GMC Red Sierra. Source: Flickr

Investors following a company may want to look at the assets portion since the assets represent the future economic benefits of the company.

The rise and fall of certain asset classes in the balance sheets may reflect the financial health of the company. Specifically, investors should pay attention to assets that directly generate cash flow such as receivables, inventory, leasing assets, etc.

In general, a growing company should see its assets growing along with revenue or sales especially for an automaker like General Motors which relies heavily on fixed or hard assets for its business operations.

With that in mind, in this article, we will look at General Motors (NYSE:GM) total assets and track them over a period of time. Besides, we will also look at the breakdown of GM’s total assets and find out what really makes up the company’s total assets. We will also look at some of GM’s valuable assets that have consistently generated revenue for the company.

Apart from the asset itself, we will also explore ratios that measure GM’s assets usage efficiency such as the asset turnover ratio and return on asset ratio.

Let’s dive in!

General Motors Assets Topics

1. Total Assets

2. Long-Term Assets

3. Current Assets

4. Tangible Assets – Property

5. Cash Generating Assets – Equipment On Operating Leases

6. Cash Generating Assets – GM Financial Receivables

7. Asset Turnover Ratio

8. Return On Assets Ratio

9. Recap

General Motors’ Total Assets

GM total assets

The chart above shows General Motors’ quarterly total assets over a 6-year period from fiscal 2015 to 2021.

As seen from the chart, GM’s total assets have been steadily rising in the last 5 years, reaching as much as $240 billion USD as of fiscal Q3 2021. The growth in total assets was particularly significant between 2015 and 2017, rising 33% from $180 billion in 1Q 2015 to as much as $240 billion in 2Q 2017.

However, GM’s total assets took a beating in 2017, dropping from its high of $240 billion in 2Q 2017 to $212 billion by the end of the year. The decline in assets was primarily due to the sale of its European subsidiary to PSE group during 2017. GM has completed the sale of its GME subsidiary in 4Q 2017.

Nevertheless, GM’s total assets were seen rising steadily again between 2017 and 2021, hitting a record high of $247 billion by the 1st quarter of 2020 for the 1st time.

In subsequent quarters, GM’s total assets have remained roughly flat and clocked at $240 billion in the latest quarter in fiscal 2021, a $10 billion higher than those recorded in fiscal 2019. On a long-term basis, GM’s total assets have grown by as much as 33% over the 5-year period.

Analyzing just the total assets alone may not tell us much about the fundamental of the company. Therefore, we will look at the breakdown of the total assets and find out exactly what has been causing the growth of GM’s total assets from the perspective of long-term and current assets.

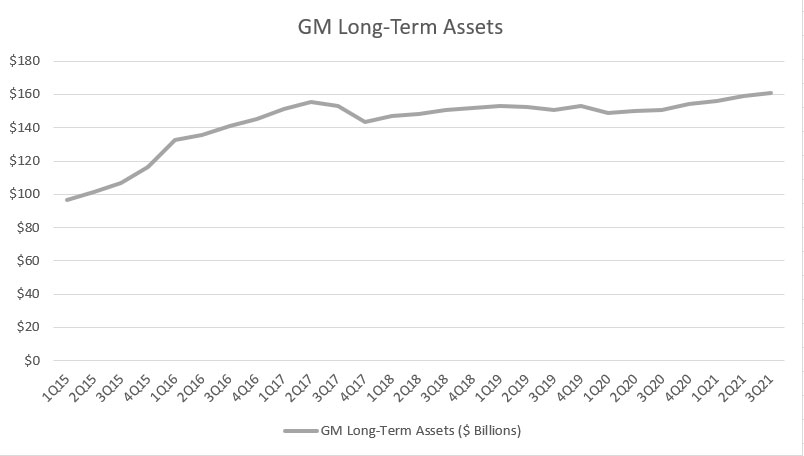

General Motors’ Long-Term Assets

GM long-term assets

In terms of long-term assets, GM’s figures look almost identical to the trend of total assets which we saw in prior discussions.

Over the last 6 years, GM’s long-term assets also have been steadily rising, reaching as much as $160 billion USD in fiscal Q3 2021.

At this figure, GM’s long-term assets contribute roughly 67% to total assets, making it the biggest portion of the company’s entire asset base.

As GM’s long-term assets have grown considerably over the years, we can safely conclude that the growth of the firm’s total assets has been largely driven by the growth of long-term assets as reflected in the identical trend of both charts.

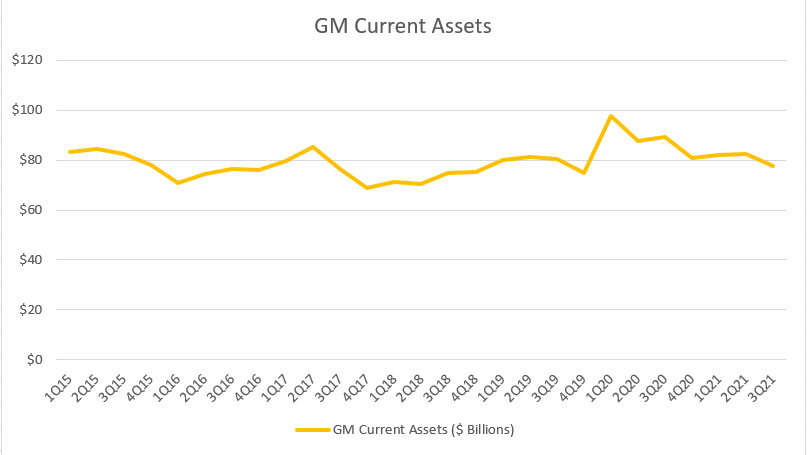

General Motors’ Current Assets

GM current asset

The chart above shows GM’s current assets over the same period from fiscal 2015 to 2021.

In the last 6 years, GM’s current assets have been mostly flat as seen from the figures which hovered around the $80 billion level. However, GM’s current assets were seen rising significantly in 1Q 2020, hitting a record high at close to $100 billion.

The dramatic rise in the company’s current assets in 1Q 2020 may have been driven by the COVID-19 outbreak as the company was shoring up its working capital in the same period.

Nevertheless, GM’s current assets were valued at only $78 billion USD as of fiscal 3Q 2021, which was down 20% from the peak recorded in fiscal 2020.

Since GM’s current assets have been mostly flat over the years, this trend reinforces the idea that the growth of GM’s total assets was driven primarily by the growth of the long-term assets.

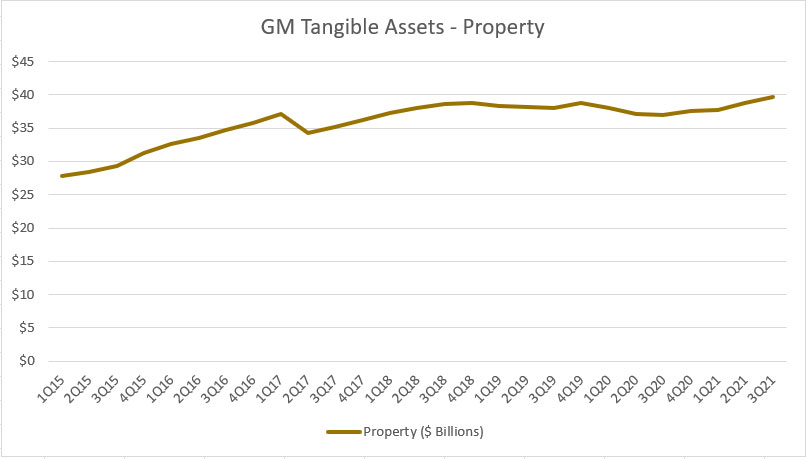

GM’s Tangible Assets – Property

GM property

Some of GM’s most valuable assets can be found within the long-term assets portion in the balance sheets. One of which is the property which is mostly made up of tangible assets such as factories, land, offices, equipment, etc.

GM’s properties are some of the company’s most important assets and these asset classes help the company to derive long-term economic benefits such as revenue for the company in the long run. Without this, GM would immediately cease operating as these are the assets where the company uses to manufacture and distribute the company’s products such as its cars, trucks and SUVs.

As seen from the chart, GM’s property has been rising significantly since fiscal 2015, reaching $40 billion as of 3Q 2021. The property asset declined slightly throughout 2017 which was mainly due to the sale of GM Europe subsidiary in the same year. However, GM’s property continued to rise steadily after fiscal 2017 and topped its record high of $40 billion as of 3Q 2021.

The growth of GM’s property assets is an indication that the company is growing. When GM’s businesses expand, they definitely need more physical assets, including offices, factories, warehouses, equipment, etc. to support the growth.

In short, GM’s growth in the property assets bodes well for not only the company but also shareholders.

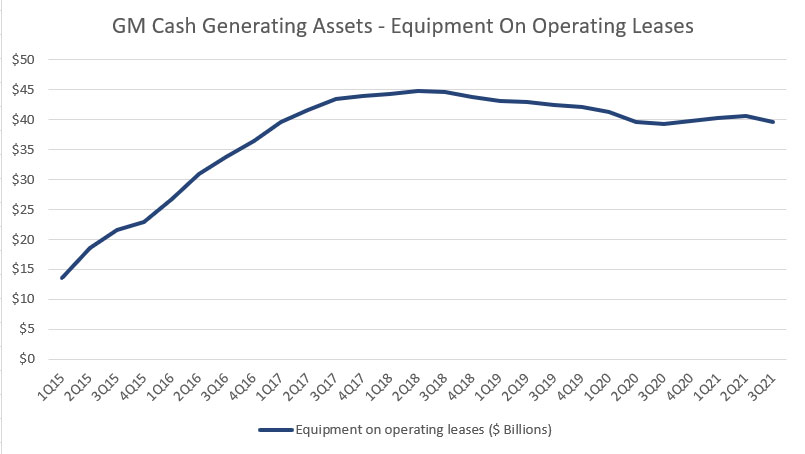

GM’s Cash Generating Assets – Equipment On Operating Leases

GM equipment on operating leases asset

The equipment on operating leases asset is one of GM’s cash-producing or income-producing assets. As the name implies, equipment on operating leases are hard or fixed assets that GM leases to 3rd parties for leasing revenue and they are primarily made up of vehicles leases to retail customers of GM Financial.

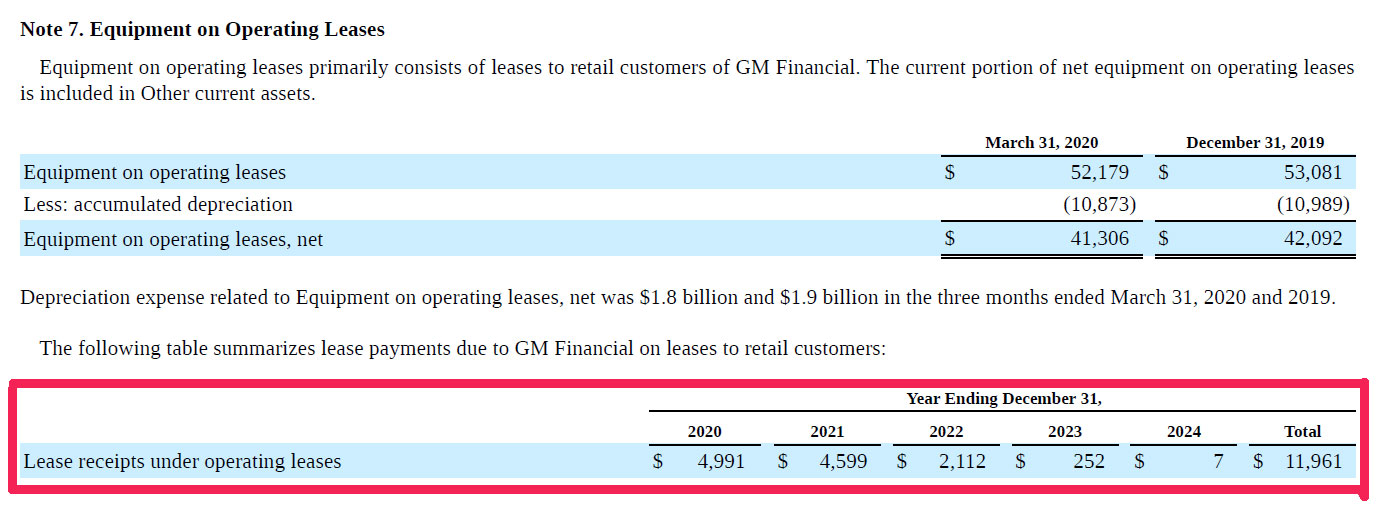

The following snapshot shows the portion extracted from GM’s 1Q 2020 quarterly filing that contains the “Equipment on Operating Leases” information.

GM equipment on operating leases asset Q1 2020

As shown in the above snapshot, the expected cash or revenue generated from the equipment on operating leases asset totaled as much as $12 billion over a span of 4 years between 2020 and 2024. You can see why this asset is being emphasized in this discussion and being called cash flow generating asset as they literally produce income for GM.

Coming back to the chart above, most of the growth of this income-generating asset occurred between fiscal 2015 and 2018. After that, the asset seems to be declining steadily. As of 3Q 2021, GM’s equipment on operating leases came in at only $40 billion, down more than 10% from its historical high reported in fiscal 2018.

As mentioned earlier, the decline of a cash-generating asset does not really bode well for the financial health of a company, especially for revenue growth. In GM’s case, the decline of this specific asset may cause leasing revenue to decline in the future.

Nevertheless, leasing revenue represents only a tiny fraction of GM’s total revenue, about 8% in fiscal 3Q 2021.

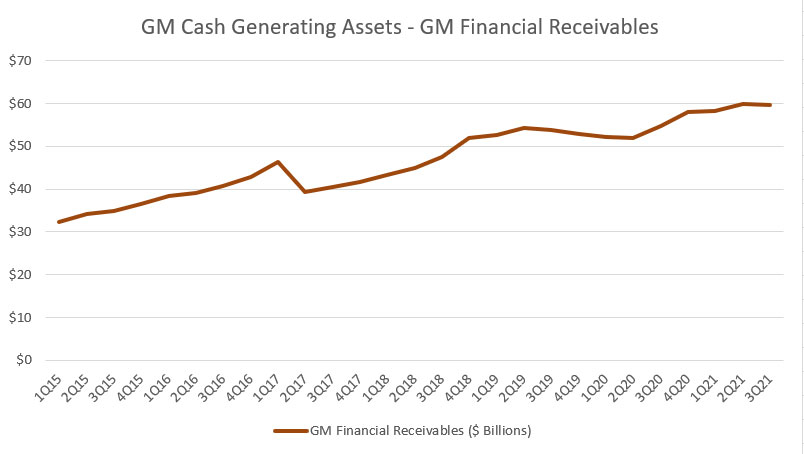

GM’s Cash Generating Assets – GM Financial Receivables

GM Financial receivables

GM Financial receivables is another GM’s cash or income-generating asset. GM Financial receivables are basically loans given to retail customers as well as commercial dealers. GM is receiving interest incomes on these loans. As such, GM Financial receivables are an important assets class that generates substantial revenue for GM. As of 3Q 2021, the interest income earned from these receivables totaled as much as $1 billion and it represents about 4% of GM’s total revenue in the latest quarter.

When we look at the chart above, the long-term trend shows that GM Financial receivables have been increasing over the years, reaching as much as $60 billion USD as of 3Q 2021.

Over the past 6 years, GM Financial receivables have nearly doubled since fiscal 2015.

Unlike the equipment on operating leases asset which has been flat since fiscal 2017 and even declined in recent years, GM Financial receivables assets have been steadily increasing over the years. The growth in this asset class is a good sign as it also means that GM’s total sales will also benefit from the increase in interest income.

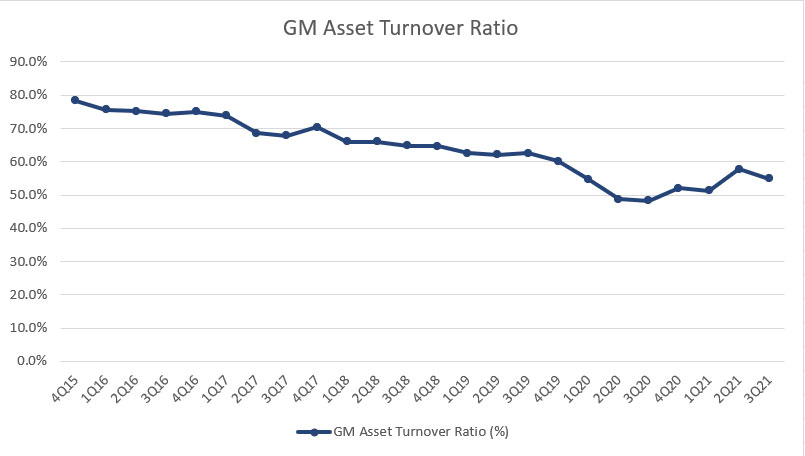

GM’s Asset Turnover Ratio

GM asset turnover ratio

With all the assets accumulated in GM’s balance sheet, how do we know whether the company is using these assets efficiently?

One way to find out is to analyze the company’s asset turnover ratio which is shown in the above chart for the period from fiscal 2015 to 2021.

The asset turnover ratio measures the asset usage of a company and it is derived by dividing the TTM revenue by total assets. The formula of asset turnover ratio is shown below:

Asset turnover ratio = ( TTM revenue / total assets ) X 100%

As the above formula shows, the asset turnover ratio measures the TTM revenue generated with respect to total assets. Indirectly, the ratio tells us how efficiently the executives are managing the company’s assets so that these assets can generate a certain amount of return in the form of revenue or sales.

Looking at the chart above, GM’s asset turnover ratio has been on a decline since fiscal 2015.

Back in 2015, GM recorded an asset turnover ratio of as much as 80%.

Since then, the ratio has been slipping and bottomed out in fiscal 2020 at about 50%.

Thereafter, GM’s asset turnover ratio rises, reaching 55% in fiscal 3Q 2021, a new high since fiscal 2020.

However, on a long-term basis, GM’s asset turnover ratio has been on a decline despite significantly recovering in fiscal 2021.

At this ratio, GM earned about $0.55 dollar of revenue on $1.00 dollar of assets.

From a comparison perspective, GM’s asset turnover ratio was slightly below that of Tesla, which recorded an asset turnover ratio above 70% as seen in this article – Tesla’s asset turnover ratio.

Therefore, Tesla is much more efficient when it comes to asset usage.

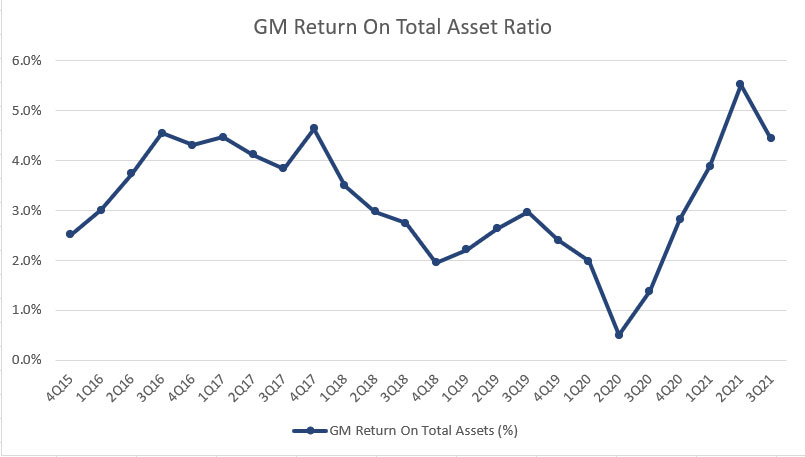

GM’s Return On Assets Ratio

GM return on asset ratio

Another ratio that measures asset efficiency is the return on asset ratio.

The formula of return on asset ratio is shown below:

Return on asset ratio = ( TTM operating profit / total assets ) X 100%

As seen in the chart above, GM’s return on asset ratio totaled only 3% on average and has been on a decline since fiscal 2015.

The ratio has seemingly bottomed out in fiscal 2020 at 0.5%.

Thereafter, GM’s return on assets has been rising and reached as much as 5.5% in 2Q 2021.

In the following quarter, GM’s return on assets declined slightly to 4.5% but was still significantly up from fiscal 2020.

From a comparison perspective, GM’s return on assets was only half of what Tesla reported in fiscal 3Q 2021.

As of fiscal Q3 2021, Tesla’s TTM operating profit came in at $4.5 billion while total assets were $58 billion in the same quarter, thereby giving a return on asset ratio of nearly 8%.

Conclusion

To recap, General Motors’ total assets have been growing, albert at a rather slow rate.

Most of GM’s assets have grown in the last 6 years except for current assets, and some portions of long-term assets such as the equipment on operating leases.

Therefore, most of GM’s assets have been on a rise, including the long-term portions especially the property and GM Financial receivables.

The rise of certain assets such as the property and GM Financial receivables is a good sign that the company is growing.

In terms of asset efficiency, GM is considerably below that of Tesla as reflected in the lower asset turnover ratio and return on asset ratio.

References and Credits

1. All financial figures in this article were obtained and referenced from GM’s financial statements which are available in GM Annual and Quarterly Results.

2. Featured images were used under Creative Common Licenses and obtained from Automotive Rhythms and EX22218 – ON/OFF

Other Statistics That May Help

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future. Thank you!