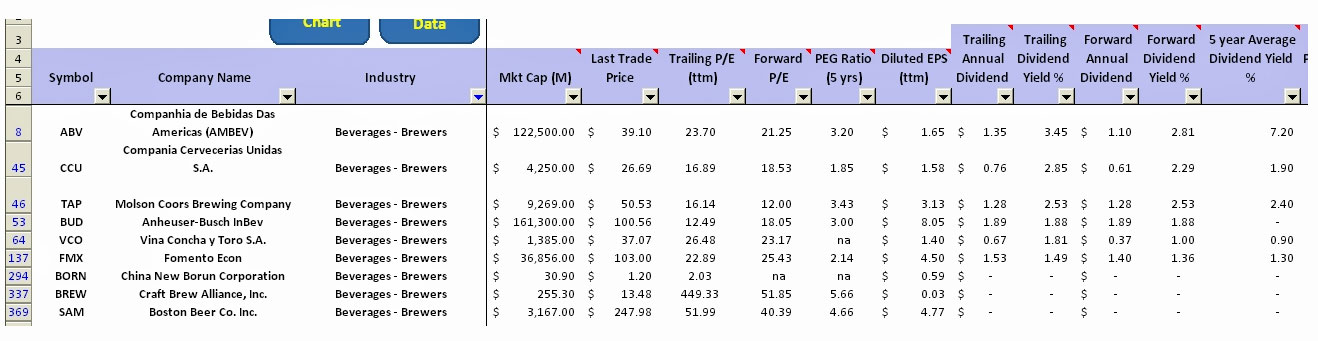

Within the “Consumer Goods” sector, there are some excellent dividend-paying companies. For example, a quick screen using the Stock Dividend Screener spreadsheet in the “Beverage Brewers” industry helps me uncovering some really good dividend paying stocks. One such excellent stock would be the Companhia de Bebidas Das Americas or ABV. ABV is offering the highest yield among the peers within the “Beverage Brewers” industry with a trailing and forward dividend yield of 3.45% and 2.81% respectively. In addition, the past 5 year average dividend yield of 7.2% makes ABV among the highest in the “Beverage Brewers” industry.

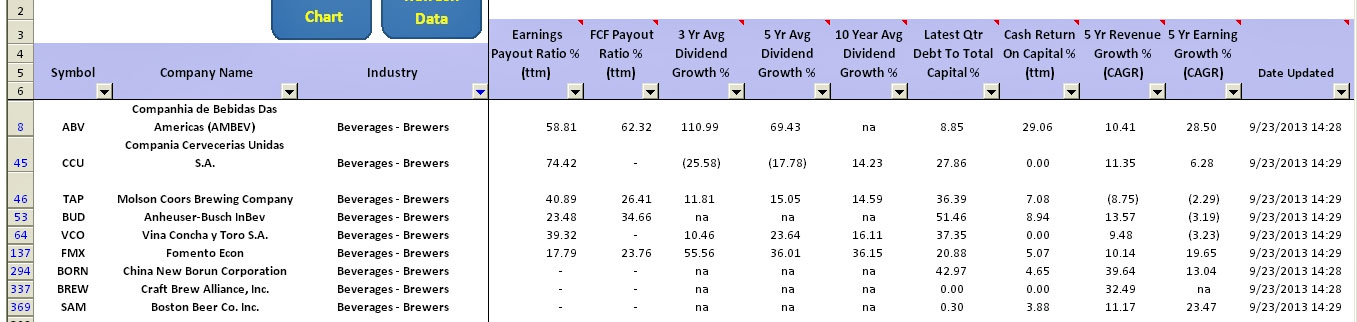

The above tables show the screening result for ABV which was done on September 23, 2013.

To find out if the company Companhia de Bebidas Das Americas can sustain the dividend payment or not, we look at a couple of important metrics for this stock in the spreadsheet. The first thing we look at would be the dividend payout ratio in terms of earnings and free cash flow. Based on the latest quarter financial statements, the earnings and free cash flow payout ratio looks quite healthy at 59% and 62% respectively. A payout ratio in the range of 60% for both of these metrics should offer plenty of room for the company to continue paying out part of the earnings and free cash flow as dividends to shareholders.

Besides, we need to look at the short and long term debt the company is having as of the latest quarter. The metric “Debt to Total Capital %” will give us clues about the level of short and long term leverage the company is having. From the table above, the debt to capital ratio for ABV is currently at 8.85%, which is among the lowest in the industry. You can see that some of the peers of ABV are having as high as 40% to 50% of debt to total capital.

High leverage means high interest rate payment and this payment will eat into the earnings and free cash flow generated from the business and thereby affecting dividend payment. Low debt definitely bodes well for dividend paying company like Companhia de Bebidas Das Americas. Shareholders will have better sleep at night knowing that the company will be able to continue churning out dividend payment for the long haul. Since the company isn’t having huge commitment in making interest payment for the loan, there will be plenty of free cash flow left as cash dividend for shareholders.

In addition, the free cash flow return to total capital of 29% for ABV is the highest in the industry. It means that for every $1 as capital, ABV is able to churn out as much as $0.30 as free cash flow. This shows that ABV is definitely a cash cow. Since dividends come from cash, this fact definitely bodes well for Companhia de Bebidas Das Americas shareholders.

In terms of dividend growth for the past 3 and 5 years, the company Companhia de Bebidas Das Americas offers the highest growth rate among the peers. A look at the table shows that the stock is offering an average annual dividend growth rate of 111% and 69% respectively. Coupled with the double-digit growth rate for annual revenue and earnings (shown in the tables above), Companhia de Bebidas Das Americas is definitely worth further investigation as a potential investment target.

As of September 23rd, 2013, the price of ABV seems fairly valued. At trailing PE of 24 and forward PE of 21, the valuation of ABV is on the high side in the “Beverages-Brewers” industry.