Ford Motor Company. Source: Flickr

Ford Motor Company (NYSE: F), a global player in the automobile industry, has committed to an all-electric future. It sold 72,000 EVs in the U.S. and 165,000 EVs globally in 2023, as shown in this article: Ford bev sales US and global.

In Feb 2021, Ford said that it would invest as much as $29 billion ($22 billion in EV and $7 billion in AV) through 2025 to turn the company into a major EV manufacturer, as quoted in this press release.

Ford had 12.5% market share in North America as of 2022, making it one of the largest automotive players in this region apart from General Motors and Toyota.

As a key player in the automotive industry, Ford invests significantly in research and development (R&D). This spending on R&D is considered essential for Ford as it pursues its electrification and autonomous driving goals.

In this article, we will compare Ford Motor’s research and development expenses with Tesla’s to evaluate Ford’s competitiveness in the automotive sector. It is interesting to see how far Ford has progressed in terms of R&D compared to Tesla, a relatively new player in the automotive industry.

Investors interested in General Motor’s research and development may find more information on this page: General Motors R&D spending.

Let’s take a look.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Are Companies With High R&D To Revenue Ratio Taking A Significant Risk?

O3. What Does A High R&D To Expense Ratio Mean?

O4. Where Does Ford Spend Its R&D?

R&D Spending: Ford Versus Tesla

A1. Research And Development Spending

Growth Rates: Ford Versus Tesla

R&D Ratios: Ford Versus Tesla

C1. R&D To Revenue Ratio

C2. R&D To Total Costs And Expenses Ratio

Summary And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

R&D To Revenue Ratio: The research and development expenses to revenue ratio is a financial metric that measures the amount of money a company spends on research and development (R&D) activities as a proportion of its total revenue.

This ratio assesses a company’s innovation investment and ability to generate new products and services. A high R&D expenses to revenue ratio may indicate a company investing heavily in research and development, which could lead to long-term growth and profitability. On the other hand, low R&D expenses to revenue ratio may suggest that a company is not investing enough in innovation and may struggle to compete in the market.

R&D To Expenses Ratio: The R&D to expenses ratio is a financial metric that measures the amount of money a company spends on research and development compared to its total expenses. It is calculated by dividing the company’s R&D expenses by its total expenses for a given period.

The higher the ratio, the more the company invests in research and development relative to its other expenses. Investors and analysts often use this ratio to evaluate a company’s commitment to innovation and potential for future growth.

Are Companies With High R&D To Revenue Ratio Taking A Significant Risk?

Yes, companies with a high R&D-to-revenue ratio are taking a significant risk. Investing heavily in research and development does not always guarantee success. There is always a risk that the company’s R&D efforts may not result in the development of a successful product or service.

However, companies willing to take this risk are often the ones most successful in the long run. By investing in innovation, they can stay ahead of their competitors and create new opportunities for growth and profitability.

What Does A High R&D To Expense Ratio Mean?

A high R&D-to-expenses ratio typically indicates that a company invests significant resources in research and development activities. This suggests that the company is committed to innovation and creating new products or services, which may help it to stay competitive in the long term.

A high ratio may also indicate that the company is pursuing disruptive technologies or new markets that require significant investment in R&D. However, a high R&D to expenses ratio may also suggest that a company is taking on more risk, as R&D projects may not always result in successful products or services.

Ultimately, the interpretation of a high R&D-to-expenses ratio will depend on the specific industry and market conditions in which the company operates.

Where Does Ford Spend Its R&D?

According to Ford Motor Company’s annual report, Ford spends a significant portion of its research and development (R&D) budget on vehicle electrification, connectivity, and autonomous technologies. Additionally, it invests in advanced materials and manufacturing processes to improve the efficiency and sustainability of its operations.

These investments aim to improve the safety, efficiency, sustainability, and overall performance of Ford’s vehicles, as well as to enhance the driving experience for customers.

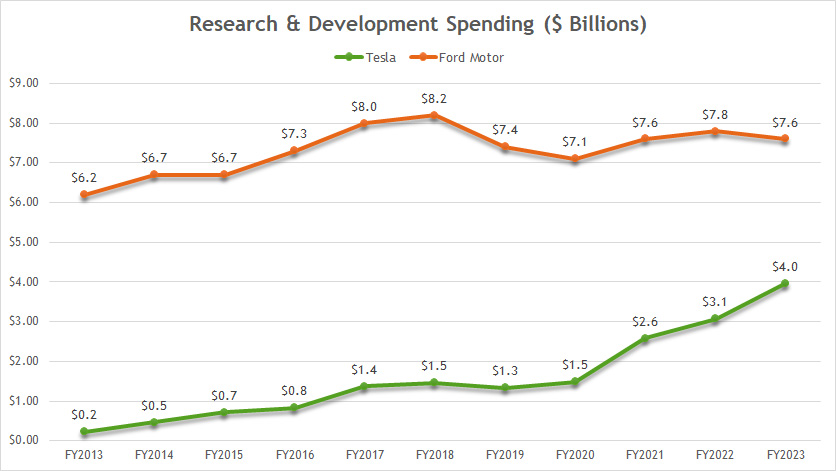

Research And Development Spending

Ford Motor R&D Spending

Ford’s R&D spending has significantly increased since 2013, reaching US$$7.6 billion as of fiscal 2023. Ford’s research and development spending averaged roughly US$7.5 billion between 2019 and 2023.

The same goes for Tesla. Its R&D expense also has significantly increased since 2013, totaling over US$4.0 billion as of fiscal 2023. Between 2019 and 2023, Tesla’s spending on research and development averaged roughly US$2.5 billion.

As Ford spends significantly more on research and development, its average R&D budget is roughly 3X higher than Tesla’s. In fiscal 2023, Ford’s R&D budget was around 90% higher than Tesla’s figure.

Although Ford’s R&D expenditure is much higher, the gap between both companies has significantly narrowed recently. If you have noticed, the difference in R&D expenses between the two automakers was much higher in 2013.

Since 2013, Ford’s R&D spending has risen by only 23%, while Tesla’s figure has increased by nearly 2,000%.

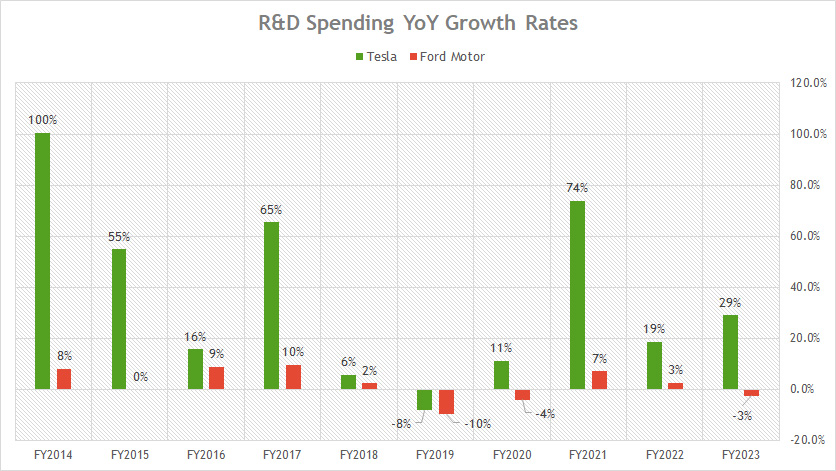

R&D Growth Rates

Ford Motor R&D Spending Growth Rates

Ford’s R&D growth is significantly lower than Tesla’s, as shown in the chart above.

For example, Ford’s R&D growth averaged -1.3% between 2019 and 2023, while Tesla’s figure reached 25% for the same period.

Therefore, Ford’s R&D expenses have decreased on average over the past five years, while Tesla’s R&D expenses have increased.

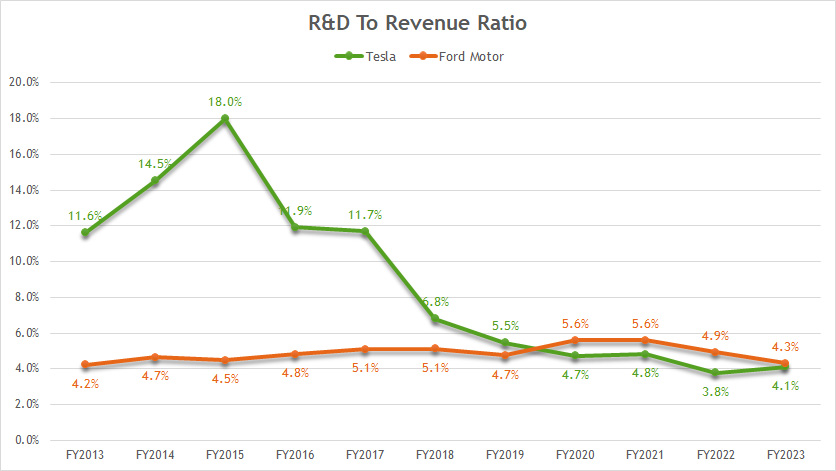

R&D To Revenue Ratio

Ford Motor R&D Spending To Revenue Ratio

The definition of R&D to revenue ratio is available here: R&D To Revenue Ratio.

Tesla used to have a much higher R&D to revenue ratio, topping as much as 18% in 2015, the highest ratio ever measured. However, this figure has significantly declined over time and landed at 4.1% as of 2023.

On the other hand, Ford’s ratio has remained relatively unchanged and came in at 4.3% as of 2023, roughly in line with Tesla’s result.

As a result, both automakers have roughly the same R&D expenses to revenue ratios, indicating that their R&D intensity is around the same level.

For your information, Ford’s total revenue is much higher than Tesla’s revenue.

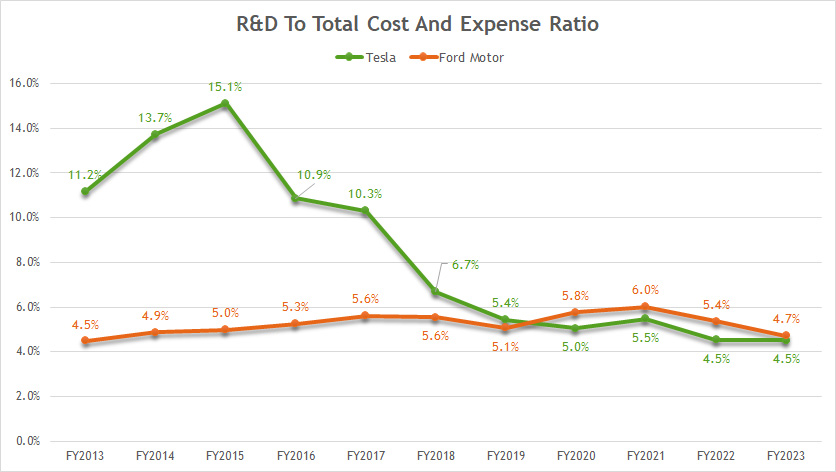

R&D To Total Costs And Expenses Ratio

Ford Motor R&D Spending To Total Costs And Expenses Ratio

The definition of R&D to expenses ratio is available here: R&D To Expenses Ratio. The R&D to expenses ratio indicates the proportion of expenses allocated for research and development.

The higher the ratio, the higher the research and development spending with respect to expenses.

That said, Tesla used to spend a much higher proportion of its total costs and expenses on research and development, with the ratio topping as much as 15% in 2015 and 10% on average in the past. However, Tesla’s ratios have significantly declined over the years and reached only 4.5% as of 2023.

On the other hand, Ford’s ratios have remained relatively flat but declined significantly in 2023 to 4.7%. As a result, Ford Motor and Tesla spend equal portions of their costs and expenses on research and development.

Conclusion

Ford Motor’s research and development budget is much higher than Tesla’s in terms of absolute value. However, with respect to revenue and expenses, Ford Motor’s R&D is at the same level as Tesla’s, indicating that both companies allocate the same proportion of resources to research and development.

References and Credits

1. All financial figures presented in this article were obtained and referenced from Ford Motor and Tesla’s quarterly and annual reports which are available in Ford SEC Filings and Tesla Sec Filings.

2. Featured images in this article are used under Creative Commons License and sourced from the following websites: Ford Asia Pacific and jjkbach.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link to this article from any website so that more articles like this can be created.

Thank you!

I would be very curious to know about how much of the $7.4B Ford spent in 2019 was on Battery Electric Vehicle Technology.

Good point! As far as I know, Ford didn’t disclose the breakdown in the financial statements. But i will try to find this out.