A Tesla battery from an electric car. Flickr Image.

While Tesla’s revenue comes primarily from the automotive segment, its energy business still makes serious money.

According to Elon Musk, Tesla’s solar segment could eventually become the same or even bigger than its automotive business.

Although Tesla’s energy business made up less than 10% of total sales in fiscal 2022, it is a business that the company cannot do without as it helps to complement the automotive business.

For example, Tesla’s entire Supercharger network could one day be powered by its own energy generation and storage systems.

Moreover, Tesla not only cross-sells its solar products to its automotive customers but also highly promotes a complete renewable energy experience.

Tesla wants its automotive customers to charge their vehicles with solar energy.

The storage and generation systems definitely play into the narrative.

Speaking of Tesla’s solar sector, the company acquired SolarCity back in 2016.

Since then, Tesla’s energy generation and storage has become a wholly-owned subsidiary and has been on a growing trajectory.

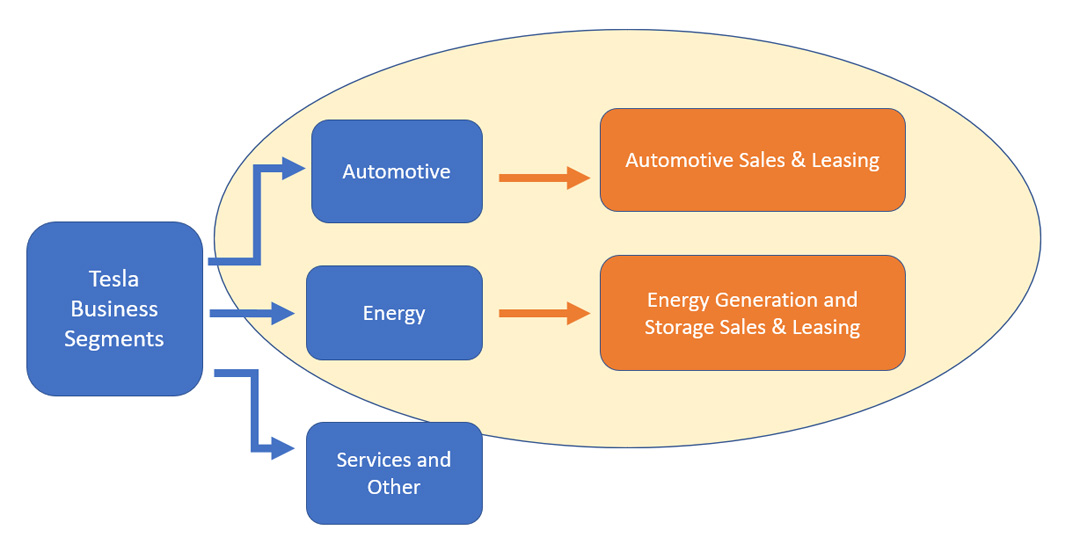

The following snapshot shows the energy and automotive business segments and how each segment generates sales.

Tesla solar vs automotive sector

According to the diagram, Tesla’s energy gets revenue from the sales and leasing of energy generation and storage products.

For leasing revenue, Tesla’s energy derives sales from the leasing of electricity and the leasing of energy generation systems.

In this article, we will look at and compare Tesla’s energy with automotive from the perspective of sales revenue and gross margin.

Additionally, we also look at other aspects of the business, including the growth rates and the percentage of revenue to total sales.

Let’s get started!

Tesla’s Solar Vs Automotive Topics

Annual Figure

A1. Solar Vs Automotive In Revenue

A2. Solar Vs Automotive In Growth Rates

Quarterly Figure

B1. Quarterly Automotive Revenue

B2. Quarterly Solar Revenue

TTM Figure

C1. Solar Vs Automotive In TTM Revenue

C2. Solar Vs Automotive In Gross Margin

Ratio

D1. Ratio of Automotive and Solar To Total Revenue

Summary And Reference

S1. Summary

S2. References and Credits

S3. Disclosure

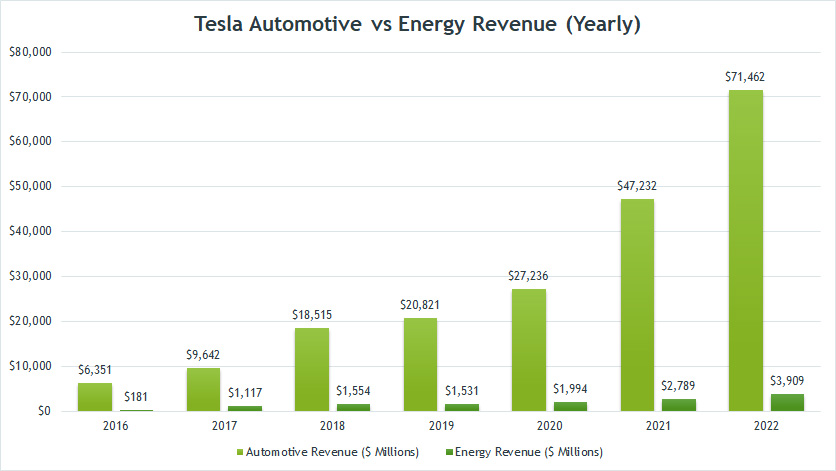

Tesla’s Energy Vs Automotive Revenue (Yearly)

Tesla automotive revenue vs solar revenue (click to enlarge)

According to the chart, Tesla’s automotive revenue is much bigger than its energy counterpart.

For example, the automotive figure was nearly 20X higher in 2022.

In fiscal 2022, Tesla’s automotive revenue reached $71.5 billion compared to only $3.9 billion for solar revenue.

Apart from the revenue figures, Tesla’s automotive also grew at a much faster growth rate than its solar counterpart, roughly twice the rate of that of the energy sector.

While Tesla’s solar sales have reached record highs, it has not always been on a growing trajectory.

For example, Tesla’s solar revenue experienced a minor decline in 2019.

On the other hand, Tesla’s automotive has never experienced a decline in sales in the past 7 years.

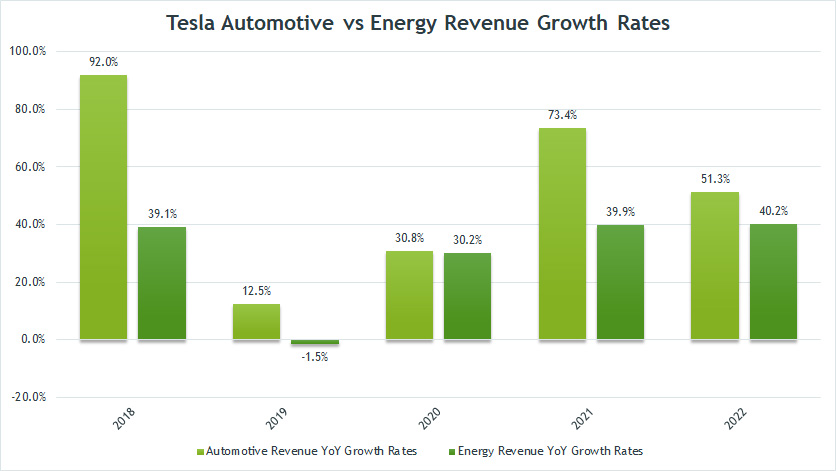

Tesla’s Energy vs Automotive In Growth Rates

Tesla automotive vs solar in growth rates (click to enlarge)

In terms of growth rates, Tesla’s automotive revenue grew much faster than the solar revenue between 2018 and 2022.

Moreover, some of the automotive growth rates are more than twice the growth rates of the energy revenue.

For example, Tesla’s automotive grew by 73% compared to 40% in the solar segment in 2021.

In 2020, both the automotive and solar sectors grew at about the same rate which was 30% year on year.

As mentioned, Tesla’s energy could experience some setbacks in sales growth and it occurred in fiscal 2019 whose growth rate was -1.5%.

Despite some setbacks, the average growth rate for Tesla’s energy is roughly 30% between 2018 and 2022.

However, the average growth rate for Tesla’s automotive revenue is much higher at 52% during the same period.

As of 2022, Tesla’s energy revenue grew by 40% from a year ago, a much higher growth rate compared to the average figure.

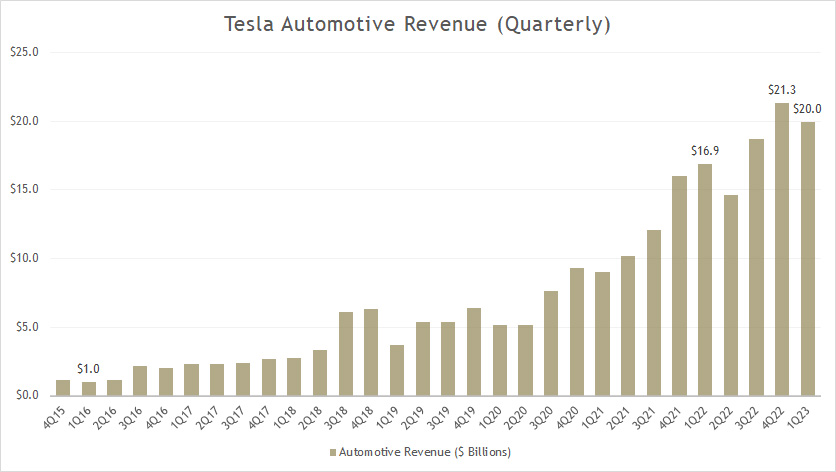

Tesla’s Automotive Revenue (Quarterly)

Tesla’s automotive revenue (click to enlarge)

On a quarterly basis, Tesla’s automotive revenue growth has been nothing short of exponential, growing from just $1 billion of sales in Q4 2015 to $20 billion as of 1Q 2023.

The compounded annual growth rate (CAGR) for Tesla’s automotive revenue grosses over 50% between fiscal 1Q 2016 and 1Q 2023.

The record growth of Tesla’s automotive segment has been driven largely in part by the exponential sales of its flagship model, the Model 3.

The Model Y which debuted in 2020 also contributed to Tesla’s record revenue growth in the automotive segment.

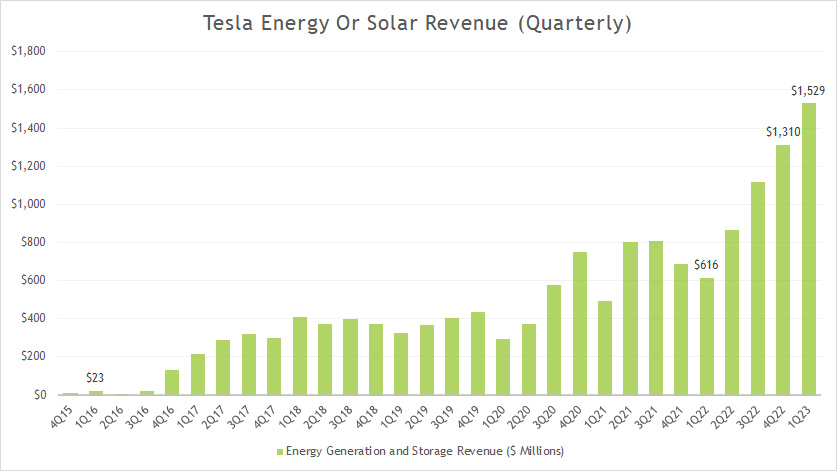

Tesla’s Solar Revenue (Quarterly)

Tesla’s solar revenue (click to enlarge)

While Tesla’s solar revenue has remained flat prior to 2020, the growth came roaring back in 2020 and the sector has done particularly well since then.

As of Q1 2023, Tesla’s solar or energy revenue soared beyond $1.5 billion for the first time, representing a YoY growth rate of 150%.

Tesla has enjoyed robust energy revenue growth after the acquisition of SolarCity in 2016.

As seen in the chart, Tesla experienced a burst of solar revenue in 2016 and the rest is history.

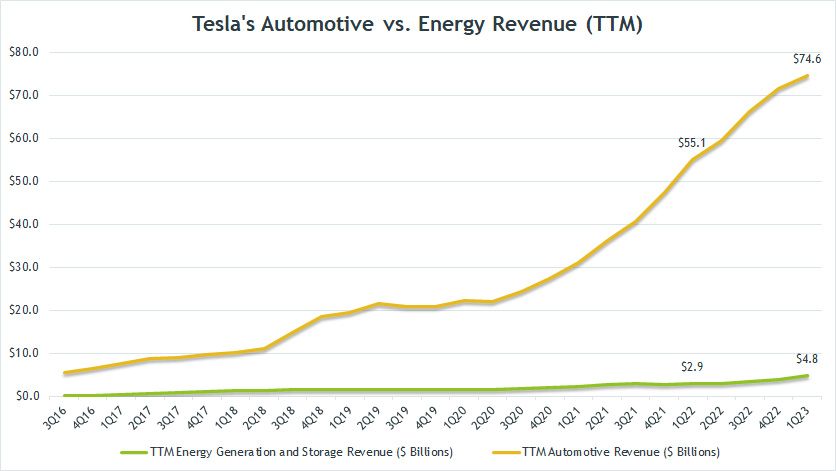

Tesla’s Automotive vs Energy Revenue (TTM)

Tesla’s solar vs automotive revenue (click to enlarge)

The TTM plots above smooth out the bumps in the quarterly plot and better display the long-term trend of both solar and automotive revenue.

According to the chart, Tesla’s solar revenue has been nearly flat while automotive revenue was growing almost exponentially on a TTM basis.

As of fiscal 2023 Q1, Tesla’s solar revenue clocked $4.8 billion on a TTM basis, a record high for Tesla but was still far behind that of the automotive sector.

In the same fiscal quarter, Tesla’s automotive revenue reaches $75 billion on a TTM basis, roughly 15X higher than the reported energy figure in the same quarter.

A trend worth mentioning is that the gap between the 2 plots actually has been on a decline, illustrating the growing solar revenue over the years.

For example, just over 1 year ago, the gap between automotive and energy was about 18X, which was far larger than the latest difference of 15X.

However, it’s still such a huge contrast between the 2 plots to look at in the chart above.

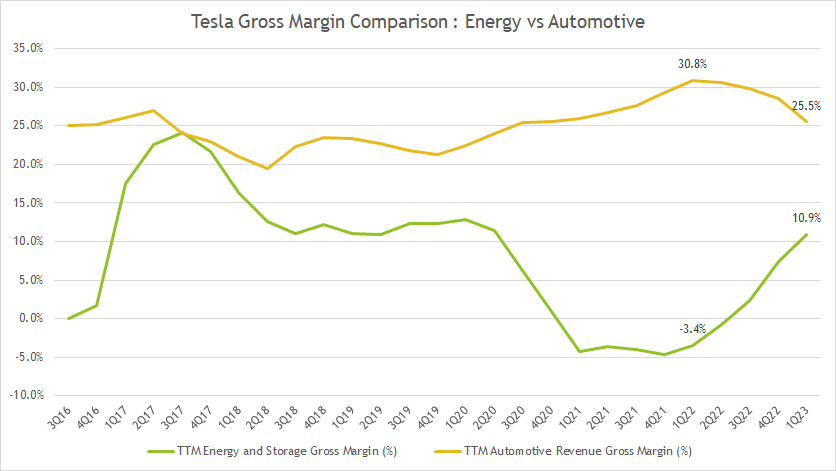

Gross Margin Comparison: Energy vs Automotive

Tesla’s solar vs automotive gross margin (click to enlarge)

In terms of gross margin, we can see that Tesla’s automotive gross margin has been relatively consistent with only minor fluctuation between 2016 and 2023.

That said, we can see that Tesla’s automotive gross margin remains roughly the same between 2016 and 2023 on a TTM basis, which was about 25%.

The consistency in gross margin illustrates Tesla’s operating efficiency which has been a result of effective cost management.

Apart from effective cost control, Tesla Automotive also has achieved the needed sales volumes to maintain the gross margin.

On the flipped side, Tesla’s solar sector has been in the opposite direction, with gross margin plummeting to a new low (below zero) in 2021.

The reason behind the plummeting gross margin for Tesla’s energy sector can be due to a high overhead during the manufacturing or installation process.

One prime example is Tesla’s solar roof.

According to Green Tech Media, Tesla Solar Roof is both too costly to install and requires skillful contractors to execute at the level of a professional roofer, preventing leaks and ensuring decades of durability.

The high level of professionalism needed often means a high cost of goods sold for the company.

Fortunately, things took a positive turn in 2022 when Tesla’s solar gross margin began to recover considerably and totaled a massive 11% as of 1Q 2023, the best record since 2021.

Does that mean a turnaround is just around the corner for Tesla’s energy business? Yes, possibly.

While solar profitability reached record highs in 2023, it was still considerably low compared to that of Tesla’s automotive segment, with gross margin clocking less than half of that reported in the automotive segment.

In short, Tesla’s automotive has much better profitability than the energy segment.

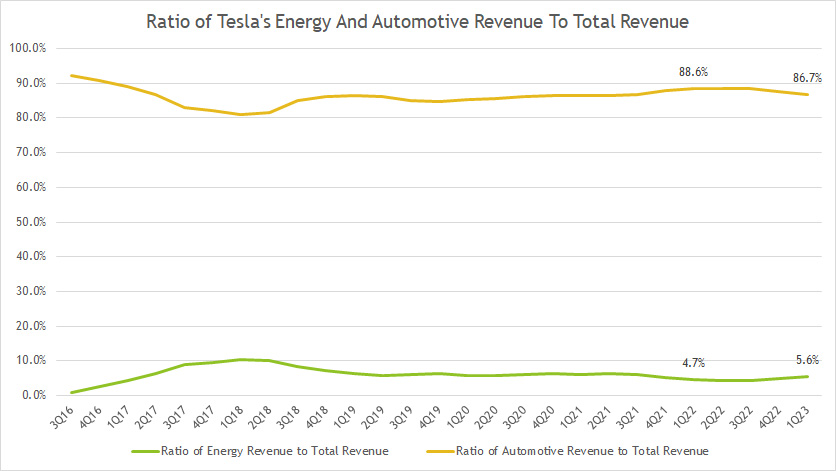

Ratio Of Tesla’s Automotive And Solar Revenue To Total Revenue

Tesla’s solar and automotive revenue to total revenue ratio (click to enlarge)

According to the chart above, Tesla’s automotive revenue makes up nearly 90% of total revenue, whereas the energy business takes up only 5% of total sales.

These figures have been quite consistent over the past several years.

As of Q1 2023, Tesla’s automotive percentage formed 87% of total revenue while that of energy formed only 6% in the same quarter.

Although they haven’t changed much, we can see that the automotive percentage has slightly trended lower while the solar portion has slightly edged up as of 2023 compared to the figures a year ago.

Conclusion

Tesla’s solar is still a much smaller business segment compared to the automotive sector.

While it represents only 6% of total revenue as of 1Q 2023, it has slowly edged higher from a year ago.

Among the results, we can see that Tesla’s automotive is still a much better business in terms of profitability and revenue growth.

However, we are seeing major improvements in Tesla’s solar since 2021.

For example, the gross margin of Tesla’s solar has been expanding and showed huge profitability as of Q1 2023.

All in all, Tesla’s solar is a business that Tesla can’t do without as it helps greatly the automotive segment.

Therefore, the fact of Tesla’s solar becoming the same or even bigger than the automotive may soon be a reality.

References and Credits

1. All financial figures in this article were obtained and referenced from Tesla’s financial statements, reports, earnings releases, etc. which are available in: Tesla Press Releases.

2. Images were used under Creative Common Licenses and obtained from Niall Kennedy and National Renewable Energy Lab.

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!

Tesla energy and solar is different. Solar is going down each year since solar city.