Whirlpool Corporation (WHR) is no doubt a solid dividend stock and the company has been paying dividend continuously for at least the past 10 years. Income investor may be interested in this stock due to the consistency of its dividend payment. We use the Stock Dividend Screener spreadsheet to find out the historical dividend performance and sustainability of the payment in future.

Before we start out, here is a short profile about the business aspect of the company.

Whirlpool Corporation engages in the manufacture and marketing of home appliances worldwide.

The company’s major products include dishwashers, refrigerators and freezers, mixers, cooking appliances, laundry appliances and other portable household appliances. It also produces hermetic compressors for refrigeration systems. The company markets and distributes its products under various brand names. The famous one includes Whirlpool, Maytag and KitchenAid.

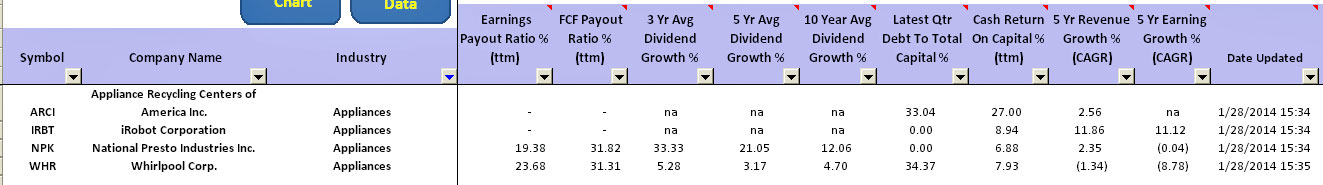

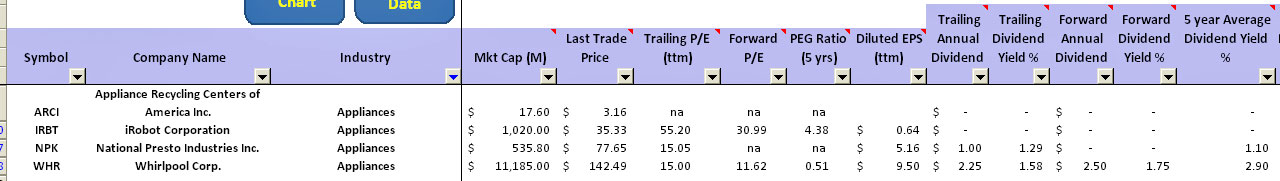

To see how the stock performs in terms of dividend payout compared to its peers, we use the Stock Dividend Screener spreadsheet to do the analysis. WHR falls under the “Consumer Goods’ sector and it’s the biggest company ($11 billion market cap) within the “Appliance” industry. There are only a couple of companies within the appliance industry and only two of them are paying dividends.

The trailing and forward dividend yield of WHR as of the screening was done on Jan 28th, 2014 is at 1.58% and 1.75% respectively. The five year average dividend yield of the stock is 2.9%.

Both the trailing and forward dividend yield of less than 2% is nothing to shout about. The good thing about the company is that both the dividend to earning and dividend to free cash flow ratio of 24% and 31% respectively are considerably low.

A low payout ratio leaves plenty of room for the company to increase its dividend in future. In WHR case, WHR shouldn’t have problem paying out dividend and at the same time increasing the payout subsequently, provided its business prospect is intact and the free cash flow generation isn’t hindered due to various reasons.

Even if sales were flat, I believe WHR will still be able to provide the dividend payment to shareholders. In addition, Whirlpool doesn’t have loads of long and short-term debt which requires interest payment that would take a big bite out of WHR free cash flow.

From the column “Latest Qtr Debt to Total Capital %”, the figure of 34%shows that of the total capital, only 34% of it consists of long and short term debt. The rest can be cash, stock holder equity, long and short term investment, etc.

Judging from the historic dividend growth rate of WHR, the stock has been in the low single digit figure for the past 10 years when it comes to increasing its dividend. The 3 year, 5 year and 10 year average dividend growth rate of roughly 5% doesn’t make this stock a screaming buy for income investors.

The good thing about WHR is that the company has been paying dividend continuously for at least the past 10 years. Although past result cannot guarantee future performance, we can be pretty sure that WHR will continue to pay dividend.

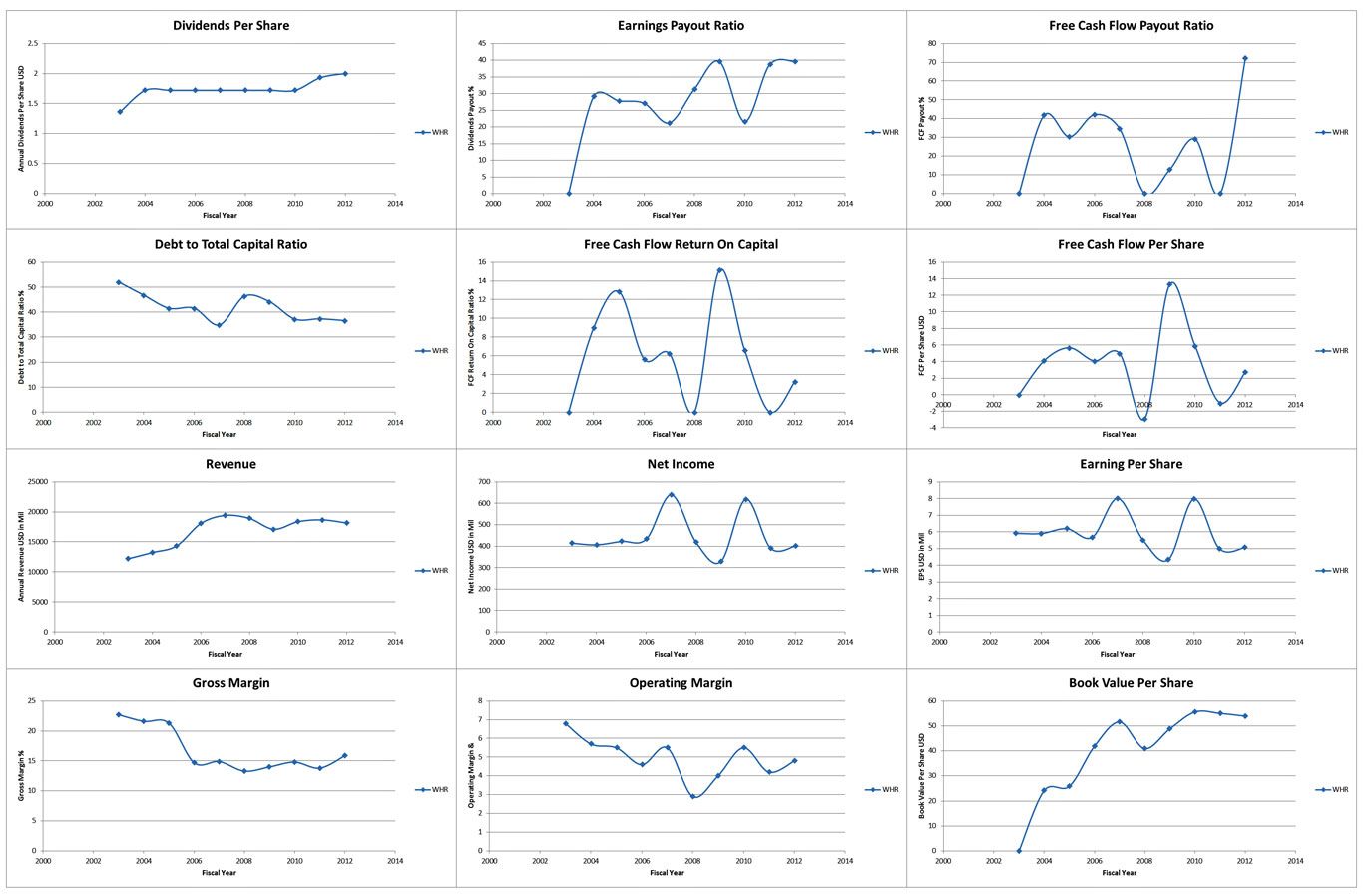

To find out the past 10 years performance of the stock, we bring up the 10 years plot of WHR in the Stock Dividend Screener spreadsheet.

The dividend plot of 10 years shows that the dividend growth is pretty flat, which is in line with the figure shown in above tables. Besides, the earnings payout ratio plot shows that WHR is pretty consistent in paying out dividend with respect to earnings. We can see that the ratio doesn’t change dramatically except for the free cash flow payout ratio whereby I found that WHR is pretty weak in generating free cash flow.

The plot of “Free Cash Flow Return on Total Capital” shows that the return rate of free cash flow is averaged at about 6 to 7%, which is quite weak. Sometimes the rate falls to zero in some years. As a result, you can see there are dramatic changes in the plots of free cash flow payout ratio and free cash flow per share.

In conclusion, Whirlpool is no doubt a solid dividend paying company. As of now, income-seeking investors can be sure that the company will continue the dividends payout judging from its historic continuous dividend payment of more than 10 years. On the other hand, we are seeing weakness in free cash flow generation for this company. Unless the company can improve its free cash flow creation, there will not be dramatic increment in its dividend growth.