A 1958 GM Oldsmobile vehicle. Flickr Image.

This article details the vehicle wholesales of General Motors (NYSE: GM), categorized by segment.

GM operates through two main divisions: GM North America (GMNA) and GM International (GMI).

You may find related statistic of General Motors on these pages:

- GM global sales and market share,

- GM sales by country – U.S., China, Brazil, U.K., etc., and

- GM stock buyback history.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

- Vehicle Wholesales

- GM North America (GMNA)

- GM International (GMI)

- GM Europe (GME)

- Revenue Per Vehicle

O2. What is driving the growth of GM’s vehicle sales in North America?

Consolidated Results

A1. Total Vehicle Wholesales

A2. YoY Growth Rates Of Total Vehicle Wholesales

Results By Segment

B1. GMNA, GMI, And GME Vehicle Wholesales

B2. GMNA, GMI, And GME Vehicle Wholesales In Percentage

Growth Rates

C1. YoY Growth Rates Of GMNA, GMI, And GME Vehicle Wholesales

Average Transaction Price Per Vehicle

D1. Average Revenue Per Vehicle

Summary And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Vehicle Wholesales: Vehicle wholesales refer to the sale of vehicles by manufacturers to dealerships or other intermediaries before they reach the final consumers.

This metric measures the number of vehicles sold from the manufacturer to these intermediaries, and it is an important indicator of a company’s production volume and demand at the dealership level.

Wholesales typically do not account for the end consumer sales but provide insight into the supply chain and inventory levels.

GM North America (GMNA): GM North America (GMNA) is a key operating segment of General Motors (GM) that encompasses the company’s automotive operations in the North American region, primarily the United States and Canada.

GMNA is responsible for the design, production, and sales of GM vehicles in these markets. It includes popular brands such as Chevrolet, GMC, Buick, and Cadillac.

GMNA is a significant revenue generator for GM and plays a crucial role in the company’s overall financial performance.

GM International (GMI): GM International (GMI) is an operating segment of General Motors (GM) that encompasses the company’s automotive operations outside of North America.

GMI includes regions such as Latin America, Africa, the Middle East, and Asia-Pacific. This segment is responsible for the design, production, and sales of GM vehicles in these international markets.

GMI focuses on meeting the diverse needs and preferences of consumers in different regions while leveraging GM’s global scale and expertise to drive growth and profitability.

GM Europe (GME): GM Europe (GME), often referred to as General Motors Europe, was the European subsidiary of the American automaker General Motors (GM).

Established in 1986, GME operated 14 production and assembly facilities across nine European countries and employed around 54,500 people. The core brands under GME were Opel and Vauxhall, which offered similar ranges of cars in different markets.

GM Europe also included the Swedish brand Saab until early 2010 and sold Chevrolet models between 2005 and 2015. In 2017, GM Europe was sold to PSA Peugeot-Citroën and later became part of Stellantis in 2021.

Revenue Per Vehicle: Revenue per vehicle is a financial metric used primarily in automotive companies dealing with vehicle sales, rentals, or leasing.

It represents the average income generated per vehicle over a specific period. This metric is calculated by dividing the total revenue earned from the vehicles by the number of vehicles involved in generating that revenue.

It helps automotive companies assess the profitability and efficiency of their vehicle-related operations and make informed decisions regarding pricing, inventory management, and promotional strategies.

What is driving the growth of GM’s vehicle sales in North America?

Several factors are driving the increase in GM’s vehicle sales in North America:

- Strong Product Portfolio: GM has invested in a diverse range of vehicles, including both electric and gas-powered models, catering to various consumer preferences. This has allowed them to offer something for everyone, from full-sized pickups to luxury SUVs.

- Electric Vehicle (EV) Sales Growth: GM has seen a significant increase in EV sales, with a 125% jump in the fourth quarter of 2024 and a doubling of EV market share over the year. Models like the Equinox EV and the Cadillac LYRIQ have been particularly popular.

- Market Share Expansion: GM’s market share for trucks and SUVs has been expanding, reaching record figures in 2024. This growth is supported by strong sales across all four of its major brands: Chevrolet, GMC, Buick, and Cadillac.

- High Transaction Prices: GM has achieved higher average transaction prices, with Q4 prices reaching nearly $53,000, well above the industry average. This indicates strong consumer demand for their vehicles.

- Record Sales in Key Segments: GM has been the leading seller of full-sized pickups and full-size SUVs for multiple years, contributing to their overall North America sales growth.

- Effective Inventory Management: GM has managed to maintain an inventory of about 54 days, meeting their target and ensuring they can meet consumer demand.

These factors combined have contributed to GM’s strong sales performance in North America, reflecting their strategic focus on innovation, market demand, and customer satisfaction.

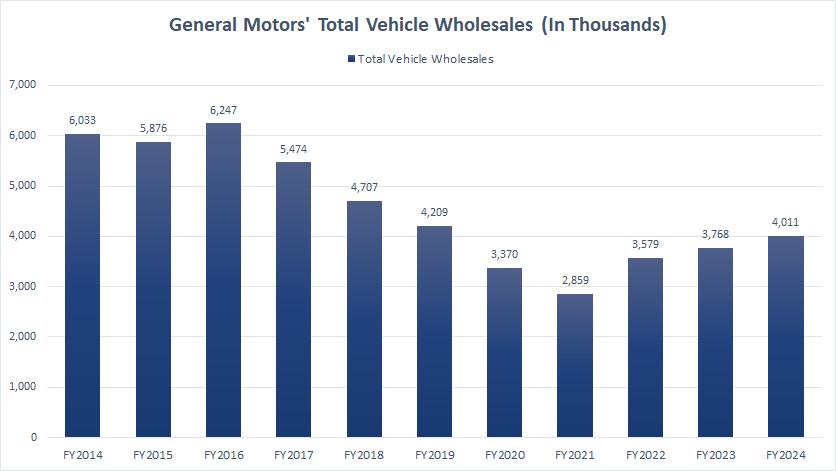

Total Vehicle Wholesales

GM global wholesale

(click image to expand)

The definition of GM’s vehicle wholesales is available here: vehicle wholesales.

Globally, GM delivered 4.0 million vehicles by the end of fiscal year 2024, representing a 6% increase from the 3.8 million units recorded in fiscal year 2023.

GM’s vehicle wholesales reached their lowest point in fiscal year 2021 at 2.9 million units. Since then, GM’s global wholesales have impressively rebounded, achieving a record figure of 4 million vehicles in fiscal year 2024. This marks an increase of over 1 million vehicles, or nearly 40%, in just three years.

Although GM’s vehicle sales have shown a positive trend over the past three years, reaching 4.0 million units in fiscal year 2024, they remain significantly lower than historical highs.

For instance, GM achieved nearly 5 million vehicle sales in fiscal year 2018. This indicates that while the company has made substantial progress in recovering from the lows of fiscal year 2021, there is still considerable room for growth to return to its peak performance levels.

The current sales figures underscore both the challenges GM has faced in recent years and the opportunities that lie ahead as the company continues to innovate and adapt to market demands.

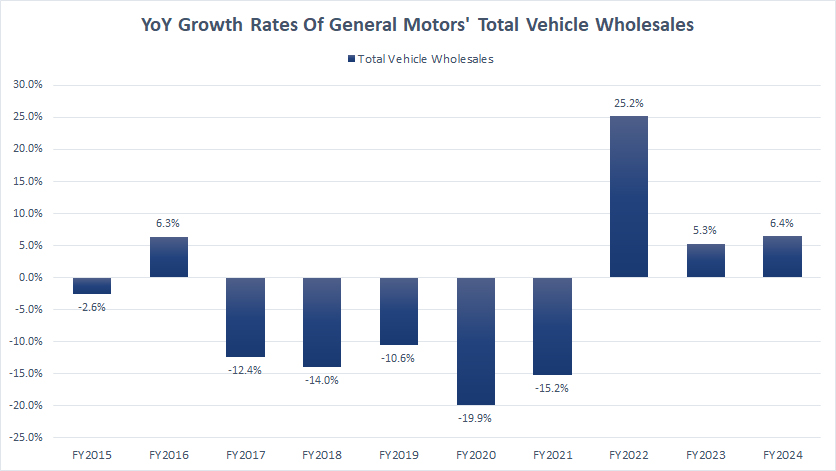

YoY Growth Rates Of Total Vehicle Wholesales

GM global wholesale YoY growth rates

(click image to expand)

The definition of GM’s vehicle wholesales is available here: vehicle wholesales.

Before fiscal year 2022, GM’s global vehicle deliveries showed little to no growth, with consistent negative sales growth in worldwide wholesales, as illustrated in the chart above.

It wasn’t until fiscal year 2022 that GM began to report positive sales growth, marking a turning point for the company’s global vehicle deliveries.

Since then, GM has demonstrated a strong recovery and upward trajectory in sales. On average, GM’s annual sales growth has amounted to 12% over the past three years, from fiscal year 2022 to 2024.

This impressive growth rate reflects GM’s successful strategies in rebounding from previous lows and capturing market share in key regions.

By focusing on innovation, electric vehicles, and adapting to changing consumer preferences, GM has managed to boost its global vehicle deliveries significantly.

This sustained growth highlights the company’s resilience and ability to navigate the dynamic automotive industry, setting a strong foundation for future expansion.

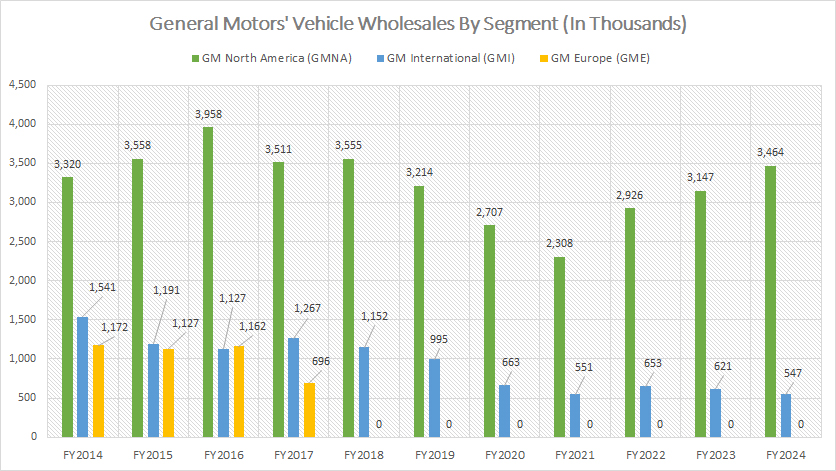

GMNA, GMI, And GME Vehicle Wholesales

GM vehicle wholesale by segment

(click image to expand)

You may find the definitions of GM’s operating segments here: GM North America, GM International, and GM Europe.

The definition of GM’s vehicle wholesales is available here: vehicle wholesales.

In fiscal year 2017, GM Europe was divested as part of a strategic restructuring, leading to its dissolution. This marked the end of GM Europe’s operations.

The most recent vehicle sales data for GM Europe indicated that approximately 700,000 vehicles were delivered in fiscal year 2017. This figure represents the final sales performance before GM Europe was divested.

Despite the challenging market conditions, GM Europe managed to deliver a significant number of vehicles, marking its last contribution to the global automotive market before ceasing operations.

On the other hand, GM North America (GMNA) shipped about 3.5 million vehicles in fiscal year 2024, a significant rise from the 3.1 million vehicles shipped in fiscal year 2023.

In fiscal year 2022, GMNA delivered approximately 2.9 million vehicles, showing a substantial increase compared to the 2.3 million vehicles delivered in fiscal year 2021.

While GMNA’s vehicle wholesales experienced a significant rebound, GM International (GMI) faced a contrasting trend. GMI’s vehicle shipments declined to just 547,000 units by the end of fiscal year 2024, marking a new low over the past decade.

GMI’s vehicle wholesales amounted to 653,000 units in fiscal year 2022 and 621,000 units in fiscal year 2023.

A significant trend observed was that GMNA’s vehicle sales reached a new low in fiscal year 2021, with only 2.3 million units sold.

This downturn marked a notable decrease compared to previous years, reflecting the impact of various challenges faced by the industry, such as supply chain disruptions and shifting market dynamics.

Despite this decline, GMNA has since worked on strategies to recover and adapt to the evolving automotive landscape. As a result, GMNA’s wholesales have significantly recovered in subsequent periods, with sales numbers not only stabilizing but reaching record figures.

This remarkable turnaround underscores GMNA’s resilience and ability to navigate the challenges of the modern automotive industry.

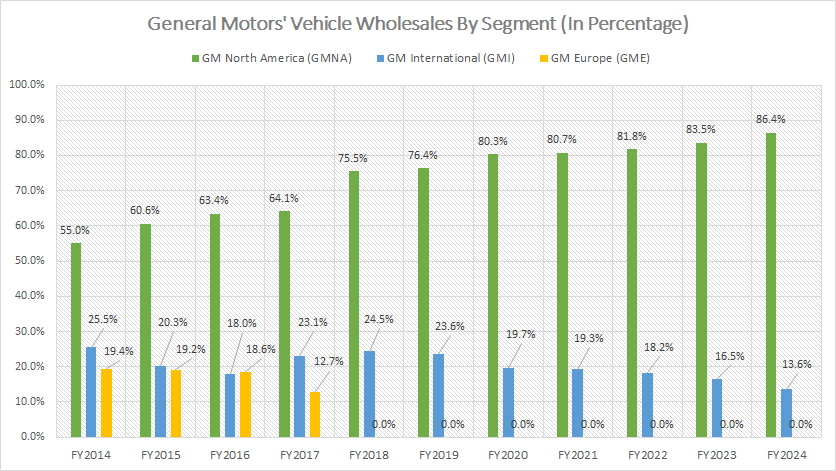

GMNA, GMI, And GME Vehicle Wholesales In Percentage

general-motors-vehicle-wholesale-by-segment-in-percentage

(click image to expand)

You may find the definitions of GM’s operating segments here: GM North America, GM International, and GM Europe.

The definition of GM’s vehicle wholesales is available here: vehicle wholesales.

In fiscal year 2024, GM North America’s (GMNA) vehicle sales accounted for 86% of the total, marking a record high over the past decade. A significant trend is the marked increase in this ratio, which has risen from 55% in fiscal year 2014 to 86% in fiscal year 2024.

This substantial growth highlights GM North America’s increasing dominance within the company’s global sales portfolio. The impressive rise can be attributed to various factors, including strategic market focus, robust performance in key regions, and successful launches of popular vehicle models.

Additionally, GMNA’s ability to adapt to market trends and consumer preferences has played a crucial role in driving this upward trajectory. As a result, GMNA has solidified its position as a cornerstone of GM’s overall business strategy, contributing significantly to the company’s financial success.

In contrast, the sales contribution from GM International (GMI) has significantly decreased since fiscal year 2014. By fiscal year 2024, GMI’s sales percentage tumbled to an all-time low of just 14%.

This decline highlights the shifting dynamics within GM’s global operations, with GMNA gaining a larger share of the market while GMI faces various challenges.

Factors contributing to this decline include competitive pressures in international markets, economic uncertainties, and changes in consumer preferences.

Despite efforts to stabilize and grow its international presence, GMI’s decreasing sales percentage underscores the need for strategic adjustments and innovative approaches to regain market share and enhance its overall performance.

Lastly, GM’s sales contribution from GM Europe (GME) ceased to exist after the divestment in fiscal year 2017. However, GME made a significant impact on wholesales in that final year, contributing 13% to the total.

Despite the strategic decision to divest, GME’s substantial contribution in the past remains a noteworthy part of GM’s history, reflecting the role it played in the company’s global business strategy.

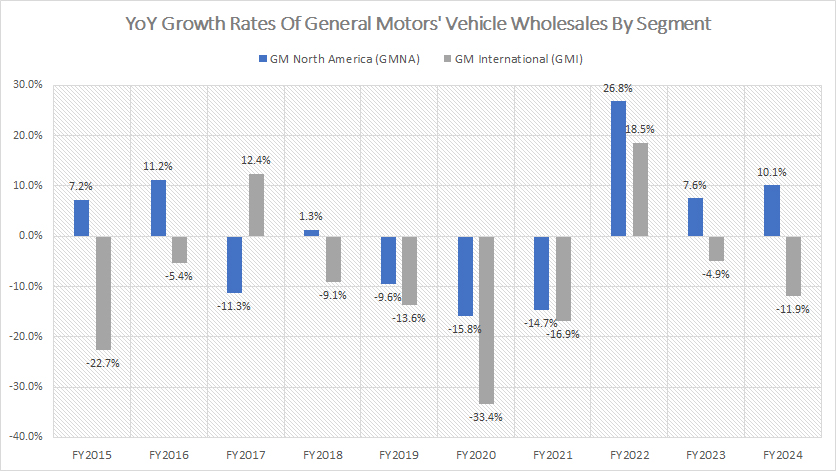

YoY Growth Rates Of GMNA, GMI, And GME Vehicle Wholesales

general-motors-vehicle-wholesale-by-segment-year-over-year-growth-rates

(click image to expand)

You may find the definitions of GM’s operating segments here: GM North America, GM International, and GM Europe.

The definition of GM’s vehicle wholesales is available here: vehicle wholesales.

Both segments experienced mostly negative sales growth before fiscal year 2022, as depicted in the chart above. However, while significant recovery was observed for GMNA post-2022, the sales decline for GM International (GMI) persisted beyond fiscal year 2023.

Between fiscal year 2022 and 2024, GMNA’s vehicle wholesales experienced an average annual growth rate of approximately 15%. In stark contrast, GMI’s average annual sales growth during the same period was a mere 0.6%.

In fiscal year 2024, GMNA’s vehicle sales grew by 10%, while in a striking difference, GMI’s sales declined by 12%.

This dramatic disparity highlights the diverging paths of the two segments, with GMNA experiencing robust growth while GMI continues to face significant challenges in the market.

The contrasting trends underline the varying dynamics at play within GM’s global operations, necessitating tailored strategies to address the unique circumstances of each segment.

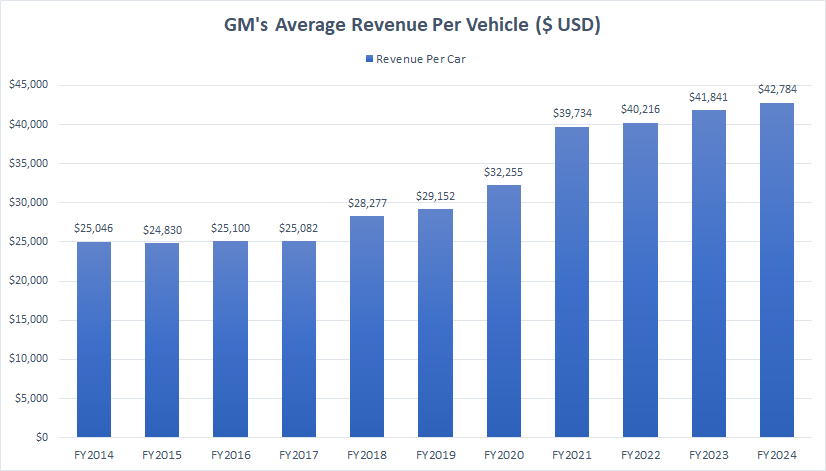

Average Revenue Per Vehicle

GM vehicle average selling price

(click image to expand)

The definition of GM’s revenue per vehicle is available here: revenue per vehicle.

As the name suggests, the average selling price (ASP) or the average transaction price of a vehicle represents the average revenue earned per vehicle. This figure can be estimated using the automotive revenue and vehicle wholesale data provided in GM’s financial reports.

In accordance with accounting standards, GM’s automotive revenue is recognized only when vehicle ownership is transferred to dealers or when the vehicles are delivered to them. Therefore, this information can be used to estimate GM’s average selling price or the average revenue per vehicle.

It is important to note that the estimated ASP reflects the wholesale price and not the retail price, which can be significantly higher due to additional costs and dealer markups.

According to the chart above, GM’s average selling price (ASP) has shown a significant increase since 2014. In fiscal 2014, GM’s ASP was approximately $25,000 per vehicle. This figure surged to nearly $43,000 by fiscal year 2024, representing a growth rate of over 70% compared to 2014.

Furthermore, the most notable increase in GM’s vehicle ASP occurred between fiscal year 2019 and 2022. In fiscal year 2021 alone, GM’s average revenue per vehicle grew by 23%, rising from $32,300 by the end of fiscal year 2020 to $39,700 by the end of fiscal year 2021.

On average, GM’s ASP has grown by nearly 7.0% year-on-year since fiscal 2014. This continuous increase in ASP reflects the higher retail prices of trucks, cars, and SUVs observed in GM dealerships today.

Furthermore, the significant increase in GM’s transaction prices accounts for the substantially higher growth rates of GM’s automotive revenue compared to vehicle wholesales.

Conclusion

Overall, while GMNA is thriving and significantly contributing to GM’s success, GMI requires strategic attention to address its challenges and enhance its performance in the global market.

GM’s ability to command higher average transaction prices also positions it well for sustained revenue growth, despite fluctuations in wholesale volumes.

References and Credits

1. All data presented were obtained and referenced from GM annual reports published on the company’s investor relations page: General Motors Investor Relation.

2. Flickr Images.

Disclosure

We may utilize the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.