A lot of companies within the “Agricultural Chemicals” industry are solid dividend-paying companies. To find out which one stands out among them, I have used the Stock Dividend Screener spreadsheet to do some screening based primarily on free cash flow metrics. One particular solid dividend paying stock that I discovered using the spreadsheet is Potash Corporation of Saskatchewan Incorporated or stock ticker POT.

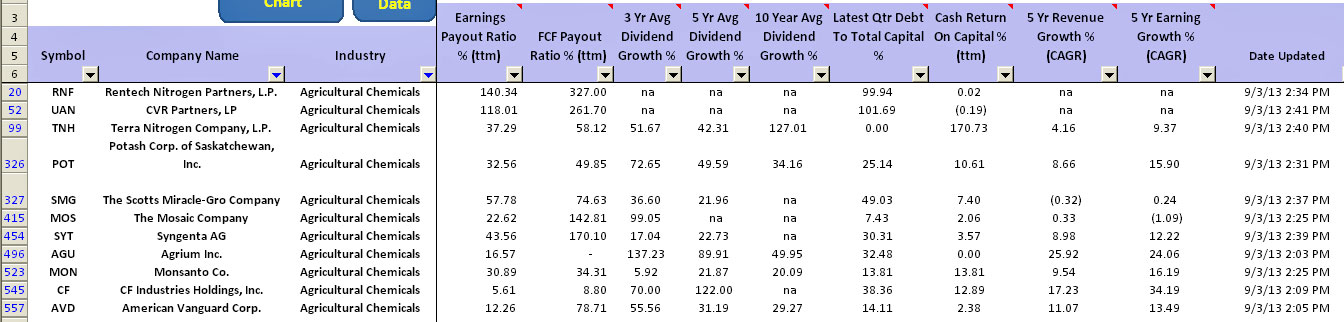

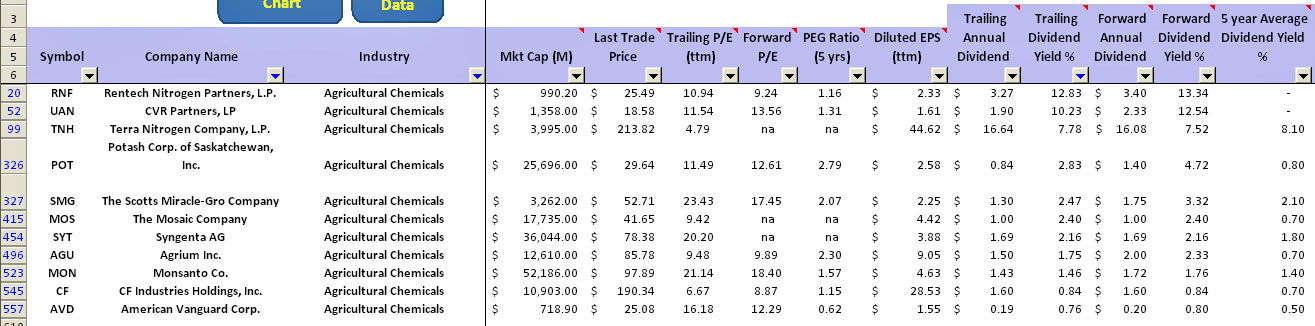

Among the dividend paying stocks within the “Agricultural Chemicals” industry, Potash Corp. is ranked number 4 in terms of trailing and forward dividend yield. Even though the trailing dividend yield is at a modest rate of 2.8%, the forward dividend yield is estimated to be 4.7% based on current stock price, a substantial increase of 67% from $0.84 dividend per share to $1.40 dividend per share. Please look at the following snapshot of the screening result.

The above tables show the screening result for POT which was done on September 23, 2013.

In terms of dividend yield for the past 5 years, the number displayed in the spreadsheet is 0.8% which is considered a modest yield. But going forward, I believe the dividend payout will increase significantly. If you look at the past 3, 5 and 10 year average dividend growth rate, the dividend payout for POT for the recent 3 years registered the highest growth rate of 72% annually.

The best part is that from the screening result of the spreadsheet, Potash has been paying dividends consecutively for the past 10 years. The metric 10 year average dividend growth shows that average annual dividend growth rate is 34%. This number will not be available if the stock has stopped paying dividend even for one year during that 10 year period.

In addition, there are plenty of rooms for POT to increase the dividend payout. The above screening result shows that the dividend to earnings and free cash flow ratio are at a rate of 32% and 50% respectively. As a result, Potash Corp. still has plenty of rooms to grow the dividend in near future. Even if the earnings of POT stays flat for the next 12 months, POT will still be able to increase if not pay out the same dividend.

In dividend investing, cash is the most important factor that will determines whether a company is able to continuously dish out cash dividend to shareholders. For Potash Corp., a quick look at the debt to capital and free cash flow return on capital metrics show that there isn’t any reason for investors to worry about as POT is carrying a modest debt and the cash return on capital is at a rate of 10%. This shows that POT is not heavily leveraged and the company is able to generate decent amount of free cash flow by efficiently using its capital. The capital in the spreadsheet is calculated from summing up the short and long terms debt as well as the stockholders equity.

Lastly, Potash Corporation registered a modest revenue and earnings growth of 8.7% and 15.9% respectively for the past 5 years. There is definitely no doubt that Potash Corp. is a solid dividend paying stock and investors should be pleased to know that POT will be able to continuously pay out dividend in the future judging from the fact that it has been doing so for the past 10 years. Besides, the agricultural business will thrive in the future no matter what since the human population will continue to grow and the demand for fertilizer will certainly continue to increase. The agricultural chemicals business is sure to stay for as long as the demand for food continues to grow.