Apple Inc (AAPL) has only started to pay dividend in 2012 and have thus become a dividend paying company in less than 3 years. Since the stock has a short history of dividend payout, it may or may not make a good investment for income-seeking investor. Nevertheless, some income investors maybe interested in Apple stock due to the stability and market capitalization of the company.

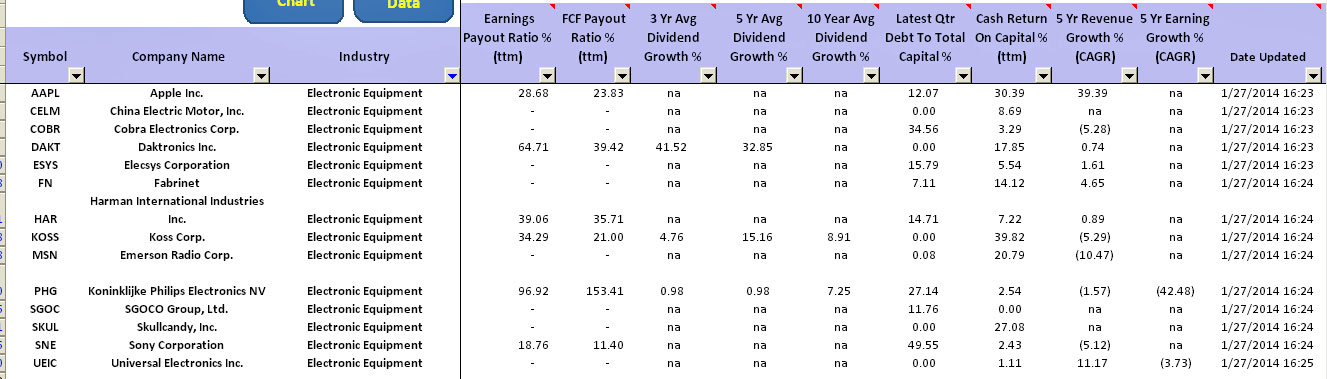

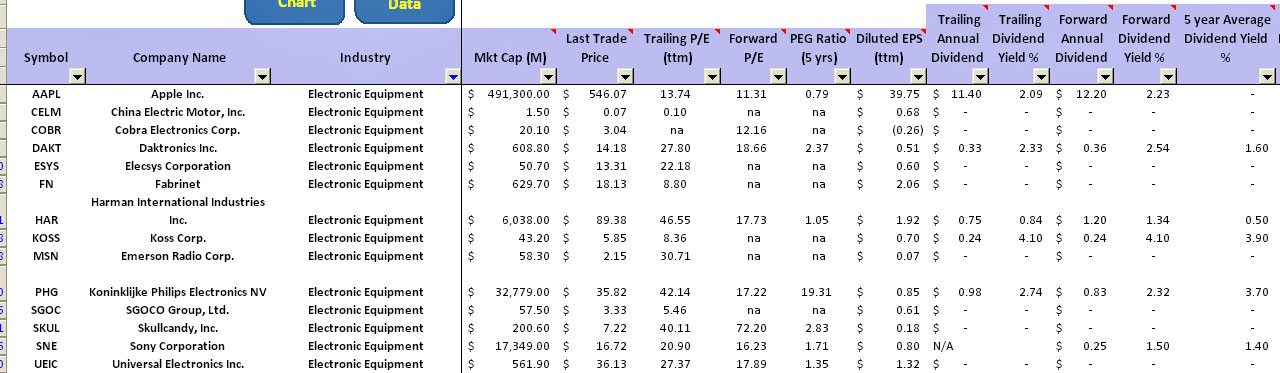

Let’s take a look at the screening result with the Stock Dividend Screener spreadsheet of AAPL stock.

Apple stock falls under the “Consumer Goods” sector and the “Electronic Equipment” industry. The company is within the same industry as companies such as Philips Electronics and Sony Corporation.

Under the “Electronic Equipment” industry, Apple Inc has a market cap of $491 billion and is no doubt the biggest in its industry. But interestingly, in terms of valuation, AAPL has one of the lowest trailing and forward PE of 13.7 and 11.3 respectively.

In terms of yield, the current trailing and forward dividend yield for AAPL comes to about 2.1% and 2.2% respectively. It’s not bad of a yield for a company that has only started to pay dividend in less than 3 years.

To find out how the dividend performs with respect to earnings and free cash flow, we look at the columns earnings and free cash flow payout ratio in the spreadsheet. The figures within these columns show that AAPL is currently having 29% and 24% of dividend to earning and free cash flow respectively in its latest quarter financial results.

As a result, AAPL should have plenty of rooms to increase its dividend payout in the future in view of its low earnings and free cash flow payout ratio. As long as the business aspect of the company remains intact in future and the free cash flow generation doesn’t decline, I believe AAPL should be able to keep and increase the dividend payout.

Even if sales went flat in future, AAPL is able to at least maintain the same payout ratio in view of its strong balance sheet. In terms of long and short-term debt, the company has very little debt based on the figure in column “Latest Qtr Debt to Total Capital %”. Based on its latest quarterly financial statement, only 12% of the total capital is debt while the rest makes up of asset.

Besides, the company can be considered a cash cow in view of its high rate of free cash flow return on capital. AAPL managed to achieve a 30% return rate of free cash flow (See the above tables). What this means is that for every dollar Apple has as capital, it manages to create $0.30 free cash flow.

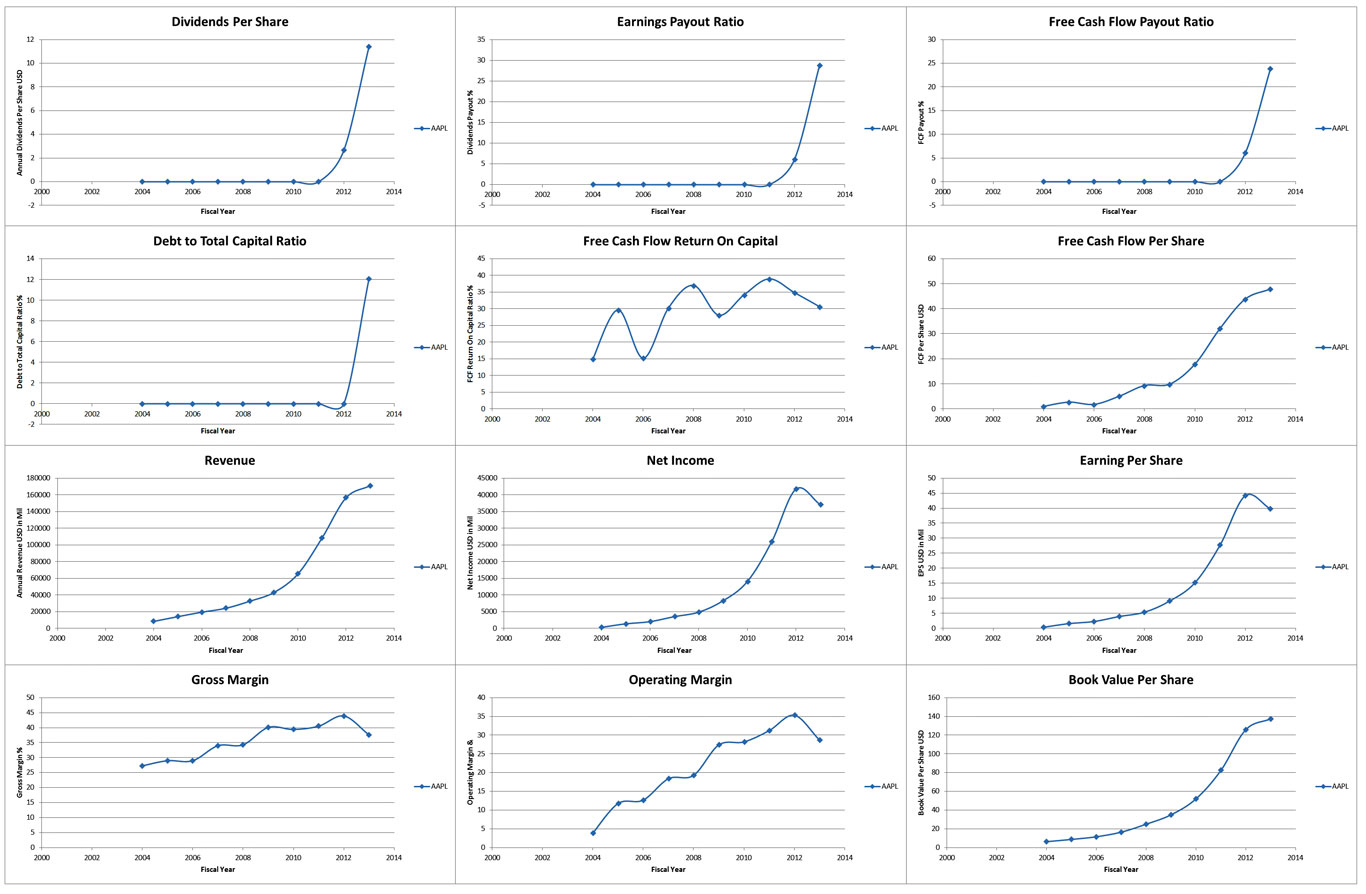

Also revenue growth for AAPL is at an incredible rate of 40% per year for the past 5 years. We can dig out more about the past performance of the stock by looking at the 10-years plot shown in the snapshot below.

What we are interested here are the plots of free cash flow return on capital and free cash flow per share. Over the pas 10 years period, AAPL has managed to generate free cash flow return at double-digit figure and the free cash flow per share is rising at an estimated double-digit rate. Apple Inc is truly a cash cow!

On the other hand, what worries me by looking at some of these plots is that we can see the growth for revenue, net income and earnings per share losing steam and margins are dropping. The question often being asked here is that can Apple maintain the same growth rate in future. The answer is that it may or may not be.

The growth of Apple will depend on a couple of factors. One of the most important factors would be the new product launch. If Apple is able to pull it off and launch a product which can be as successful as the ipod and iphone, the stock will become not only a growth stock but also one that pays out dividend.

Nevertheless, even if Apple is having a flat growth rate, I believe the company will not cut its dividend. In fact, it may even increase the payout to reward shareholders judging from its strong free cash flow generation.

In the end, AAPL may end up becoming a boring dividend paying stock just like Intel and Microsoft.