Jaguar XF. Flickr Image.

This article presents the breakdown of Jaguar Land Rover (JLR)’s car sales by country and region. For your information, Jaguar Land Rover is a wholly-owned subsidiary of Tata Motors Group. Tata Motors Group is a leading global automaker based in Mumbai, India.

In addition to JLR, Tata Motors Group also fully owns Tata Motors Limited (TML), an automaker based in Mumbai, India that designs, manufactures, and distributes a range of vehicles, including commercial and passenger vehicles, targeting mainly the Indian market.

In this article, we focus only on Jaguar Land Rover’s car sales by country. Jaguar Land Rover was established in 2008 after being acquired by Tata Motors in the same year.

The Jaguar brand vehicles include the luxury Jaguar XE and Jaguar XF as well as the mainstream F-PACE SUV. On the other hand, Land Rover produces popular models such as the Range Rover, Discovery, and Defender.

Keep in mind that the vehicle sales presented in this article are on a wholesale basis and they may differ from the retail-based car sales numbers. Also, the wholesale-based numbers exclude unconsolidated affiliates such as the Chery Jaguar Land Rover China JV.

Let’s look at the details!

Investors interested in other key statistics of JLR may find more resources on these pages:

Wholesales

- JLR global sales,

- Land Rover sales by model,

- Jaguar best selling car,

- Jaguar sales of all car models

Retail Sales

- JLR global sales and sales by country,

- Land Rover sales by model,

- Jaguar sales by model

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Why are Jaguar Land Rover’s vehicle sales concentrated mainly in North America?

Results By Country

A1. Sales In North America, UK, Europe, And China

A2. Percentage Of Sales In North America, UK, Europe, And China

Growth Rates

B1. Sales Growth In North America, UK, Europe, And China

China Sales (Inclusive Of CJLR)

C1. Sales In China With CJLR Included

Summary And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Wholesale: Wholesale for automobile companies refers to the sale of vehicles from manufacturers to dealerships, distributors, or other businesses, rather than to individual consumers. Here are some key points:

-

Bulk Sales: Wholesale transactions typically involve the sale of multiple vehicles in large quantities, which allows manufacturers to move inventory more efficiently.

-

Pricing: Wholesale prices are usually lower than retail prices because they do not include the additional costs associated with selling to individual consumers, such as marketing and dealership overhead.

-

Distribution Channels: Automobile manufacturers often have established networks of dealerships and distributors who purchase vehicles at wholesale prices and then sell them to the end consumers.

-

Inventory Management: Wholesale helps manufacturers manage their production schedules and inventory levels by ensuring a steady flow of vehicles to the market.

-

Incentives: Manufacturers may offer incentives, such as volume discounts or financing deals, to encourage dealerships and distributors to purchase more vehicles.

By focusing on wholesale transactions, automobile companies can streamline their operations and ensure that their vehicles reach a wide market efficiently.

North America: North America includes the United States Of America, Canada, and Mexico.

In addition to these countries, North America encompasses several other nations and territories, including Central American countries (such as Guatemala and Honduras), island nations in the Caribbean (like Cuba and Jamaica), and Greenland, an autonomous territory within the Kingdom of Denmark.

China: China includes Hong Kong and Taiwan.

United Kingdom (U.K.): The United Kingdom (U.K.) is a sovereign country located off the northwestern coast of mainland Europe. It comprises four constituent countries: England, Scotland, Wales, and Northern Ireland.

Chery Jaguar Land Rover (CJLR): Chery Jaguar Land Rover (CJLR) is a 50:50 joint venture between the Chinese automaker Chery Automobile and the UK-based Jaguar Land Rover (JLR), which is a subsidiary of Tata Motors.

Established in November 2012, CJLR aims to produce Jaguar and Land Rover vehicles in mainland China1. The company’s first assembly plant is located in Changshu, Jiangsu, China, and it began production in October 2014.

CJLR focuses on manufacturing premium vehicles, including models like the Range Rover Evoque, Land Rover Discovery Sport, and various Jaguar models. The joint venture allows JLR to expand its presence in the Chinese market while leveraging Chery’s manufacturing capabilities.

Why are Jaguar Land Rover’s vehicle sales concentrated mainly in North America?

Jaguar Land Rover’s vehicle sales are concentrated in North America due to several factors:

-

Market Demand in North America

-

North America has a substantial demand for premium SUVs and luxury off-road vehicles, which Jaguar Land Rover (JLR) specializes in. Models like the Range Rover, Defender, and Discovery resonate strongly with the preferences of consumers in the U.S. and Canada.

-

JLR benefits from the popularity of SUVs, which now dominate the vehicle sales mix in this region.

-

-

High-Profit Margins

-

JLR’s product mix in North America leans heavily toward high-margin vehicles. Larger luxury SUVs, such as Range Rovers, generate more revenue per unit sold compared to compact cars.

-

Selling in a market where consumers are willing to pay a premium for luxury vehicles adds significantly to JLR’s bottom line.

-

-

Branding and Heritage

-

Land Rover has cultivated a strong association with adventure, luxury, and British craftsmanship. This branding resonates with North American buyers seeking high-end vehicles with off-road capability.

-

North America represents one of JLR’s key markets where their luxury branding efforts have yielded long-standing loyalty and recognition.

-

-

Economic Stability and Consumer Affluence

-

North America’s economic conditions, with higher average disposable incomes compared to emerging markets, make it a fertile ground for luxury brands like JLR.

-

Financing options, low-interest rates (historically), and favorable tax incentives for large SUVs also contribute to the demand.

-

-

Extensive Dealer Network

-

JLR has invested heavily in creating a strong network of dealerships and service centers in North America. This accessibility and high-quality post-purchase experience attract more buyers.

-

The robust dealer infrastructure helps in providing luxury service experiences that cater to consumer expectations.

-

-

Competitive Edge in Luxury Off-Roading

-

JLR vehicles like the Land Rover Defender and Range Rover offer unmatched off-road capabilities combined with luxury, giving them a unique selling proposition in a market where rugged, versatile luxury vehicles are in high demand.

-

-

Regulatory and Size Trends

-

In North America, larger vehicles like SUVs face less stringent regulations compared to smaller vehicles in European markets. This regulatory leniency aligns well with JLR’s portfolio, which features larger luxury SUVs.

-

The geographic landscape of North America, with open highways, rural areas, and national parks, complements the use-case for JLR’s off-road-capable vehicles.

-

These factors have collectively contributed to JLR’s significant vehicle sales in North America.

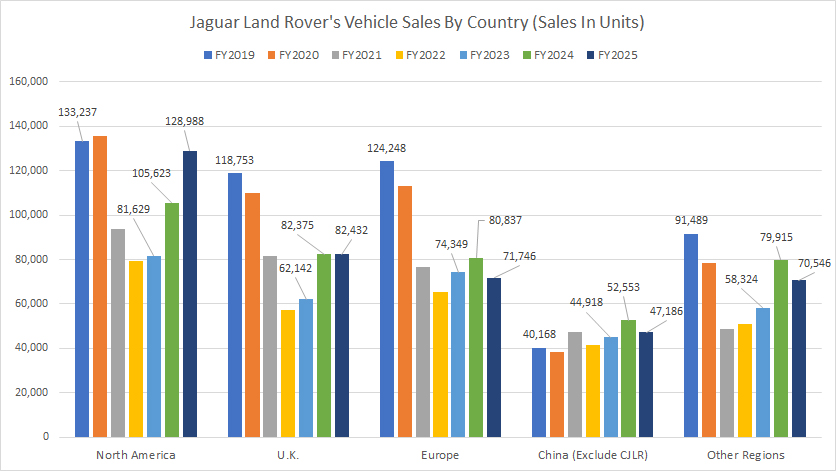

Sales In North America, UK, Europe, And China

Jaguar Land Rover car sales by region

(click image to enlarge)

JLR’s largest markets, by sales volume, are North America, the United Kingdom, Europe, and China. These four regions represent the top sales regions for Jaguar Land Rover. China’s sales exclude CJLR, a joint-venture between Chery and JLR. More information about CJLR is available here: CJLR.

Since fiscal year 2019, North America has been Jaguar Land Rover’s (JLR) largest market, as reflected in the chart above. In fiscal year 2025, JLR delivered 129,000 vehicles in the region — a notable increase of 23,000 units or 23% compared to the previous year. On average, JLR sold 105,000 vehicles annually in North America between fiscal years 2023 and 2025.

The United Kingdom (UK) ranked as JLR’s second-largest market after North America in fiscal year 2025. During this period, the automaker shipped 82,400 vehicles in the UK, maintaining the same volume as the previous fiscal year. Over the three-year span from fiscal years 2023 to 2025, JLR averaged 75,000 vehicle sales per annum in the UK.

Europe, excluding the UK, was JLR’s third-largest market in fiscal year 2025, with total vehicle sales reaching 71,700 units. Between fiscal years 2023 and 2025, JLR sold an average of 76,000 vehicles per year in the region.

China followed as JLR’s fourth-largest market in fiscal year 2025, with the company delivering 47,200 vehicles (excluding sales from CJLR). Between fiscal years 2023 and 2025, JLR averaged 48,000 vehicle sales annually in China.

A significant trend over the years has been the decline in JLR’s vehicle sales across most regions and countries since fiscal year 2019. By fiscal year 2025, JLR’s sales volumes in most markets remained well below pre-pandemic levels.

For instance, JLR delivered 130,000 vehicles in North America in fiscal year 2019 and nearly 140,000 in fiscal year 2020, results that have not been matched or surpassed in the post-pandemic era.

China stands out as the only region where JLR’s vehicle sales have significantly increased since fiscal year 2019. Sales in China grew from 40,000 units in fiscal year 2019 to 47,200 units in fiscal year 2025 — a rise of over 17% over six years.

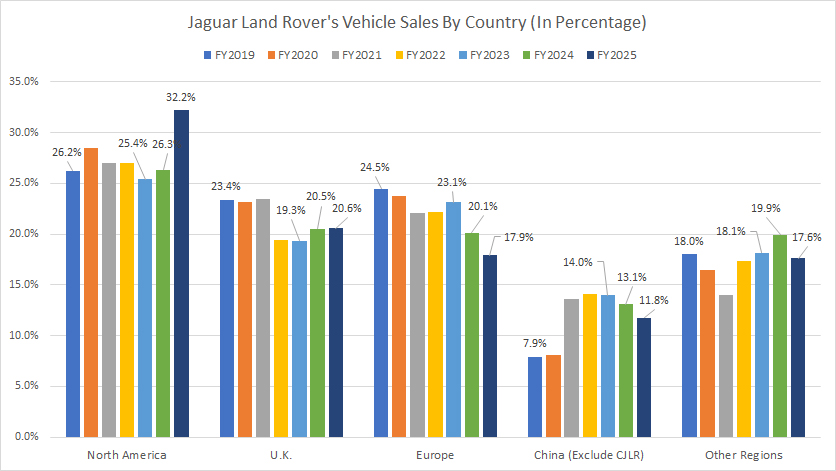

Percentage Of Sales In North America, UK, Europe, And China

Jaguar Land Rover car sales by region in percentage

(click image to enlarge)

JLR’s largest markets, by sales volume, are North America, the United Kingdom, Europe, and China. These four regions represent the top sales regions for Jaguar Land Rover. China’s sales exclude CJLR, a joint-venture between Chery and JLR. More information about CJLR is available here: CJLR.

In fiscal year 2025, Jaguar Land Rover’s (JLR) combined vehicle sales from North America, the UK, Europe, and China accounted for over 80% of the company’s global sales volume.

North America emerged as JLR’s largest market in fiscal year 2025, contributing 32% of the company’s global vehicle sales volume.

The UK and Europe followed as the second and third largest markets, with the UK accounting for 21% and Europe 18% of JLR’s global sales volume in the same fiscal year.

China ranked as the fourth largest market, contributing approximately 12% to JLR’s total sales volume in fiscal year 2025. Notably, since fiscal year 2019, most regions have seen a decline in their sales contributions, except for North America and China.

For instance, North America’s contribution increased from 26% in fiscal year 2019 to 32% in fiscal year 2025. Similarly, China’s share rose from less than 10% in fiscal year 2019 to 12% in fiscal year 2025. It is important to note that the sales figures for China exclude contributions from CJLR.

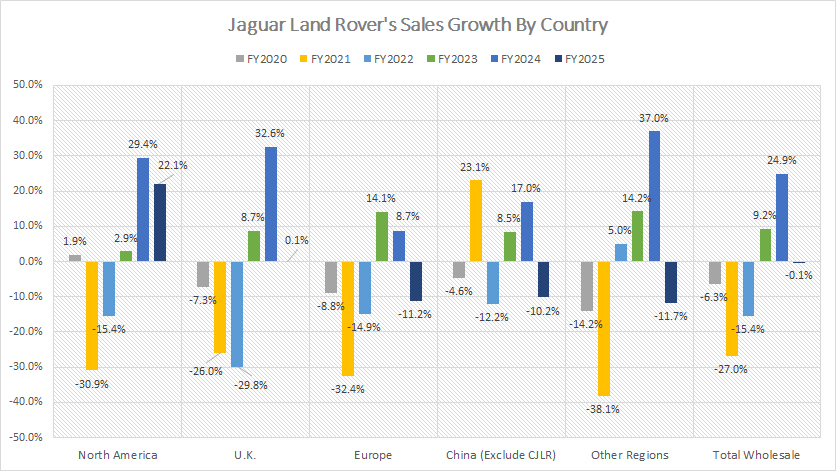

Sales Growth In North America, UK, Europe, And China

Jaguar Land Rover car sales by region growth rates

(click image to enlarge)

JLR’s largest markets, by sales volume, are North America, the United Kingdom, Europe, and China. These four regions represent the top sales regions for Jaguar Land Rover. China’s sales exclude CJLR, a joint-venture between Chery and JLR. More information about CJLR is available here: CJLR.

Jaguar Land Rover (JLR) has experienced significant sales growth across all regions and countries since fiscal year 2023, as illustrated in the chart above.

Before fiscal year 2023, JLR’s car sales growth was largely negative, reflecting the challenges posed by factors such as the COVID-19 disruption.

In fiscal year 2025, JLR’s total wholesale growth remained flat on a consolidated basis. However, North America emerged as a standout market, with sales increasing by 22% year-over-year — outpacing all other regions significantly.

In contrast, JLR’s car sales in the UK were flat in fiscal year 2025 compared to the previous year. Despite this, the average annual growth rate of car sales in the UK stood at an impressive 14% between fiscal years 2023 and 2025.

Meanwhile, sales in Europe (excluding the UK) saw an 11% decline in fiscal year 2025. Over the same three-year period, the average annual growth rate in Europe was a modest 4%.

In China, JLR’s fiscal year 2025 car sales declined by 10% year-over-year. Yet, between fiscal years 2023 and 2025, the average annual growth rate in this market remained at 5%.

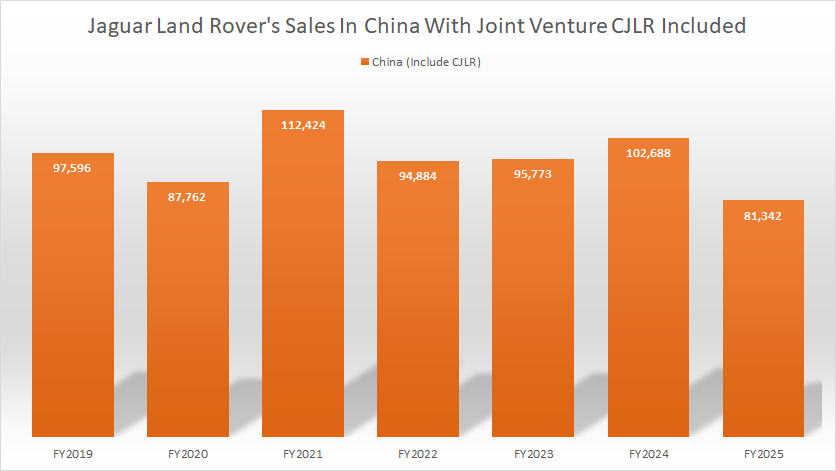

Sales In China With CJLR Included

jaguar-land-rover-china-sales-include-cjlr

(click image to enlarge)

Chery Jaguar Land Rover (CJLR) is a 50:50 joint venture between the Chinese automaker Chery Automobile and JLR. You can find more information about CJLR here: CJLR.

CJLR plays a significant role in boosting Jaguar Land Rover’s (JLR) presence in China, delivering nearly as many vehicles as JLR itself. With the inclusion of sales from the joint venture CJLR, JLR’s overall performance in China surges substantially, as illustrated in the chart above.

In fiscal year 2025, JLR’s total vehicle sales in China, including contributions from CJLR, climbed to 81,300 units. This remarkable figure not only surpassed sales volumes in both the UK and Europe but also rivaled the numbers recorded in North America, establishing China as one of the automaker’s largest and most crucial markets globally (outside of India).

Looking back, an interesting trend emerges: between fiscal years 2021 and 2023, JLR consistently delivered more vehicles in China than in North America. During these years, sales in China reached impressive highs—112,400 units in fiscal year 2021, followed by 94,900 in fiscal year 2022, and 95,800 in fiscal year 2023. These figures underscore China’s pivotal role in JLR’s global strategy.

The strength of CJLR’s contributions cannot be understated. Its robust deliveries, coupled with JLR’s direct sales, solidify China’s position as a force to be reckoned with in the luxury automobile market. The collaboration with CJLR has allowed JLR to effectively cater to local market demands, broaden its product appeal, and tap into China’s growing appetite for premium vehicles.

Furthermore, the strategic partnership with CJLR demonstrates the effectiveness of joint ventures in penetrating competitive markets like China. It has enabled JLR to localize production, reduce costs, and navigate regulatory challenges, while simultaneously leveraging CJLR’s established presence and insights into the Chinese automotive landscape.

With both JLR’s direct sales and CJLR’s contributions, China has become a cornerstone of JLR’s global sales strategy — serving as a model for how automakers can combine direct operations with local partnerships to achieve sustainable growth in key markets.

Insight

North America remains the cornerstone of JLR’s sales strategy due to strong demand for luxury SUVs and high-margin vehicles.

The UK and Europe show steady but limited growth, while China stands out for its remarkable post-pandemic performance and the key role of CJLR in boosting sales.

While other regions struggle to recover, JLR’s strategic partnerships and local production in China serve as a blueprint for sustainable growth in competitive markets.

Credits And References

1. All sales data presented were obtained and referenced from JLR’s car sales reports published on the company’s investor relations page: JLR Investor Relation.

2. Flickr Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.

So they are in the pooper.