Arrow made of Euro. Pixabay image.

This article presents Stellantis’ global vehicle sales and sales distribution by region and country.

Stellantis operates through five segments or regions, including North America, Enlarged Europe, Middle East & Africa (MEA), South America, China & India & Asia Pacific, and Maserati.

The definitions of these segments are available here: Stellantis’s segments.

Investors looking for other sales statistics of Stellantis may find more resources on these pages:

- Stellantis North America,

- Stellantis Europe,

- Stellantis South America,

- Stellantis China, India & Asia Pacific,

- Stellantis Middle East & Africa, and

- Stellantis Maserati.

Let’s take a look!

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

- New Vehicle Sales

- North America

- Enlarged Europe

- Middle East & Africa

- South America

- China and India & Asia Pacific

- Maserati

O2. Why is Stellantis struggling with sales?

Worldwide Sales

Consolidated Sales Growth

A2. Growth Rates Of Global Vehicle Sales

Results By Region

B1. Vehicle Sales In North America, Europe, MEA, South America, Asia, And Maserati

B2. Vehicle Sales By Region In Percentage

Sales Growth By Region

B3. Growth Rates Of Vehicle Sales By Region

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

New Vehicle Sales: Stellentis defines its new vehicle sales as the sales of vehicles primarily by dealers and distributors or, directly by the company in some cases, to retail customers and fleet customers.

Sales include mass-market and luxury vehicles manufactured at Stellantis’ plants, manufactured by joint ventures and third-party contract manufacturers, and distributed under its brands. Sales figures exclude sales of vehicles that it contracts to manufacture for other OEMs.

While vehicle sales are illustrative of Stellantis’s competitive position and the demand for its vehicles, sales are not directly correlated to net revenues, cost of revenues, or other measures of financial performance in any given period.

For a discussion of Stellantis’ vehicle shipments that directly correlate to its Net revenues, Cost Of revenues, and other financial measures, you may visit this article: Stellantis vehicle wholesale.

North America: Stellantis’ North American operations involve manufacturing, distributing and selling vehicles in the United States, Canada and Mexico, primarily under the Jeep, Ram, Dodge, Chrysler, Fiat and Alfa Romeo brands. Manufacturing plants are located in the US, Canada and Mexico.

Enlarged Europe: Stellantis’ European operations involve manufacturing, distributing and selling vehicles in Europe (which includes the 27 members of the European Union, the United Kingdom (“UK”) and the members of the European Free Trade Association).

Stellantis’ mainstream European brands include Citroën, Fiat, Opel, Peugeot, Vauxhall, and premium brands Alfa Romeo, DS and Lancia. Manufacturing plants are in France, Italy, Spain, Germany, the UK, Poland, Portugal, Serbia and Slovakia.

Middle East & Africa: Stellantis’ MEA operations involve manufacturing, distributing and selling vehicles primarily in Turkey, Algeria and Morocco under the Peugeot, Citroën, Opel, Fiat and Jeep brands.

Manufacturing plants are located in Morocco, Algeria and Turkey through a joint venture with Tofas-Turk Otomobil Fabrikasi A.S. (“Tofas”).

South America: Stellantis’ South American operations involve manufacturing, distributing and selling vehicles in South and Central America, primarily under the Fiat, Jeep, Peugeot and Citroën brands, with the largest focus of its business in Brazil and Argentina.

Manufacturing plants are located in the main markets of Brazil and Argentina.

China and India & Asia Pacific: Stellantis’ China and India & Asia Pacific operations involves manufacturing, distributing and selling vehicles in the Asia Pacific region (mostly in China, Japan, India, Australia and South Korea) carried out in the region through both subsidiaries and joint ventures, primarily under the Jeep, Peugeot, Citroën, Fiat, DS and Alfa Romeo brands.

Manufacturing plants are located in India and Malaysia through joint operation with India Fiat India Automobiles Private Limited (“FIAPL JV”) and wholly owned subsidiary Stellantis Gurun (Malaysia).

In China, Stellantis had a joint venture with GAC Fiat Chrysler Automobiles Co (“GAC-Stellantis JV”) until production ceased in January 2022. GAC JV filed for bankruptcy in November 2022.

Stellantis’ Citroën and Peugeot branded vehicles are manufactured in China by Dongfeng Peugeot Citroën Automobiles (“DPCA”) under various license agreements.

Maserati: Stellantis’ Maserati operations involve designing, engineering, developing, manufacturing, worldwide distributions and selling luxury vehicles under the Maserati brand. Design, engineering and manufacturing plants are located in Italy.

Why is Stellantis struggling with sales?

Stellantis has been facing several challenges that have contributed to its recent struggles with sales:

- High Prices and Quality Issues: Stellantis’ brands, particularly Jeep, have been criticized for high prices and quality problems. This has led to a decline in customer satisfaction and sales.

- Product Lineup: Some of Stellantis’ key models, like the Jeep Grand Cherokee and Gladiator, have seen significant sales declines. Additionally, the discontinuation of popular models like the Dodge Charger and Challenger has hurt overall sales.

- Inventory Surplus: Stellantis has been dealing with high inventories in North America, which indicates that their vehicles are not selling as expected. This has put additional pressure on dealers and the company’s financial performance.

- Leadership Changes: The early departure of CEO Carlos Tavares has left the company without its leader, adding to the uncertainty and challenges faced by Stellantis.

- Market Competition: Stellantis is falling behind its competitors like Ford and GM, who have managed to increase their sales while Stellantis has seen a decline.

These factors combined have created a challenging environment for Stellantis, leading to a significant drop in sales and profitability.

Global Vehicle Sales

Stellantis-worldwide-new-vehicle-sales

(click image to expand)

A definition of Stellantis’ vehicle sales is available here: vehicle sales.

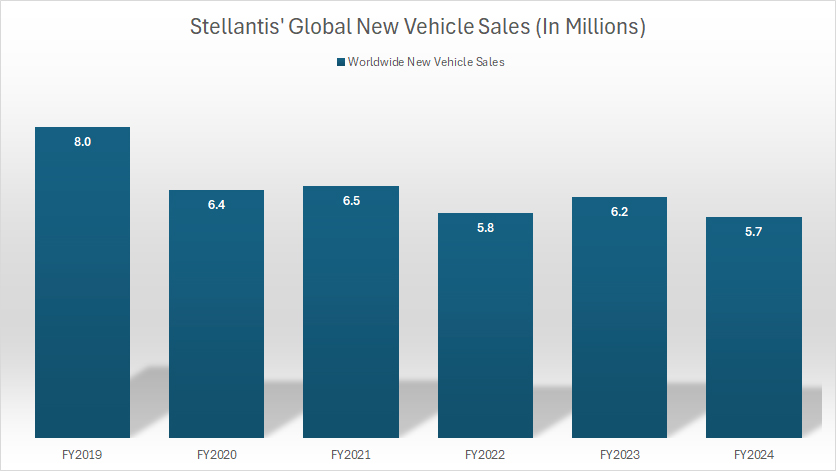

Stellantis, on average, sells approximately six million cars globally each year. However, in fiscal year 2024, its sales declined to 5.7 million units, marking a significant drop from the 6.2 million cars sold in 2023.

This decline is part of a broader trend for Stellantis. Since 2019, when their global vehicle sales peaked at 8 million units, there has been a steady decrease.

The latest figures indicate that their sales have now fallen below the six-million mark, highlighting ongoing challenges in the automotive market.

Growth Rates Of Global Vehicle Sales

Stellantis-growth-rates-of-worldwide-new-vehicle-sales

(click image to expand)

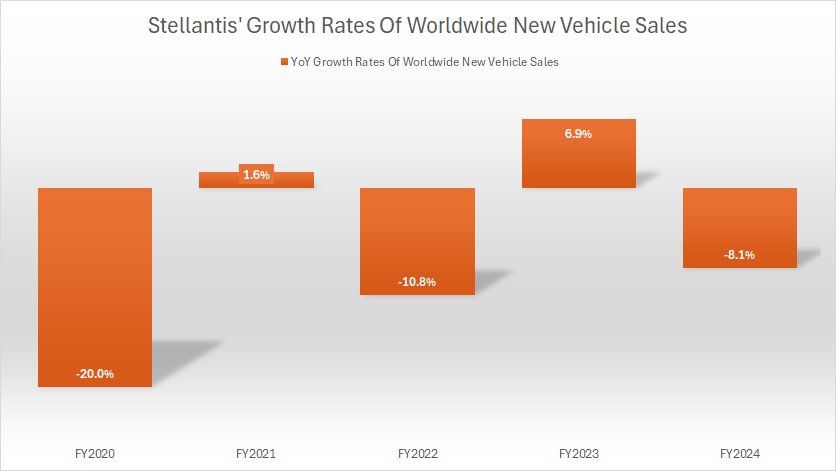

Stellantis faced a significant setback in its global vehicle sales in 2020, with a steep decline of 20%. This was followed by a modest recovery in 2021, where the company achieved a growth rate of 1.6%.

However, the sales momentum faltered again in 2022, only to bounce back with a robust growth rate of 6.9% in 2023. Despite this recovery, Stellantis encountered another downturn in 2024, with global sales decreasing by 8%.

Analyzing the period from 2022 to 2024, Stellantis experienced an average annual decline of 4% in its global vehicle sales. This fluctuation in sales performance highlights the challenges and volatility in the automotive market that Stellantis had to navigate during these years.

Vehicle Sales In North America, Europe, MEA, South America, Asia, And Maserati

Stellantis-worldwide-new-vehicle-sales-by-region

(click image to expand)

The definitions of Stellantis’ vehicle sales are available here: vehicle sales. The definitions of Stellantis’ regions are available here: North America, Enlarged Europe, Middle East & Africa, South America, China and India & Asia Pacific, and Maserati.

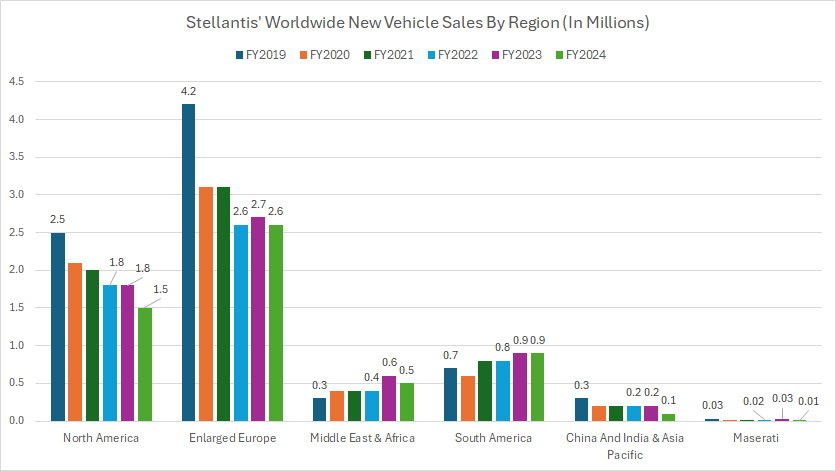

Stellantis has long considered Europe and North America as its most significant markets. From 2022 to 2024, the company averaged annual sales of 2.6 million vehicles in Europe and 1.7 million units in North America. However, by 2024, Stellantis’ sales in Europe settled at 2.6 million units, showing a slight decrease from the 2.7 million vehicles sold in 2023.

The North American market also saw a downward trend. In fiscal year 2024, Stellantis sold 1.5 million vehicles, marking a notable reduction from the 1.8 million cars delivered in 2023. These figures indicate a considerable decline in vehicle sales in both key regions.

On the brighter side, Stellantis experienced a significant surge in sales in South America and the Middle East & Africa regions. Particularly in the Middle East & Africa, sales have doubled since 2019. In 2024, Stellantis sold 0.9 million vehicles in South America, reflecting nearly a 30% increase over four years.

Conversely, the China, India & Asia Pacific segment lagged behind, with Stellantis selling only 0.1 million units in 2024, nearly half of the 0.2 million units delivered in 2023. This region has been a challenging market for Stellantis for several years.

The luxury brand Maserati also faced difficulties. Maserati sold approximately 10,000 vehicles in 2024, a sharp decline from the 30,000 units sold in 2023. This downturn highlights the ongoing struggle with declining sales that Maserati has been dealing with for years.

Vehicle Sales By Region In Percentage

Stellantis-worldwide-new-vehicle-sales-by-region-in-percentage

(click image to expand)

The definitions of Stellantis’ regions are available here: North America, Enlarged Europe, Middle East & Africa, South America, China and India & Asia Pacific, and Maserati.

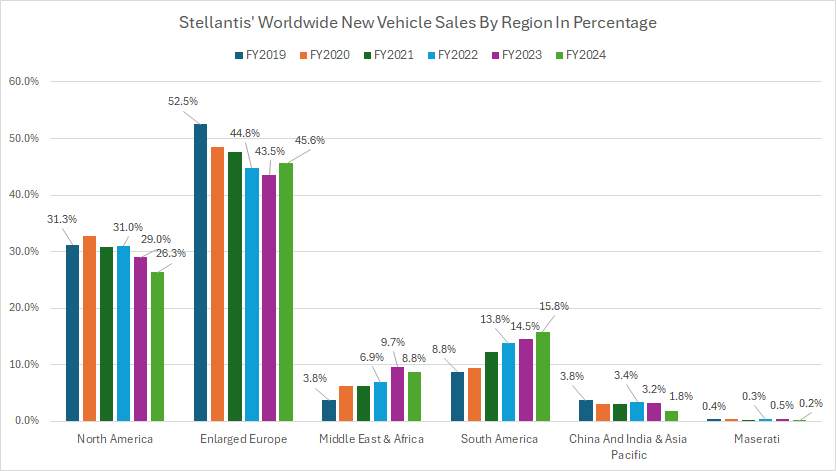

In 2024, Stellantis sold approximately 45.6% of its vehicles in Europe, the highest share among all regions. However, this percentage has declined by seven points since 2019, marking the most significant drop in any region over the past six years.

This trend suggests that Stellantis’ sales have decreased more substantially in Europe compared to other regions. However, there is a silver lining — the latest sales percentage in Europe saw a notable rise from the 43.5% recorded in the previous year.

The North American market also experienced a decline, though not as pronounced as in Europe. From 2019 to 2024, the sales percentage in North America dropped by five points. Despite this, in fiscal year 2024, Stellantis’ vehicle sales in North America still represented 26% of its global vehicle volume.

South America has emerged as Stellantis’ third-largest market after Europe and North America. In fiscal year 2024, the company’s sales in this region accounted for 15.8% of its total volume, a significant increase from the 8.8% recorded in 2019.

Similarly, the Middle East & Africa region has shown remarkable growth in sales contribution, with the ratio rising from 3.8% in 2019 to 8.8% in 2024.

In contrast, Stellantis’ sales in China, India & Asia Pacific regions remained dismal, with only 1.8% of its total vehicle sales in fiscal 2024, the lowest among all regions. Over the long term, the sales contribution from these regions has declined from 3.8% in 2019 to 1.8% in 2024, highlighting significant challenges in Asia.

Maserati’s sales represent less than 1% of Stellantis’ global vehicle volume, which is understandable as Maserati solely targets the luxury segment.

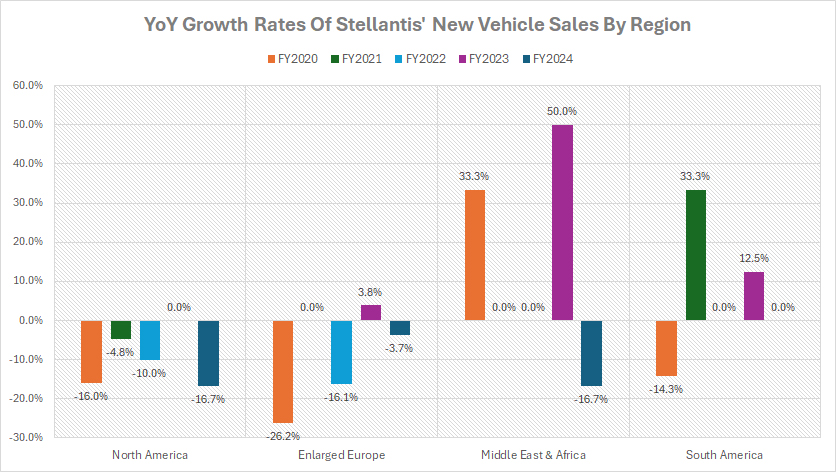

Growth Rates Of Vehicle Sales By Region

Stellantis-growth-rates-of-worldwide-new-vehicle-sales

(click image to expand)

The definitions of Stellantis’ regions are available here: North America, Enlarged Europe, Middle East & Africa, South America, China and India & Asia Pacific, and Maserati.

Stellantis experienced notable growth in the Middle East & Africa and South America, contrasting with significant declines in North America and Europe.

Between 2022 and 2024, Stellantis’ sales growth in the Middle East & Africa averaged an impressive 11% per year, while South America saw an annual average growth rate of 4%. These regions emerged as bright spots for Stellantis during this period.

On the other hand, North America faced the steepest decline, with sales growth averaging -9% annually between 2022 and 2024. This region’s performance was the most challenging among all the markets.

Europe, although also experiencing a downward trend, had a mixed performance. Vehicle sales in Europe increased by 3.8% in 2023 but declined by 4% in 2024. Overall, Stellantis’ sales growth in Europe averaged -5% annually between 2022 and 2024, reflecting a challenging environment.

Conclusion

Stellantis has experienced significant fluctuations in global vehicle sales over recent years, reflecting the volatility and competitive nature of the automotive market. This volatility underscores the need for Stellantis to remain agile, continuously innovate, and respond proactively to market changes and consumer demands.

References and Credits

1. All financial figures presented were obtained and referenced from Stellantis’ quarterly and annual reports published on the company’s investor relations page: Stellantis Investor Relation.

2. Pixabay images.

Disclosure

We may utilize the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.