People. Source: Flickr

This article explores and compares the profit margins of social media giants Meta Platforms, Twitter, Snap Inc., and Pinterest.

We will analyze the gross margin, operating margin, net profit margin, and EBITDA margin.

In general, margins indicate the profitability of a company. Therefore, the larger the margin, the higher the company’s profit.

Besides, margins can be compared across companies that operate in the same industry and adopt the same accounting standard.

Before making a decision, investors should look at the companies’ margins and pick the one that produces the best results.

Typically, companies with the highest margins tend to be the most profitable and perform better in the long run.

This is not just reflected in the growth of share prices but also in the capital return, which includes cash dividends and share buybacks, if applicable.

Without further delay, let’s take a look!

Please use the table of contents to navigate this article.

Table Of Contents

Overview

O1. Definitions

Profit Margins

A1. Gross Margin

A2. Operating Margin

A3. Net Profit Margin

A4. Adjusted EBITDA Margin

Summary And Reference

S1. Summary

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Gross Margin: Gross margin is a financial metric representing the percentage of revenue exceeding the cost of goods sold (COGS). It is calculated by subtracting the COGS from the total revenue and dividing the result by the total revenue.

The gross margin indicates how much money a company has left over after accounting for the direct costs of producing its products or services. It is an important measure of a company’s profitability and efficiency in managing its production costs.

Operating Margin: Operating profit margin is a financial metric that measures the percentage of revenue that remains after deducting all operating expenses, such as salaries, rent, and utilities, but before deducting interest and taxes.

The operating profit margin indicates how much profit a company generates from its core business operations, and it is a key indicator of its operational efficiency and profitability. A higher operating profit margin indicates that a company can generate more profit from its operations, which can be reinvested in the business or distributed to shareholders.

Net Profit Margin: Net profit margin is a financial metric that measures the percentage of revenue that remains after deducting all expenses, including operating expenses, interest, taxes, and other non-operating expenses.

The net profit margin indicates how much profit a company generates from its total revenue and is a key indicator of its profitability. A higher net profit margin means that a company can generate more profit from its revenue, which can be used for reinvestment, expansion, or distribution to shareholders.

EBITDA Margin: EBITDA margin is a financial metric that measures a company’s profitability by calculating its earnings before interest, taxes, depreciation, and amortization (EBITDA) as a percentage of its total revenue.

The EBITDA margin is a useful measure of a company’s operating profitability. It shows how much cash flow a company generates from its core business operations without the impact of non-operating expenses such as interest and taxes. A higher EBITDA margin indicates that a company is generating more cash flow from its operations, which can be used for reinvestment, debt reduction, or distribution to shareholders.

Gross Margin

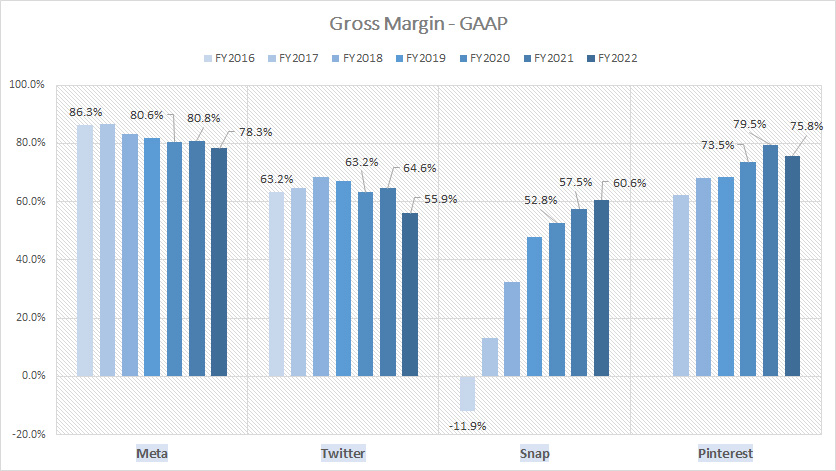

Meta, Twitter, Snap and Pinterest’s gross margin comparison

(click image to expand)

The majority of social media companies generate revenue by selling advertising space on their platforms.

Therefore, the gross margin for social media companies is a measurement of the direct costs of providing advertisement services to customers.

From the first look of the chart, Meta commands the highest gross margin among all social media companies in comparison, notably at 78.3% as of 2022.

Despite being the most profitable, the gross margin of Meta Platforms has significantly declined since 2016.

The decline in the gross margin of Meta Platforms over the years highlights the company’s struggle to manage its costs and maintain its profitability in the face of increasing competition and changing market dynamics.

On the contrary, Snap’s gross margin has expanded the fastest, despite being relatively new in the social media space.

As of fiscal 2022, Snap’s gross margin reached 61%, a year-on-year increase of 3 percentage points, but has improved by a massive milestone since 2016.

Pinterest’s gross margin is not that far behind, reaching as much as 75.8% as of fiscal 2022, second only to Meta.

Similar to Snapchat, Pinterest’s gross margin has been on a tear, highlighting the company’s remarkable growth over the years.

Twitter’s gross margin is the lowest among all social media companies in comparison and has remained relatively stagnant since 2016.

As of 2022, Twitter’s gross margin totaled only 55.9%, a significant decline over 2021.

Operating Margin

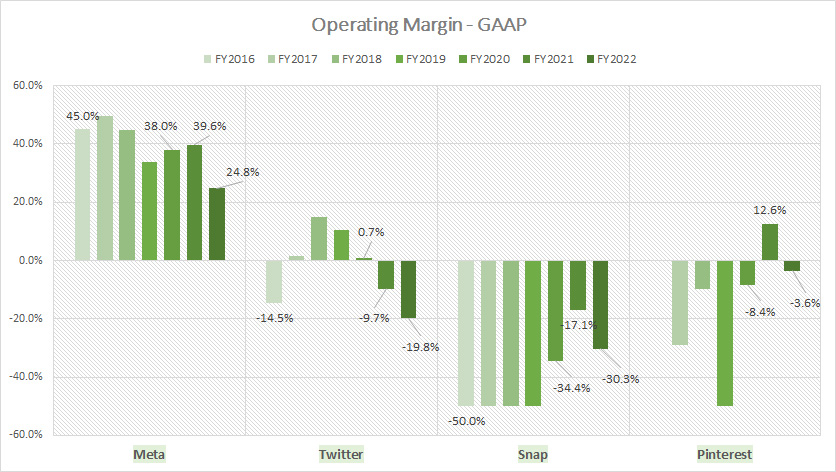

Meta, Twitter, Snap and Pinterest’s operating margin comparison

(click image to expand)

Again, Meta Platforms leads the pack when it comes to operating margin.

As presented in the chart, Meta Platforms’ operating margin topped 24.8% as of fiscal 2022, the highest among all social media companies in comparison.

Despite being a leading social media company, Meta’s profitability has significantly declined since 2016, as reflected in the decreasing operating margin.

A noteworthy trend is that most social media companies operate at a loss, as shown in the negative operating margins.

For example, Snap Inc.’s operating margin declined to -30.3% in fiscal 2022, while Pinterest’s figure reached -3.6% during the same period.

Twitter’s profitability also has significantly tumbled, with its operating margin plummeting to -19.8% in 2022 compared to -9.7% in the previous year.

The negative operating margins show that social media companies like Snapchat, Pinterest, and Twitter have enormous operating expenses, primarily in research and development expenses, as presented in this article, Meta R&D Vs. Snap, Twitter, And Pinterest.

In short, most social media companies’ profits after the costs of goods sold are insufficient to cover their huge operating expenses, leading to the operating loss.

Net Profit Margin

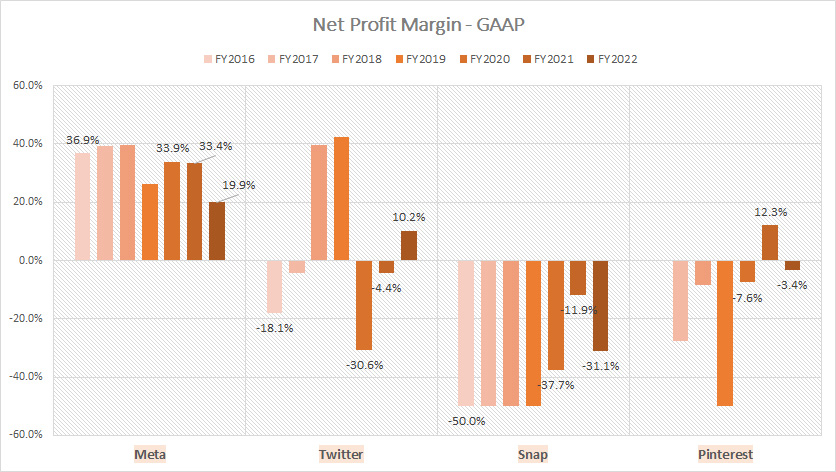

Meta, Twitter, Snap and Pinterest’s net profit margin comparison

(click image to expand)

Similar to the operating margin, Meta Platforms appears to be the only profitable social media company in terms of net profit margin.

Other social media companies such as Twitter, Snapchat, and Pinterest generate mostly negative net profit margins.

In fiscal 2022, Meta’s net profit margin declined to 19.9% from 33.4% in 2021.

Although Meta’s profitability leads all social media companies in comparison, its net profit margin has significantly declined since 2016, from 36.9% in 2016 to 19.9% as of 2022.

Pinterest’s net profit margin fell to -3.4% in 2022, while Snap’s result tumbled to -31.1% for the same period.

Surprisingly, Twitter recorded a positive net profit margin of 10.2% in fiscal 2022, fueled by a gain on the sale of asset group totaling nearly US$1 billion.

Despite being unprofitable in most fiscal years, Pinterest looked promising when its net profit margin surged to 12.3% in fiscal 2021.

However, Pinterest’s net profit margin declined to -3.4% in fiscal year 2022, causing the company to become unprofitable again.

Adjusted EBITDA Margin

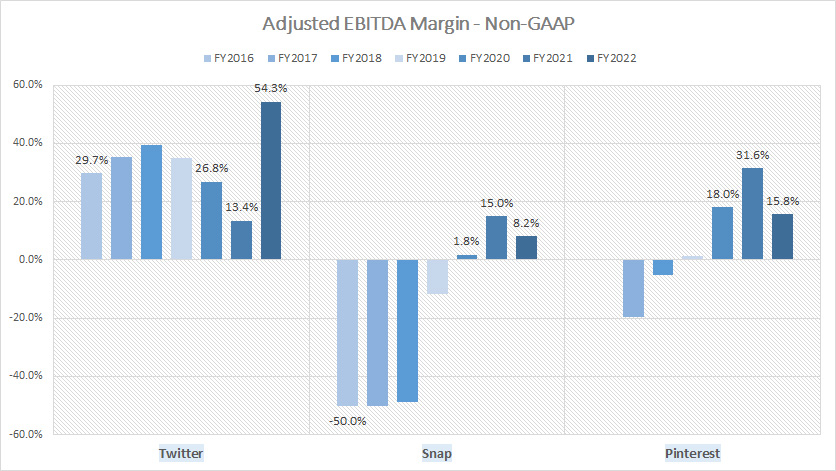

Twitter, Snap and Pinterest’s EBITDA margin comparison

(click image to expand)

Meta does not provide an EBITDA result.

We can still compare the results of Snap, Pinterest, and Twitter.

The chart shows that Twitter logged a significantly higher adjusted EBITDA margin than Pinterest’s and Snap’s in most fiscal years.

As of 2022, Twitter’s adjusted EBITDA margin surged to 54.3%, while Snap’s result topped 8.2% and Pinterest’s figure reached 15.8% for the same period.

Twitter has produced positive results in all fiscal years between 2016 and 2022, illustrating the company’s solid cash earnings generation.

On the other hand, Snapchat and Pinterest have only produced positive adjusted EBITDA margin in recent years.

Nevertheless, the latest positive figures indicate that the adjusted EBITDA margins of Snap and Pinterest have significantly improved, suggesting the solid capability of these social media firms to generate positive cash earnings.

Among all social media companies in comparison, Pinterest looks the most promising, as its adjusted EBITDA margin has been the most consistent over the past three years.

Conclusion

In short, Meta Platforms is among the most profitable social media firms compared to Pinterest, Snap Inc., and Twitter, with margins significantly exceeding those in comparison.

While other social media companies such as Snap and Pinterest may have lagged in margins, they have the best growth prospects given their excellent margins improvement over the years.

In this aspect, Pinterest and Snapchat have turned around from negative margins to positive results.

References and Credits

1. All financial figures presented in this article were obtained and referenced from quarterly and annual reports, investor presentations, earnings releases, SEC filings, etc., which are available on the following pages:

a) Meta Investor Relations

b) Pinterest Investor Relations

c) Twitter Investor Relations

d) Snap Investor Relations

2. Pixabay Images.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link to this article from any website so that more articles like this can be created.

Thank you!