An underground coal mine. Flickr Image.

This article presents Peabody Energy (NYSE: BTU)’s comprehensive financial performance in the coal sector, focusing on key metrics such as coal revenue per ton, coal profit per ton, and coal profit margin per ton for both U.S. and overseas operations.

Let’s get started! You may find related statistic of Peabody Energy on these pages:

- Peabody global and U.S. coal sales,

- Peabody revenue by segment and profit margin, and

- Peabody profit breakdown by segment.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. What is driving the higher margin per ton of Peabody’s seaborne coal sales?

Results Of U.S. Mining Operations

A1. U.S. Thermal Coal Revenue Per Ton

A2. U.S. Thermal Coal Adjusted EBITDA Per Ton

A3. U.S. Thermal Coal Adjusted EBITDA Margin Per Ton

Results Of Overseas Mining Operations

B1. Seaborne Coal Revenue Per Ton

B2. Seaborne Coal Adjusted EBITDA Per Ton

B3. Seaborne Coal Adjusted EBITDA Margin Per Ton

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Seaborne Mining Operation: Peabody Energy’s seaborne mining operations primarily involve the extraction and export of coal to international markets. These operations are mainly located in Australia, where Peabody mines both thermal coal (used for power generation) and metallurgical coal (used in steel production).

Key mines in Australia include the Wambo Underground Mine, Wilpinjong Mine, Centurion Mine, Coppabella Mine, Metropolitan Mine, Middlemount Mine, and Moorvale Mine. These operations have significantly contributed to Peabody’s revenue, especially in the post-pandemic recovery period.

U.S. Mining Operation: Peabody Energy’s U.S. mining operations primarily involve coal mining and distribution across several states.

Their U.S. mines are located in Alabama, Colorado, Illinois, Indiana, New Mexico, and Wyoming. The company’s largest operation in the U.S. is the North Antelope Rochelle Mine in Wyoming (part of the Powder River Basin region), which produced over 62 million tons of coal in 2023.

Peabody Energy focuses on providing coal for electricity generation and steel production. They also market, broker, and trade coal through offices in the U.S. and other countries.

Powder River Basin: The Powder River Basin (PRB) is a major coal-producing region in the United States, primarily located in northeastern Wyoming and southeastern Montana.

Here are some key points about the PRB:

- Coal Production: The PRB is known for its vast reserves of low-sulfur, sub-bituminous coal, which is highly sought after for electricity generation due to its cleaner-burning properties.

- Major Mines: The region is home to some of the largest coal mines in the world, including the North Antelope Rochelle Mine and the Black Thunder Mine.

- Geological Significance: The basin was formed during the Cretaceous period and contains significant coal deposits, as well as oil and natural gas resources.

- Economic Impact: Coal mining in the PRB plays a crucial role in the local economy, providing jobs and contributing to state and federal revenues through taxes and royalties.

Tons Or Tonnes: The terms “tons” and “tonnes” are often used interchangeably, but they actually refer to different units of mass:

Tons: This is a unit of weight commonly used in the United States. One ton is equivalent to 2,000 pounds (approximately 907.185 kilograms).

Tonnes: This is a metric unit of weight used in most other countries. One tonne is equivalent to 1,000 kilograms (approximately 2,204.62 pounds).

So, while they both measure weight, the key difference is in their respective measurement systems and conversion factors.

Adjusted EBITDA: Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a financial metric providing a clearer picture of a company’s operating performance by excluding certain items that may distort the actual performance of its core operations.

It is a variant of the standard EBITDA metric, adjusted to eliminate the effects of non-recurring, irregular, or non-cash items.

Components of Adjusted EBITDA:

- Earnings (Net Income): The company’s total earnings, or net income.

- Before Interest: Excludes interest expenses and income, focusing solely on operating performance.

- Taxes: Excludes tax expenses, providing a pre-tax view of profitability.

- Depreciation: Excludes depreciation, which is a non-cash expense related to the wear and tear of fixed assets.

- Amortization: Excludes amortization, a non-cash expense related to the gradual write-off of intangible assets.

- Adjustments: Additional adjustments are made to remove the impact of non-recurring, irregular, or non-cash items, such as:

- Restructuring costs

- Impairment charges

- Litigation expenses

- Gains or losses on asset sales

- Share-based compensation

- Any other unusual or one-time expenses or gains

Why Use Adjusted EBITDA?

- Enhanced Comparability: By excluding non-operational and one-time items, Adjusted EBITDA allows for better comparison of financial performance across different periods and companies.

- Focus on Core Operations: It highlights the profitability and efficiency of a company’s core business operations, without the noise of non-recurring events or accounting adjustments.

- Investor Insight: Investors and analysts often use Adjusted EBITDA to assess the underlying health and operating performance of a business.

Overall, Adjusted EBITDA provides a more accurate and meaningful measure of a company’s operating performance, making it a valuable tool for financial analysis.

What is driving the higher margin per ton of Peabody’s seaborne coal sales?

The higher margin per ton of Peabody’s seaborne coal sales can be attributed to several key factors:

- Strong Market Demand: The global demand for seaborne coal, particularly in regions like Asia, remains robust. This strong demand allows Peabody to command higher prices for its coal exports.

- Favorable Pricing: Seaborne coal prices have been relatively high compared to domestic coal prices. This favorable pricing environment contributes significantly to higher revenue and profit margins.

- Operational Efficiency: Peabody’s overseas operations, especially in Australia, benefit from efficient mining practices and cost-effective logistics, which help in maintaining higher profit margins.

- Market Dynamics: The company has been able to capitalize on favorable market conditions, including higher sales realizations and strong forward sales commitments. This has allowed Peabody to lock in profitable contracts and improve its cash flow.

These factors combined have enabled Peabody to achieve higher margins on its seaborne coal sales compared to its domestic operations.

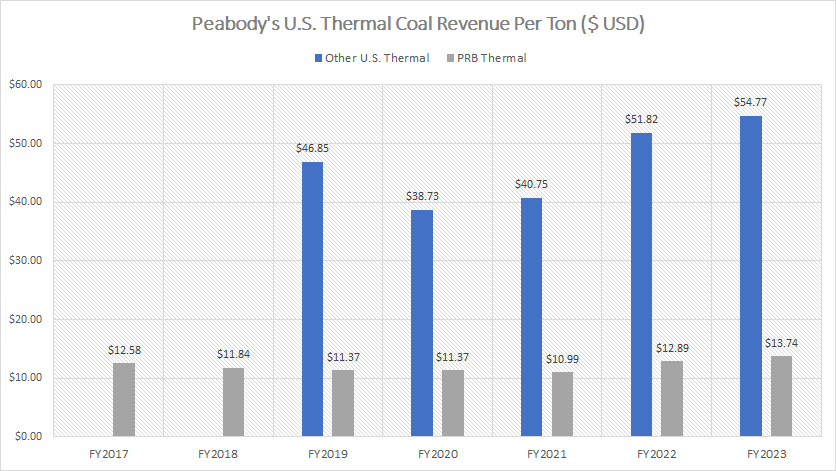

Peabody’s U.S. Thermal Coal Revenue Per Ton

Peabody U.S. thermal coal revenue per ton

(click image to enlarge)

The revenue per ton results measure the average realized price of coal per ton delivered. To help readers understand the content, you may find the definition of Peabody’s U.S. mining operations here: U.S. mining operation. The definition of tons and tonnes is available here: tons or tonnes.

In fiscal year 2023, Peabody Energy achieved an average realized price of $54.77 per ton for its other U.S. thermal coal, marking a record high since 2019. This impressive figure is nearly 4X higher than the realized price of Peabody’s Powder River Basin (PRB) thermal coal, which stood at $13.74 per ton as of the end of fiscal yer 2023, also a new record over the past seven years.

The significant price difference indicates that other U.S. thermal coal fetches much better pricing than PRB thermal coal. Both other U.S. thermal and PRB thermal coal have shown growing revenue per ton over the years. As of fiscal year 2023, Peabody shipped its coals at record revenue per ton levels.

A noteworthy trend is the increasing revenue per ton for both categories of coal shipments in the U.S. This trend reflects the rising demand and favorable market conditions for Peabody’s coal products.

While the revenue per ton has been rising, it does not necessarily mean that Peabody has been achieving record profits. Profitability per ton depends on several factors, including production costs, operational efficiencies, and market dynamics.

Peabody’s ability to achieve record high prices for its other U.S. thermal coal and PRB thermal coal highlights the company’s strong market position. However, the profitability per ton will be a crucial metric to examine to fully understand Peabody’s financial health.

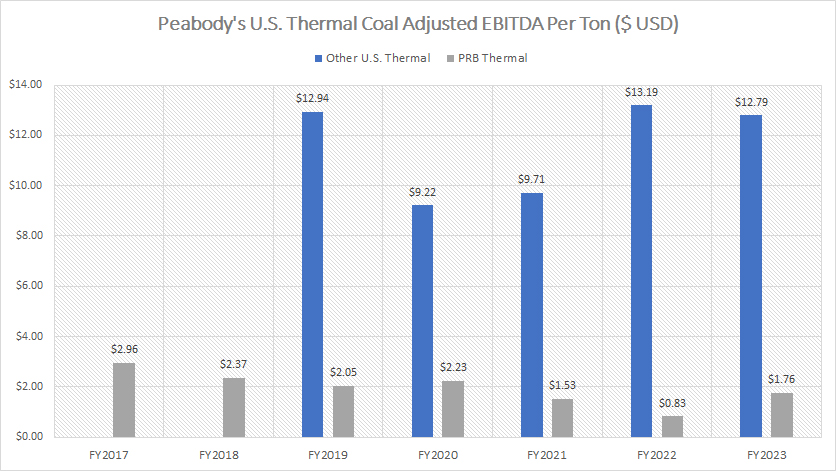

Peabody’s U.S. Thermal Coal Adjusted EBITDA Per Ton

Peabody U.S. thermal coal EBITDA per ton

(click image to enlarge)

For Peabody’s coal profitability, we look at the adjusted EBITDA per ton which is presented in the chart above. The definition of the adjusted EBITDA is available here: adjusted EBITDA.

To help readers understand the content, you may find the definition of Peabody’s U.S. mining operations here: U.S. mining operation. The definition of tons and tonnes is available here: tons or tonnes.

Peabody Energy’s coal profitability shows contrasting trends for different types of coal, particularly between other U.S. thermal coal and Powder River Basin (PRB) thermal coal.

The profitability of Peabody’s other U.S. thermal coal has been much higher compared to the PRB thermal coal. In this aspect, the adjusted EBITDA for the other U.S. thermal segment has significantly increased, highlighting the strong financial performance of this coal type.

In contrast, the profitability of PRB thermal coal has been declining over the past several years. Although the adjusted EBITDA for PRB thermal coal rose to $1.76 per ton as of fiscal year 2023, it had previously decreased to a record low of $0.83 per ton in fiscal year 2022, indicating ongoing challenges in this segment.

The coal mined in the PRB region has significantly lower profitability compared to other U.S. thermal coal on a per-ton basis. For example, the EBITDA per ton for PRB thermal coal has not even reached $2.00 per ton, while other U.S. thermal coal has managed to fetch more than $10.00 per ton. This stark difference underscores the disparity in financial performance between the two segments.

Peabody’s other U.S. thermal coal demonstrates much higher profitability, driven by favorable market conditions and efficient operations. Based on the 2024 adjusted EBITDA results, this segment is far more lucrative than PRB thermal coal.

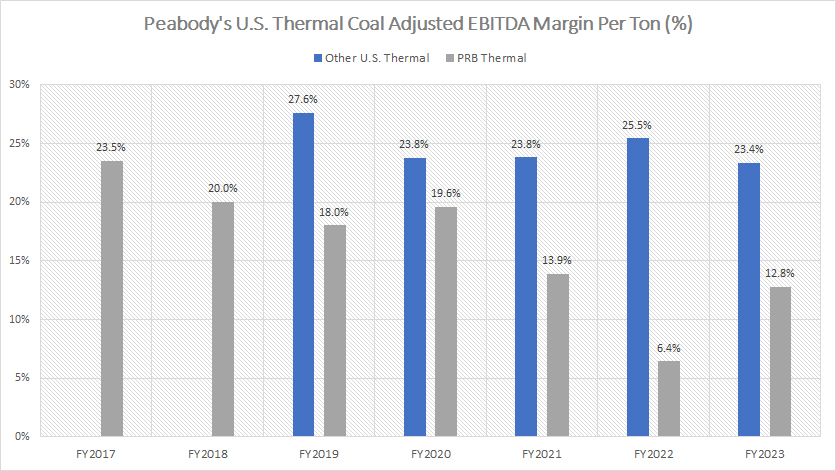

Peabody’s U.S. Thermal Coal Adjusted EBITDA Margin Per Ton

Peabody U.S. thermal coal EBITDA margin per ton

(click image to enlarge)

For Peabody’s coal profitability, we look at the adjusted EBITDA per ton which is presented in the chart above. The definition of the adjusted EBITDA is available here: adjusted EBITDA.

To help readers understand the content, you may find the definition of Peabody’s U.S. mining operations here: U.S. mining operation. The definition of tons and tonnes is available here: tons or tonnes.

From the chart above, it is evident that Peabody’s other U.S. thermal coal has significantly better margins compared to Powder River Basin (PRB) thermal coal on a per-ton basis. This illustrates the higher profitability of coal obtained from other U.S. thermal regions compared to the PRB region.

In fiscal year 2023, Peabody’s other U.S. thermal coal had an adjusted EBITDA margin per ton of 23.4%, nearly double the adjusted EBITDA margin per ton of the PRB thermal which fetched only 13% in the same period.

In addition, Peabody’s adjusted EBITDA margin per ton for other U.S. thermal coal has remained steady over the past several years. This trend highlights the strong profitability and favorable market conditions for this segment.

In contrast, Peabody’s PRB thermal adjusted EBITDA margin per ton has experienced a downward trend, hitting its lowest point of 6.4% in fiscal year 2022. However, the situation improved notably in fiscal year 2023, with the margin rebounding to 13%. Despite this recovery, the current margin is still significantly lower compared to the historical highs observed in previous years.

Overall, there has been a decline in profit margin for the PRB thermal coal. This decline indicates the decreasing profitability of coal mined in the PRB region, emphasizing the challenges faced in this segment.

In short, Peabody’s other U.S. thermal coal is much more profitable than PRB thermal coal on a per-ton basis. The adjusted EBITDA results from 2023 demonstrate that other U.S. thermal coal enjoys much higher margins, driven by strong market demand, favorable pricing, and operational efficiency. Meanwhile, the profitability of PRB thermal coal has been declining, reflecting the challenges faced in this segment.

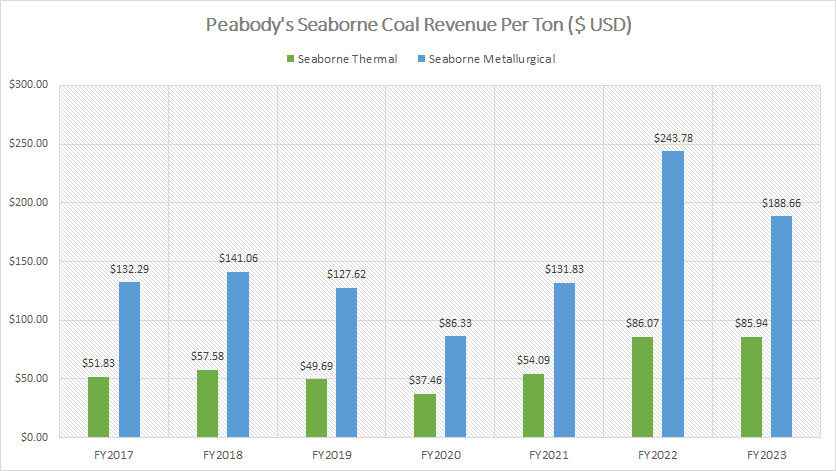

Peabody’s Seaborne Coal Revenue Per Ton

Peabody seaborne coal revenue per ton

(click image to enlarge)

The revenue per ton results measure the average realized price of coal per ton delivered. To help readers understand the content, you may find the definition of Peabody’s seaborne mining operations here: seaborne mining operation. The definition of tons and tonnes is available here: tons or tonnes.

Peabody’s seaborne metallurgical coal commands significantly higher pricing than its seaborne thermal coal, as illustrated in the chart. The average realized price for seaborne metallurgical coal is consistently higher than that for seaborne thermal coal, reflecting the premium market demand for metallurgical coal.

Peabody’s seaborne revenue per ton for both thermal and metallurgical coals has steadily climbed, reaching record highs as of fiscal year 2023. In fiscal year 2023, the revenue per ton figures were $85.94 for seaborne thermal coal and $188.66 for seaborne metallurgical coal.

On average, Peabody’s seaborne thermal coal revenue per ton amounted to $75.37 between fiscal year 2021 and 2023, while the seaborne metallurgical coal revenue per ton reached $188.09 during the same period.

Peabody’s seaborne metallurgical coal achieves significantly higher pricing compared to seaborne thermal coal, with revenue per ton figures reaching record highs. However, assessing profitability per ton will be crucial to understanding the true financial impact of these higher prices.

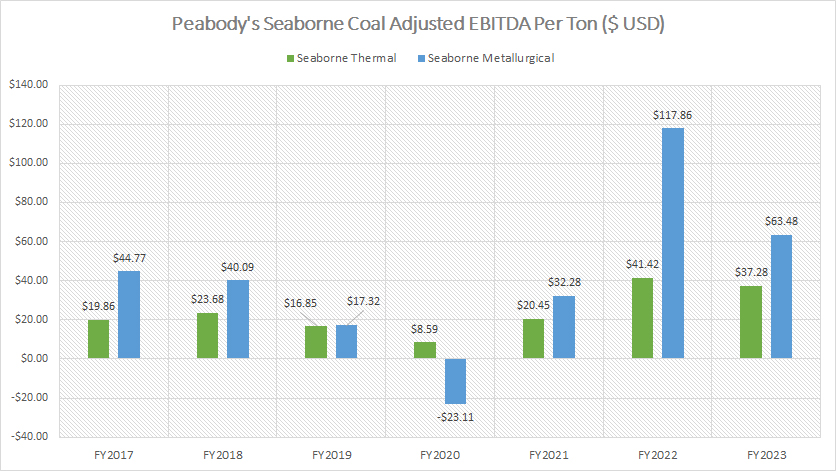

Peabody’s Seaborne Coal Adjusted EBITDA Per Ton

Peabody seaborne coal EBITDA per ton

(click image to enlarge)

For Peabody’s coal profitability, we look at the adjusted EBITDA per ton which is presented in the chart above. The definition of the adjusted EBITDA is available here: adjusted EBITDA.

To help readers understand the content, you may find the definition of Peabody’s seaborne mining operations here: seaborne mining operation. The definition of tons and tonnes is available here: tons or tonnes.

Peabody’s seaborne metallurgical coal demonstrates significantly higher profitability on a per-ton basis compared to seaborne thermal coal. For instance, the adjusted EBITDA per ton for seaborne metallurgical coal was $63.48 in fiscal year 2023.

In fiscal year 2022, the profitability surged to $117.86 per ton. Over the past three years, Peabody’s adjusted EBITDA per ton for seaborne metallurgical coal has averaged $71.21, more than double the figure of seaborne thermal coal per ton.

In contrast, the adjusted EBITDA per ton for seaborne thermal coal was $37.28, which is about half of that for seaborne metallurgical coal. Over the past three years, Peabody’s adjusted EBITDA per ton for seaborne thermal coal has averaged only $33.05.

A notable trend is the recovery of adjusted EBITDA per ton for both seaborne metallurgical and thermal coal since fiscal 2020, when profitability hit record lows.

Since 2020, Peabody’s adjusted EBITDA per ton for both seaborne metallurgical and thermal coals has been on the rise, indicating the growing profitability of its overseas mining operations.

Overall, Peabody’s seaborne metallurgical coal outperforms seaborne thermal coal in terms of profitability on a per-ton basis. The significant difference in adjusted EBITDA per ton underscores the higher market value and demand for metallurgical coal.

The recovery trend in profitability since 2020 further illustrates Peabody’s growing success and efficiency in its seaborne mining operations.

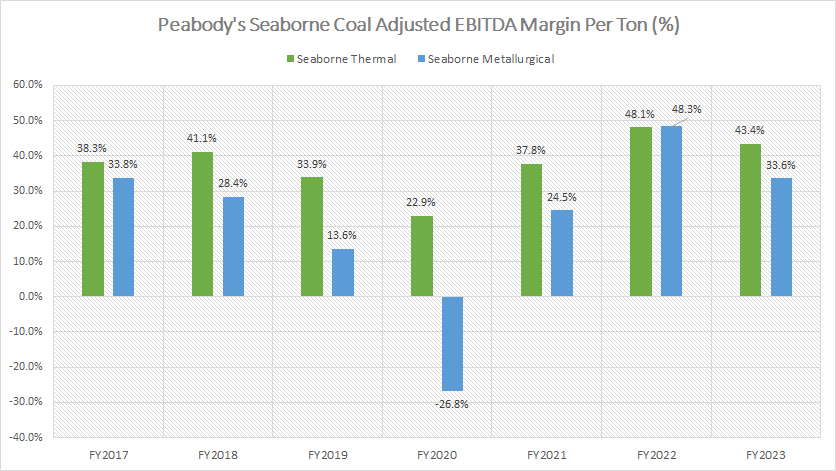

Peabody’s Seaborne Coal Adjusted EBITDA Margin Per Ton

Peabody seaborne coal EBITDA margin per ton

(click image to enlarge)

For Peabody’s coal profitability, we look at the adjusted EBITDA per ton which is presented in the chart above. The definition of the adjusted EBITDA is available here: adjusted EBITDA.

To help readers understand the content, you may find the definition of Peabody’s seaborne mining operations here: seaborne mining operation. The definition of tons and tonnes is available here: tons or tonnes.

From the perspective of margin per ton, Peabody’s seaborne thermal coal operation has historically been more profitable compared to seaborne metallurgical coal. This trend is in contrast to the adjusted EBITDA per ton, as previously discussed.

In fiscal year 2022, Peabody’s adjusted EBITDA margin per ton for both seaborne thermal and metallurgical coal was approximately 48%. In fiscal year 2023, both margins declined to 43% and 34%, respectively.

On average, Peabody’s adjusted EBITDA margin per ton for seaborne thermal coal was 43% between fiscal year 2021 and 2023, while that of the seaborne metallurgical coal was 36% for the same period, a much lower figure compared to seaborne thermal coal.

Although the adjusted EBITDA per ton for seaborne metallurgical coal is higher, the margin per ton reveals a different story. Seaborne thermal coal has exhibited stronger profitability margins, indicating better cost management and market positioning.

Despite the differences in profitability, both seaborne thermal and metallurgical coal have achieved record profit margins per ton post-pandemic, reflecting strong market demand and favorable pricing.

In summary, Peabody’s seaborne thermal coal operations have demonstrated superior profitability from a margin per ton perspective.

While the adjusted EBITDA per ton for seaborne metallurgical coal remains higher, the margins per ton suggest that thermal coal has been a more consistently profitable segment.

Summary

An important summary from the analysis of Peabody Energy’s financial metrics is the significant disparity in profitability between its different coal segments.

Seaborne metallurgical coal not only commands higher prices but also delivers much higher adjusted EBITDA per ton compared to other coal types, reflecting its premium market demand and usage in steel production.

However, this doesn’t always translate to the best margins, as seaborne thermal coal has shown stronger adjusted EBITDA margins per ton over the years, highlighting its operational efficiency and market positioning.

Moreover, the contrasting trends in profitability between other U.S. thermal coal and PRB thermal coal emphasize the need for strategic focus.

The consistently rising adjusted EBITDA for other U.S. thermal coal indicates robust demand and effective cost management, whereas the declining profitability of PRB thermal coal signals operational challenges and potentially higher costs.

Lastly, the recovery in revenue per ton, adjusted EBITDA per ton and adjusted EBITDA margin per ton for both U.S. and seaborne coal mining operations post-pandemic underscores Peabody’s ability to adapt and improve its financial performance in a dynamic market environment.

References and Credits

1. All financial figures were obtained and referenced from Peabody’s annual reports published in the company’s investor relations page: Peabody Investor Center.

2. Flickr Images.

Disclosure

We may utilize the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.