Avocado. Pexels Image.

This article presents the combined market share of Philip Morris International’s (PMI) cigarettes and heated tobacco units (HTU) across different regions.

PMI distributes its cigarette and HTU products in four key regional markets: Europe, SSEA & CIS & MEA, EA & AU & PMI DF, and Americas.

Let’s look at the results!

For other key statistics of Philip Morris International, you may find more resources on these pages:

Sales

Revenue

Market Share

- Global market share: cigarette and HTU combined,

- Market share by country: cigarette and HTU combined,

- Market share by country: cigarette only,

- Market share by country: HTU only,

- Market share of Marlboro and other cigarette brands

Profit Margin

Other Statistics

- Financial health: total debt, payment due, and cash,

- Capital expenditures

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

- Total Market Share

- Heated Tobacco Units (HTU)

- Reduced-risk Products (RRPs)

- In-Market Sales (IMS)

- Europe Region

- SSEA, CIS & MEA

- EA, AU & PMI DF

- Americas

O2. Why does the market share of Philip Morris International remain solid in most markets?

New Regions

A1. Total Market Share By Region (New)

Legacy Regions

B1. Total Market Share By Region-1 (Legacy)

B2. Total Market Share By Region-2 (Legacy)

Summary And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Total Market Share: Total market share is defined as PMI’s cigarette and heated tobacco unit in-market sales volume as a percentage of total industry cigarette and heated tobacco unit sales volume, excluding China and the U.S., including cigarillos in Japan.

Heated Tobacco Units (HTU): HTU is the term PMI uses to refer to heated tobacco consumables, which include BLENDS, DELIA, HEETS, HEETS Creations, HEETS Dimensions (defined collectively as “HEETS”), Marlboro HeatSticks, SENTIA, TEREA, TEREA CRAFTED, and TEREA Dimensions, as well as the KT&G licensed brands, Fiit and Miix (outside of South Korea). HTU’s also include zero tobacco heat-not-burn consumables (LEVIA).

Reduced-risk Products (RRPs): Reduced-risk products (“RRPs”) is the term PMI uses to refer to products that present, are likely to present, or have the potential to present less risk of harm to smokers who switch to these products versus continuing smoking.

PMI has a range of RRPs in various stages of development, scientific assessment and commercialization. PMI’s RRPs are smoke-free products that contain and generate far lower quantities of harmful and potentially harmful constituents than those found in cigarette smoke.

In-Market Sales (IMS): In-market sales (“IMS”) is defined as sales to the trade channels, which serve the end legal age nicotine users.

Depending on the market and distribution model, IMS may represent an estimate. Consequently, past reported periods may be updated to ensure comparability and to incorporate the most current information.

In other words, in-market sales (IMS) represents the number of units sold to consumers rather than shipments from manufacturers or distributors.

IMS is often used to gauge real consumer demand and market penetration, making it a valuable metric for assessing product performance.

Europe Region: Europe Region is headquartered in Lausanne, Switzerland, and covers all the European Union countries, Switzerland, the United Kingdom, and also Ukraine, Moldova and Southeast Europe.

SSEA, CIS & MEA: South and Southeast Asia, Commonwealth of Independent States, Middle East and Africa Region (“SSEA, CIS & MEA”) is headquartered in Dubai, United Arab Emirates.

It covers South and Southeast Asia, the African continent, the Middle East, Turkey, as well as Israel, Central Asia, Caucasus and Russia.

EA, CIS & PMI DF: East Asia, Australia, and PMI Duty Free Region (“EA, AU & PMI DF”) is headquartered in Hong Kong, and includes the consolidation of PMI’s international duty free business with East Asia & Australia.

Americas: Americas Region is headquartered in Stamford, Connecticut, and covers the United States, Canada and Latin America.

Why does the market share of Philip Morris International remain solid in most markets?

Philip Morris International (PMI) maintains a strong market share across various regions due to several key factors:

-

Brand Strength: PMI owns globally recognized brands like Marlboro, which continue to dominate the cigarette market.

-

Diversification into Smoke-Free Products: The company has aggressively expanded its portfolio of heated tobacco products (HTUs) and nicotine pouches, such as IQOS and ZYN, which now account for a significant portion of its revenue.

-

Resilience in Consumer Demand: Despite declining smoking rates in some regions, PMI benefits from the addictive nature of nicotine, ensuring steady demand for its products.

-

Strategic Market Positioning: PMI operates outside the U.S., allowing it to navigate regulatory challenges differently than domestic tobacco companies like Altria.

-

Financial Strength: The company has consistently delivered strong earnings growth, with its smoke-free segment driving profitability.

PMI’s ability to adapt to changing consumer preferences while leveraging its established brand presence has helped it maintain a solid foothold in the global tobacco industry.

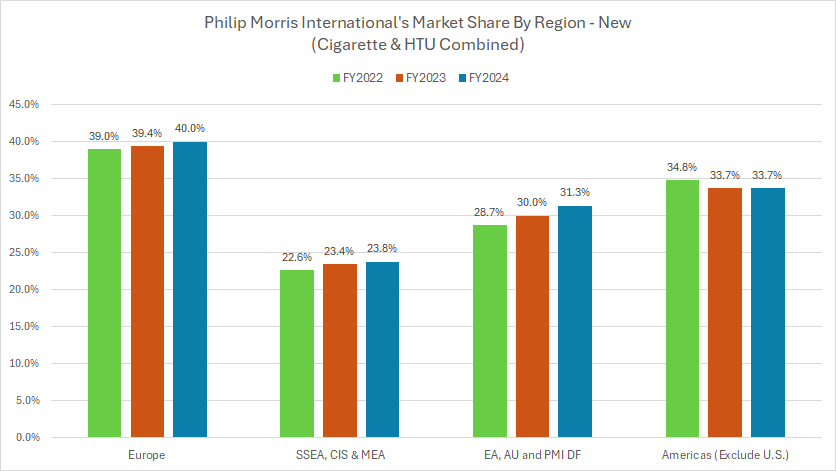

Total Market Share By Region (New)

philip-morris-market-share-by-region-new

(click image to expand)

The definition of PMI’s total market share is available here: total market share.

You may find more information about PMI’s regions here: Europe, SSEA, CIS & MEA, EA, AU & PMI DF, and Americas.

Market share numbers are based on the combined shipments of cigarette and HTU.

PMI reorganized its regions from the previous six to four starting in fiscal year 2023. Prior year data was a recast.

Legacy regions are presented here: legacy regions.

Philip Morris International (PMI)’s total market share of cigarette and HTU has remained solid across most regions, as show in the chart. Here is the breakdown:

Market Share in FY2024:

| Region | Market Share (%) |

|---|---|

| Europe | 40.0% |

| SSEA, CIS & MEA | 23.8% |

| EA, AU & PMI DF | 31.3% |

| Americas | 33.7% |

2-Year Market Share Trend from FY2022 to FY2024:

| Region | Market Share (%) | % Point Changes |

|---|---|---|

| Europe | 39.0% to 40.0% | +1.0% |

| SSEA, CIS & MEA | 22.6% to 23.8% | +1.2% |

| EA, AU & PMI DF | 28.7% to 31.3% | +2.6% |

| Americas | 34.8% to 33.7% | -1.1% |

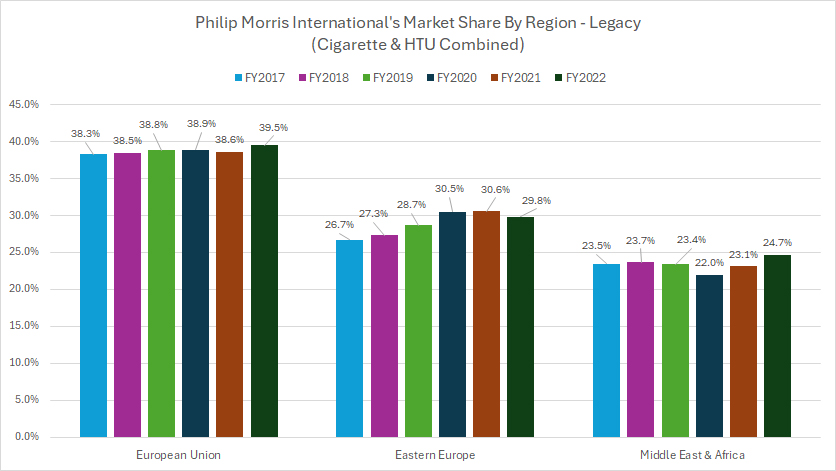

Total Market Share By Region-1 (Legacy)

philip-morris-market-share-by-region-legacy

(click image to expand)

The definition of PMI’s total market share is available here: total market share.

Market share numbers are based on the combined shipments of cigarette and HTU.

The regions presented in this section are considered legacy and are no longer classified as reportable segments starting in fiscal year 2023.

New reportable regions are presented here: new regions.

Philip Morris International (PMI) has maintained a relatively stable total market share for cigarettes and heated tobacco units (HTUs) across most regions. However, market share has declined in South & Southeast Asia as well as Americas, as illustrated in the chart.

Here is the breakdown:

Market Share in FY2022:

| Region | Market Share (%) |

|---|---|

| European Union | 39.5% |

| Eastern Europe | 29.8% |

| Middle East & Africa | 24.7% |

5-Year Market Share Trend from FY2017 to FY2022:

| Region | Market Share (%) | % Point Changes |

|---|---|---|

| European Union | 38.3% to 39.5% | +1.2% |

| Eastern Europe | 26.7% to 29.8% | +3.1% |

| Middle East & Africa | 23.5% to 24.7% | +1.2% |

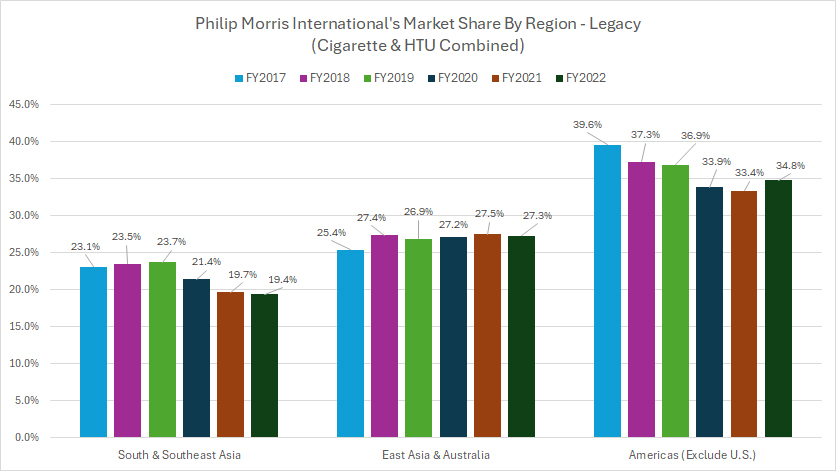

Total Market Share By Region-2 (Legacy)

philip-morris-market-share-by-region-legacy

(click image to expand)

The definition of PMI’s total market share is available here: total market share.

Market share numbers are based on the combined shipments of cigarette and HTU.

The regions presented in this section are considered legacy and are no longer classified as reportable segments starting in fiscal year 2023.

New reportable regions are presented here: new regions.

Philip Morris International (PMI) has maintained a relatively stable total market share for cigarettes and heated tobacco units (HTUs) across most regions. However, market share has declined in South & Southeast Asia as well as Americas, as illustrated in the chart.

Here is the breakdown:

Market Share in FY2022:

| Region | Market Share (%) |

|---|---|

| South & Southeast Asia | 19.4% |

| East Asia & Australia | 27.3% |

| Americas | 34.8% |

5-Year Market Share Trend from FY2017 to FY2022:

| Region | Market Share (%) | % Point Changes |

|---|---|---|

| South & Southeast Asia | 23.1% to 19.4% | -3.7% |

| East Asia & Australia | 25.4% to 27.3% | +1.9% |

| Americas | 39.6% to 34.8% | -4.8% |

Insight

PMI’s ability to retain a solid market share reflects its successful balance of traditional tobacco sales and expansion into smoke-free alternatives.

While the company faces regional challenges in East Asia & Australia and the Americas, its strategic execution continues to sustain competitive strength.

References and Credits

1. All financial figures presented were obtained and referenced from PMI’s quarterly and annual reports published on the company’s investor relations page: PMI’s Reports And Filings.

2. Pexekls Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.

I appreciate you sharing this blog post. Thanks Again. Cool.