AB InBev’s Stella Artois. Source: Flickr

AB InBev (Anheuser-Busch InBev SA/NV) is a Belgian-Brazilian multinational beverage and brewing company headquartered in Leuven, Belgium. It is the largest brewer in the world, with a vast portfolio of over 630 beer brands in 150 countries. Some of its well-known brands include Budweiser, Stella Artois, Corona, and Beck’s.

This article presents a comprehensive cash flow analysis of AB InBev. We will cover several key cash flow statistics, including cash on hand, cash flow from operating and financing activities, free cash flow, and cash flow margins.

Let’s take a look!

Investors looking for other statistics of AB InBev may find more information on these pages:

- 8 reasons AB InBev dividend is safe and 4 it is not,

- AB InBev sales volume by region, and

- AB InBev revenue by country.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. How Does AB InBev Manage Its Cash?

Consolidated Results

Ratio

B1. Cash On Hand To Current Assets Ratio

Cash Flow

C1. Net Cash From Operations And Free Cash Flow

Cash Flow Margins

D1. Operating Cash Flow And Free Cash Flow Margin

Cash From Debt Borrowing And For Debt Repayment

E1. Net Cash From Financing Activities (Not Accounting For Capital Returns)

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Cash To Current Assets Ratio: The cash to current assets ratio is a financial metric measuring the proportion of a company’s cash and cash equivalents relative to its total current assets.

This ratio provides insight into a company’s liquidity and its ability to meet short-term obligations without having to rely on the sale of inventory or other non-cash assets.

Here’s how it’s calculated:

\[\text{Cash To Current Assets Ratio} = \left( \frac{\text{Total Cash On Hand}}{\text{Current Assets}} \right) \times 100\%\]

A higher ratio indicates that a company has a greater proportion of cash on hand compared to its current assets, suggesting strong liquidity and financial flexibility.

Conversely, a lower ratio may indicate potential liquidity issues, as the company might have to convert other assets to cash to meet its short-term liabilities.

Free Cash Flow: Free cash flow (FCF) is a financial metric representing a company’s cash generated after accounting for the cash outflows needed to support operations and maintain its capital assets.

Essentially, it’s the excess cash the company produces after paying for its operating expenses and capital expenditures.

Free cash flow is a crucial indicator of a company’s financial health and its ability to generate sufficient cash to support its business, invest in growth opportunities, pay dividends to shareholders, and reduce debt. It is calculated as:

[ {Free Cash Flow} = {Net Cash from Operating Activities} – {Capital Expenditures} ]

Investors and analysts often use this metric to assess a company’s profitability, efficiency, and potential for growth and expansion.

Cash Flow Margin: The cash flow margin is a financial metric measuring the efficiency of a company in converting its sales into cash.

It’s expressed as a percentage and calculated by dividing the cash flow from operating activities by the net sales or revenue of the company. Here is the formula:

\[\text{Cash Flow Margin} = \left( \frac{\text{Net Cash From Operations}}{\text{Total Revenue}} \right) \times 100\%\]

This ratio provides insights into the company’s ability to generate cash from its sales. It is crucial for covering its expenses, paying down debt, and funding new investments without relying on external financing.

A higher cash flow margin indicates that the company is efficiently managing its operations to produce more cash, which is a positive sign for investors and creditors. It’s a useful indicator of the company’s financial health and operational efficiency.

Net Cash From Financing Activities: Net Cash from Financing Activities refers to the section of a company’s cash flow statement showing the net cash flows used to fund the company.

This includes transactions involving equity, debt, and dividends. Specifically, it captures the inflow of cash from investors or banks and the outflow of cash to shareholders as dividends or to repay debt obligations.

The calculation of net cash from financing activities includes issuing stock, debt issuance, dividend payments, and debt repayment. It is a crucial component for understanding how a company finances its operations and growth, indicating whether it generates more cash than it uses or vice versa.

This metric is essential to a company’s financial health and provides investors with insight into its financial strategy and ability to manage its capital structure effectively.

How Does AB InBev Manage Its Cash?

AB InBev manages its cash through several key strategies:

1. Maintaining Liquidity: AB InBev ensures it has sufficient cash on hand and cash equivalents, such as short-term bank deposits and treasury bills, to meet its short-term obligations.

2. Operating Cash Flow: The company generates significant cash flow from its operating activities, which includes revenue from beer sales and other beverages.

3. Free Cash Flow: AB InBev focuses on generating free cash flow, which is the cash generated from operations minus capital expenditures. This cash flow is used for reinvestment in the business, debt reduction, and shareholder returns.

4. Cash Flow from Financing Activities: The company manages its cash flow from financing activities, which includes proceeds from debt issuances and repayments, as well as dividend payments and share buybacks.

5. Strategic Investments: AB InBev makes strategic investments in acquisitions, new facilities, and technology to drive growth and enhance its competitive position.

6. Cost Management: The company implements cost management initiatives to optimize its cash flow and improve profitability.

By effectively managing these aspects, AB InBev ensures financial stability and supports its long-term growth objectives.

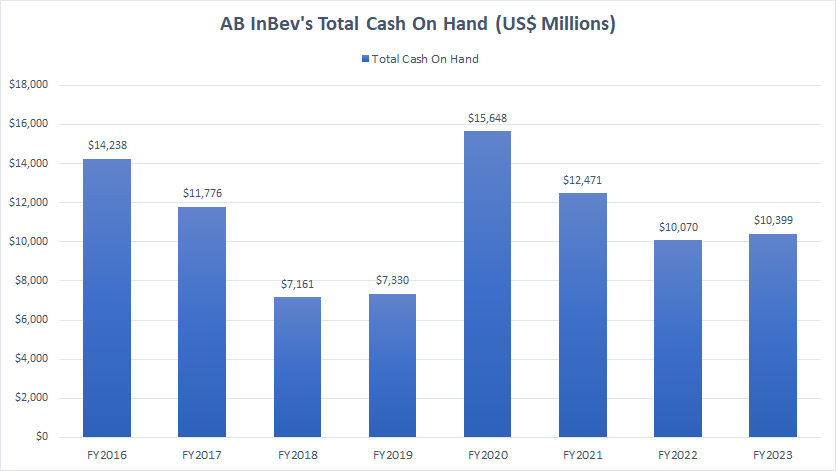

AB InBev’s Total Cash On Hand

AB InBev’s cash on hand

AB InBev’s total cash on hand consists of cash and cash equivalents and short-term investments. As of the end of fiscal year 2023, the company’s cash on hand amounted to US$ 10.4 billion, up slightly from US$ 10.1 billion in the previous year.

AB InBev’s cash on hand has remained fairly consistent in most fiscal years, except during the COVID-19 period in fiscal year 2020 when it surged to $15.6 billion. In the post-COVID period, AB InBev’s cash reserves have gradually normalized to their pre-COVID levels.

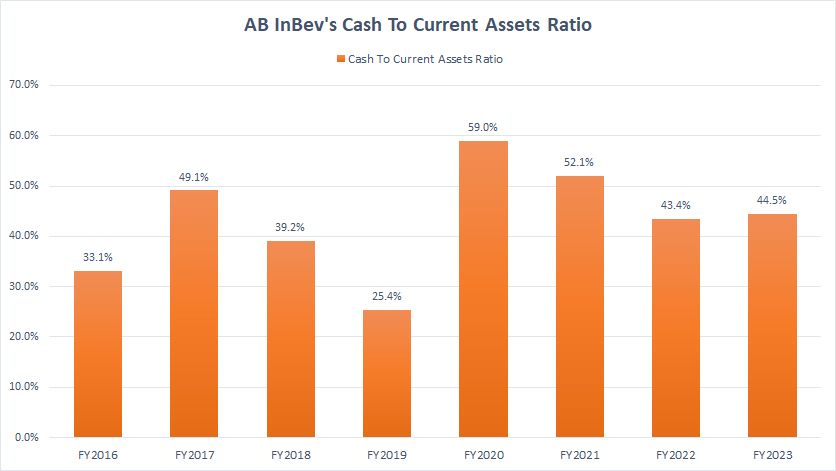

AB InBev’s Cash To Current Assets Ratio

ab-inbev-cash-to-current-assets-ratio

(click image to expand)

The definition of ABI’s cash to current assets ratio is available here: cash to current assets ratio.

AB InBev’s cash to current assets ratio has remained relatively stable in most fiscal years. However, the ratio has been slightly higher in the post-pandemic period, indicating the company’s strong liquidity and its robust ability to meet short-term liabilities over the last several years.

On average, AB InBev’s cash to current assets ratio has amounted to 47% over the last three fiscal years. This ratio is significantly higher than the pre-2020 levels, indicating that the company has more cash readily available. This increase provides AB InBev with greater financial flexibility to handle unexpected expenses or seize investment opportunities.

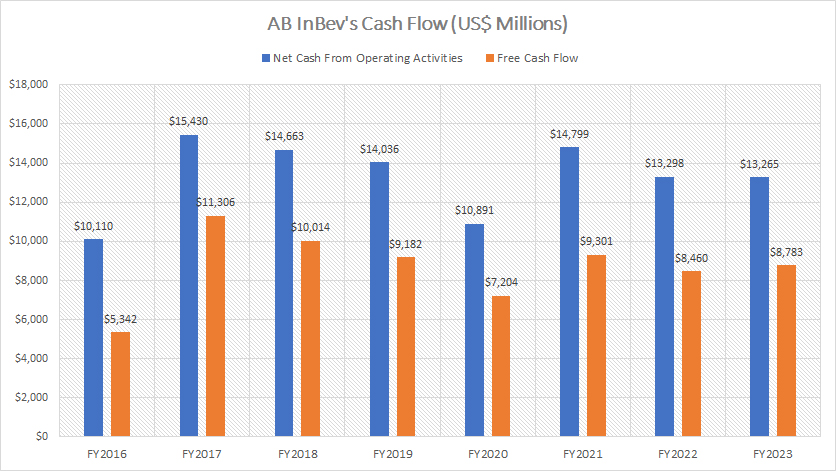

AB InBev’s Net Cash From Operations And Free Cash Flow

ab-inbev-cash-flow

(click image to expand)

The definition of ABI’s free cash flow is available here: free cash flow.

AB InBev generates solid cash flow, as shown in the chart above. Over the past three years, AB InBev’s net cash from operating activities averaged $13.8 billion annually, while free cash flow averaged $8.8 billion annually.

Besides, AB InBev has maintained positive operating and free cash flow over the last eight fiscal years, demonstrating the company’s solid cash-flow generating capability.

AB InBev’s strong cash flow generally indicates several positive aspects of its financial health and operational efficiency. For example, AB InBev’s strong cash flow ensures that the company has sufficient liquidity to meet its short-term obligations, such as paying suppliers, employees, and creditors on time.

In addition, AB InBev’s consistent and positive cash flow demonstrates the company’s ability to generate revenue and manage its expenses effectively, contributing to overall financial stability.

Also, with strong cash flow, AB InBev has the financial flexibility to invest in growth opportunities, such as expanding operations, acquiring new businesses, and developing new products or services.

AB InBev’s solid cash flow has also allowed the company to service its debt more comfortably, reducing the risk of financial distress and improving its creditworthiness.

For your informaton, AB InBev’s indebtedness has significantly reduced over the last eight years, as depicted in this article: AB InBev’s total debt and leverage ratios.

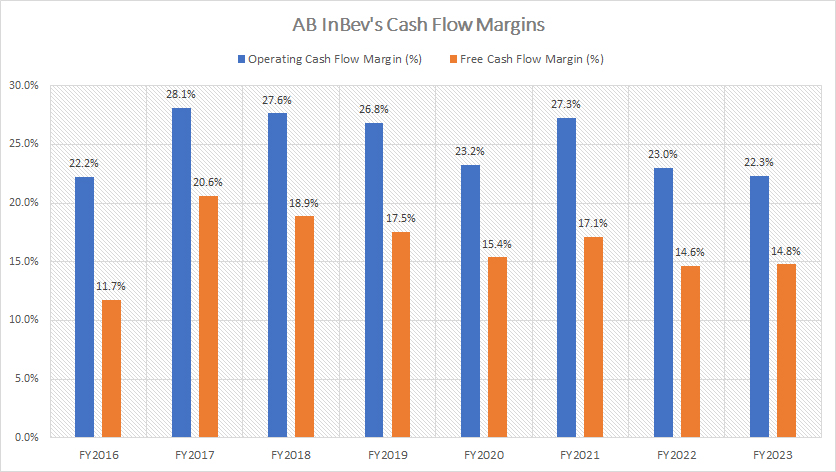

AB InBev’s Operating Cash Flow And Free Cash Flow Margin

ab-inbev-cash-flow-margins

(click image to expand)

The definition of ABI’s cash flow margins is available here: cash flow margins.

As depicted in the chart above, AB InBev has demonstrated strong cash flow margins, averaging around 24% for operating cash flow and 16% for free cash flow over the past three years.

In other words, AB InBev has managed to convert approximately $0.24 of net cash from operations for every $1.00 of revenue. Similarly, for free cash flow, the company has turned $0.16 of free cash flow for every $1.00 of revenue.

AB InBev’s strong cash flow margins has provided the company with several advantages. For example, AB InBev is generating a significant amount of cash from its operations relative to its revenue. This suggests effective cost management and high profitability.

In addition, AB InBev has the ability to efficiently convert sales into cash. This efficiency has been a result from effective management of receivables, payables, and inventory.

AB InBev’s solid cash flow margins have ensured that the company has sufficient liquidity to meet its short-term obligations, invest in growth opportunities, handle unexpected expenses, and pay down debt.

As mentioned, AB InBev’s total debt has significantly reduced over the last several years, as shown in this article: AB InBev’s total debt and leverage ratios.

Overall, AB InBev’s strong cash flow margins are a key indicator of the company’s operational success, financial stability, and ability to generate value for its stakeholders.

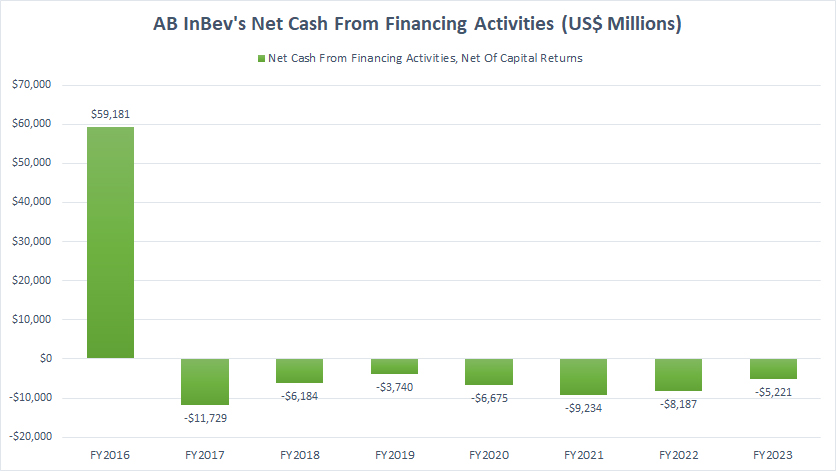

AB InBev’s Net Cash From Financing Activities (Not Accounting For Capital Returns)

AB InBev’s net cash from financing activities

The definition of ABI’s net cash from financing activities is available here: net cash from financing activities.

As seen from the chart above, AB InBev generates negative net cash from financing activities (net of capital returns) in most fiscal years, suggesting a significant cash outflow from the company through financing activities.

AB InBev’s negative net cash flow from financing activities typically indicates that the company is paying out more cash than it is receiving from financing sources.

However, in fiscal year 2016, it received over $59 billion in cash through debt, as shown in the chart above. During fiscal year 2016, AB InBev was obtaining capital to buy SABMiller. Its debt also significantly increased in the same period, due to the borrowing.

For the rest of the fiscal years, AB InBev has consistently generated negative net cash from financing activities. This means AB InBev has been repaying its debt, which is a positive sign of financial health and stability. It suggests that AB InBev is reducing its leverage and interest expenses.

In addition, AB InBev’s consistent negative net cash from financing activities in all fiscal years also means a reduction in new borrowing. In this aspect, the company may not be taking on new debt or issuing new equity, which could indicate a conservative financial strategy and reliance on existing cash flow for growth and operations.

Overall, AB InBev’s negative net cash flow from financing activities can be a sign of financial strength and prudent management, as the company focuses on reducing debt, returning value to shareholders, and maintaining a conservative approach to new financing.

Summary

Overall, AB InBev’s cash flow analysis demonstrates strong liquidity, financial flexibility, and solid cash-flow generating capability. These factors contribute to the company’s ability to meet short-term obligations, invest in growth, handle unexpected expenses, pay down debt, and maintain financial stability.

References and Credits

1. All financial figures presented in this article were referenced and obtained from AB Inbev’s annual reports published in the company’s investor relation page: AB InBev’s Financial Reports.

2. Flickr Images

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link back to this article from any website so that more articles like this can be created.

Thank you!