Tesla supercharger stations at Southlake, Texas. Source: Flickr

To support the world’s transition from fossil fuel to clean energy, Tesla (NASDAQ: TSLA) has built a network of infrastructure that spans all over the world.

This infrastructure network comprises buildings and vehicles, including the supercharger stations, mobile service vehicles, and stores and service locations that work tirelessly for the company.

These properties represent some of Tesla’s most valuable assets. These assets help Tesla to generate revenue and differentiate it from competitors.

Apart from being monetary, these assets provide the company with competitive advantages, which serve as a barrier of entry that is hard to replicate because it takes years and a vast amount of resource to set up.

In addition, Tesla’s operations also rely on these infrastructures to work seamlessly. Therefore, a look at the growth of these assets will give investors valuable insights into Tesla’s business prospects.

This article explores Tesla’s most valuable infrastructures and tracks the growth of these assets, primarily consisting of supercharger stations, mobile service vehicles, and stores and service locations.

Let’s take a look!

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Are Tesla Superchargers Free?

Network Of Infrastructure

A1. Supercharger Stations

A2. Mobile Service Fleet

A3. Stores and Service Locations

Summary And Reference

S1. Investor Takeaway

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Superchargers: Tesla’s Superchargers are a network of high-speed charging stations designed to charge Tesla electric vehicles quickly. They are strategically located along popular highways and city centers, making long-distance travel more convenient and accessible for Tesla owners.

The Superchargers can deliver up to 170 miles of range in just 30 minutes of charging time, allowing drivers to quickly and easily recharge their vehicles while on the go. The stations are powered by renewable energy sources, such as solar and wind power, making them a more sustainable transportation option.

Mobile Service Fleet: Tesla’s mobile service fleet consists of technicians who travel to Tesla owners’ homes or workplaces to perform vehicle maintenance and repairs.

The service fleet is equipped with all the necessary tools and parts to address common issues and perform routine maintenance, such as tyre rotations or brake replacements. This service is designed to make it more convenient for Tesla owners to maintain their vehicles without taking them to a service center.

Stores And Service Locations: Tesla’s stores and service locations are physical locations where customers can purchase Tesla vehicles, receive information about Tesla products, and get support for their Tesla vehicles after purchase.

These locations are typically found in high-traffic areas, such as shopping malls or city centers, and are designed to provide customers with a unique and engaging experience. Tesla’s stores and service locations also offer maintenance and repair services for Tesla vehicles, test drives and product demonstrations.

The company aims to create a seamless and enjoyable customer experience at every stage of the vehicle ownership process, from purchase to maintenance and beyond.

Are Tesla Superchargers Free?

No, Tesla’s Superchargers are not free. While some early Tesla models had unlimited free Supercharging, most new Tesla vehicles are now sold with a Supercharging fee.

The cost of Supercharging varies by location and electricity rates and can be viewed on the vehicle’s touchscreen or in the Tesla mobile app. However, Tesla occasionally offers free Supercharging as a promotion to incentivize purchases or to reward existing Tesla owners.

Supercharger Stations

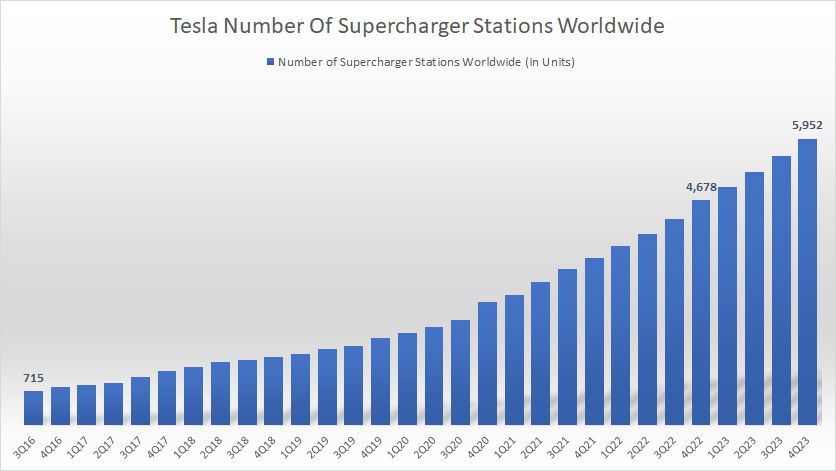

Tesla’s supercharger stations

(click image to enlarge)

Average YoY Growth Rate In 2023 => 32%

The definition of Superchargers is available here: Superchargers.

Tesla has built a network of charging infrastructure referred to as Supercharger stations to remove the general perception that electric vehicles are typically limited by travelling distance.

These Supercharger stations are built to provide fast charging to enable long-distance travel and to encourage the broad adoption of electric vehicles.

According to Tesla, they are built with an industrial-grade high-speed charger explicitly designed to recharge a Tesla electric vehicle significantly faster than other charging options.

For instance, Tesla Superchargers can replenish half the battery in as little as 20 minutes. Besides, Tesla has a growing network of Destination Charging partners – including hotels, restaurants, resorts, and Airbnb locations. The use of the Supercharger network is either free or requires a small fee.

A typical Supercharger station is equipped with six to twenty electric outlets and is strategically located along well-traveled routes to allow electric vehicle owners the ability to enjoy long-distance travel with convenience and minimal stops.

When we look at the chart above, the number of Tesla’s Supercharger stations has dramatically grown since 2016. Over the past eight years, Tesla has more than quadrupled the number of Supercharger stations worldwide, from 700 stations in 2016 to nearly 6,000 stations as of 2023.

Tesla has been adding this important asset from quarter to quarter, demonstrating that expanding a network of Supercharging infrastructure is crucial for the broad adoption of electric vehicles.

This unique asset is hard to replicate and requires huge upfront capital outlay.

Over the chart, we can see that the growth of Tesla’s Supercharger stations was particularly impressive between fiscal 2021 and 2023.

In 2023 alone, Tesla added over 1,200 Supercharger stations, beating all prior records, while the number soared by 1,000 units in fiscal 2022. These were the two best years in which the growth of the company’s Supercharger stations was the highest.

In summary, the continuous expansion of Tesla’s supercharging infrastructure indicates healthy business prospects.

Mobile Service Fleet

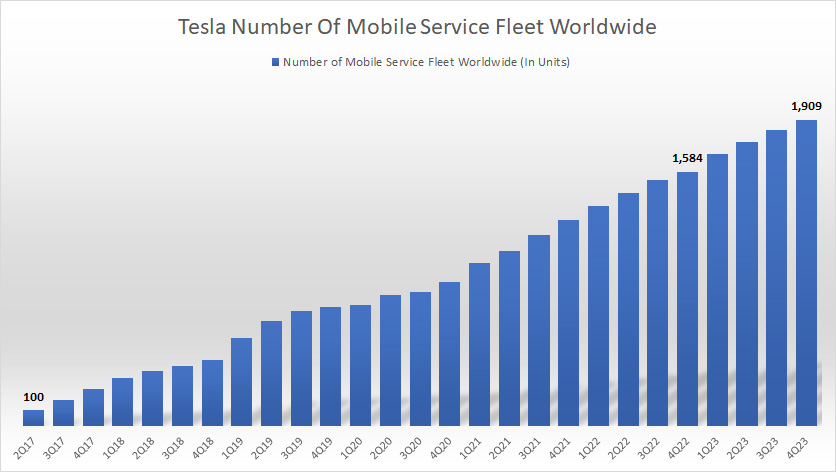

Tesla’s mobile service fleet numbers

(click image to enlarge)

Average YoY Growth Rate In 2023 => 22%

The definition of mobile service fleet is available here: mobile service fleet.

Tesla launched the mobile service fleet to create the best car ownership experience for its customers. The biggest advantage of the mobile service fleet is that Tesla’s customers are not required to come to Tesla service centers to service their vehicles.

In North America alone, mobile service is now completing a substantial number of all service jobs, allowing its customers never to leave their homes or offices to get their cars serviced.

According to Tesla, the mobile service fleet has achieved excellent customer satisfaction because of its convenience and lower service cost than its service centers.

Tesla will continue to increase its service capacity, especially during the period of Model 3 and Model Y ramp up.

As the chart above shows, Tesla’s mobile service fleet total has increased tremendously from only 100 vehicles in 2Q17 to over 1,900 vehicles as of 2023 4Q, representing an average growth rate of roughly 22% in 2023.

Similarly, the high number of Tesla’s mobile service fleet indicates a high barrier of entry for other EV companies and a distinctive competitive advantage for Tesla.

In fiscal 2021 alone, Tesla added nearly 400 mobile service vehicles, representing a more than 40% growth from 2020. In 2022, Tesla added roughly 300 mobile service vehicles, up 24% from a year ago, while in 2023 alone, it gained 325 vehicles.

In 4Q 2023, Tesla’s mobile service fleet grew 20% year over year. Again, the continuous expansion of Tesla’s mobile service fleet demonstrates Tesla’s improving business prospects over the years.

Stores and Service Locations

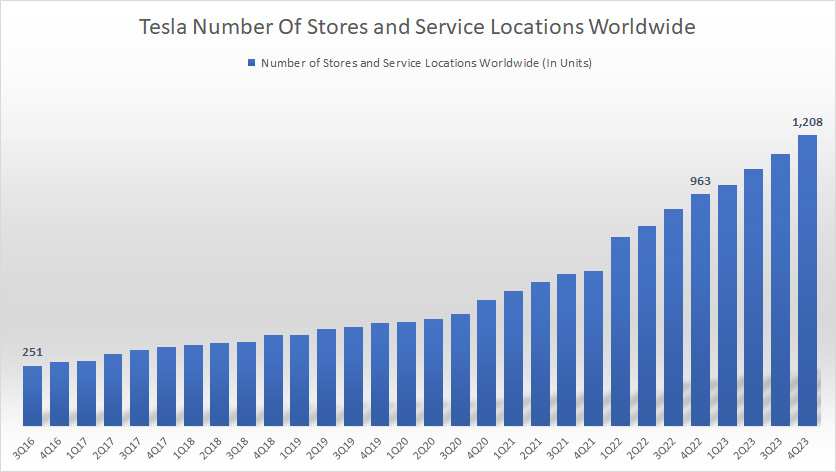

Tesla’s new stores and service locations numbers

(click image to enlarge)

Average YoY Growth Rate In 2023 => 31%

The definition of stores and service locations is available here: stores and service locations.

Tesla opens its stores and service locations in highly visible, premium outlets in major metropolitan markets. These stores are owned and operated by Tesla.

As far as I know, no third-party vendors are involved in the sales of any products. The reason is that the company wants to have better control of inventory, manage warranty services and pricing, maintain and strengthen the Tesla brand, and more importantly, have faster customer feedback.

According to Tesla, opening a new store and service center in a new geographic area boost demand for its products. Therefore, Tesla has rapidly increased its retail footprint by having more stores and service outlets.

In addition, Tesla combines these facilities with sales personnel in service centers and refers to them as “Service Plus” locations. Despite the importance of opening new stores and service locations, the average YoY growth rate was slightly over 30% in 2023.

Tesla may have slowed down in recent years in opening new stores and service locations as the services provided by these stores can overlap with those provided by the mobile service fleet.

Besides, maintaining new stores and service locations requires huge working capital and takes resources out of the company. Tesla has been quite conservative in expenses and costs and has switched to online booking for most of its products.

As a result, Tesla’s new store and service location openings have remained relatively flat in recent years. Although new stores and service location openings have slowed, Tesla still operates over 1,200 stores and service locations globally as of 2023 4Q, as shown in the chart above.

As of 4Q 2023, Tesla grew its store and service locations by 25% year-over-year, which worked out to about 245 new store and service location openings.

Investor Takeaway

In conclusion, Tesla runs a massive network of Supercharger stations globally. Similarly, Tesla has significantly expanded its mobile service fleet, while new store and service location openings have remained upbeat.

Compared to new stores and service locations, Tesla’s mobile service fleet is easier to maintain and requires less capital to operate. More importantly, they cover a greater area than stores and service centers, usually fixed to a location.

In addition, the mobile service fleet gives better customer satisfaction in terms of flexibility and cost, according to Tesla. Therefore, the mobile service fleet probably offers a much higher return on invested capital.

For these reasons, Tesla may have closed some physical stores and switched to online ordering. Tesla will likely further slow the opening of physical stores and service locations.

However, Tesla’s physical stores and service locations are not without their merits. Tesla’s physical stores and service locations provide a better shopping experience than online stores.

In summary, Tesla’s infrastructure, including Supercharger stations, mobile service fleets, stores, and service locations, is experiencing substantial growth. This growth in infrastructure is a positive indication of the company’s strong business prospects.

Again, Tesla’s supercharging stations, mobile service vehicles, stores, and service locations are all important assets that the company can’t do without.

References and Credits

1. All data presented in this article were obtained and referenced from Tesla’s quarterly and annual update letters, which are available in Tesla Press Releases.

2. Tesla supercharger detailed info: Tesla charging infrastructure.

3. Featured images in this article are used under a Creative Commons license and sourced from the following websites: Ed Uthman

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link to this article from any website so that more articles like this can be created.

Thank you!