Property. Pexels Image.

This article presents the revenue breakdown of Berkshire Hathaway’s insurance segment. For an overview of Berkshire’s insurance revenue, you may visit this page: Berkshire Hathaway insurance vs non-insurance revenue.

Berkshire Hathaway’s insurance revenue consists of multiples sources, including premiums earned from insurance underwriting and investment income.

Please note that the revenue data provided does not account for the eliminations due to intersegment transactions. Consequently, the total sum of these revenues may slightly differ from the final amount presented in the company’s consolidated statements of earnings.

That said, let’s look at Berkshire’s insurance revenue by segment.

Investors looking for other statistics of Berkshire Hathaway may find more resources on these pages:

- Berkshire Hathaway revenue by segment,

- Berkshire Hathaway insurance revenue by region and country, and

- Berkshire Hathaway profit breakdown.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

- Insurance Underwriting

- Investment Income

- GEICO

- Berkshire Hathaway Primary Group

- Berkshire Hathaway Reinsurance Group

O2. How Does Berkshire Hathaway Grow Its Insurance Revenue?

Insurance Revenue By Category

A1. Revenue From Insurance Underwriting And Investment Income

A2. Percentage Of Revenue From Insurance Underwriting And Investment Income

Breakdown Of Insurance Underwriting Revenue

B1. Insurance Underwriting Revenue Breakdown

B2. Insurance Underwriting Revenue Breakdown In Percentage

Growth Rates

C1. Growth Rates Of Revenue From Insurance Underwriting And Investment Income

C2. Growth Rates Of Insurance Underwriting Revenue Breakdown

Summary And Reference

S1. Summary

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Insurance Underwriting: Insurance underwriting is the process by which an insurance company evaluates the risks associated with insuring a person, property, or entity and determines the terms and conditions of the insurance policy.

This process helps the insurer decide whether to provide coverage and at what premium rate. Here are the key steps involved in insurance underwriting:

- Risk Assessment: Underwriters assess the potential risk factors associated with the applicant. This may include reviewing the applicant’s health, occupation, lifestyle, or the characteristics of the property being insured.

- Application Review: The underwriter examines the information provided in the insurance application, including any supporting documents, such as medical records or property appraisals.

- Data Analysis: Underwriters use statistical data, historical claims information, and other relevant data to estimate the likelihood of a claim being made and the potential cost of that claim.

- Decision Making: Based on the risk assessment and data analysis, the underwriter decides whether to approve or deny the insurance application. If approved, they determine the policy terms, coverage limits, exclusions, and the premium rate.

- Policy Issuance: Once the terms are agreed upon, the insurance policy is issued to the applicant, outlining the coverage details and the conditions under which claims will be paid.

Insurance underwriting ensures that the insurer can manage its risk portfolio effectively while providing appropriate coverage to policyholders.

Investment Income: Berkshire Hathaway’s investment income refers to the earnings generated from the investments made by its insurance subsidiaries, as well as other segments of the company. Here’s an overview:

- Insurance Float: Berkshire Hathaway’s insurance operations, such as GEICO and Berkshire Hathaway Reinsurance Group, collect premiums from policyholders. This pool of funds, known as “float,” represents money that the company holds until claims are paid out. Warren Buffett and his team invest this float in various financial assets to generate returns.

- Equity Investments: Berkshire Hathaway holds significant positions in publicly traded companies. These equity investments generate income through dividends and capital appreciation. Notable investments include large stakes in companies like Apple, Coca-Cola, and American Express.

- Fixed-Income Investments: The company also invests in fixed-income securities, such as bonds and Treasury bills. These investments provide regular interest income, contributing to the overall investment income.

- Private Investments: Berkshire Hathaway makes investments in private companies and businesses, often acquiring them outright. These investments contribute to the company’s investment income through dividends, interest, and the profits generated by these businesses.

- Real Estate Investments: Berkshire Hathaway invests in real estate properties, both directly and through its subsidiaries. These properties generate rental income and potential capital gains.

Overall, Berkshire Hathaway’s investment income is a critical component of its financial performance, allowing the company to leverage its insurance float and other capital to generate substantial returns.

GEICO: Berkshire Hathaway’s GEICO, also known as the Government Employees Insurance Company, is one of the largest auto insurance companies in the United States.

GEICO was founded in 1936 by Leo and Lillian Goodwin, initially targeting government employees and military personnel for affordable auto insurance. Over the years, GEICO has expanded its customer base to include the general public.

GEICO is a wholly-owned subsidiary of Berkshire Hathaway, the multinational conglomerate led by Warren Buffett. As a subsidiary of Berkshire Hathaway, GEICO benefits from the financial strength and stability of its parent company.

GEICO is well-known for its innovative and memorable advertising campaigns, featuring characters like the GEICO Gecko and the Caveman. The company provides a variety of insurance products, including:

- Auto Insurance: Coverage for cars, motorcycles, and other vehicles.

- Homeowners Insurance: Protection for homes and personal property.

- Renters Insurance: Coverage for personal property in rental units.

- Condo Insurance: Protection for condominium owners.

- Boat Insurance: Coverage for boats and personal watercraft.

- Business Insurance: Various insurance products for small businesses.

GEICO is recognized for its excellent customer service and user-friendly online platform, which allows customers to obtain quotes, manage policies, and file claims efficiently.

Berkshire Hathaway Primary Group: Berkshire Hathaway Primary Group consists of multiple insurance operations that collectively offer a range of commercial insurance products.

These products include commercial motor vehicle insurance, workers’ compensation, commercial property, healthcare liability, business owners’ insurance, and other insurance offerings.

The Primary Group is one of the key segments within Berkshire Hathaway’s insurance operations, contributing significantly to the company’s overall revenue.

Berkshire Hathaway Reinsurance Group: Berkshire Hathaway Reinsurance Group is a division of Berkshire Hathaway Inc. This group is one of the largest reinsurance groups globally, providing insurance and reinsurance solutions to other insurance companies.

Here are some key points about the Berkshire Hathaway Reinsurance Group:

- Financial Strength: The group has unparalleled financial strength, enabling it to facilitate large, tailored solutions for insurance and reinsurance companies worldwide.

- Diverse Portfolio: It offers a diverse portfolio of reinsurance contracts, including treaty, facultative, quota-share, and excess reinsurance.

- Global Reach: The group operates in 26 countries, showcasing its extensive influence and reach in the global reinsurance market.

- Segments: The group includes divisions like Berkshire Hathaway Life, which specializes in large transactions for life and health risks, and other segments focusing on property/casualty reinsurance.

Berkshire Hathaway Reinsurance Group is known for its strategic acumen and resilience, contributing significantly to Berkshire Hathaway’s overall success.

How Does Berkshire Hathaway Grow Its Insurance Revenue?

Berkshire Hathaway grows its insurance revenue through several key strategies:

- Diversification: Berkshire Hathaway operates multiple insurance businesses, including GEICO, Berkshire Hathaway Reinsurance Group, and Berkshire Hathaway Primary Group. This diversification allows the company to capture revenue from various segments of the insurance market.

- Underwriting Excellence: The company focuses on strong underwriting practices, ensuring that it maintains a profitable portfolio of insurance policies. This involves careful risk assessment and pricing of insurance products to balance risk and reward.

- Acquisitions: Berkshire Hathaway has a history of acquiring other insurance companies and businesses, which helps to expand its market presence and increase its revenue streams1.

- Investment Income: The company’s insurance operations generate significant investment income from the premiums they collect. These funds are invested in a diversified portfolio of stocks, bonds, and other assets, contributing to overall revenue growth.

- Customer Retention and Growth: By offering competitive insurance products and maintaining strong customer relationships, Berkshire Hathaway ensures a steady stream of renewals and attracts new customers.

- Innovative Products: The company continuously develops and introduces new insurance products to meet evolving market demands and customer needs.

These strategies collectively contribute to Berkshire Hathaway’s robust growth in insurance revenue.

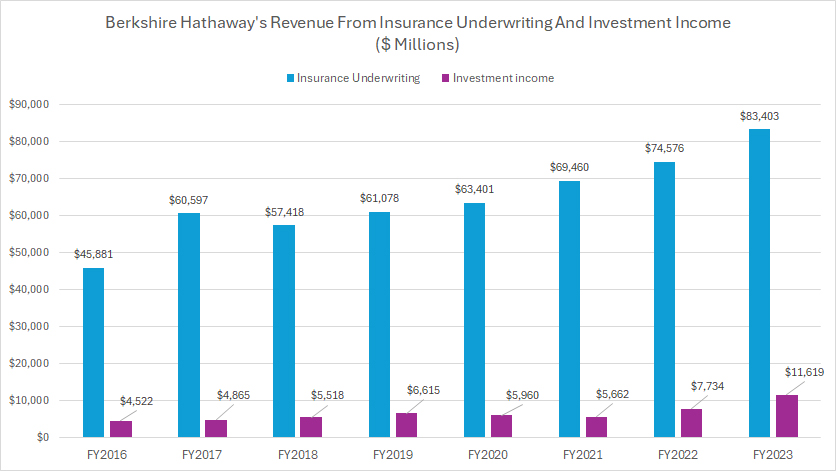

Revenue From Insurance Underwriting And Investment Income

berkshire-insurance-revenue-from-underwriting-and-investment

(click image to expand)

Berkshire’s insurance revenue consists of two sources: revenue from insurance underwriting and investment income. You can find the definitions of Berkshire’s insurance underwriting and investment income here: insurance underwriting and investment income.

As shown in the chart above, it is very obvious that Berkshire Hathaway’s revenue from insurance underwriting significantly surpasses its revenue from investment income.

In fiscal year 2023, Berkshire Hathaway’s revenue from insurance underwriting reached a staggering $83.4 billion, while revenue from investment income totaled $11.6 billion, also a record high.

Moreover, both revenue segments have experienced substantial growth over the years, reaching record highs in the latest results. For instance, Berkshire’s revenue from insurance underwriting has surged by over 80% since fiscal year 2016, climbing from $45.9 billion to $83.4 billion over the past eight years.

Similarly, Berkshire’s revenue from investment income has more than doubled since fiscal year 2016, increasing from $4.5 billion to $11.6 billion between fiscal year 2016 and 2023.

A major factor contributing to Berkshire’s much higher insurance underwriting revenue is the scale of its insurance unit. In this aspect, Berkshire Hathaway operates one of the largest insurance businesses in the world, with significant premium income from its various insurance subsidiaries, including GEICO, Berkshire Hathaway Reinsurance Group, and Berkshire Hathaway Primary Group. This large scale results in substantial underwriting revenue.

While investment income is also a significant part of Berkshire Hathaway’s overall revenue, it is generally lower than underwriting revenue because it relies on the returns from invested premiums and other financial assets, which can be more variable.

Berkshire Hathaway’s insurance operations generate a large amount of “float” – money collected from premiums that is held until claims are paid out. Berkshire Hathaway effectively invests this float to generate additional income, but the primary revenue still comes from underwriting.

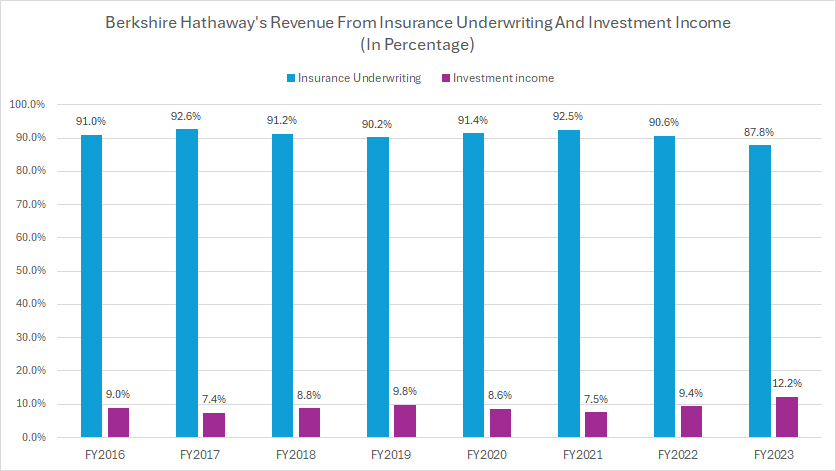

Percentage Of Revenue From Insurance Underwriting And Investment Income

berkshire-insurance-revenue-from-underwriting-and-investment-in-percentage

(click image to expand)

Berkshire’s insurance revenue consists of two sources: revenue from insurance underwriting and investment income. You can find the definitions of Berkshire’s insurance underwriting and investment income here: insurance underwriting and investment income.

Berkshire Hathaway’s revenue from insurance underwriting constitutes the largest portion of its total insurance revenue, as illustrated in the chart above.

In fiscal year 2023, Berkshire Hathaway’s revenue from insurance underwriting accounted for 87.8% of its total insurance revenue. This is slightly lower than the 90.6% recorded in the previous year. Over the long term, Berkshire’s revenue share from insurance underwriting has remained relatively stable since fiscal year 2016, averaging around 91% over the past eight years, as depicted in the graph above.

On the flip side, Berkshire’s investment income accounted for only 12.2% of its total insurance revenue in fiscal year 2023. This ratio saw a significant increase from 9.4% the previous year, primarily due to a dramatic rise in investment income during the same fiscal year.

In short, Berkshire Hathaway predominantly generates its insurance revenue from underwriting, consistently exceeding 90% of the total insurance revenue. The dominance of Berkshire’s revenue from insurance underwriting underscores the scale of the company’s insurance business.

Berkshire Hathaway runs one of the largest insurance businesses in the world, generating significant premium income from its various insurance subsidiaries, including GEICO, Berkshire Hathaway Reinsurance Group, and Berkshire Hathaway Primary Group. This vast scale leads to substantial underwriting revenue.

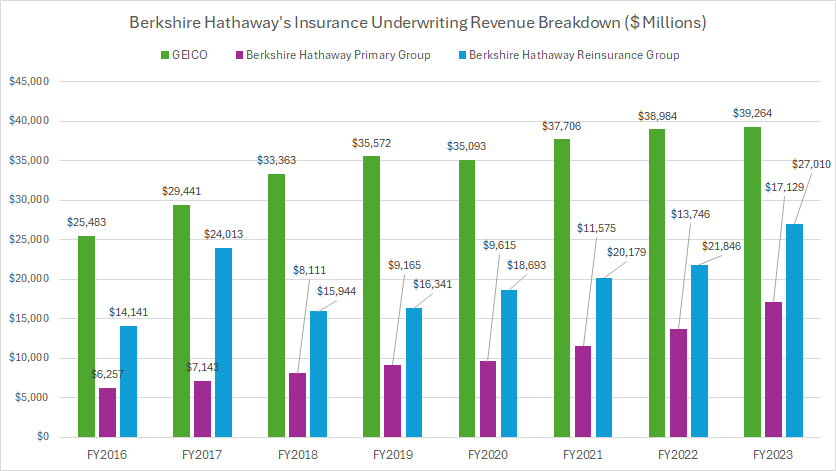

Insurance Underwriting Revenue Breakdown

berkshire-insurance-underwriting-revenue-breakdown

(click image to expand)

Berkshire’s insurance underwriting revenue consists of three sources: GEICO, Berkshire Hathaway Primary Group, and Berkshire Hathaway Reinsurance Group.

You can find the definitions of the breakdown of Berkshire’s insurance underwriting revenue here: GEICO, Berkshire Hathaway Primary Group, and Berkshire Hathaway Reinsurance Group.

Berkshire’s underwriting revenue from GEICO accounts for the largest portion among the three sources, reaching a record figure of $39.3 billion as of fiscal year 2023.

On the other hand, underwriting revenue from Berkshire Hathaway Primary Group is the smallest among the three sources, amounting to $17.1 billion in fiscal year 2023.

Berkshire Hathaway Reinsurance Group’s underwriting revenue stood at $27 billion in fiscal year 2023. This figure is approximately 58% higher than the Primary Group’s underwriting revenue, but 30% smaller than that of GEICO.

A notable trend is the substantial growth in all insurance underwriting revenue sources since fiscal year 2016, as depicted in the chart above.

For example, GEICO’s underwriting revenue has grown by over 50% since fiscal year 2016, from $25.5 billion to $39.3 billion in eight years. Similarly, Berkshire Hathaway Reinsurance Group’s underwriting revenue has surged over 90% since fiscal year 2016, while that of the Primary Group has nearly tripled during the same period.

A key reason that GEICO’s underwriting revenue is significantly higher than that of the reinsurance and primary insurance groups is its extensive market penetration and large customer base.

As one of the largest auto insurers in the U.S., GEICO generates substantial premium income. Additionally, its efficient operations, effective claims management, and strategic rate increases contribute to its higher underwriting revenue compared to other Berkshire Hathaway insurance units.

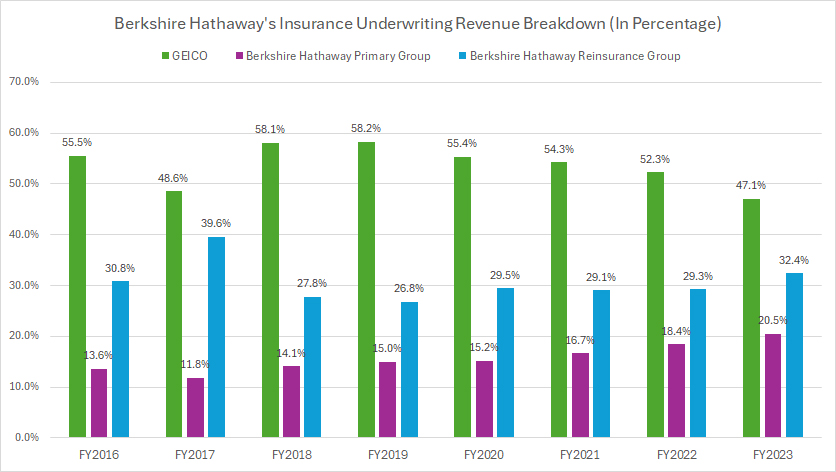

Insurance Underwriting Revenue Breakdown In Percentage

berkshire-insurance-underwriting-revenue-breakdown-in-percentage

(click image to expand)

Berkshire’s insurance underwriting revenue consists of three sources: GEICO, Berkshire Hathaway Primary Group, and Berkshire Hathaway Reinsurance Group.

You can find the definitions of the breakdown of Berkshire’s insurance underwriting revenue here: GEICO, Berkshire Hathaway Primary Group, and Berkshire Hathaway Reinsurance Group.

Within the insurance underwriting segment, Berkshire Hathaway’s GEICO revenue represents the largest portion, as illustrated in the chart above. In fiscal year 2023, Berkshire Hathaway’s underwriting revenue from GEICO accounted for 47% of the total within the insurance underwriting unit. The Reinsurance Group contributed 32%, while the Primary Group made up the remaining 20.5%.

Although GEICO’s revenue accounts for the biggest part, its share has significantly declined over the years, as shown in the graph above. For example, the share of GEICO’s underwriting revenue has decreased from 55.5% in fiscal year 2016 to 47.1% as of fiscal year 2023.

On the flip side, the revenue share of Berkshire Hathaway Primary Group has increased from 13.6% in fiscal year 2016 to 20.5% as of fiscal year 2023. Meanwhile, the revenue share of Berkshire Hathaway Reinsurance Group has remained relatively consistent during the same period, averaging around 31% over the past eight years.

A major factor contributing to the higher portion of underwriting revenue from GEICO is its extensive market penetration and large customer base. As one of the largest auto insurers in the U.S., GEICO generates substantial premium income. Additionally, its efficient operations, effective claims management, and strategic rate increases play significant roles in driving its underwriting revenue.

However, the combined revenue share of the Reinsurance Group and Primary Group is quite substantial, making up roughly half of Berkshire’s total insurance underwriting revenue. This is because these groups cover a diverse range of risks, command higher premiums, and have effectively implemented growth strategies and rate increases to boost their revenues.

Nevertheless, the significant growth in the underwriting revenue share of Berkshire Hathaway Primary Group highlights its much faster revenue growth compared to GEICO and the Reinsurance Group.

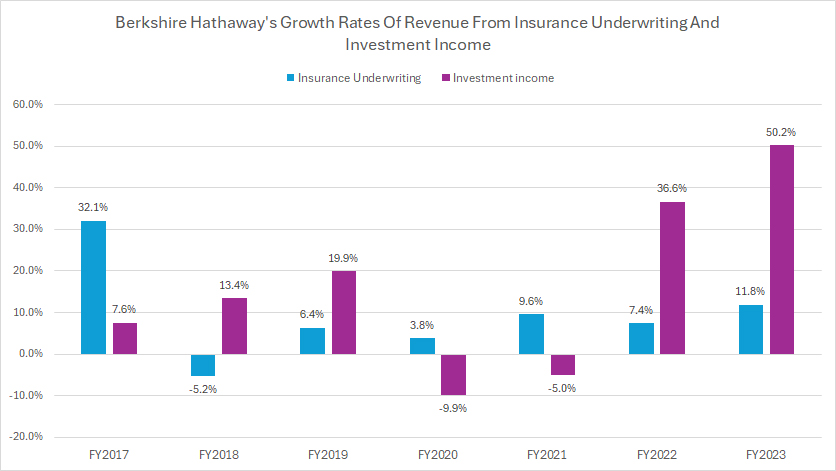

Growth Rates Of Revenue From Insurance Underwriting And Investment Income

berkshire-growth-rates-of-insurance-revenue-from-underwriting-and-investment

(click image to expand)

Berkshire’s insurance revenue consists of two sources: revenue from insurance underwriting and investment income. You can find the definitions of Berkshire’s insurance underwriting and investment income here: insurance underwriting and investment income.

Berkshire Hathaway’s revenue from investment income has experienced the highest growth compared to its revenue from insurance underwriting. For example, Berkshire Hathaway’s revenue from investment income has grown at an average annual rate of 27%, compared to a 10% growth rate for its revenue from insurance underwriting.

In fiscal year 2023, Berkshire’s revenue from investment income surged by 50% compared to the previous year, marking the highest growth rate since fiscal year 2016. Meanwhile, Berkshire’s revenue from insurance underwriting grew by 12% in fiscal year 2023 — a significant increase by any measure, even though it was considerably lower than the growth rate of investment income.

The key factor driving the much higher growth rates of Berkshire’s investment income compared to insurance underwriting is the diverse and strategic investment portfolio. This portfolio includes high-quality equities, bonds, and real estate assets that have significantly appreciated over time. Additionally, favorable market conditions and smart acquisitions have bolstered Berkshire’s investment returns.

Additionally, the high interest rate environment over the past few years has significantly bolstered Berkshire’s returns. Higher interest rates can lead to increased returns on fixed-income investments, further enhancing Berkshire Hathaway’s investment income.

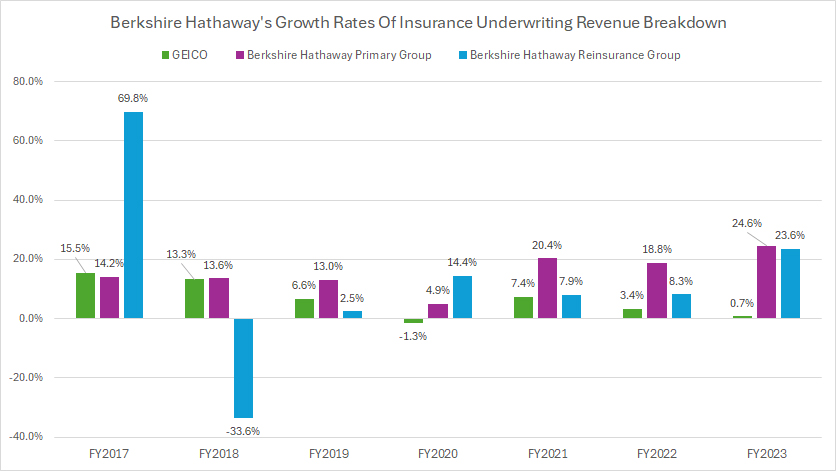

Growth Rates Of Insurance Underwriting Revenue Breakdown

berkshire-growth-rates-of-insurance-underwriting-revenue-breakdown

(click image to expand)

Berkshire’s insurance underwriting revenue consists of three sources: GEICO, Berkshire Hathaway Primary Group, and Berkshire Hathaway Reinsurance Group.

You can find the definitions of the breakdown of Berkshire’s insurance underwriting revenue here: GEICO, Berkshire Hathaway Primary Group, and Berkshire Hathaway Reinsurance Group.

Over the past three years, among Berkshire Hathaway’s three sources of underwriting revenue, the Primary Group has experienced the most remarkable growth, as depicted in the graph above.

On average, insurance underwriting revenue from Berkshire Hathaway Primary Group has increased at an annual growth rate of 21% between fiscal years 2021 and 2023. In fiscal year 2023, the Primary Group’s revenue growth reached a record high of 25% year-over-year, marking the highest increase recorded since 2016.

The significant revenue growth of Berkshire Hathaway Primary Group can be attributed to several factors, including strategic acquisitions that have expanded its portfolio and market share, product diversification that caters to various industries and risk profiles, and favorable market conditions that have increased demand for commercial insurance.

Additionally, the Primary Group’s disciplined underwriting practices and effective risk management strategies have led to improved loss ratios and underwriting profitability. Strategic rate increases have also contributed to this impressive revenue growth, making the Primary Group stand out among Berkshire Hathaway’s insurance units.

The revenue growth of Berkshire Hathaway Reinsurance Group is also noteworthy. Over the past three years, the Reinsurance Group has experienced an average annual growth rate of 13%. In fiscal year 2023, its revenue growth surged to 24%, marking the highest increase in five years.

On the flip side, GEICO’s underwriting revenue growth has significantly declined over the past several years, with growth rates hovering only in the low to mid-single digits year-over-year.

Over the past three years, GEICO’s underwriting revenue has grown at an average annual rate of just 4%, the lowest among all three sources of underwriting revenue. Alarmingly, in fiscal year 2023, the growth rate plummeted to just 1%, one of the lowest figures recorded since fiscal year 2016.

Summary

To recap, Berkshire Hathaway’s investment income has grown the most compared to revenue from insurance underwriting. Over the past three years, investment income has grown at an average annual rate of 27%, compared to a 10% growth rate for insurance underwriting revenue.

Among the three sources of underwriting revenue, the Primary Group has experienced the most significant growth over the past three years. GEICO’s underwriting revenue growth has significantly declined, with growth rates hovering only in the low to mid-single digits year-over-year.

Berkshire Hathaway Reinsurance Group’s revenue has grown by more than 30% over the past three years, even though its revenue share has remained relatively stable. This highlights the much higher revenue growth of Berkshire’s other insurance units.

Credits And References

1. All financial data presented in this article was obtained and referenced from Berkshire Hathaway’s annual reports published in the company’s investor relation page: Berkshire’s Reports.

2. Pexels Images.

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link to this article from any website so that more articles like this one can be created in the future.

Thank you!