery numbers in 2022

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future. Thank you!