Computing. Pexels Image.

This article presents the revenue distribution across various platforms (segments) of Taiwan Semiconductor Manufacturing Company Limited (TSMC).

TSMC’s platforms encompass High Performance Computing (HPC), Smartphone, Internet of Things (IoT), Automotive, Digital Consumer Electronics (DCE), and Others.

Let’s take a look! You may find related statistic of TSMC on these pages:

- TSMC revenue by country – U.S., China, Taiwan, Japan, etc.

- TSMC revenue by process node: 3nm, 5nm, 7nm, 10nm, and more, and

- TSMC revenue by product – wafer sales and other products.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

- New Taiwan Dollar (TWD)

- High Performance Computing (HPC)

- Smartphone

- Internet Of Things (IoTs)

- Automotive

- Digital Consumer Electronics (DCE)

O2. What is driving the significant revenue growth in TSMC’s HPC platform?

HPC, Smartphone, And IoT

A1. Revenue From HPC, Smartphone, And IoT

A2. Percentage Of Revenue From HPC, Smartphone, And IoT

Automotive, DCE, And Others

B1. Revenue From Automotive, DCE, And Others

B2. Percentage Of Revenue From Automotive, DCE, And Others

Revenue Growth By Platform

C1. YoY Growth Rates Of Revenue By Platform

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

New Taiwan Dollar (TWD): The New Taiwan Dollar (TWD), abbreviated as NT$, is the official currency of Taiwan.

It is used in all forms of transactions within the country, from daily expenses to business dealings. The New Taiwan Dollar is issued by the Central Bank of the Republic of China (Taiwan) and is subdivided into 100 cents.

Its symbol is NT$, and it is known for its stability and wide acceptance in the region. The exchange rate of TWD to USD is NT$1,000 to US$30.30.

High Performance Computing (HPC): TSMC’s High-Performance Computing (HPC) platform supports data-intensive applications driven by the explosion of data and advancements in AI.

This platform includes leading-edge logic process technologies such as 3nm, 4nm, 5nm, 6nm, and 7nm FinFET, as well as specialized HPC-focused technologies like N4X and N3X.

These technologies enable the development of AI accelerators, GPUs, ASICs, CPUs, FPGAs, server processors, and high-speed networking chips.

The HPC platform also incorporates advanced packaging technologies like CoWoS®, InFO, and TSMC-SoIC®, enhancing performance, compute density, energy efficiency, and integration for various applications, including 5G/6G infrastructures, AI, cloud, and enterprise data centers.

Smartphone: TSMC’s Smartphone Platform is designed to optimize performance, power, and area for mobile applications.

It leverages advanced logic process technologies and specialty components to support high-end to mainstream smartphones. The platform includes RF, power management ICs, sensors, and advanced packaging solutions like InFO, enabling higher performance and energy efficiency.

TSMC’s comprehensive IP ecosystem ensures first-time-right design and rapid time-to-market, making it a key enabler for the development of advanced smartphones with features like AI-enhanced picture quality, high frame rates, and low power consumption.

Internet Of Things (IoTs): TSMC’s IoT platform addresses the demand for connected devices and smart applications.

The platform includes ultra-low power (ULP) technologies, low operating voltage technologies, and specialty components such as RF, embedded non-volatile memory, CMOS image sensors, and MEMS.

Advanced wafer-level system integration (WLSI) technologies, including 3DIC, enhance performance and integration.

This platform supports various IoT applications, including wearables, smart homes, smart cities, and Industry 4.0, by providing low-power, high-performance solutions tailored to the specific needs of these applications.

Automotive: The Automotive Platform by TSMC caters to the unique semiconductor challenges of the automotive industry.

It includes advanced CMOS technologies for ADAS, RF technologies for 5G connectivity, non-volatile memory for next-gen MCUs, and CIS technologies for image and LiDAR sensors.

Additionally, TSMC offers BCD technologies for power management ICs and a comprehensive IP ecosystem for automotive-grade applications.

The platform ensures high reliability and quality standards, supporting the development of safer, greener, and smarter vehicles with advanced features like autonomous driving, enhanced connectivity, and efficient power management.

Digital Consumer Electronics (DCE): TSMC’s Digital Consumer Electronics (DCE) platform supports the development of innovative smart consumer devices.

It includes a comprehensive SoC process technology portfolio for smart digital TVs, set-top boxes, cameras, and other consumer electronics.

The platform features integrated CPU/GPU/NPU SoCs, advanced packaging technologies like InFO, and specialty components for RF, PMICs, sensors, and display chips.

These technologies enable high-performance, energy-efficient devices with advanced capabilities such as AI-enhanced video quality, 8K/4K resolution, and high frame rate gaming.

What is driving the significant revenue growth in TSMC’s HPC platform?

The significant revenue growth in TSMC’s High-Performance Computing (HPC) platform is driven by several key factors:

-

Demand for AI Processors:

- The increasing demand for AI processors has been a major driver of revenue growth. AI applications require high-performance computing capabilities, and TSMC’s advanced process technologies, such as 3nm, 5nm, and 7nm nodes, are well-suited to meet these needs.

-

Rebound of the PC Market:

- The rebound of the PC market has also contributed to the growth in HPC revenue. As the demand for personal computers and related components increases, TSMC benefits from higher orders for its advanced semiconductor products.

-

Advanced Manufacturing Processes:

- TSMC’s advanced manufacturing processes, including 3nm, 5nm, and 7nm technologies, have been a significant factor in driving revenue growth. These technologies accounted for a substantial portion of TSMC’s total wafer revenue, with the 3nm process contributing 26%, the 5nm process 34%, and the 7nm process 14% in Q4 2024.

-

High-Performance Computing Products:

- The launch of various HPC products, such as AI accelerators, GPUs, ASICs, CPUs, FPGAs, server processors, and high-speed networking chips, has fueled revenue growth. These products are essential for current and future 5G/6G infrastructures, AI, cloud, and enterprise data centers.

-

Capital Expenditure and Investment:

- TSMC’s significant capital expenditure and investment in advanced process technologies, specialty technologies, and advanced packaging have supported the growth of its HPC platform. The company allocated a substantial portion of its capital spending to these areas, ensuring continued innovation and capacity expansion.

In summary, the significant revenue growth in TSMC’s HPC platform is driven by the increasing demand for AI processors, the rebound of the PC market, advanced manufacturing processes, the launch of high-performance computing products, and substantial capital expenditure and investment in advanced technologies.

Revenue From HPC, Smartphone, And IoT

tsmc-revenue-from-hpc-smartphone-and-iot

(click image to expand)

The definitions of TSMC’s platforms are available here: High Performance Computing (HPC), Smartphone, and Internet Of Things (IoTs).

TSMC reports its financial statements primarily in New Taiwan Dollars (TWD). You can find more information about the currency exchange rates between TWD and the US dollar here: New Taiwan Dollar (TWD).

TSMC has demonstrated robust growth across its High Performance Computing (HPC), Smartphone, and Internet of Things (IoT) segments.

From fiscal year 2018 to fiscal year 2023, the HPC division saw substantial revenue increases, driven by the demand for AI processors and advanced computing applications, culminating in NT$935 (US$28.6 billion) billion in 2023.

The Smartphone segment experienced fluctuations, peaking at NT$889 billion (US$27.2 billion) in 2022 before slightly declining to NT$815 billion (US$24.9 billion) in 2023, reflecting varying market conditions and consumer preferences.

Meanwhile, the IoT segment consistently grew, nearly doubling from NT$87 billion (US$2.7 billion) in 2018 to NT$162 billion (US$5.0 billion) in 2023, as the proliferation of connected devices and smart applications fueled demand.

A significant trend in TSMC’s revenue distribution is the shift in dominance from the Smartphone segment to the High-Performance Computing (HPC) segment.

Historically, the Smartphone division generated the largest revenue among all of TSMC’s platforms. This was driven by the high demand for advanced mobile devices and TSMC’s leading-edge semiconductor technologies that powered many of these devices.

However, since fiscal year 2022, the HPC segment has overtaken the lead. This shift is attributed to the exponential growth in data and the increasing adoption of artificial intelligence (AI) and other data-intensive applications.

TSMC’s advanced process technologies, including 3nm, 4nm, 5nm, 6nm, and 7nm nodes, have been crucial in meeting the demands of HPC applications, such as AI accelerators, GPUs, CPUs, and high-speed networking chips.

The HPC segment’s growth has been further supported by the rebound of the PC market and the ongoing expansion of 5G/6G infrastructures, AI, cloud, and enterprise data centers.

The transition in revenue dominance from the Smartphone to the HPC segment highlights TSMC’s ability to adapt to changing market dynamics and capitalize on emerging trends.

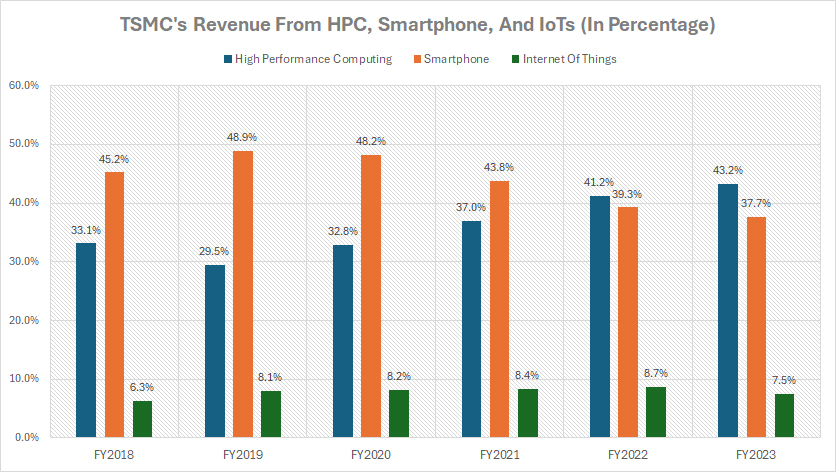

Percentage Of Revenue From HPC, Smartphone, And IoT

tsmc-revenue-from-hpc-smartphone-and-iot-in-percentage

(click image to expand)

The definitions of TSMC’s platforms are available here: High Performance Computing (HPC), Smartphone, and Internet Of Things (IoTs).

TSMC reports its financial statements primarily in New Taiwan Dollars (TWD). You can find more information about the currency exchange rates between TWD and the US dollar here: New Taiwan Dollar (TWD).

TSMC’s Smartphone segment used to generate the majority of the company’s revenue, accounting for nearly 50% of the total between fiscal years 2019 and 2020.

During this period, the demand for advanced mobile devices and TSMC’s leading-edge semiconductor technologies fueled significant revenue growth. The Smartphone segment even peaked at 49% in fiscal year 2019, marking its dominance in TSMC’s revenue distribution.

However, this dominance has waned over recent years. By fiscal year 2023, the Smartphone division’s contribution to the total revenue had declined to 38%.

This decline reflects shifting market dynamics, changes in consumer preferences, and increased competition within the mobile device industry.

In contrast, TSMC’s High Performance Computing (HPC) platform has experienced significant growth and has overtaken the Smartphone segment in terms of revenue share since fiscal year 2022.

By fiscal year 2024, the HPC segment accounted for an impressive 43% of the company’s total revenue, a substantial increase from 33% five years earlier.

This rise has been driven by the growing demand for advanced computing solutions, AI applications, and data-intensive tasks, which require TSMC’s cutting-edge semiconductor technologies.

Meanwhile, the Internet of Things (IoT) division, although growing, has contributed the least revenue compared to the HPC and Smartphone segments. In fiscal year 2024, the IoT platform made up only 7.5% of the total revenue.

Despite being the smallest contributor, the IoT segment’s steady growth reflects the increasing proliferation of connected devices and smart applications across various industries.

In summary, TSMC’s revenue distribution has shifted significantly over the past few years. While the Smartphone segment once dominated, the HPC segment has emerged as the leading revenue driver.

The IoT segment, though smaller in comparison, continues to grow steadily, highlighting TSMC’s ability to adapt to changing market trends and capitalize on emerging technologies.

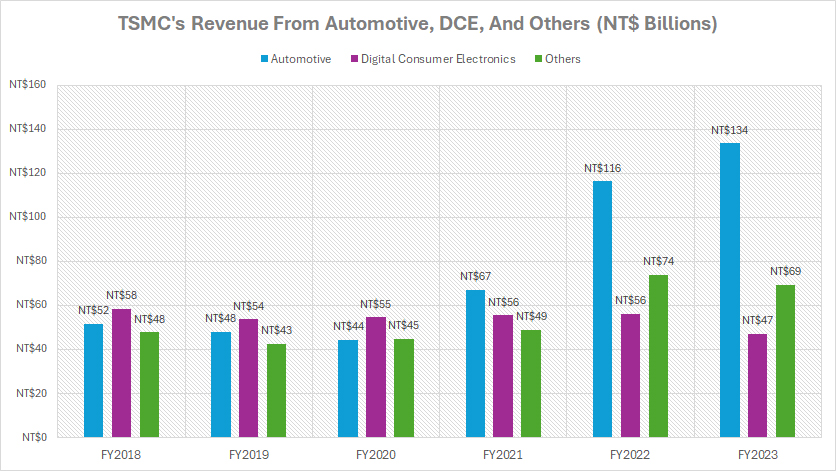

Revenue From Automotive, DCE, And Others

tsmc-revenue-from-automotive-dce-and-others

(click image to expand)

The definitions of TSMC’s platforms are available here: Automotive and Digital Consumer Electronics (DCE).

TSMC reports its financial statements primarily in New Taiwan Dollars (TWD). You can find more information about the currency exchange rates between TWD and the US dollar here: New Taiwan Dollar (TWD).

TSMC’s Automotive, Digital Consumer Electronics (DCE), and Others divisions contribute significantly less revenue in comparison to the High Performance Computing (HPC), Smartphone, and Internet of Things (IoT) platforms.

These latter segments are the primary drivers of TSMC’s revenue, overshadowing the contributions from the automotive, DCE, and other categories.

Nevertheless, TSMC’s Automotive segment has shown consistent and substantial growth. It started at NT$58 billion (US$1.8 billion) in fiscal year 2018 and increased significantly to NT$134 billion (US$4.1 billion) in fiscal year 2023.

This reflects a growth rate of approximately 158%, driven by the rising demand for automotive semiconductor products and the increasing adoption of advanced automotive technologies.

In contrast, the DCE segment has experienced significant fluctuations over the years. Between fiscal year 2018 and 2023, TSMC’s revenue from the DCE platform has dropped from NT$58 billion (US$1.8 billion) to NT$47 billion (US$1.4 billion), representing a decline of 19% in five years.

The decreasing trend illustrates that the demand for digital consumer electronics has not seen significant growth and has even slightly declined in recent years.

The Others segment has shown a steady increase in revenue. Starting at NT$48 billion (US$1.5 billion) in fiscal year 2018, it gradually rose to NT$74 billion (US$2.3 billion) in fiscal year 2022 before slightly declining to NT$69 billion (US$2.1 billion) in fiscal year 2023.

This division experienced an overall growth rate of approximately 43.8%, reflecting TSMC’s growing diversification in revenue sources outside of the automotive and DCE segments.

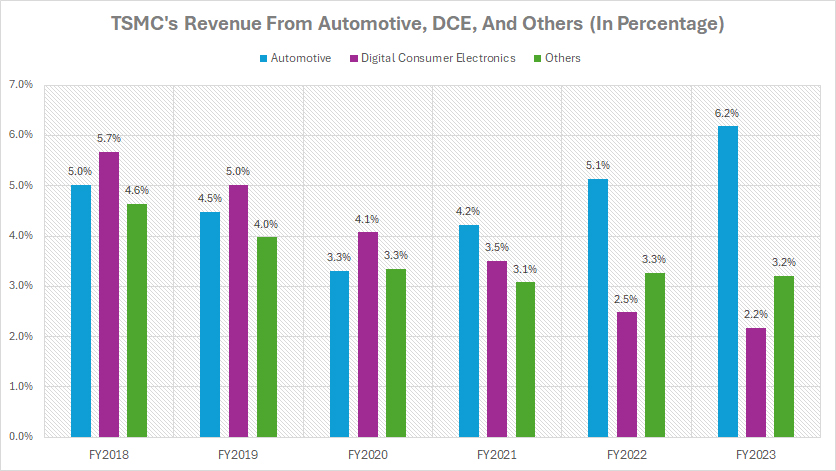

Percentage Of Revenue From Automotive, DCE, And Others

tsmc-revenue-from-automotive-dce-and-others-in-percentage

(click image to expand)

The definitions of TSMC’s platforms are available here: Automotive and Digital Consumer Electronics (DCE).

TSMC reports its financial statements primarily in New Taiwan Dollars (TWD). You can find more information about the currency exchange rates between TWD and the US dollar here: New Taiwan Dollar (TWD).

In 2018, TSMC’s Automotive segment accounted for 5.0% of total revenue, and by 2023, this segment’s share had increased to 6.2%.

This trend highlights the growing importance of the automotive sector in TSMC’s revenue generation, driven by the rising demand for automotive semiconductor products.

In contrast, TSMC’s Digital Consumer Electronics (DCE) division has experienced a consistent decline. In 2018, DCE made up 5.7% of TSMC’s total revenue, but by 2023, this share had decreased to 2.2%.

This indicates that the demand for digital consumer electronics has not only failed to grow but has also diminished over the years, contributing less to TSMC’s overall revenue.

The Others segment has shown fluctuations but generally maintained a stable revenue contribution. Starting at 4.6% in 2018, this segment’s share saw minor changes, reaching 3.2% in 2023.

This stability suggests that while the Others division may not be a major driver of revenue growth, it remains a consistent source of income for TSMC.

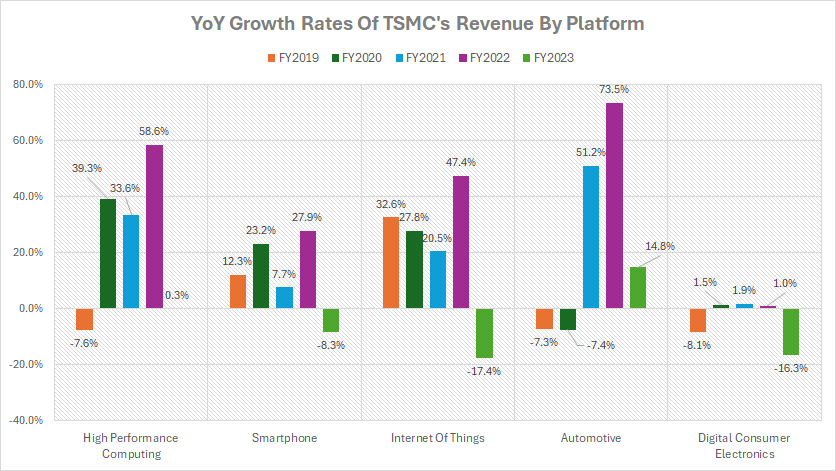

YoY Growth Rates Of Revenue By Platform

tsmc-revenue-by-platform-yoy-growth-rates

(click image to expand)

While the Automotive segment contributes significantly less revenue, it stands out with one of the highest growth rates among all segments.

From fiscal year 2021 to 2023, TSMC’s Automotive division achieved an impressive average annual growth rate of 46.5%, reflecting the rising demand for automotive semiconductor products and the increasing adoption of advanced automotive technologies.

In comparison, the High Performance Computing (HPC) segment obtained a substantial annual average growth rate of 31% during the same period.

This growth underscores the expanding need for advanced computing solutions and AI applications, driven by the proliferation of high-performance computing and data-intensive tasks.

TSMC’s Internet of Things (IoT) platform reported a steady average annual growth rate of 17% from fiscal year 2021 to 2023. This consistent growth highlights the increasing proliferation of connected devices and smart applications, which continue to drive demand in the IoT market.

On the other hand, the Smartphone segment experienced a modest average annual growth rate of 9% over the same period. This modest growth reflects the cyclical nature of the smartphone market and the impact of changing consumer preferences and market conditions.

The Digital Consumer Electronics (DCE) segment faced challenges, experiencing a decrease in revenue growth between fiscal year 2021 and 2023, with an average annual decline of -4.5%.

This decline indicates stagnation and volatility in the demand for digital consumer electronics, highlighting the need for strategic adjustments to address market dynamics.

A significant trend observed is that TSMC experienced revenue declines across most divisions in fiscal year 2023. However, the Automotive segment defied this trend, achieving a remarkable revenue increase of 15% year-on-year.

This growth emphasizes the segment’s resilience and strong market demand, positioning it as a key contributor to TSMC’s overall revenue growth.

In summary, while the Automotive segment contributes less revenue compared to other segments, its high growth rate and recent performance highlight its strategic importance for TSMC.

Conclusion

In summary, TSMC’s diversified platform strategy, with strong growth in the HPC, IoT, and Automotive segments, and the varying performance of the Smartphone and DCE segments, reflects its adaptability and strategic focus on emerging technologies to maintain robust revenue growth.

Credits and References

1. All financial figures presented were obtained and referenced from TSMC’s annual reports published on the company’s investor relations page: TSMC Annual Reports.

2. Pexels Images.

Disclosure

We may utilize the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.