Bull market. Source: Flickr

Pinterest (NYSE:PINS) is one of the leading social media companies and it operates in a highly lucrative industry.

The company’s main revenue source comes from advertising.

While Pinterest has gone public since April 2019, the company has never declared or paid any cash dividends.

The following excerpt extracted from Pinterest’s 2022 annual report explains the company’s dividend policy:

-

Dividend Policy

We have never declared or paid dividends on our capital stock and do not intend to pay any dividends in the foreseeable future.Any future determination to declare dividends will be made at the discretion of our board of directors, subject to applicable laws, and will depend on then-existing conditions, including our financial condition, operating results, capital requirements, general business conditions, and other factors that our board of directors may deem relevant.

In addition, the terms of our revolving credit facility place certain limitations on the number of dividends we can pay, even if no amounts are currently outstanding.

Although Pinterest is currently a non-dividend-paying stock, that does not necessarily mean that the company will never pay a dividend in the future.

For your information, Pinterest has already been able to make a decent profit and generate positive net cash from operations.

In addition, Pinterest is projected to make even more profits and generate higher cash flow in 2023.

Therefore, the possibility of Pinterest paying a cash dividend in the future is very real to some extent.

That said, in this article, we are exploring the factors that support a dividend from Pinterest.

As the saying goes, every coin has two sides and it is no exception for Pinterest.

Therefore, apart from looking at the pros, we also dive into factors that do not support a cash dividend coming from Pinterest.

Let’s take a look.

Pinterest’s Cash Dividend Topics

Factors That Support A Dividend

A1. A Growing MAU

A2. An Increasing ARPU

A3. Rising Revenue In All Regions

A4. Cash Flow Positive

A5. Pinterest Is Debt Free

Factors That Do Not Support A Dividend

B1. Pinterest Is Unprofitable

B2. Poor Margins

Summary And Reference

C1. Summary

C2. References and Credits

C3. Disclosure

Pinterest’s Growing MAU

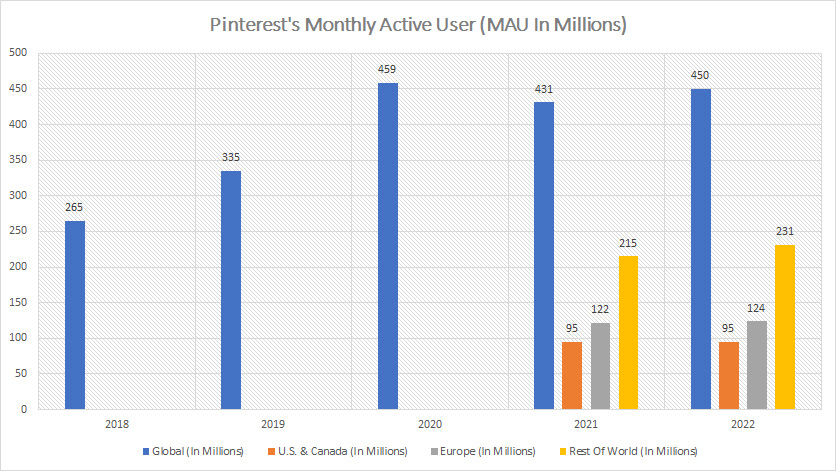

Pinterest monthly active users (click to enlarge)

The case of Pinterest becoming a cash dividend-paying company depends very much on the MAU or monthly active users.

As the name implies, this metric measures user engagement on the social media platform.

Therefore, the higher the MAU, the larger the user base will become.

Since Pinterest’s revenue source comes primarily from advertising, it will be able to monetize more effectively when the MAU increases.

In other words, Pinterest will make more money as the MAU grows.

The good news is that Pinterest has been able to grow its MAU numbers in all regions over the years as shown in the chart above.

For instance, Pinterest’s MAU on a global basis has been on the rise since 2018 while its international user base has now become one of the largest among all regions in the world.

Although Pinterest’s MAUs in all regions have been increasing, they represented only a tiny fraction of what Facebook obtained, according to this article – Facebook Vs Pinterest In MAU.

As seen, Pinterest’s MAU on a global basis as of Q4 2022 was less than one-fifth of that obtained by Facebook in the same period.

And, Pinterest is still a relatively young social media company compared to Facebook.

Therefore, there is definitely a lot of headroom for Pinterest to grow its MAU in the future.

As Pinterest’s MAU grows, so will its revenue and profitability.

Eventually, the case of a cash dividend coming from Pinterest will most likely become a reality.

Pinterest’s Increasing ARPU

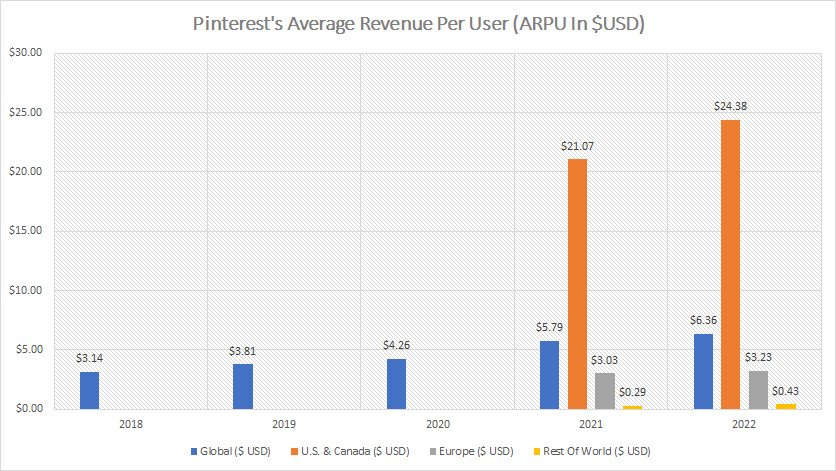

Pinterest average revenue per user (click to enlarge)

Similar to the MAU, Pinterest’s ARPU, or average revenue per user also has been on the rise as shown in the chart above.

As seen, Pinterest’s ARPU on a global basis reached a record high of $6.36 USD as of 2022 while that of the U.S. & Canada was among the highest at a massive $24.38 USD compared to other regions.

Pinterest’s growing ARPU literally means that the company is collecting more revenue on a per-user basis.

Therefore, the higher the ARPU, the more revenue Pinterest will earn for a user on its platforms.

Subsequently, Pinterest’s total revenue will rise along with the growing ARPU.

Although Pinterest’s ARPU has reached record highs in all regions as of 2022 as seen in the chart above, it represented only a tiny fraction of the numbers obtained by Facebook, a more mature social media company, according to this article – Pinterest Vs Facebook In Revenue Per User.

Moreover, Pinterest’s ARPU in other regions such as Europe and internationally was among the lowest compared to Facebook and Snapchat, according to the same article.

As Pinterest is still relatively a young social media company, its ARPU is likely to grow as it turns into a more mature platform in the future and it may attain the same level of ARPU as Facebook and Snapchat, given the vast potential of the platform.

Again, Pinterest may consider a capital return to shareholders in the form of cash dividends when it is making money as seen in the growing ARPU.

Pinterest’s Rising Revenue In All Regions

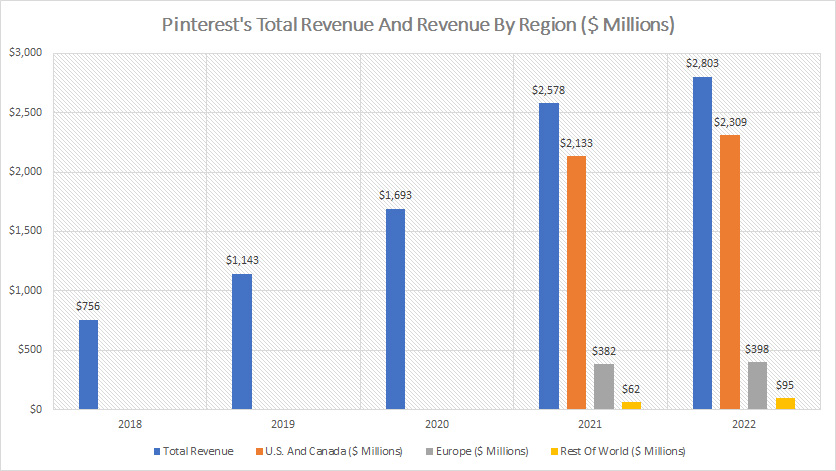

Pinterest total revenue and revenue by region (click to enlarge)

Pinterest’s total revenue and revenue by region have been on the rise as a result of the growing MAU and the increasing ARPU.

As shown in the chart above, Pinterest’s revenue and revenue by region have reached record highs as of 2022, with the total revenue rising nearly 4X since 2018.

Apart from the total revenue, Pinterest’s revenue in the U.S. & Canada, Europe, and internationally also has risen considerably since 2018.

While a cash dividend may not necessarily come from revenue, the soaring sales figures could certainly increase of possibility of it coming from Pinterest.

Pinterest’s Positive Cash Flow

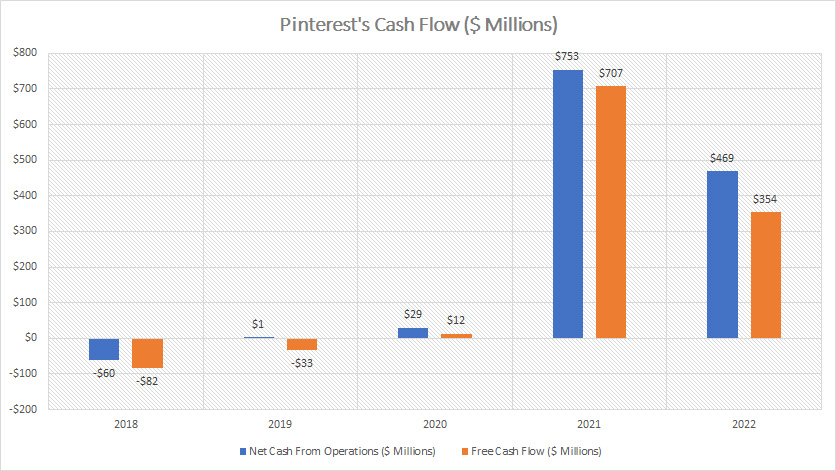

Pinterest cash flow (click to enlarge)

* Operating cash flow and free cash flow are obtained from Pinterest’s earnings releases.

* Pinterest’s fiscal year begins on Jan 1 and ends on Dec 31.

The cash flow is certainly an important determining factor in the case of a dividend coming from Pinterest as dividends are usually made out of cash flow.

As seen, Pinterest has been able to generate positive cash flow since 2020.

For example, Pinterest’s net cash from operations had been positive since 2020 and totaled $469 million as of 2022, one of the highest figures ever reported.

Similarly, Piniterest’s free cash flow also had been positive since 2020 and reached $354 million as of 2022, a seemingly impressive figure in the past 5 years.

While the positive cash flow may not mean much compared to the billions generated by solid dividend-paying companies, it matters a lot to Pinterest as it marks a major milestone in the history of the company.

As shown, Pinterest has turned around from being cash flow negative to cash flow positive since 2020 and it had successfully produced positive cash flow for 3 years in a row.

Having positive net cash from operations and free cash flow is important to Pinterest as it means that the company will no longer need to rely on external capital injections.

The extra cash produced can be channeled to other purposes, including a capital return to shareholders in the form of dividends.

Therefore, it is incredibly important for Pinterest to be able to continuously produce positive cash flow if it ever wants to become a dividend-paying stock.

In short, Pinterest’s positive cash flow is a step forward and makes the case for a cash dividend extremely likely.

Pinterest Is Debt Free

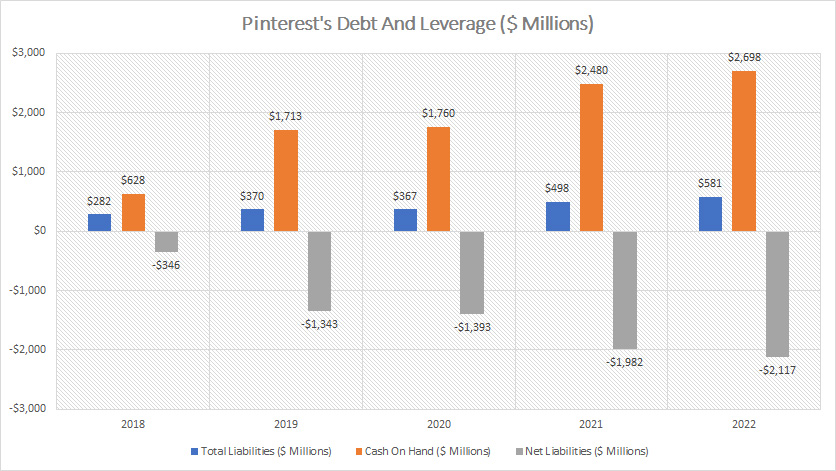

Pinterest debt and leverage (click to enlarge)

* Total liabilities and cash on hand are obtained from Pinterest’s balance sheets.

* Net liabilities comes from the author’s own calculation based on the difference between total liabilities and cash on hand.

* Pinterest’s fiscal year begins on Jan 1 and ends on Dec 31.

As discussed, Pinterest has been able to produce positive cash flow since 2020.

Although Pinterest’s cash flow was negative prior to 2020, it was very little and probably didn’t have any impact on the company’s cash position.

As such, the company has been able to avoid debt all these years as shown in the table below.

Pinterest Long And Short-Term Debt

| Fiscal Year | |||||

|---|---|---|---|---|---|

| 2022 | 2021 | 2020 | 2019 | 2018 | |

| Total Debt Level | 0 | 0 | 0 | 0 | 0 |

As shown in the table above, Pinterest’s debt level has been zero in the last 5 years, be it long or short-term debt.

As a result, Pinterest has been having negative net liabilities as shown in the chart above after accounting for its cash position.

In other words, Pinterest could literally pay off its entire liabilities with its cash on hand all these years.

Being debt-free bodes well not only for Pinterest but also for shareholders as the company will not be bounded by any credit agreement or debt arrangement from returning capital to shareholders.

Therefore, Pinterest will be able to declare a cash dividend anytime it wants when it is ready to do so.

Again, the case for a cash dividend coming from Pinterest looks even more compelling when the company is debt free.

Pinterest Is Unprofitable

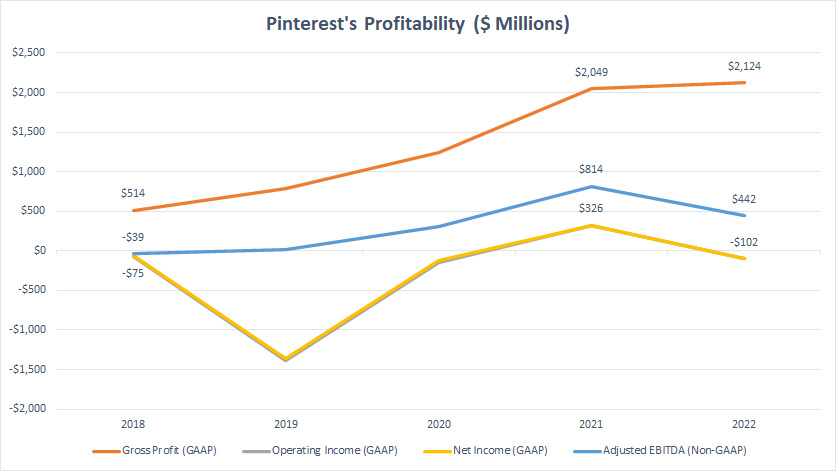

Pinterest profitability (click to enlarge)

* Gross profit, operating income, net income, and adjusted EBITDA are obtained from Pinterest’s earnings releases.

* EBITDA stands for earnings before interest, taxes, depreciation, and amortization.

* Pinterest’s fiscal year begins on Jan 1 and ends on Dec 31.

The only thing that is holding back Pinterest from declaring a cash dividend is the company’s unprofitability.

Although Pinterest’s gross profit has been extremely impressive all these years as shown in the chart above, its operating income and net income have been poor.

As seen, Pinterest had only managed to make a profit in 1 out of the 5 fiscal years between 2018 and 2022.

To make matters worse, Pinterest’s profitability was only a meager $300 million in operating and net profit on a GAAP basis which was reported in fiscal 2021.

For other fiscal years, Pinterest incurred losses that ranged from $100 million to nearly $1.5 billion USD.

While Pinterest has been unprofitable in most fiscal years, its losses have been getting smaller and profitability has been getting better.

For example, Pinterest’s adjusted EBITDA (Non-GAAP) has turned around from having a loss to being profitable as shown in the chart above.

As of 2022, Pinterest’s adjusted EBITDA topped $442 million, one of the highest figures that has ever been reported.

I believe it is only a matter of time before Pinterest becomes a highly profitable company.

When that time has come, a cash dividend from Pinterest may soon be within reach among investors.

Pinterest Has Poor Margins

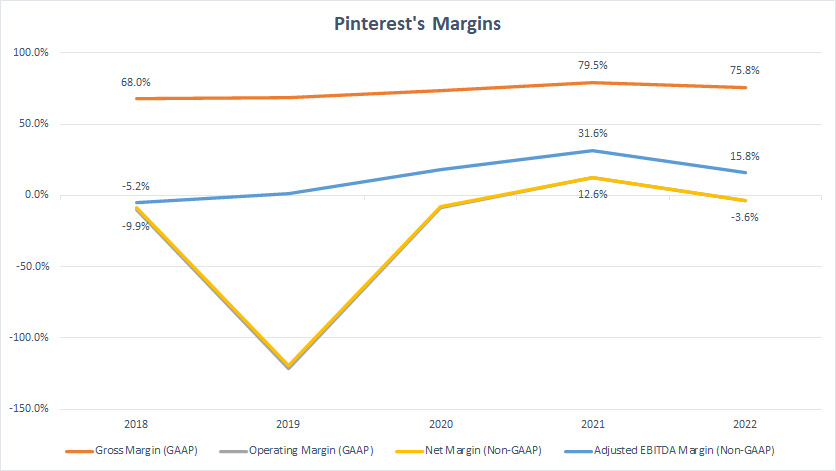

Pinterest margins (click to enlarge)

* Gross margin, operating margin, net margin, and adjusted EBITDA margin come from the author’s own calculation.

* EBITDA stands for earnings before interest, taxes, depreciation, and amortization.

* Pinterest’s fiscal year begins on Jan 1 and ends on Dec 31.

Pinterest’s poor margins have to do with the unprofitable nature of the company’s operations.

As shown in the chart above, Pinterest’s operating and net margins have been negative in most fiscal years and had only managed to stay positive in 1 out of 5 fiscal years.

Although Pinterest has been having poor margins, they have improved significantly over the years.

For example, Pinterest managed to achieve an operating and net margin that stayed above 10% in fiscal 2021 and the figure in 2022 was only slightly below 0%, illustrating the narrowing losses and improving margins.

Besides, Pinterest’s adjusted EBITDA margin topped an impressive 32% and 16% in 2021 and 2022, respectively, also illustrating an improving business prospect for the company.

If Pinterest’s steady improvement in margins is able to continue in the foreseeable future, a cash dividend declaration by the company will not be completely out of the question.

For now, Pinterest is still dealing with negative margins and unprofitability.

Therefore, a cash dividend in the near future looks unlikely to happen.

Investors just need to be patient with the company and let management does the necessary jobs.

Conclusion

Pinterest is a well-run social media company.

It has no debt and is fundamentally strong and has a rock-solid balance sheet.

Moreover, Pinterest also has been showing an improving business prospect as reflected in the narrowing losses and improving margins.

Revenue-wise, Pinterest also has been able to grow its revenue across all regions.

Besides, it generates a healthy cash flow.

Therefore, the only thing that has been holding back Pinterest is the unprofitable operation that it has been running.

But this is only temporary.

The company should be able to reel back to profitability in the near future as seen in the positive results reported for fiscal 2021 and 2022.

While Pinterest still made a loss in 2022, it was much better than the losses reported in prior years.

In short, Pinterest is making progress.

Judging from all the factors that we have seen, I believe Pinterest should make a great dividend-paying stock.

Credits and References

1. Pinterest’s financial figures were obtained and referenced from the company’s financial statements which are available at the following links:

a) Pinterest Investor Relations

b) Yahoo Finance

2. Featured images in this article are used under creative commons license and sourced from the following websites: Bull Market and Pins your ideas here!.

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!