Tesla Gigafactory Shanghai. Source: Tesla Q3 2019 Update Letter.

Tesla is still a car company that relies substantially on its automotive revenue.

As of 2023, Tesla’s automotive segment contributed 86% of sales to total revenue compared to only 5% for the energy sector.

Tesla’s automotive sector is one of the most profitable segments, with a gross margin exceeding 20%.

Tesla’s massive profit generated by the automotive segment helps to cover operating expenses, pay off the company’s debt, generate tonnes of free cash flow, and possibly buy back shares and declare a dividend in the future.

All said, this article takes a deeper look at several statistics of Tesla’s automotive segment, which include vehicle sales, revenue figures, gross margin, growth rates, and a few ratios.

Let’s take a look!

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Automotive Segment Overview

O3. Number Of Vehicles Delivered

Revenue Numbers

A1. Automotive Revenue By Year

A2. Automotive Revenue By Quarter

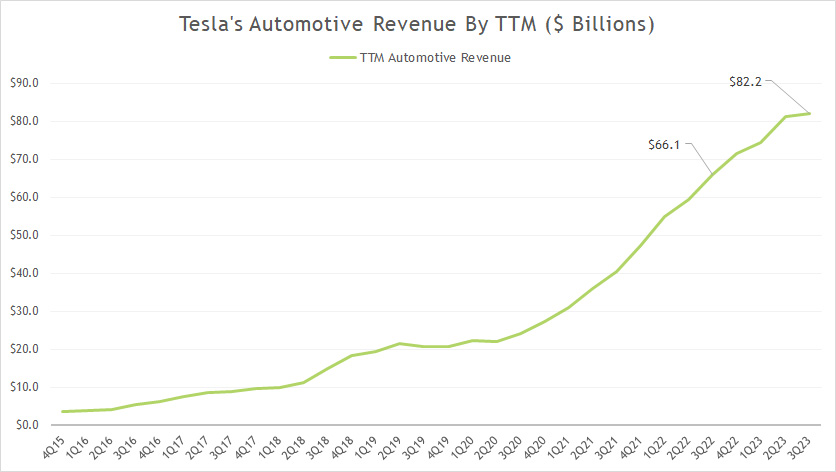

A3. Automotive Revenue By TTM

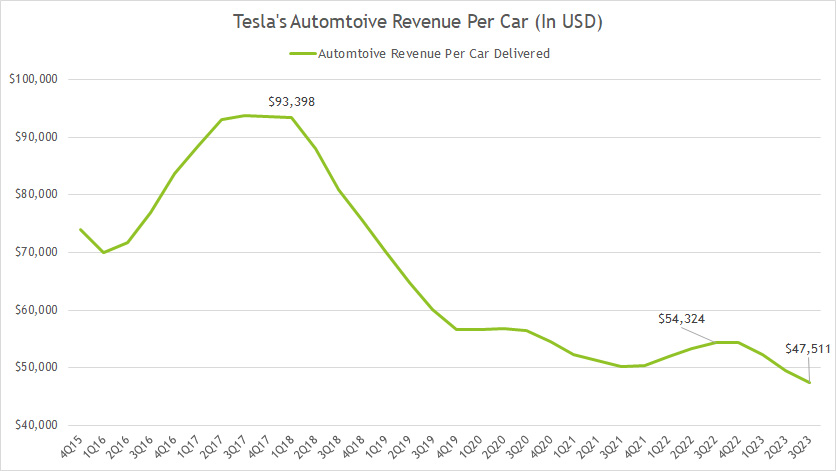

Revenue Per Car

A4. Automotive Revenue Per Car

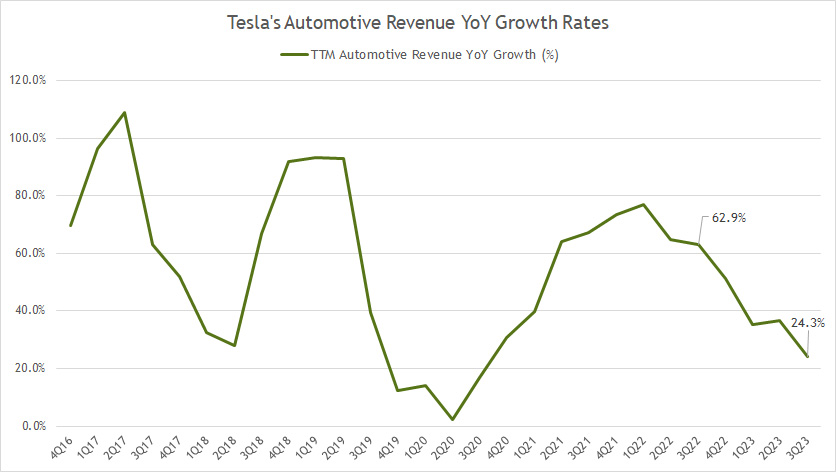

Growth Rates

B1. Growth Rates Of Automotive Revenue

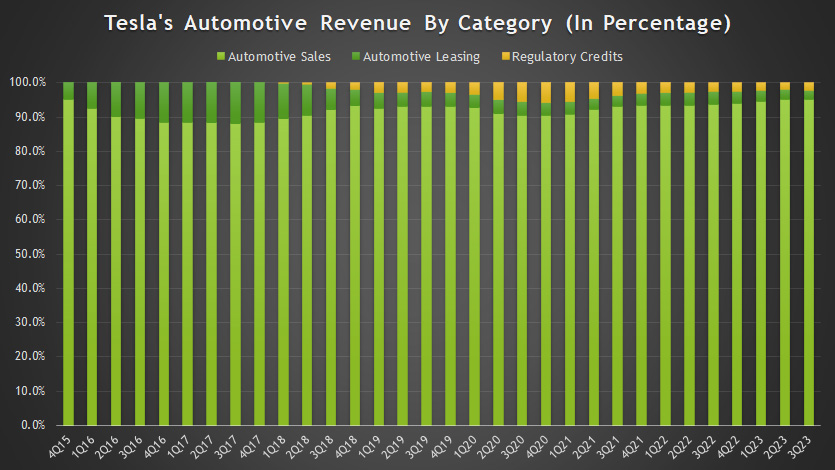

Revenue Breakdown

C1. Automotive Revenue By Category

As A Percentage Of Total Revenue

D1. Automotive Revenue to Total Revenue Ratio

Gross Margin

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Automotive Revenue: Tesla’s automotive revenue refers to the financial income generated by the sales and leasing of Tesla’s electric vehicles. This includes revenue from selling and leasing their Model S, Model X, Model 3, and Model Y vehicles and any other automotive products or services the company offers.

Precisely, Tesla’s automotive revenue consists of two components: automotive sales and automotive leasing.

Investors interested in Tesla’s automotive sales revenue may find more information on this page: Tesla Car Sales Revenue.

Investors interested in Tesla’s leasing revenue may find more information on this page: Tesla Leasing Revenue And Leased Vehicle Sales.

Automtoive Revenue Per Car: Tesla’s automotive revenue per vehicle is calculated as:

Automotive Revenue Per Car = Total Revenue From The Automotive Segment / Total Car Deliveries

Automotive Segment Overview

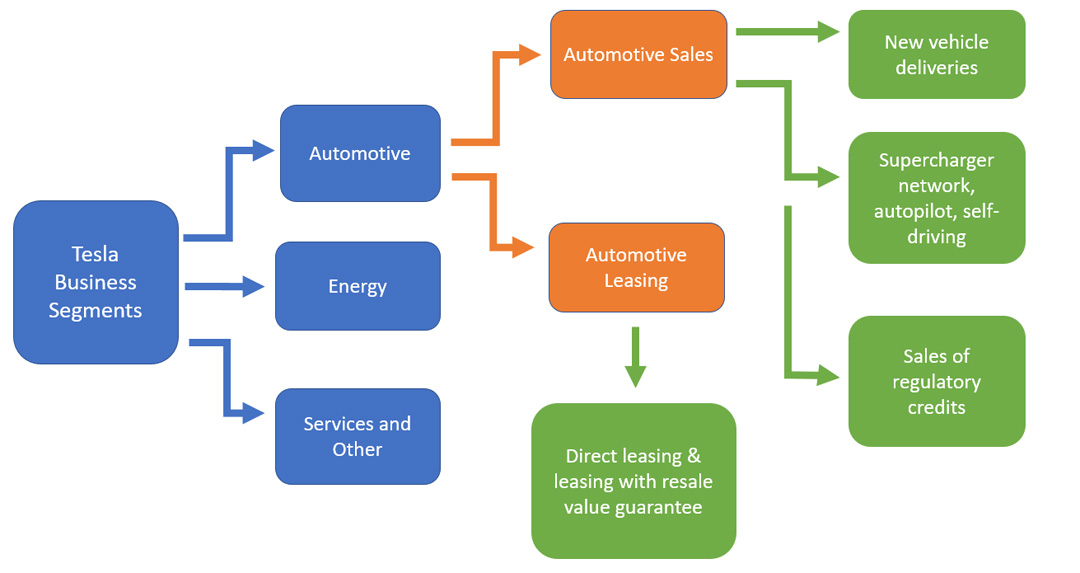

The following diagram sums up Tesla’s automotive business segment.

Tesla automotive business segment (click to enlarge)

Basically, Tesla’s automotive sector consists of two major segments: automotive sales and automotive leasing.

The automotive sales segment gets its revenue from new vehicle deliveries, charging and self-driving services, as well as the sale of carbon credits.

Investors interested in Tesla’s infrastructure expansion may find more information on this page: Tesla Supercharger Worldwide, Mobile Service Vehicles, And Number Of Stores.

On the other hand, the automotive leasing segment gets its revenue from vehicle leasing, which is further divided into direct leasing and leasing with a resale value guarantee.

Number Of Vehicles Delivered

Tesla vehicle delivery figures as of 4Q 2023

| As at 31 Dec | |||||||

|---|---|---|---|---|---|---|---|

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 Estimate | |

| Total Deliveries | 245,506 | 367,656 | 499,647 | 936,222 | 1,313,851 | 1,808,581 | 2,700,000 |

| Of Which Subject To Lease Accounting | 11,034 | 25,439 | 34,470 | 60,912 | 47,582 | 71,353 | 82,056 |

| % Of Leased Vehicles To Total Deliveries | 4.5% | 6.9% | 6.9% | 6.5% | 3.6% | 3.9% | 3.0% |

Tesla’s total vehicles delivered in 2023 topped 1.8 million units worldwide, helped significantly by Model 3 and Model Y.

Going into 2024, Tesla’s total vehicles delivered are estimated to be around 2.7 million units.

Investors interested in Tesla’s car sales and production by model may find more information on this page: Tesla Production And Delivery By Model.

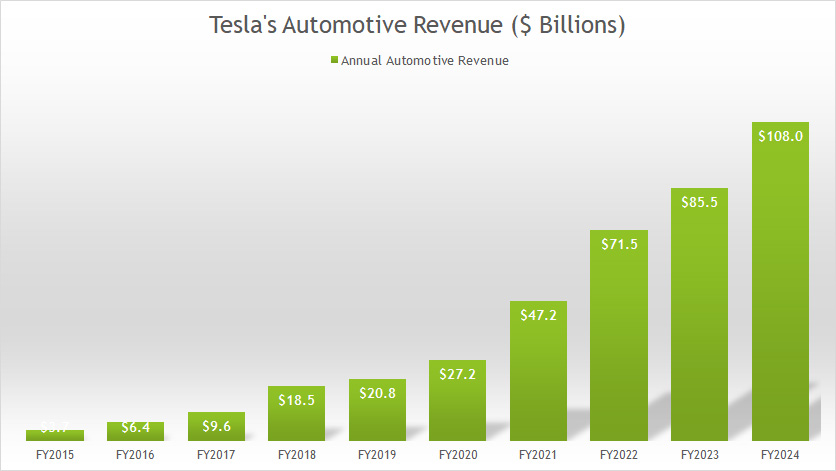

Automotive Revenue By Year

Tesla-automotive-revenue-by-year

(click image to expand)

Tesla earned US$71.5 billion in automotive revenue in fiscal 2022, a rise of over 50% from 2021.

Tesla is expected to earn up to US$85 billion in automotive revenue for fiscal 2023, and that figure is estimated to surge to US$108 billion by the end of fiscal 2024.

The 2024 estimated automotive revenue is based on the delivery figure of 2.7 million vehicles, which we saw in earlier discussions, and a conservative revenue per car of around US$40,000.

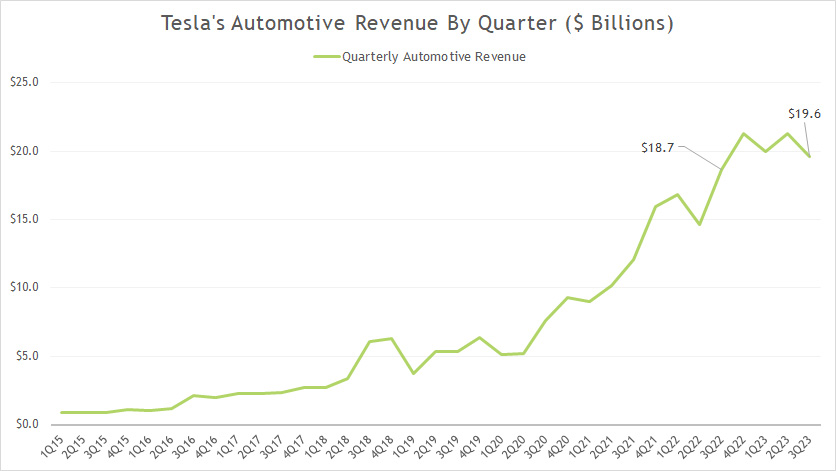

Automotive Revenue By Quarter

Tesla-automotive-revenue-by-quarter

(click image to expand)

Tesla earned quarterly automotive revenue of US$19.6 billion, US$21.3 billion, and US$20.0 billion in fiscal 3Q, 2Q, and 1Q 2023, respectively.

Tesla’s 3Q 2023 quarterly automotive revenue of US$19.6 billion represents an increase of 5% year-over-year.

Automotive Revenue By TTM

Tesla-automotive-revenue-by-ttm

(click image to expand)

The TTM plot above depicts the incredible rise of Tesla’s automotive revenue since 2015.

As of 3Q 2023, Tesla’s TTM automotive revenue reached a record figure of US$82.2 billion, up 24% from last year.

Automotive Revenue Per Car

Tesla-automotive-revenue-per-car

(click image to expand)

Although Tesla’s automotive revenue has been on a significant rise, its automotive revenue per car has considerably declined.

As of 3Q 2023, Tesla’s automotive revenue per car decreased to a record low of US$47,511, down 12.5% from a year ago.

At this rate of decline, Tesla’s automotive revenue per car may reach US$40,000 by the end of fiscal 2024.

Investors interested in Tesla’s revenue per car and revenue per employee may find more information on this page: Tesla Revenue Per Car And Sales Per Employee.

Growth Rates Of Automotive Revenue

Tesla-automotive-revenue-YoY-growth-rates

(click image to expand)

Year-over-year, Tesla’s automotive revenue growth has significantly slowed post-2022, as shown in the chart above.

For example, Tesla registered an automotive revenue year-on-year growth rate of 24.3% as of 3Q 2023, down significantly from the 62.9% growth rate measured a year ago.

Automotive Revenue By Category

Tesla-automotive-revenue-by-category

(click image to expand)

Tesla’s automotive sales revenue contributes the majority of sales to the automotive revenue.

The ratio reached 95% as of 3Q 2023, while automotive leasing contributed only 2.7%. Tesla’s regulatory credits revenue made up the rest at 2.2%.

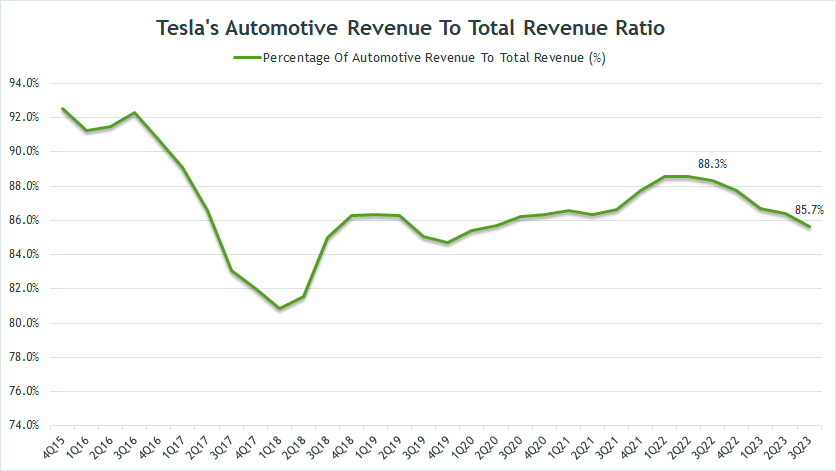

Automotive Revenue To Total Revenue Ratio

Tesla’s automotive revenue to total revenue ratio

(click image to expand)

With respect to the total revenue, Tesla’s automotive revenue represents about 85% of sales, as shown in the chart above.

This figure has remained relatively stable over the past several years but has slightly declined since 2015.

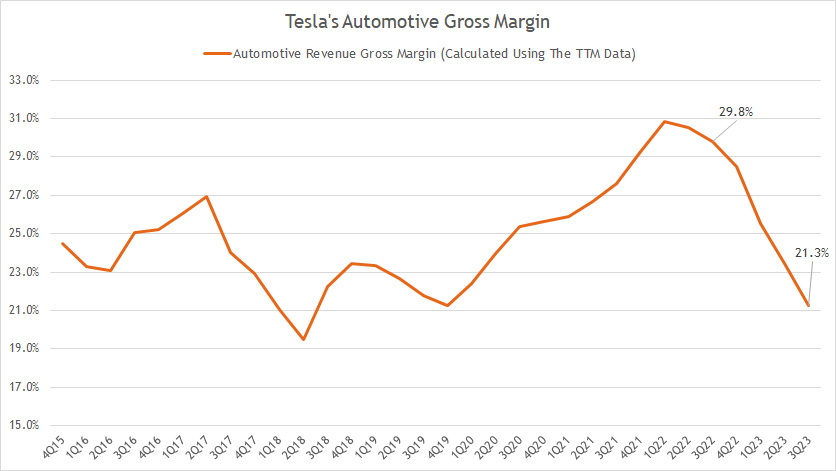

Automotive Gross Margin

Tesla-automotive-gross-margin

(click image to expand)

Tesla’s automotive gross margin decreased to 21.3% as of 3Q 2023, down significantly from the 29.8% measured a year ago.

Post-2022, Tesla’s automotive gross margin has significantly declined, possibly driven by the decrease in the automotive revenue per car, which we saw earlier.

Conclusion

Tesla’s automotive revenue has significantly risen over the past few years. In 2022, the company’s automotive revenue was $71.5 billion, a 50% increase from the previous year, and is expected to rise to $108 billion in 2024.

Tesla’s growing automotive revenue has been primarily driven by the increased sales of the Model 3 and Model Y vehicles. The Model 3, Tesla’s most affordable vehicle, accounted for most of the company’s sales so far.

There are concerns about Tesla’s automotive revenue due to its slowing growth and the decreasing gross margin.

Besides these problems, Tesla’s automotive revenue per car has also significantly declined and is expected to go lower due to rising competition.

The slowing revenue growth and the decreasing revenue per car have decreased Tesla’s automotive profit.

The good news is that Tesla has been actively expanding into new markets, such as China and Europe, which can undoubtedly contribute to the growth of its automotive segment.

As the company continues to innovate and introduce new models, its automotive revenue will continue to rise in the coming years.

References and Credits

1. All financial figures presented in this article were obtained and referenced from Tesla’s quarterly and annual reports, SEC filings, investor update letters, presentations, press releases, etc., which are available in Tesla Investor Overview.

2. Featured image was used under a Creative Common License and obtained from Pål-Kristian Hamre.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link to this article from any website so that more articles like this can be created.

Thank you!