A hand full of cash money. Flickr Image.

Cash is the lifeline of a business.

Without cash, even a profitable company can still succumb to a liquidity crisis.

The reason can be that the company does a lot of credit sales and hence, cash is not received on time.

It’s no exception for social media companies such as Meta Platforms, Twitter, Pinterest, and Snap Inc. where cash is critical for these companies’ operations.

In this article, we will look at and compare several cash metrics of Meta, Twitter, Pinterest, and Snap.

These metrics include operating cash flow, free cash flow, net cash from financing activities, and cash margin.

Keep in mind that the comparison of these cash metrics may not be on an apple-to-apple basis but it is close as all of them are operating in the same industry and have the same business model.

Let’s check them out!

Meta, Twitter, Pinterest, And Snap Cash Flow Topics

1. Net Cash From Operations (With Meta)

2. Net Cash From Operations (Without Meta)

3. Operating Net Cash Margin

4. Free Cash Flow (With Meta)

5. Free Cash Flow (Without Meta)

6. Net Cash From Financing Activities

7. Summary

8. References and Credits

9. Disclosure

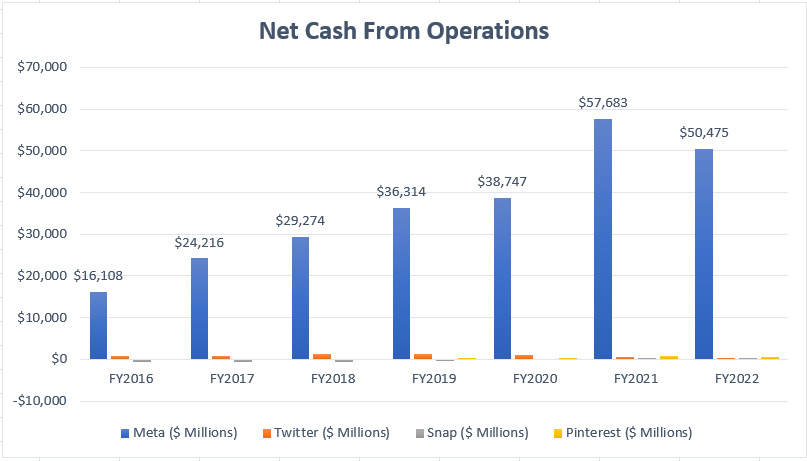

Net Cash From Operations (With Meta)

Meta, Twitter, Snap and Pinterest’s net cash from operations

Let’s first look at the net cash from operations for social media companies such as Meta, Twitter, Snap, and Pinterest as shown in the chart above.

The net cash from operations is a cash metric that measures cash flow used in or provided by the core business operations.

For social media companies, their core business operations stem primarily from selling advertisement spaces on their platforms.

Therefore, the net cash from operations for social media companies measures primarily the amount of cash generated from the sales of advertisement spaces.

From the first look at the chart, Meta has been the dominating figure since fiscal 2016, generating tens of billions of net cash from operations, well above the amount of cash generated by Twitter, Pinterest, and Snapchat.

As of fiscal 2022, Meta’s net cash from operations swelled to a massive $50 billion, far higher than the cash flow of other social media platforms.

Since fiscal 2016, Meta has managed to grow its net cash from operation at a compounded annual growth rate (CAGR) of around 30%, a feat that no other social media company can match.

In contrast, Twitter, Snap Inc., and Pinterest’s net cash from operations look significantly small when compared to that of Meta.

As a matter of fact, Twitter, Snap and Pinterest’s net cash from operations has not even crossed the $5 billion mark as of fiscal 2022.

In short, Meta produces enormous cash that no other social media platforms can match or even come close to.

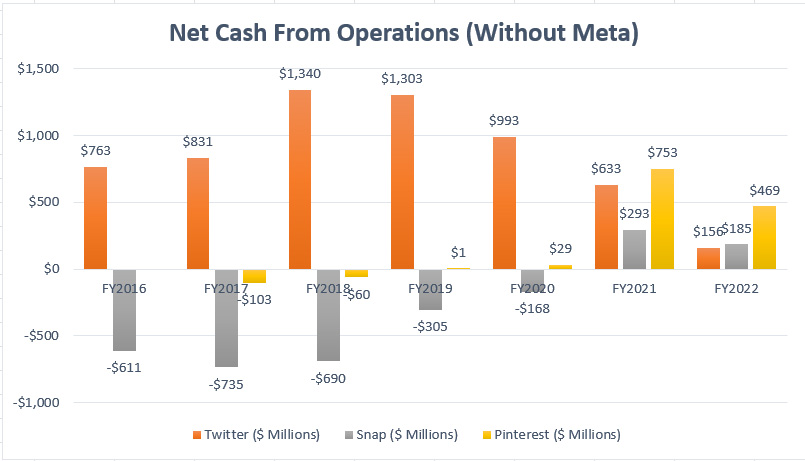

Net Cash From Operations (Without Meta)

Twitter, Snap and Pinterest’s net cash from operations

Without Meta in the chart, Twitter, Snap and Pinterest’s net cash from operations looks much clearer.

Of all social media companies in the chart, Twitter has been the only one that has managed to cross the $1 billion level since fiscal 2018.

However, Twitter’s net cash from operations has been on a slide since fiscal 2020 and reached only $633 million in 2021, a drop of 36% compared to the prior year.

Twitter generated about $156 million of cash flow from operations in the first 6 months of 2022.

For Snapchat and Pinterest, their respective net cash from operations has been mostly in the red, suggesting that these companies have been burning cash instead of producing it.

While Snap and Pinterest have been producing negative operating cash flow, the figures have been narrowing.

In other words, their cash-generating capability has been on a rise.

In fact, Snap and Pinterest’s net cash from operations was the best ever reported in fiscal 2021.

As of fiscal 2022, Snap and Pinterest’s net cash from operations totaled $185 million and $469 million, respectively, down slightly from 2021.

Moreover, Pinterest’s cash flow from operations expanded the fastest and is now rivaling that of Twitter.

The social media company generated half a billion dollars of net cash from operating activities on average since 2021.

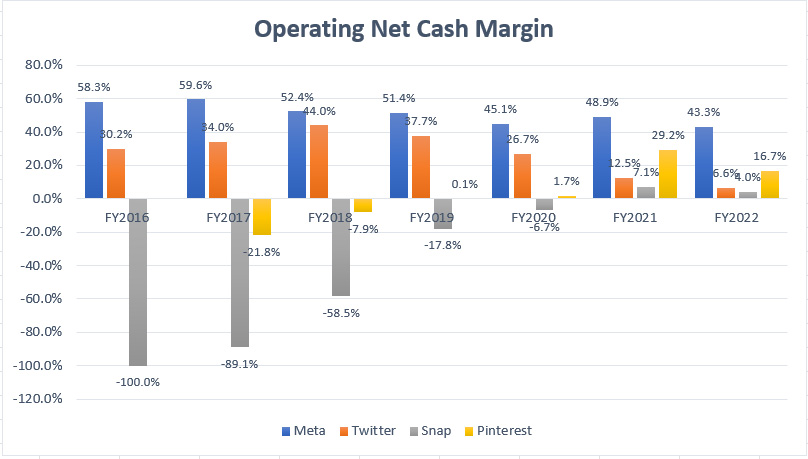

Operating Net Cash Margin

Meta, Twitter, Snap and Pinterest’s operating net cash margin

The cash-to-revenue ratio is another cash metric that measures the cash conversion efficiency from revenue.

Therefore, the higher the ratio, the better the cash conversion efficiency is for a company.

That said, Meta is again the crown of all social media platforms in terms of cash flow margin.

Its cash-to-revenue ratio has been the highest since 2016 and has exceeded that of all other social media companies by a very huge margin.

While Meta’s cash conversion efficiency has been the best among Twitter, Snapchat, and Pinterest, the ratio has been on a decline and reached 43% as of fiscal 2022, one of the lowest figures ever seen for the company.

At a 43% cash margin, Meta still beats Twitter, Snap, and Pinterest by a very wide margin in terms of cash conversion efficiency.

On the contrary, Snap Inc has been the worst in terms of cash conversion efficiency among all social media companies.

Snap’s cash margins are notably in the red in all fiscal years and have only risen to positive figures since 2021.

While Snap’s result has been down the drain, Pinterest’s cash margin has been on a rise and reached as much as 29% in 2021, second only to Meta.

As of 2022, Pinterest’s operating net cash margin totaled 17%, also one of the best figures ever reported, and was second to Meta only.

Nevertheless, Meta generates about $0.43 dollars of net cash from operations out of $1 dollar of sales at a 43% operating net cash margin.

Again, Meta leaves other social media companies in the dust when it comes to cash conversion efficiency.

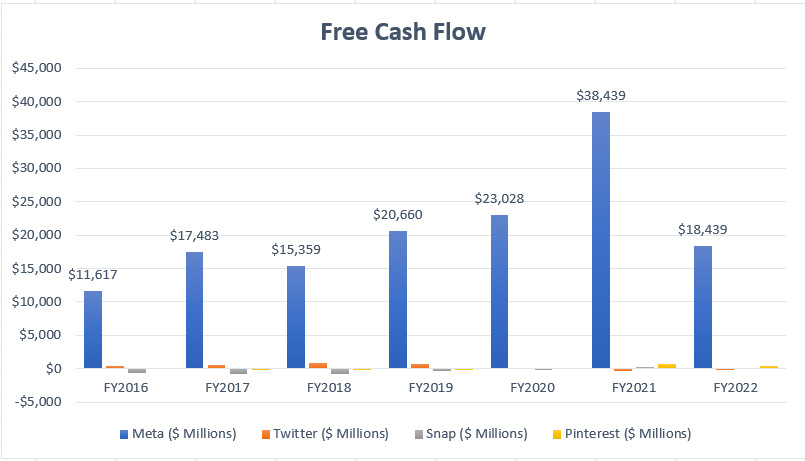

Free Cash Flow (With Meta)

Meta, Twitter, Snap and Pinterest’s free cash flow

A discussion of the cash flow will be incomplete without involving free cash flow.

As such, a chart above is created to show the free cash flow of Meta, Twitter, Snap Inc., and Pinterest.

In terms of free cash flow, Meta is again the top social media company that produces massive amounts of free cash flow, far exceeding that of Twitter, Pinterest, and Snap Inc.

Since fiscal 2016, Meta’s free cash flow has been growing at a CAGR of 20%.

As of fiscal 2022, Meta’s free cash flow reached as much as $18 billion, down 50% from a year ago.

In contrast, Twitter, Pinterest, and Snap’s free cash flow look considerably small with respect to that of Meta.

And some of them even had a negative free cash flow as a result of their inability to produce positive operating cash flow which we saw earlier.

In short, Meta wins hands-down compared to Twitter, Snap, and Pinterest when it comes to free cash flow generation.

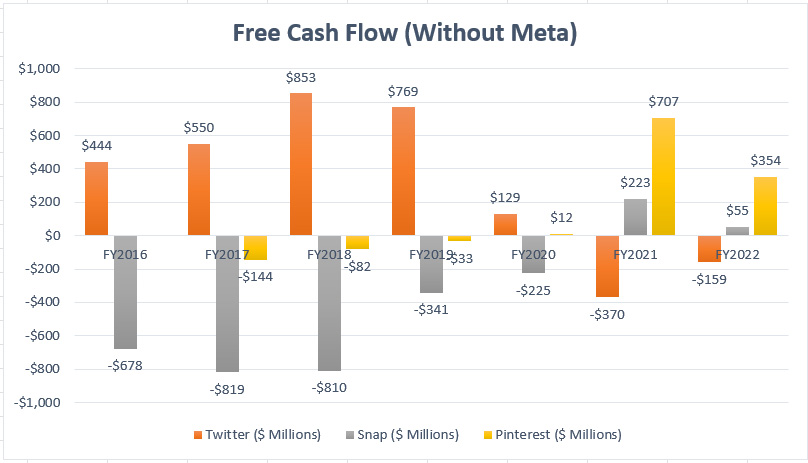

Free Cash Flow (Without Meta)

Twitter, Snap and Pinterest’s free cash flow

Without Meta in the picture, Twitter, Pinterest, and Snapchat’s free cash flow figures look much clearer.

According to the chart, Twitter’s free cash flow comes next after Meta at an average figure of around $500 million between fiscal 2016 and 2021.

However, Twitter’s free cash flow topped out at $853 million in fiscal 2018 and has since declined dramatically.

As of fiscal 2021, Twitter’s free cash flow tumbled to -$370 million, a record low for the company since fiscal 2016.

For Snap and Pinterest, their respective free cash flow has been getting better since 2020.

While Snap Inc. has been having negative free cash flow, the figures are narrowing and reached $223 million as of fiscal 2021, a record high for the company.

This figure was down to only $55 million in 2022.

Similarly, Pinterest experienced the same trend in which free cash flow has been improving and even turned positive.

In 2021, Pinterest’s free cash flow surged to $707 million, way ahead of other social media companies.

This figure was down to $354 million in 2022.

Despite a relatively small amount in comparison to that of Meta, Pinterest’s surging free cash flow marks a new milestone for the company, and is now a cash cow.

Overall, Twitter seems inconsistent when it comes to generating free cash flow while Snap is already having positive free cash flow.

Pinterest has managed to produce half a billion of free cash flow on average in the last 2 years, marking a new achievement for the company.

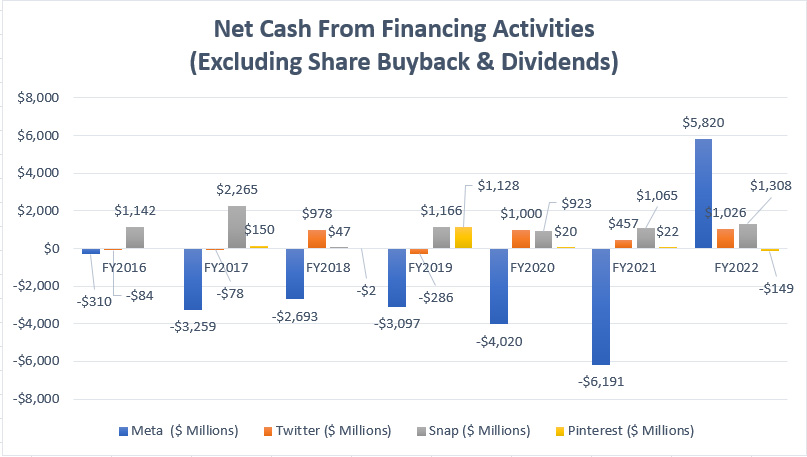

Net Cash From Financing Activities

Meta, Twitter, Snap and Pinterest’s net cash from financing activities

Net cash from financing activities is a cash metric that measures the cash flow as a result of financing activities such as dividend payments, share buyback, capital raise through loan and/or equity, etc.

For the most part, this metric is meant to find out if the company has been on a borrowing spree or issuing equity to raise cash.

For this purpose, I have excluded the share buyback and/or dividend payment if there is any to rule out the effect of share buyback and dividend payment.

For your information, Meta has been the only company that has been buying back shares in the last 7 years while Twitter and Snap Inc. also have started a share repurchase program in recent years.

For dividend payout, none of the social media companies has so far paid any cash dividend but Meta can absolutely afford to pay a dividend according to this article – Meta dividend.

All told, according to the chart, Meta’s net cash from financing activities has been entirely in the red in the last 7 years, suggesting that the company has been repaying debt.

Meta had only raised cash once which was in 2022 at nearly $6 billion net in the last 7 years.

In contrast, Snap and Twitter have been having positive net cash from financing activities in most of the fiscal years, indicating that they have been either on a borrowing spree or issuing equity for capital raising.

Snap seems to be the social media company that has raised the most cash in the last 7 years, reporting a minimum of $1 billion of net cash from financing activities in each fiscal year from 2016 to 2022.

Twitter also has been doing the same and has raised $1 billion of cash in fiscal 2018, 2020, and 2022, respectively.

On the other hand, Pinterest borrowed the least debt as shown in the chart among all social media companies, reporting slightly over $1 billion of net cash from financing activities in fiscal 2019.

In this aspect, Pinterest has only raised capital once in the last 6 years and that was in 2019, at more than $1 billion USD net.

Since fiscal 2020, Pinterest has not been incurring significant debt.

Instead, Pinterest was seen paying back its debt in 2022, topping $149 million in net cash outflow.

Conclusion

Of all social media companies, Meta has the most superior cash metrics, including net cash from operations as well as free cash flow.

Additionally, Meta also has the best cash margin, totaling more than 40%, showing that the social media giant’s cash conversion efficiency is far exceeding that of Twitter, Pinterest, and Snapchat.

While Snap and Pinterest are weak at generating cash, their results have been improving and negative cash flow has been narrowing.

In fact, Pinterest is much better than Snap in terms of cash generation.

On the other hand, Twitter’s cash flow results have slightly declined between fiscal 2016 and 2021, indicating that the company’s cash-producing ability may have weakened over the years.

It’s not surprising to see that Twitter and Snap have resorted to raising cash again in fiscal 2022 given the companies’ weak cash flow metrics.

Instead, Pinterest has only raised capital once in 2019 and has been paying back its debt since then.

References and Credits

1. All financial figures in this article were obtained and referenced from the respective financial statements and reports available on the following pages:

a) Meta Investor Relations

b) Pinterest Investor Relations

c) Twitter Investor Relations

d) Snap Investor Relations

2. Featured images in this article are used under creative commons license and sourced from the following websites: A hand full of cash money and one hundred dollar bills cash money USD.

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you for the help!