Automotive manufacturing. Pixabay Image.

When it comes to the automotive industry, marketing, advertising, and promotional expenses play a crucial role in driving sales and creating brand awareness.

Automotive companies, including Tesla, Ford, and General Motors, allocate a significant portion of their budget to these activities, aiming to differentiate themselves from their competitors and attract potential customers.

Through various marketing and advertising strategies, automotive companies such as Tesla, Ford Motor, and GM try to showcase their products and services’ unique features and benefits.

Additionally, promotional activities such as events, sponsorships, and discounts help create a buzz and generate consumer interest.

In this way, marketing, advertising, and promotional expenses are essential tools for automotive companies to stay relevant and competitive in today’s fast-paced market.

This article explores the marketing, advertising, and promotional expenses of automotive companies such as Tesla, General Motors, and Ford Motor.

Let’s look at the numbers!

Investors looking for other statistics of Tesla, Ford, and GM may find more resources on these pages:

- Tesla vs GM: R&D costs comparison,

- Tesla expenses breakdown analysis, and

- Ford vs Tesla: R&D spending analysis.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. How does Tesla’s marketing, advertising, and promotional spending differ from Ford and GM?

Marketing, Advertising, And Promotional (MAP) Expenses

A1. Tesla

A2. General Motors And Ford Motor

As A Percentage Of Revenue

B1. MAP Expenses To Total Revenue Ratio

As A Percentage Of Total Costs And Expenses

C1. MAP Expenses To Total Costs And Expenses Ratio

As A Percentage Of SGA Expense

D1. MAP Expenses To SGA Expense Ratio

Summary And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Marketing, Advertising, And Promotional Expenses: Marketing, advertising, and promotional expenses refer to the costs incurred by automotive companies in promoting their products and services.

Marketing activities involve creating a brand image, developing marketing strategies, and conducting market research to understand consumer behavior and preferences.

Advertising involves making and disseminating messages about the product or service through various channels such as television, radio, print media, and digital platforms.

On the other hand, promotional activities are short-term tactics used to attract customers and generate sales. These include events, sponsorships, contests, discounts, and other methods.

These expenses are essential in creating brand awareness, driving sales, and maintaining a competitive edge in the automotive industry.

How does Tesla’s marketing, advertising, and promotional spending differ from Ford and GM?

Tesla’s approach to marketing, advertising, and promotional spending significantly differs from that of traditional automakers like Ford Motor and General Motors.

Tesla, led by CEO Elon Musk, relies heavily on word-of-mouth, social media presence, and Musk’s substantial social media following to generate buzz and interest in its vehicles. This strategy is bolstered by the unique Tesla ownership experience, innovative product launches, and mission-driven approach focusing on sustainability and the transition to electric vehicles.

In contrast, Ford and General Motors have historically invested substantial sums in traditional advertising methods, including television commercials, print ads, and digital marketing campaigns. These companies allocate significant portions of their budgets to marketing and promotions to maintain brand awareness, launch new models, and compete in various automotive segments.

Financially, Tesla spends a fraction of what Ford and General Motors allocate to marketing and advertising. For instance, Tesla has reported spending essentially $0 on advertising in several financial disclosures, emphasizing their reliance on organic growth and direct sales model.

Meanwhile, Ford and General Motors spend billions annually on global marketing and advertising efforts. This disparity in spending highlights Tesla’s unconventional approach to market penetration and brand building, which has proven effective given its rapid growth and high brand recognition without traditional advertising expenditures.

This difference in strategy reflects broader trends in the automotive industry and consumer behavior. Tesla capitalizes on digital engagement and direct customer relationships, while traditional automakers like Ford and General Motors balance modern digital campaigns and traditional advertising strategies to reach a diverse consumer base.

Tesla

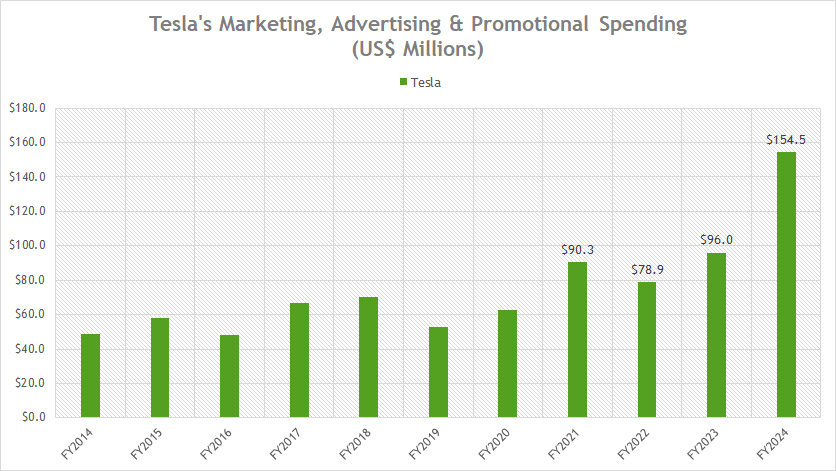

Tesla-marketing-advertising-and-promotional-spending

(click image to expand)

In the fiscal year 2024, Tesla’s expenditure on marketing, advertising, and promotional activities was approximately $155 million. This figure represents a significant increase compared to the $96 million spent in fiscal year 2023.

According to the 2024 annual report, Tesla attributed this substantial rise in expenses primarily to an increase of $57 million in marketing costs.

Over the past five years, Tesla has averaged an annual expenditure of around $100 million on marketing, advertising, and promotional activities.

While Tesla’s marketing budget is notably smaller than those of competitors such as General Motors and Ford, it has been consistently increasing, as illustrated in the accompanying chart, surpassing $100 million per year in recent periods.

Thus, even though Tesla’s marketing and advertising spending remains comparatively modest, the upward trend in their investment is evident.

General Motors And Ford Motor

GM-and-Ford-marketing-advertising-and-promotional-spending

(click image to expand)

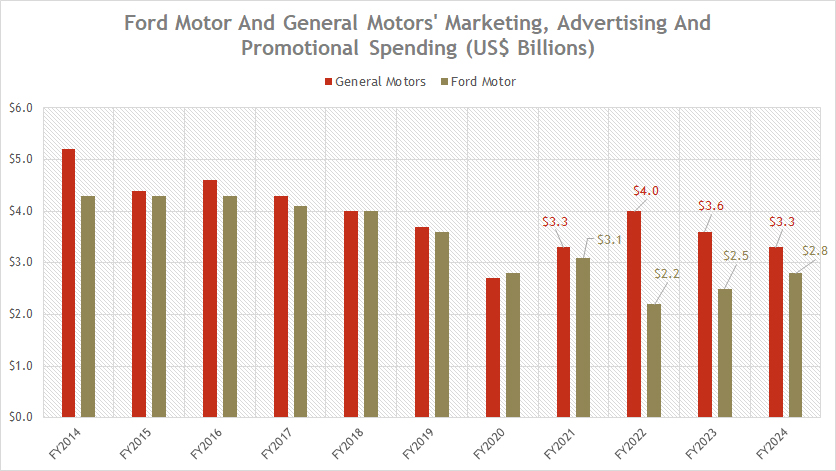

On the other hand, General Motors and Ford Motor Company allocate substantially more resources to marketing, advertising, and promotional activities, with expenditures reaching billions of dollars, as illustrated in the chart above.

For instance, in fiscal year 2024, General Motors’ marketing and advertising expenses amounted to $3.3 billion, while Ford Motor’s expenditure reached $2.8 billion, as reported in their respective annual reports.

In fiscal year 2023, these figures were $3.6 billion for General Motors and $2.5 billion for Ford Motor Company.

On average, General Motors’ spending on marketing and advertising activities has been slightly higher than that of Ford Motor Company. Over the past five years, General Motors has invested an average of $3.4 billion annually, whereas Ford Motor Company has spent an average of $2.7 billion per year.

This significant investment in marketing and advertising underscores the competitive landscape in the automotive industry, where brand visibility and consumer engagement are crucial for maintaining market share and driving sales growth.

The consistent and substantial expenditures by General Motors and Ford Motor Company highlight their commitment to reinforcing their brand presence and attracting customers in a highly competitive market.

MAP Expenses To Total Revenue Ratio

marketing-advertising-and-promotional-spending-to-revenue-ratio

(click image to expand)

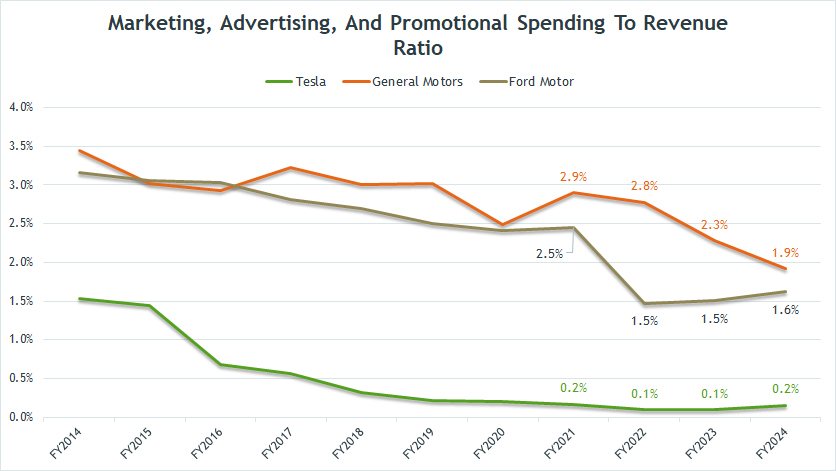

In terms of revenue, Tesla’s ratio of marketing and advertising expenditures is among the lowest when compared to Ford Motor Company and General Motors.

As depicted in the chart, Tesla’s marketing and advertising to revenue ratio was a mere 0.2% in the fiscal year 2024. This means that Tesla allocated only 0.2% of its total revenue to marketing, advertising, and promotional activities.

Conversely, in fiscal year 2024, General Motors and Ford Motor Company dedicated 1.9% and 1.6% of their automotive revenue, respectively, to these expenses. These figures were significantly higher than Tesla’s.

A noticeable trend is the declining ratios for all automakers over the years. For instance, Ford’s marketing and advertising to revenue ratio has decreased from 3.5% in 2014 to 1.6% in 2024. Similarly, General Motors’ ratio has dropped from over 3.0% in 2014 to 1.9% in 2024. Tesla’s ratio has also seen a substantial decline, from 1.5% to 0.2% during the same period.

This downward trend suggests that these automakers have been allocating a smaller proportion of their revenue to marketing, advertising, and promotional activities over the years. This reduction could be attributed to several factors, including a shift towards more cost-effective digital marketing strategies, increased brand recognition, and a focus on other areas of investment such as research and development.

The chart provided above underscores these changes, illustrating the evolving landscape of marketing expenditures in the automotive industry. Despite the lower spending ratios, the continued investment in marketing and advertising remains a critical component for maintaining brand visibility and engaging with consumers in an increasingly competitive market.

MAP Expenses To Total Costs And Expenses Ratio

marketing-advertising-and-promotional-spending-to-total-costs-and-expenses-ratio

(click image to expand)

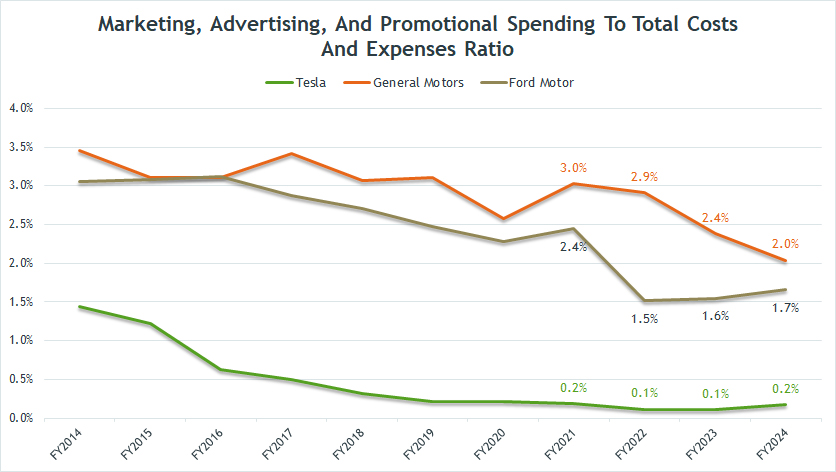

Tesla’s expenditure on marketing, advertising, and promotional activities constitutes only a small fraction of its total costs and expenses. As illustrated in the chart, Tesla allocated approximately 0.2% of its total costs and expenses to marketing and advertising activities in fiscal year 2024.

In contrast, in fiscal year 2024, General Motors allocated about 2.0% of its total costs and expenses to marketing, advertising, and promotional spending, while Ford Motor Company’s ratio decreased to 1.7%. Among the automakers under comparison, General Motors has the highest budget allocation for marketing and advertising activities relative to its total costs and expenses.

However, it is notable that the ratio of marketing and advertising expenditure to total costs and expenses has been declining for General Motors, Ford Motor Company, and Tesla, as depicted in the chart. This decreasing trend suggests a shrinking budget allocation by these automakers for marketing, advertising, and promotional spending over the years.

The reduction in the marketing and advertising to total costs and expenses ratio could be attributed to several factors. It may indicate a strategic shift towards more efficient marketing practices or a greater emphasis on other areas such as research and development. Additionally, increased brand recognition and customer loyalty may allow these companies to maintain sales with lower marketing expenditures.

Overall, while General Motors continues to lead in marketing and advertising spending relative to its total costs and expenses, the declining ratios across these major automakers reflect a broader industry trend towards optimizing budget allocations and enhancing cost efficiency in marketing strategies.

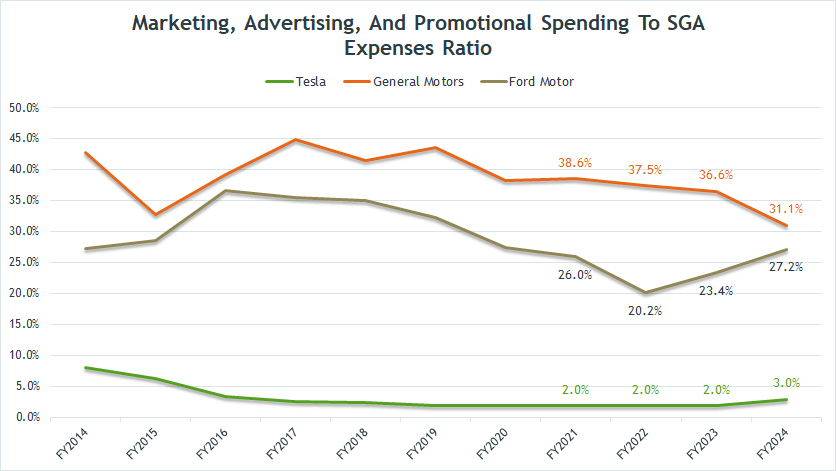

MAP Expenses To SGA Expense Ratio

marketing-advertising-and-promotional-spending-to-SGA-expenses-ratio

(click image to expand)

Marketing, advertising, and promotional expenditures for all automakers fall under their selling, general, and administrative (SGA) expenses.

Notably, Tesla’s marketing, advertising, and promotional spending has consistently been one of the lowest among major automakers, constituting an estimated 2% of its SGA expenses in recent years. This ratio has seen a significant decline from nearly 10% in 2014 to just 2% in the latest results. For fiscal year 2024, this figure was slightly higher, estimated at 3%.

In contrast, General Motors allocated a substantial 31% of its SGA expenses to marketing, advertising, and promotional activities during 2024, while Ford Motor Company’s figure stood at 27% for the same period.

A closer examination reveals a declining trend in the ratio of marketing and advertising expenditures within SGA expenses for General Motors. Over the last several years, GM’s ratio has decreased, reaching a record low of 31% in 2024.

Similarly, Ford Motor Company’s ratio has steadily declined since peaking at over 35% in 2016, suggesting a shrinking marketing and advertising budget from 2016 to 2022. However, in recent years, Ford’s marketing and advertising budget relative to SGA expenses has seen a modest increase, rising from 20% in fiscal year 2022 to 27% in 2024.

These trends indicate that automakers are allocating a smaller proportion of their SGA expenses to marketing, advertising, and promotional activities over the years. This shift could reflect a strategic move towards optimizing marketing budgets, leveraging more efficient marketing channels, or reallocating resources to other critical areas such as research and development.

The declining ratios across these major automakers highlight the evolving landscape of marketing expenditures, with a focus on maintaining cost efficiency while continuing to engage consumers and uphold brand visibility.

Conclusion

To recap, Tesla’s marketing, advertising, and promotional expenditure is minimal compared to its overall costs and expenses, and even more so when compared to major competitors like General Motors (GM) and Ford Motor Company.

Conversely, GM and Ford have consistently allocated a larger portion of their costs and expenses to marketing and promotional activities.

Analyzing these figures indicates a notable trend: all three automakers are spending a decreasing proportion of their budgets on marketing, advertising, and promotional activities relative to their overall costs and expenses, revenue and SGA.

For Tesla, the low expenditure on marketing aligns with its strategic reliance on its strong brand presence and word-of-mouth advocacy. The company’s innovative products and high-profile CEO, Elon Musk, often generate significant media coverage without the need for hefty advertising budgets.

In contrast, GM and Ford, operating in a highly competitive market, have historically invested heavily in marketing to maintain brand visibility and consumer engagement. Their recent efforts to optimize budget allocations while gradually increasing their marketing spend relative to SGA expenses suggest a balanced approach towards sustaining brand presence and adapting to market dynamics.

Essentially, the trends underscore a broader industry movement towards optimizing marketing budgets, improving cost efficiency, and focusing on impactful marketing strategies. These shifts highlight the evolving landscape in which automakers operate, balancing the need for brand visibility with prudent financial management.

References and Credits

1. All financial figures presented were obtained and referenced from annual and quarterly reports published in the respective companies’ investor relations pages:

– Tesla Investor Relations,

– Ford Investor Relations,

– GM Sec Filings.

2. Pixabay Images

Disclosure

We may use the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.