Tesla Model S. Pexels Image.

This article covers Tesla’s inventory turnover ratio and inventory days. For a comprehensive coverage of the automaker’s inventory levels, you may visit this page: Tesla’s total inventory and inventory breakdown.

You may find related statistic of Tesla on these pages:

- Tesla vehicle profit vs Ford Motor,

- Tesla gross margin vs General Motors, and

- Tesla profit per employee.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. What is driving the improvement in Tesla’s inventory turnover?

Total Inventory Turnover

A1. Inventory Turnover Ratio

A2. Days Sales In Inventory

Finished Goods Inventory Turnover

B1. Finished Goods Inventory Turnover Ratio

B2. Finished Goods Inventory Days

Summary And Reference

S1. Summary

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Inventory Turnover Ratio: The inventory turnover ratio is a financial metric measuring how often a company’s inventory is sold and replaced over a specific period, typically a year. It is calculated by dividing the cost of goods sold (COGS) by the average inventory.

This ratio helps businesses understand how efficiently they manage their inventory, indicating whether they effectively sell their stock without overstocking or understocking.

A higher inventory turnover ratio implies that a company is selling its inventory quickly and is generally seen as positive, indicating strong sales or effective inventory management. Conversely, a low turnover ratio could suggest weak sales or excessive inventory levels.

Inventory Days: Inventory days, also known as days inventory outstanding (DIO), is a financial metric that measures the average number of days a company takes to sell its entire inventory over a specific period, typically a year.

It reflects how efficiently a company manages its inventory, indicating how quickly it can convert its inventory into sales. A lower number of inventory days suggests that a company is more efficient at selling its inventory, while a higher number suggests slower sales.

To calculate inventory days, you divide the ending inventory by the cost of goods sold (COGS) for the period, then multiply the result by the number of days in the period.

Finished Goods Inventory: Finished Goods Inventory refers to the stock of completed products that are ready for sale but have not yet been sold. These products have undergone the entire production process, from raw materials to final goods, and are waiting to be distributed to retailers or consumers.

This type of inventory is a crucial component of a manufacturing company’s assets, reflecting both the value of the labor and materials invested in the products. Monitoring and managing finished goods inventory effectively is essential for meeting customer demand, optimizing sales, and maintaining efficient production cycles.

Tesla’s finished goods inventory includes products-in-transit to fulfill customer orders, new vehicles available for sale, used vehicles and energy products available for sale, according to the quarterly and annual reports.

What is driving the improvement in Tesla’s inventory turnover?

Tesla’s improvement in inventory turnover can be attributed to several key factors:

- Enhanced Production Efficiency: Tesla has made significant strides in optimizing its production processes, reducing bottlenecks, and increasing automation. This has allowed the company to produce vehicles more quickly and efficiently, leading to a faster turnover of inventory.

- Strong Demand for Electric Vehicles: The growing global demand for electric vehicles has driven higher sales volumes for Tesla. As more consumers transition to electric vehicles, Tesla’s inventory turnover improves due to increased sales.

- Streamlined Supply Chain: Tesla has worked on streamlining its supply chain, ensuring timely delivery of raw materials and components. This reduces delays in production and helps maintain a steady flow of finished goods.

- Inventory Management Practices: Improved inventory management practices, such as just-in-time (JIT) inventory systems, have helped Tesla minimize excess inventory and reduce holding costs. This approach ensures that inventory levels are closely aligned with market demand.

- Expansion of Product Lines: Tesla’s expansion into new product lines, such as energy storage solutions and solar products, has diversified its revenue streams and contributed to overall inventory turnover.

These factors collectively contribute to Tesla’s improved inventory turnover, reflecting the company’s ability to manage its inventory more effectively and respond to market demands efficiently.

Total Inventory Turnover Ratio

Tesla inventory turnover ratio

(click image to expand)

The definition of inventory turnover ratio is available here: inventory turnover ratio.

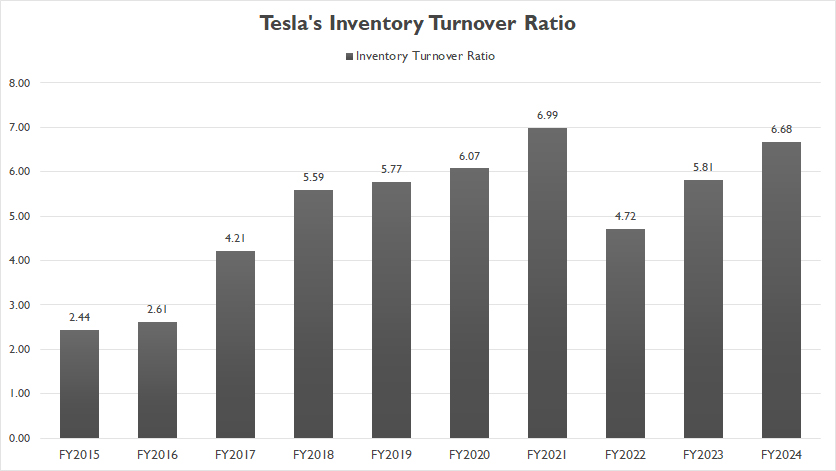

Since fiscal year 2015, Tesla’s inventory turnover ratio has experienced substantial growth, culminating in a record figure of 6.68X by the end of fiscal year 2024.

On average, Tesla recorded an inventory turnover ratio of 5.70X between fiscal year 2022 and 2024.

This remarkable increase highlights Tesla’s significant achievement in optimizing its inventory management and production efficiency.

The higher inventory turnover ratio indicates that Tesla has been able to move its inventory more quickly through the production and sales cycle, reducing holding costs and enhancing cash flow.

Several factors are driving the remarkable improvement in Tesla’s inventory turnover ratio. A notable factor is Tesla’s improving production processes.

Essentially, Tesla has continuously enhanced its manufacturing processes, incorporating advanced automation and lean manufacturing techniques.

These improvements have enabled the company to produce vehicles more efficiently and maintain a steady flow of finished goods.

Days Sales In Inventory

Tesla days of inventory

(click image to expand)

The definition of inventory days is available here: inventory days.

The days of inventory ratio is the number of days it takes for a company to sell its entire inventory. It is calculated by dividing the average inventory by the cost of goods sold and represents how efficiently a company manages its inventory.

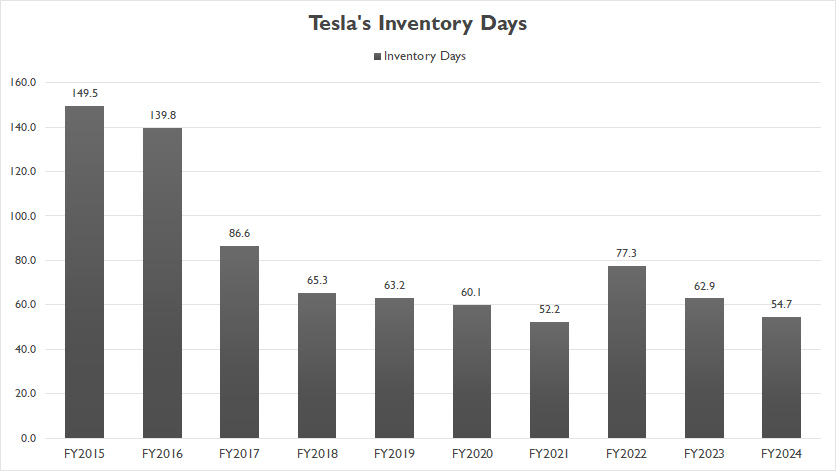

By the end of fiscal year 2024, Tesla’s inventory days declined to a record low of 55 days, down significantly from 63 days a year ago.

On average, Tesla recorded an inventory days of 65 days between fiscal year 2022 and 2024. Since fiscal year 2015, Tesla’s days of inventory has beend down by more than 60%.

Similar to the inventory turnover ratio, the remarkable improvement in Tesla’s days of inventory underscores the company’s significant achievement in inventory management and operational efficiency.

Tesla’s days of inventory, a key metric that indicates how long it takes for a company to turn its inventory into sales, has shown a notable decrease, reflecting the automaker’s enhanced ability to swiftly move products through its supply chain.

By reducing the number of days inventory remains on hand, Tesla not only minimizes holding costs but also ensures that its products are fresh and aligned with current market trends.

Tesla’s enhanced production processes is the key factor in driving the reduction in inventory days. The continuous improvements in manufacturing processes, including automation and lean techniques, have allowed Tesla to produce vehicles more efficiently and respond quickly to market needs.

Finished Goods Inventory Turnover Ratio

Tesla finished goods inventory turnover ratio

(click image to expand)

You may find more information about Tesla’s finished goods inventory here: finished goods inventory. The definition of inventory turnover ratio is available here: inventory turnover ratio.

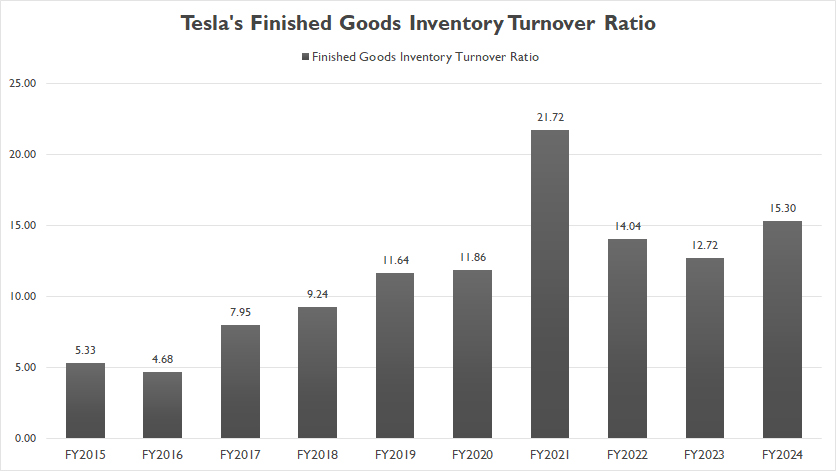

According to the definition, Tesla’s finished goods inventory consists of new vehicles available for sale, used vehicles, and energy products available for sale.

If we focus exclusively on Tesla’s finished goods inventory, the inventory turnover ratio is substantially higher. For instance, by the end of fiscal year 2024, Tesla’s finished goods inventory turnover ratio stood at 15.3X, compared to the 6.7X turnover ratio for total inventory previously discussed.

Simiar to the turnover ratio of total inventory, the turnover ratio of Tesla’s finished-goods inventory has also experienced a similar improvement, rising from only 5.33X ten years ago to 15.3X as of fiscal year 2024.

Again, the reason driving the significant rise in Tesla’s finished-goods inventory turnover ratio is the automaker’s enhanced production efficiency, which has allowed the company to produce vehicles more efficiently and respond quickly to market needs.

Apart from that, Tesla’s strategic inventory management, which incorporates just-in-time (JIT) inventory systems and other best practices, has enabled the automaker to optimize its stock levels.

This approach reduces excess inventory and ensures that the inventory closely aligns with customer demand.

Finished Goods Inventory Days

Tesla finished goods inventory days

(click image to expand)

You may find more information about Tesla’s finished goods inventory here: finished goods inventory. The definition of inventory days is available here: inventory days.

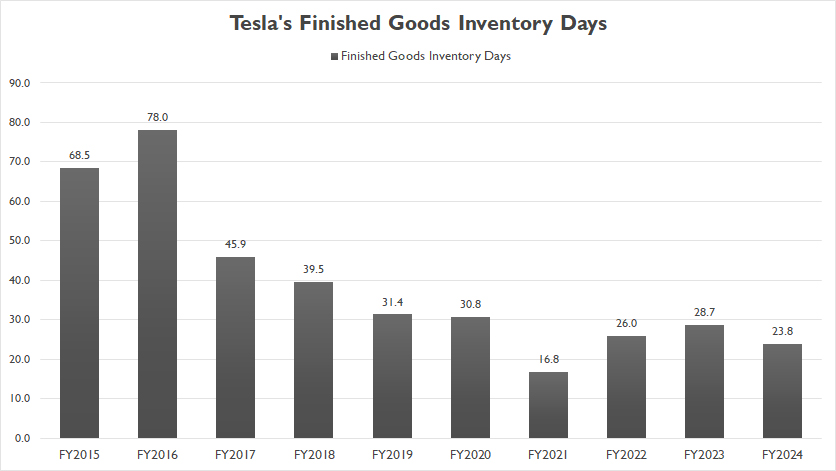

Tesla’s finished goods inventory days arrived at only 24 days as of the end of fiscal year 2024, compared to 29 days a year ago.

In fiscal year 2015, Tesla’s finished goods inventry days marked 69 days. In fiscal year 2024, it was just 24 days, as depicted in the chart above. Therefore, there has been a significant enhancement to Tesla’s inventory management.

Again, Tesla’s strong sales performance over the years is driving this improvement in inventory days.

The growing demand for Tesla’s electric vehicles and clean energy products has resulted in higher sales volumes, enabling the company to maintain lower inventory levels and faster turnover.

Of course, Tesla’s efficient supply chain management has also contributed to the decline in inventory days.

Tesla’s efforts to streamline its supply chain have reduced delays and bottlenecks, ensuring a steady flow of materials and finished goods through the production and sales cycle.

Conclusion

In summary, Tesla’s focus on inventory turnover and days of inventory metrics highlights its commitment to operational efficiency.

The significant growth in inventory turnover ratio and the decrease in days of inventory indicate that Tesla can swiftly move products through its supply chain, ensuring that products are fresh and market-ready.

This agility is crucial in the highly competitive automotive and clean energy markets, where responsiveness to consumer preferences and market trends can make a significant difference.

References and Credits

1. All financial figures presented were obtained and referenced from Tesla’s annual report published on the company’s investor relations page: Tesla Investor Relations.

2. Pexels Images.

Disclosure

We may utilize the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.