There lies a silver lining within the silver industry in the basic materials sector. With that said, the silver lining here points to the company Silver Wheaton Corporation (SLW) which operates silver and gold streaming worldwide. According to Yahoo Finance, Silver Wheaton has 20 long-term purchase agreements associated with silver and gold relating to 23 mining assets. Its principal portfolio includes silver and precious metal streams on the Barrick’s Pascua-Lama project, Hudbay’s Constancia project, and Vale’s Salobo and Sudbury mines.

As a streaming company, Silver Wheaton does not operate mines. It buys the rights to purchase silver and gold at a predetermined price in exchange for an up front cash payment. For this reason, SLW is able to operate efficiently without having to resort to the high operating cost where most mining companies will have to endure.

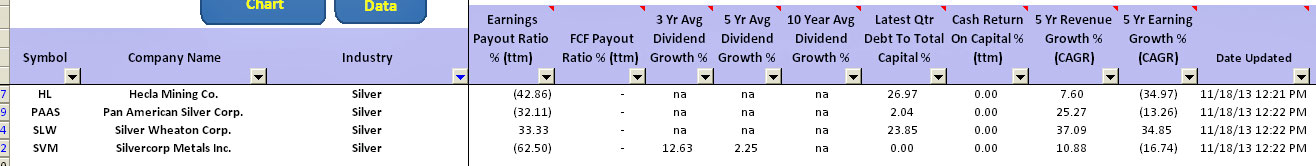

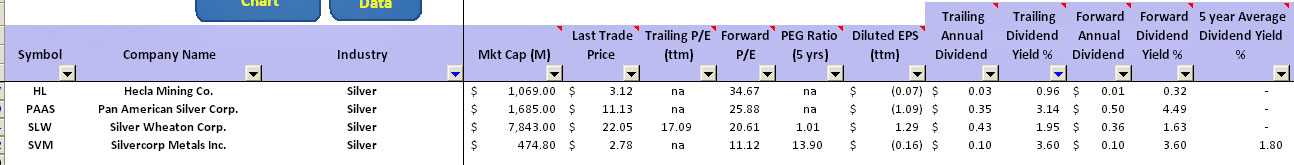

SLW is a dividend paying stock and its dividend policy is linked to its operating cash flow. To find out the performance of the dividend payment from SLW, we look at a couple of metrics from the Stock Dividend Screener spreadsheet. As of November 18th 2013 (shown in table 1 and 2 below), at current stock price of $22, the trailing and forward dividend yield of SLW is 1.95% and 1.63% respectively. That doesn’t sound too bad even though the yield is still lacking when compared to its peers in the “Silver” industry.

Among the dividend paying stocks in the “Silver” industry, SLW is the only one operating with positive earnings. For this reason, its dividend to earnings payout ratio for the last trailing twelve months is 33%. Even though SLW is operating with positive earnings, its free cash flow has been negative for the past 12 months, as seen in the column “FCF Payout Ratio” where the number is at zero. It’s been having negative free cash flow because of the depressed prices of gold and silver.

To further analyze the dividend history of SLW, we look at the column “3 Yr Avg Dividend Growth”. The information in this column isn’t available because the stock has only begun paying dividend in less than 3 years. In addition, SLW is moderately leveraged judging from its latest quarter debt to total capital ratio of 24%. A highly leverage company will have its debt to total capital ratio of more than 50%.

A surprising result from the Stock Dividend Screener spreadsheet for SLW shows that the revenue and earnings growth for the past 5 years for Silver Wheaton is the highest at 37% and 35% respectively among its dividend paying peers in the “Silver” industry.

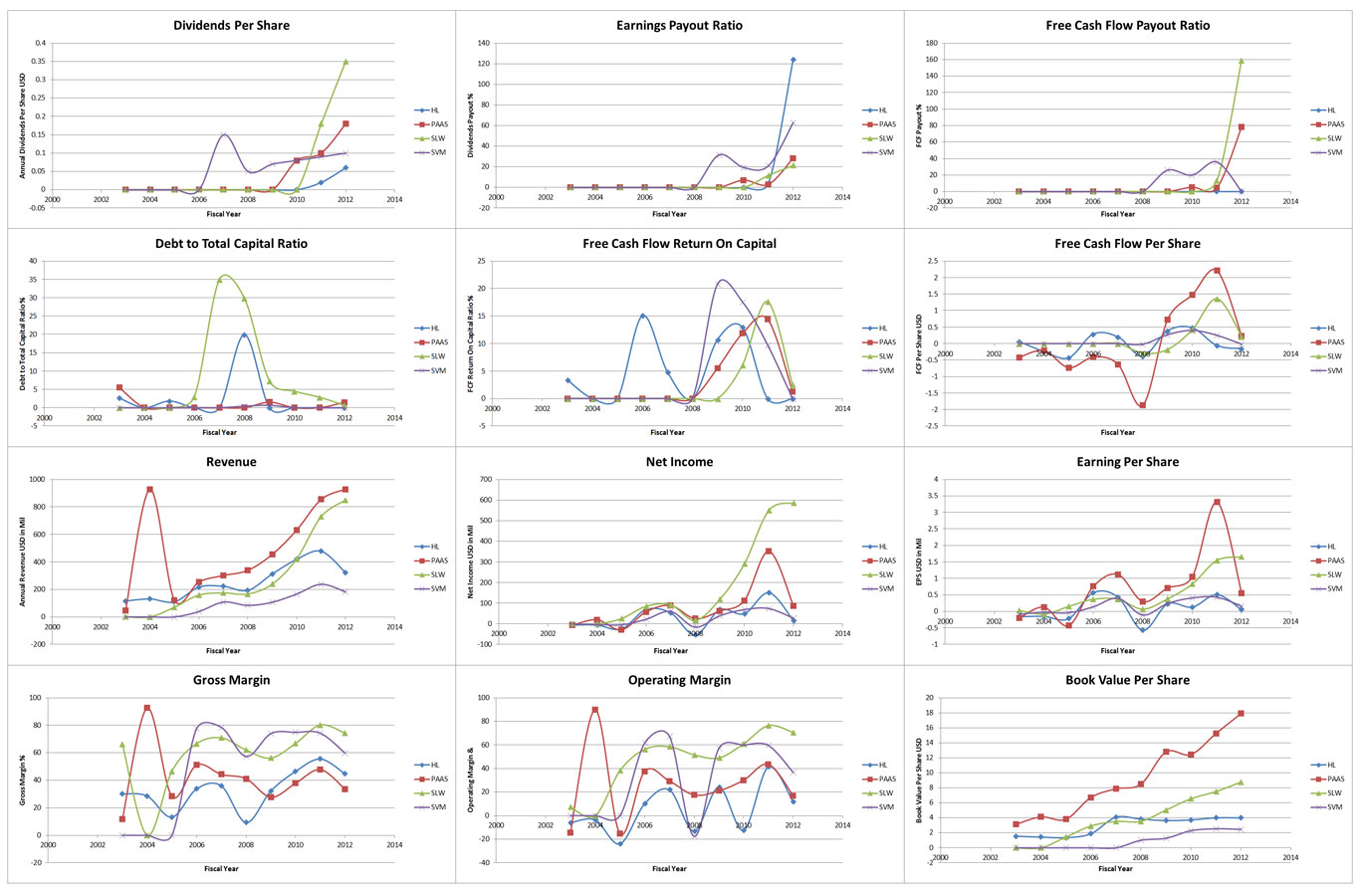

To further analyze the dividend history of Silver Wheaton, we look at the 10 years plot. The dividend per share plot shows that the company has the highest growth in dividend payout (Yellow Line).

In terms of revenue and net income growth, one interesting thing to note is that even though PAAS has higher revenue compared to SLW, the net income of PAAS is considerably lower. The reason is that SLW has higher gross margin compared to PAAS. The two plots of “Gross Margin” and “Operating Margin” have shown that SLW has the highest margin.

In conclusion, I believe that Silver Wheaton is a solid dividend paying company going forward. Because of its dividend policy that ties to its operating cash flow, the dividend may suffer a setback in near future due to low prices of gold and silver. Even at this level of gold and silver prices, SLW is still able to churn out that sweet quarterly dividend payout.

High gross margin, low leverage and a good business model have all made the dividend payment sustainable even in current environment. When prices of gold and silver rebound, shareholder will definitely enjoy increase in dividend. Now may be the time to pick up some shares of Silver Wheaton since it’s cheap. It will definitely pay back for long term investors.