Ford GT at the Regent Street Motor Show London 2018. Flickr Image.

Ford Motor Company (NYSE:F) is a world-leading automaker that specializes in the design and manufacture of cars, trucks and SUVs.

Ford operates thousands if not hundreds of offices and factories all around the world and employs nearly 200,000 people globally.

For this reason, Ford Motor Company incurs huge expenses and requires a massive amount of working capital to run its capital-intensive operations.

Even a minor shortage of liquidity may put the company at risk of bankruptcy and adversely affect shareholders.

A very obvious example was the cash dividend suspension that occurred during the COVID crisis in 2020.

As you can see, liquidity is the lifeline of a business.

In this article, we will explore Ford’s short-term liquidity by using only 3 ratios, namely the current ratio, working capital, and quick ratio (acid test ratio).

Let’s check them out here!

Table Of Contents

Liquidity Ratios

A1. Current Ratio

A2. Working Capital

Liquidity Under Stressed Test

B1. Quick Ratio (Acid Test Ratio)

Extra Liquidity

Summary And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

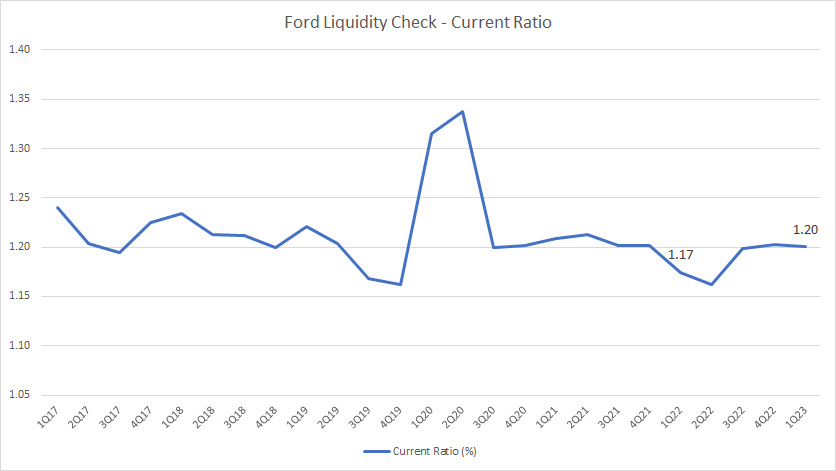

Ford Motor Current Ratio

Ford Motor’s current ratio

(click image to enlarge)

Ford’s current ratio had been quite consistent over the years except in fiscal 2020 when the COVID-19 pandemic hit.

As shown in the chart above, Ford’s current ratio shot up significantly during the COVID pandemic in fiscal 2020, indicating the extra liquidity obtained by the company.

Ford Motor considerably jacked up its liquidity during the COVID crisis so that the company could still maintain its financial flexibility in the event its existing cash dried up.

As of fiscal 1Q 2023, Ford’s current ratio totaled 1.20X, suggesting ample liquidity for the company.

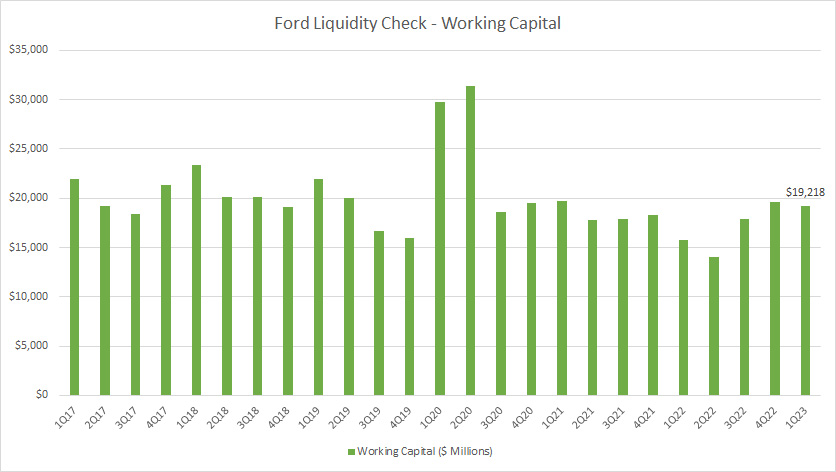

Ford Motor Working Capital

Ford Motor’s working capital

(click image to enlarge)

The working capital indicates the excess liquid assets that a company has after accounting for all current liabilities that come due in the next 12 months.

In Ford Motor’s case, the company had over $19 billion of working capital as of 1Q 2023.

Similar to the current ratio, Ford had pretty consistent working capital over the years.

We can see that the company’s working capital increased significantly in fiscal 2020 during the COVID-19 pandemic.

As mentioned, the higher working capital during the pandemic was expected as Ford was trying to maintain its liquidity needs by keeping a larger pile of cash on hand.

In the post-pandemic period, Ford’s working capital had normalized to its pre-pandemic level.

In line with the current ratio that we saw earlier, Ford Motor should have no liquidity issues given the huge amount of working capital.

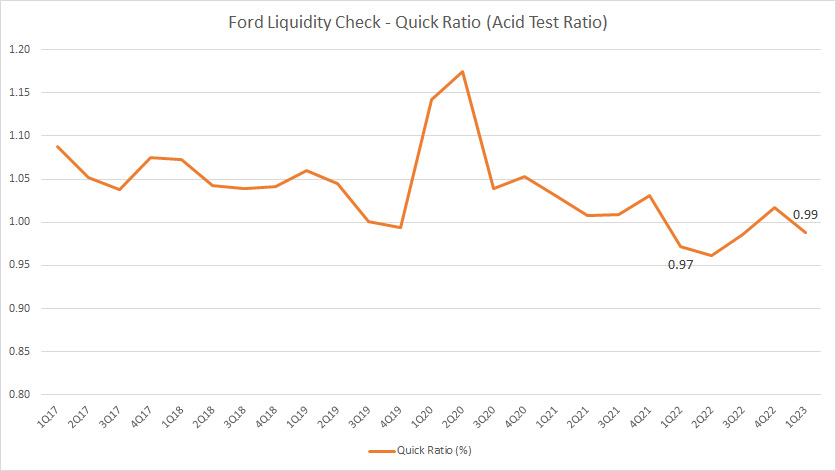

Ford Motor Quick Ratio (Acid Test Ratio)

Ford Motor’s quick ratio

(click image to enlarge)

The quick ratio is calculated based on the equation below:

Quick Ratio = Adjusted Current Assets / Total Current Liabilities

Therefore, the quick ratio is almost identical to the current ratio except that it is a more stringent version of the current ratio.

In this aspect, the quick ratio or acid test ratio strips off some current assets such as inventories and prepaid expenses.

What remains in the quick ratio are highly liquid assets such as cash and cash equivalents, marketable securities, short-term investments, and receivables.

All told, Ford’s quick ratio also had been quite consistent over the past several years.

On average, the ratio clocked 1.04X between 2017 and 2023, illustrating that Ford was still able to cover all short-term liabilities even with just its cash and near-cash assets alone.

As of 1Q 2023, the ratio totaled 0.99X, meaning that Ford’s highly liquid assets were just about enough to cover all current liabilities expected to be due in the next 12 months starting from 31 March 2023.

Therefore, Ford has had pretty solid liquidity.

Ford Motor Available Line Of Credit

-

“Available Credit Lines.

Total Company committed credit lines, excluding Ford Credit, at March 31, 2023 were $19.3 billion, consisting of $13.5 billion of our corporate credit facility, $2.0 billion of our supplemental revolving credit facility, $1.75 billion of our 364-day revolving credit facility, and $2.1 billion of local credit facilities.”

Apart from having its own cash, Ford Motor Company, the automotive segment, in particular, utilizes extra liquidity from its committed credit facilities.

For example, the quote above shows that Ford Motor Company, primarily the automotive segment, as of 1Q 2023, had a total amount of $19.3 billion USD of extra liquidity, which came primarily from its bank facilities.

Of this amount, roughly $1.7 billion was utilized as of 1Q 2023, leaving gross facilities of $17.6 billion USD.

Of course, the credit lines are debt that needs to be paid back if Ford decides to borrow from the bank facilities.

However, the extra cash can come in handy and provides financial flexibility to the company.

In short, Ford should have no problem meeting its short-term obligations given the extra cash that the company can access under its credit lines.

Conclusion

To recap, Ford has pretty solid liquidity ratios.

The company’s current and quick ratios have been very consistent and it also comes with positive working capital in every quarter.

Moreover, Ford also has a sizeable amount of credit lines at its disposal.

In short, Ford should be able to satisfy all of its near-term payments for now.

Credits And References

1. All financial data presented in this article was obtained and referenced from Ford’s financial statements, SEC filings, earnings reports, quarterly and annual reports, etc, which are available in Ford’s Earnings Releases.

2. Featured images in this article are used under creative commons licenses and sourced from the following websites: mangopulp2008 and Thomas Hawk.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the full correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!