3D printing conference & expo. Flickr Image.

This article compares the margins and profitability between 3D Systems (DDD) and Stratasys (SSYS).

3D Systems and Stratasys are leaders and early disruptors in additive manufacturing.

They offer innovative 3D printing solutions that cover the hardware part, such as 3D printers, and the software ecosystem that usually tags along with the printers.

The investment thesis revolving around 3D Systems and Stratasys is the lucrative razor and blades business model, which offers stable and long-term recurring revenue.

In this aspect, the razor is the printer, while the blades are the proprietary consumables that can only be provided by the respective company.

Therefore, 3D Systems and Stratasys operate in a highly lucrative industry.

Should the business take off, the share price would soar to the moon.

Without further delay, let’s head out to the following topics!

Please use the table of contents to navigate this page.

Table Of Contents

Overview

O2. Why Are 3D Printing Companies Making Less Profit Now?

Revenue

A1. Total Revenue And Net Sales

GAAP Margins

B1. Gross Profit Margin

B2. Operating Profit Margin

B3. Net Profit Margin

Non-GAAP Margins

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Adjusted EBITDA: Adjusted EBITDA stands for Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization. It’s a financial metric used by companies to evaluate their operating performance.

This metric adjusts the standard EBITDA figure to exclude non-recurring, irregular, or one-time expenses or incomes to provide a clearer picture of a company’s ongoing operational profitability.

Adjustments may include items like restructuring costs, stock-based compensation, unrealized gains or losses, and other non-cash items.

These adjustments aim to present a more accurate reflection of a company’s core earnings and financial health, facilitating better comparison across periods and with other companies.

Why Are 3D Printing Companies Making Less Profit Now?

Several factors could be contributing to 3D printing companies making less money now. Here are some potential reasons:

1. **Market Saturation**: As the 3D printing industry has grown, more companies have entered the market, increasing competition and potentially driving down prices.

2. **Technological Maturity**: As the technology behind 3D printing matures, the initial high demand and excitement that led to premium pricing may decrease. If companies cannot innovate quickly enough to maintain high-profit margins, this can lead to lower revenue.

3. **Supply Chain Issues**: Global supply chain disruptions, such as those caused by the COVID-19 pandemic, have affected many industries, including 3D printing. Disruptions can lead to increased costs and decreased efficiency, impacting profitability.

4. **Changing Markets and Applications**: As the applications for 3D printing evolve, companies that fail to adapt to new markets or use cases may find their products less in demand. For example, shifting from prototyping to production applications requires different capabilities and approaches, which not all companies can meet.

5. **Economic Factors**: Broader economic downturns or recessions can reduce spending on new technologies like 3D printing, as businesses and consumers cut back on expenses.

6. **Investment in Research and Development (R&D)**: Companies heavily investing in research and development to stay competitive may see short-term reductions in profitability, despite these investments being crucial for long-term success.

It’s important to note that these are potential reasons, and the specific circumstances can vary widely between different companies within the 3D printing industry.

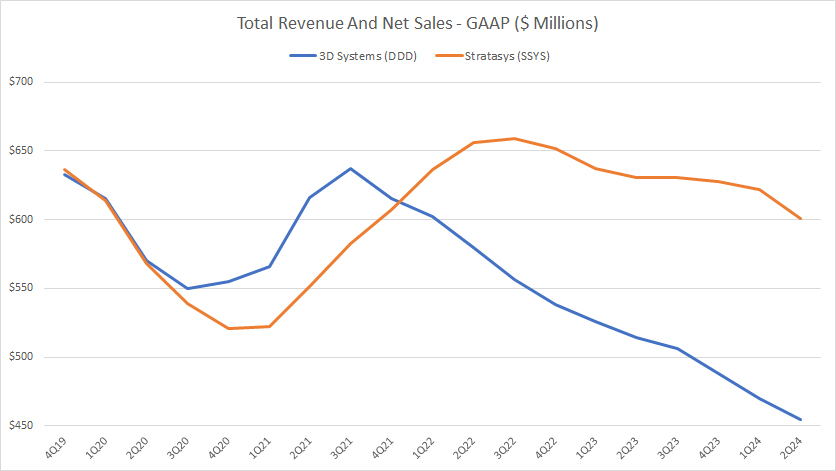

Total Revenue And Net Sales

Total revenue and net sales

(click image to expand)

Stratasys earns much higher revenue than 3D Systems.

As of fiscal 2Q 2024, Stratasys’ total revenue reached US$600 million compared to 3D Systems’ total revenue of just US$450 million on a TTM basis.

3D Systems used to earn much higher revenue. However, the company’s revenue figures have significantly declined in the post-pandemic era, highlighting the weaknesses of its business in the post-pandemic periods.

On the other hand, Stratasys’ sales have remained relatively intact during the same period, suggesting the resilience of its businesses in the post-pandemic periods.

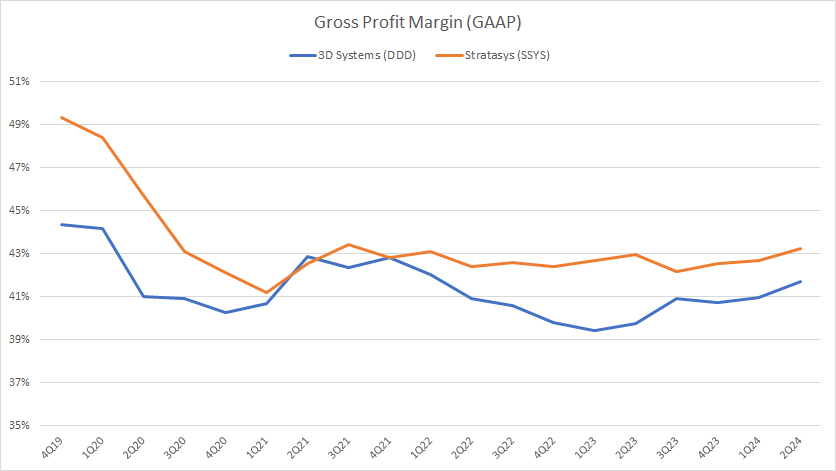

Gross Profit Margin

Gross profit margin

(click image to expand)

From the perspective of gross profit margin, both 3D Systems and Stratasys have nearly the same level of profitability.

Stratasys used to have much higher gross margins, notably at 50%.

However, Stratasys’ gross profit margins have significantly declined and totaled just 43% as of 2Q 2024.

On the other hand, 3D Systems’ gross profit margins reached nearly 42% as of 2Q 2024, only a bit lower than Stratasys’.

The gross profit margins of both companies have remained relatively stable in post-pandemic periods.

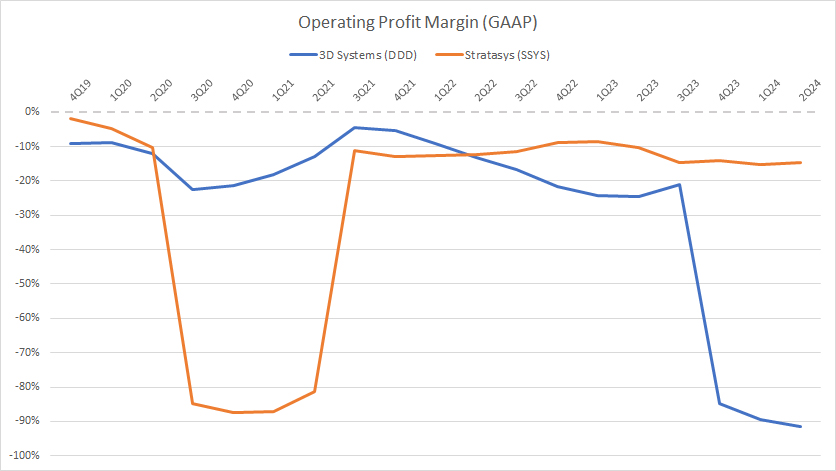

Operating Profit Margin

Operating profit margin

(click image to expand)

Stratasys and 3D Systems have nearly the same operating profit margins, in which both have been operating at a loss.

As of fiscal 2Q 2024, Stratasys’ operating profit margin reached about -15%, while 3D Systems’ figure dived to -90%.

As a result, 3D Systems’ operating profit margin is much worse than Stratasys’.

A noteworthy point is that both companies have operating losses in most fiscal years, suggesting the unprofitable nature of their businesses in most periods.

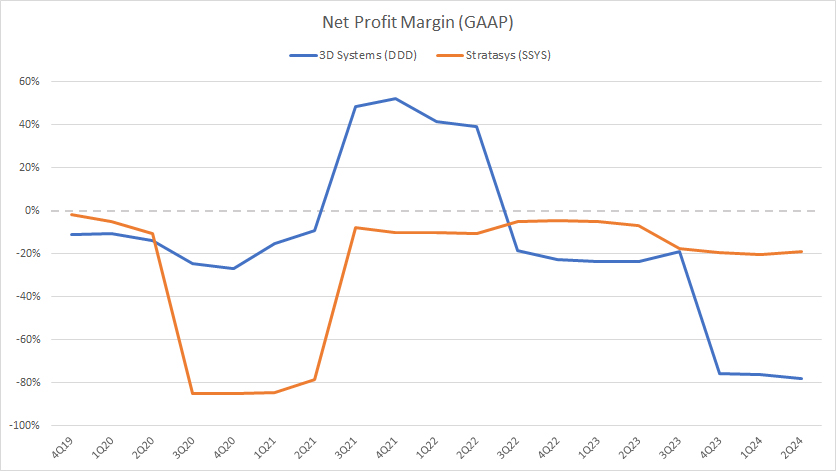

Net Profit Margin

Net profit margin

(click image to expand)

3D Systems and Stratasys have not been profitable when considering their net profit margins.

As of Q2 2024, 3D Systems’ net profit margin totaled nearly -80%, while Stratasys’ figure came in at -20%, a much smaller loss than 3D Systems.

3D Systems’ positive net profit margin in fiscal 2021 was due primarily to the sales of several assets, including the firm’s subsidiaries.

Therefore, this particular gain in net income for 3D Systems was a one-time deal and would not recur.

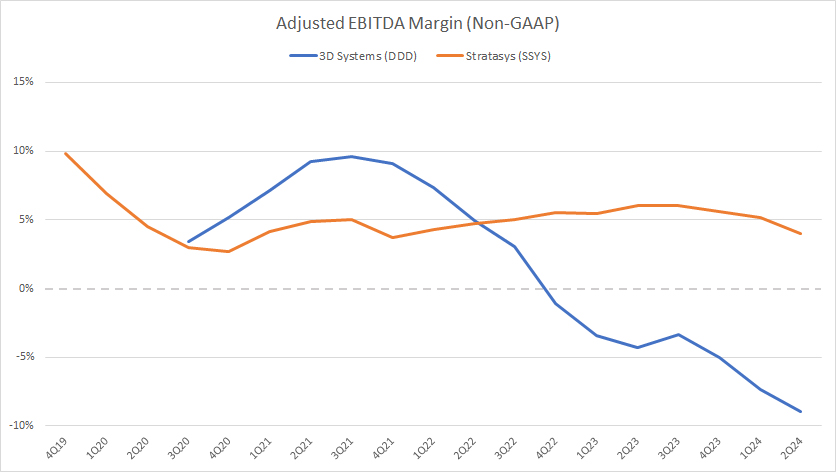

Adjusted EBITDA Margin

Adjusted EBITDA margin

(click image to expand)

The respective companies compute the adjusted EBITDA margin. The respective definition is available here: adjusted EBITDA.

Therefore, they may not be comparable on an apple-to-apple basis due to the different adjustment methods.

Nevertheless, according to the chart, 3D Systems used to have a much higher adjusted EBITDA margin than Stratasys, suggesting that the company generates much better cash earnings.

However, 3D Systems’ adjusted EBITDA margin has declined in the post-pandemic era, while Stratasys’ adjusted EBITDA margin has remained firm.

As of 2Q 2024, 3D Systems’ adjusted EBITDA margin decreased to nearly -10% compared to Stratasys’ figure of 5% for the same period.

Therefore, Stratasys generates much better cash earnings than 3D Systems does. Stratasys generates better profit than 3D System from the perspective of the EBITDA.

Summary

From a profitability perspective, Stratasys wins hands down.

This is evident from all of the better profitability metrics of Stratasys.

The difference was more profound in post-pandemic periods, in which Stratasys’ profit margins were particularly better than those of 3D Systems.

In the post-pandemic era, 3D Systems’ results have significantly declined in most profitability metrics.

As a result, Stratasys’ market cap has been valued significantly higher than 3D Systems.

As of Sept 2024, Stratasys’ market cap was US$530 million, while 3D Systems’ market cap was just US$320 million, only about half of that of Stratasys.

Credits and References

1. All financial figures in this article were obtained and referenced from financial filings available in the following locations:

i) SSYS Press Releases

ii) DDD Investor Relation

2. Featured images in this article are used under Creative Commons licenses and obtained from the following websites: 3D printing conference and expo and jello brain created by 3D printing.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link to this article from any website so that more articles like this can be created.

Thank you!