National Oilwell Varco, with stock ticker NOV, provides equipment and components for oil and gas drilling and production; oilfield services; and supply chain integration services to the upstream oil and gas industry worldwide.

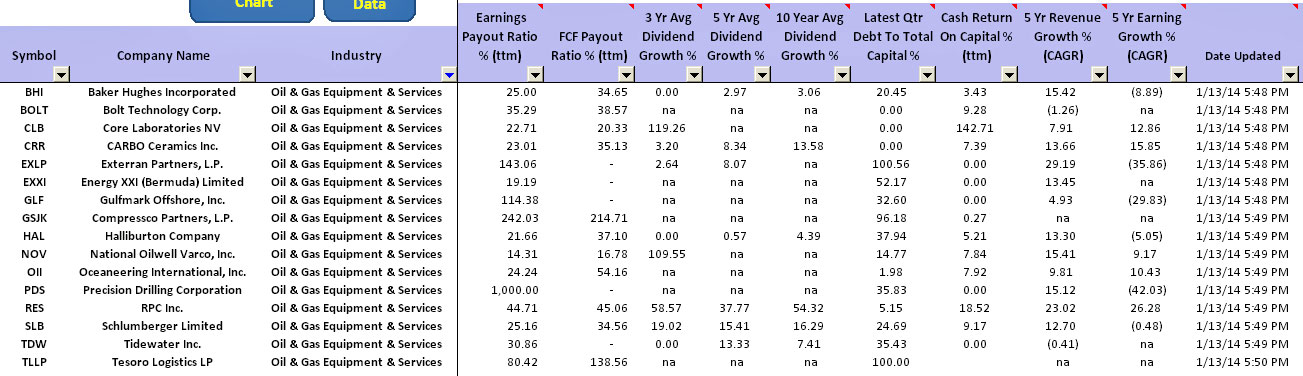

Based on the dividend screening result which is shown in the following snapshot, the column “3 Yr Avg Dividend Growth %” shows that NOV has an average annual dividend growth rate of 109% while both the columns “5 Yr Avg Dividend Growth %” and “10 Yr Avg Dividend Growth %” shows nothing. This could imply that the stock has only started to pay dividend recently and in less than 5-years period.

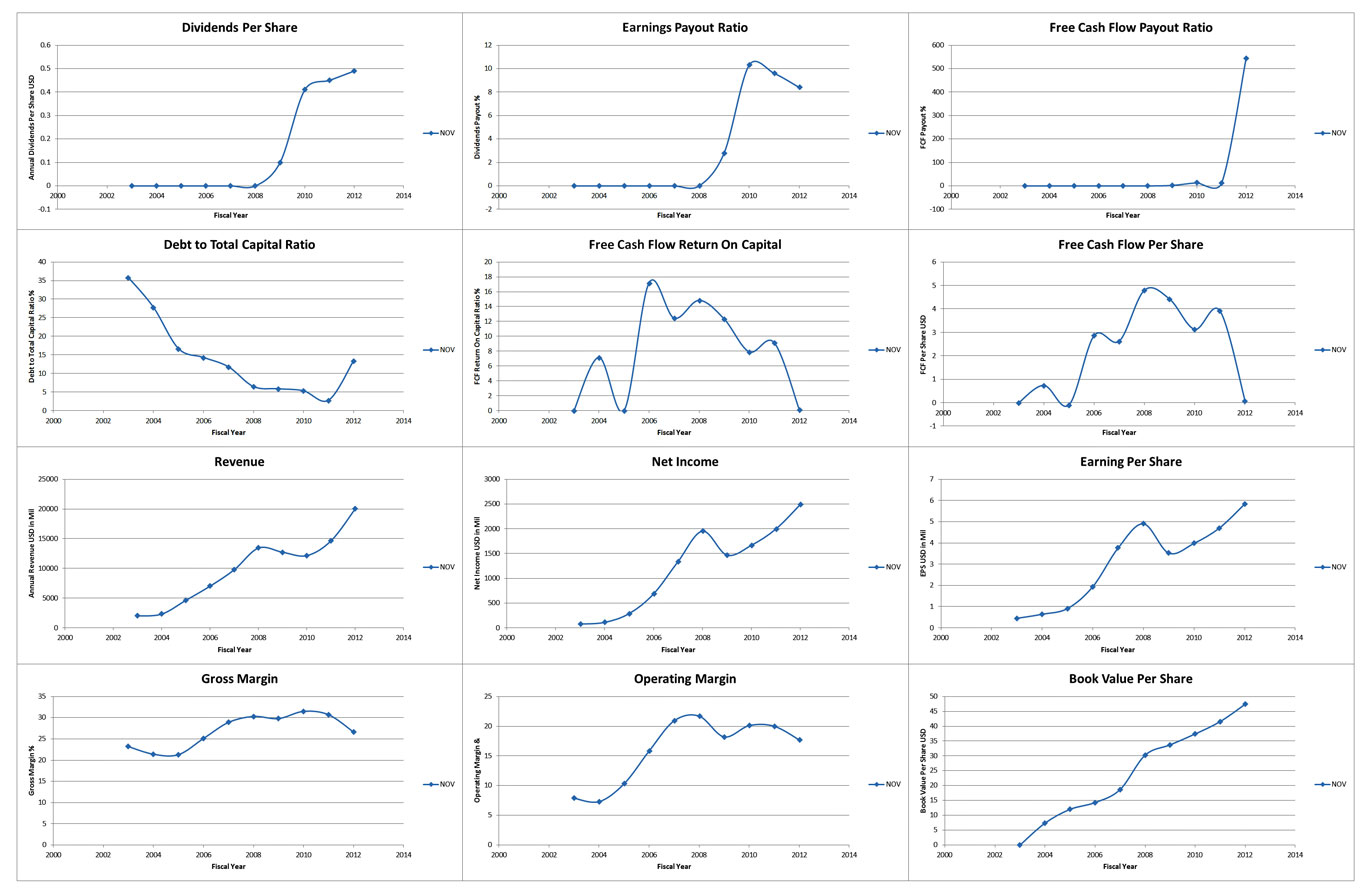

You could always bring out the 10 years plot in the stock dividend screener spreadsheet to look at the dividend history of National Oilwell Vargo. After we bring the plots up, we could see that the company is confirmed to be only starting paying dividend since 2009.

From the screening result, I believe NOV will be a solid dividend paying stock going forward. Judging from the dividend growth rate of 109% for the past 3 years, NOV is poised to grow its dividend in double digit rate in the next few years.

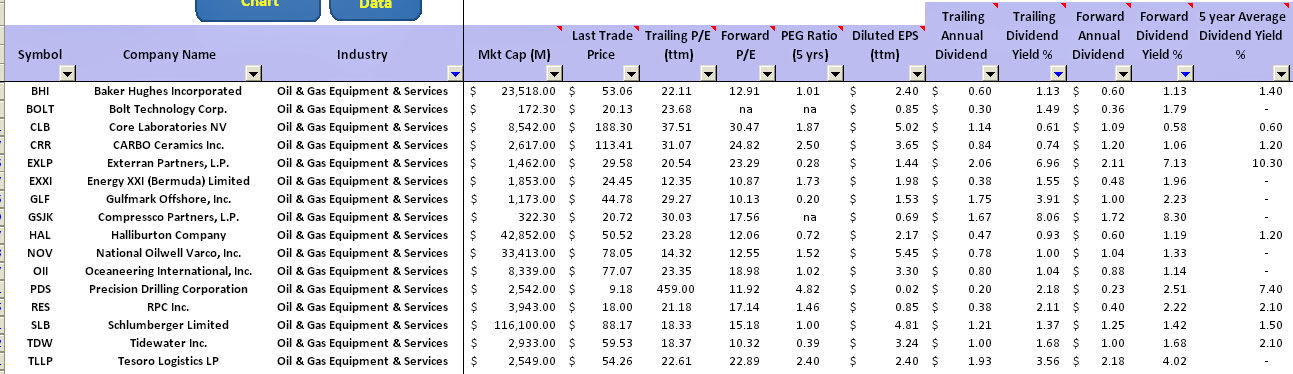

Even though the trailing and forward dividend yield of 1% and 1.33% respectively is nothing to boost of for National Oilwell Vargo, there are plenty of rooms for NOV to grow its dividend.

A check on the screening result in the snapshot above shows that the dividend to earnings payout ratio and dividend to free cash flow payout ratio is only 14% and 16% respectively. This means there are still plenty of rooms left for NOV to increase the dividend payout. Even if earnings and sales stay flat, NOV will still be able to grow its dividend payout because of the low payout ratio with respect to earnings and free cash flow.

As of the date (Jan 13th, 2014) the screening was done, NOV is currently sitting at the bottom in terms of trailing PE when compared to its peers in the same industry. I believe NOV is currently undervalued compared to its peers.

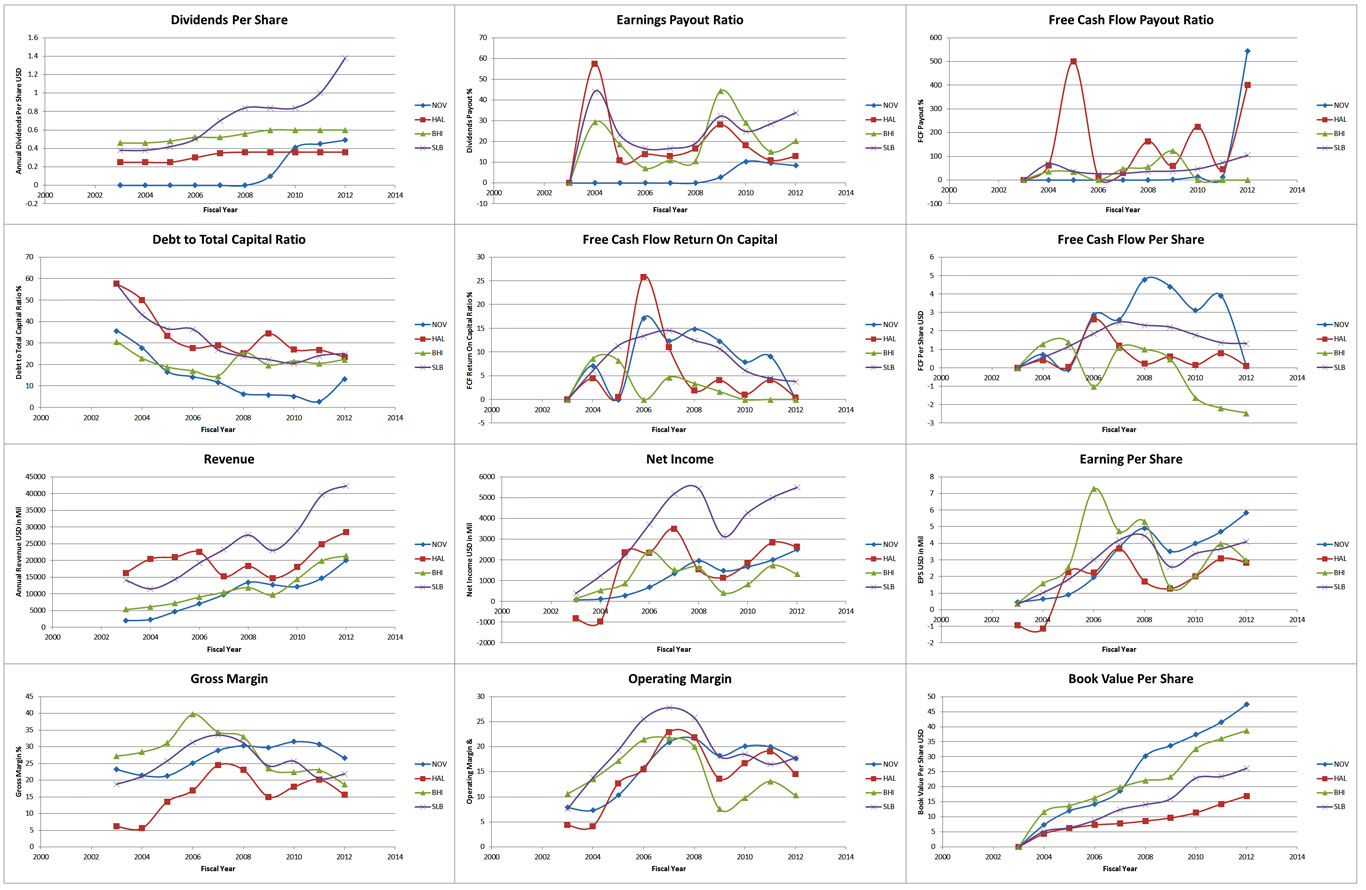

Based on the past 10 years performance plot (shown below), compared its peers, NOV is having the best book value per share. In addition, the gross and operating margin for NOV is among the best in the same industry. Besides, NOV is the least leveraged when its debt to capital ratio is the lowest among its peers.

In conclusion, NOV is currently having the lowest trailing PE compared to its peers in the “Oil & Gas Equipment & Service” industry. There is no doubt that National Oilwell Vargo is a solid dividend paying company judging from its historic dividend growth rate and low payout ratio. I believe now is a good time to initiate a position in this stock. The price will certainly catch up with its peers in terms of valuation soon.