Cash matters when it comes to dividend investing because dividends come from cash and it doesn’t come from earnings. Cash flow plays a big part in terms of the cash dividends that are paid to investors. Without cash, even with earnings, the companies may not be able to make the dividend payments.

In fact, you will find that there are a lot of cash strapped companies resorting to assets selling or taking on more debt or digging into cash reserve in order to make the dividends payment. Under these circumstances, the dividend payments that come from these stocks are not going to sustain in the long term.

With that being said, I am not saying that earnings are not important at all. In fact, the income statement does play an important part when it comes to scrutinizing whether a company is making profits or not. But under Generally Accepted Accounting Principles (GAAP), most of the entries in the income statement have nothing to do with the operations of the company. As a result, I generally avoided most earnings related metrics such as earnings payout ratio, EBITDA, etc. Instead I focus on cash based metrics such as free cash flow, free cash flow per diluted shares, dividend to free cash flow payout ratio and cash return on total capital when it comes to screening for solid dividend paying stocks.

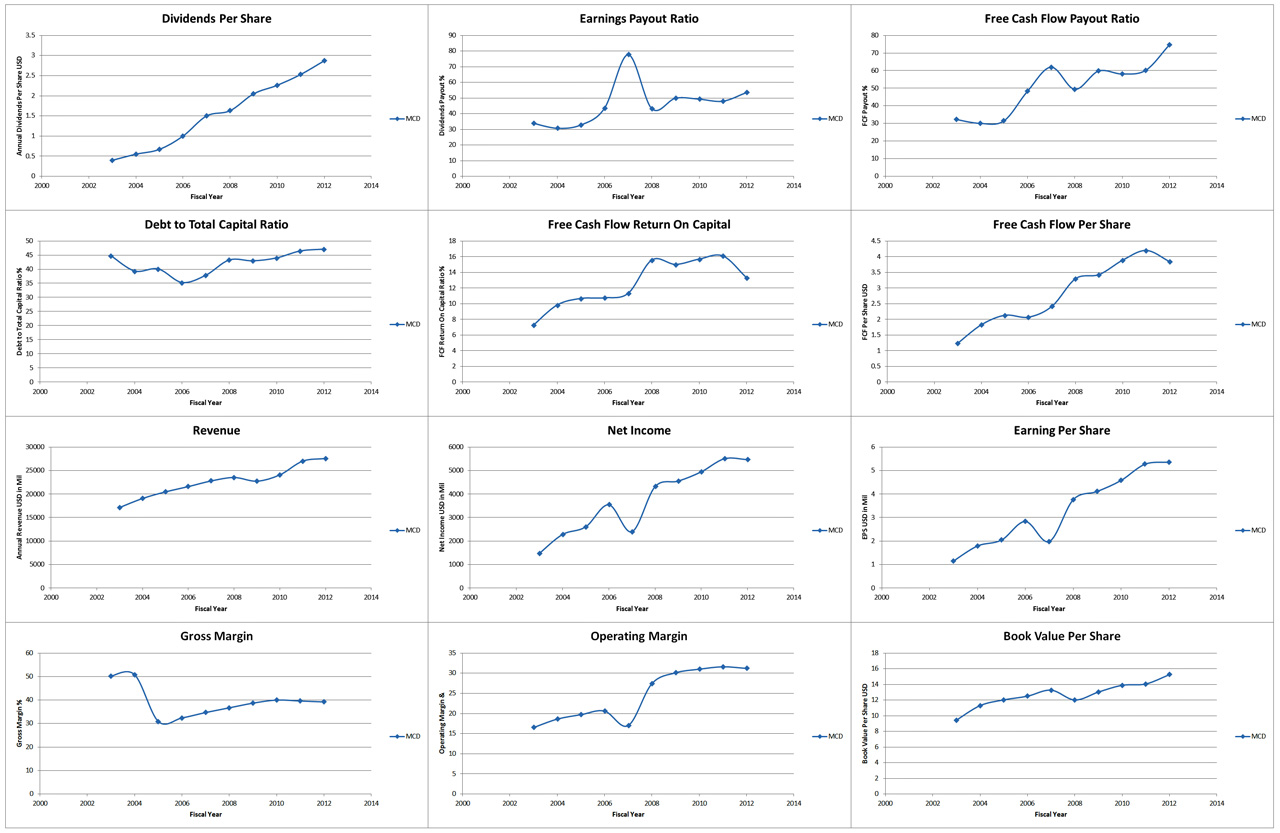

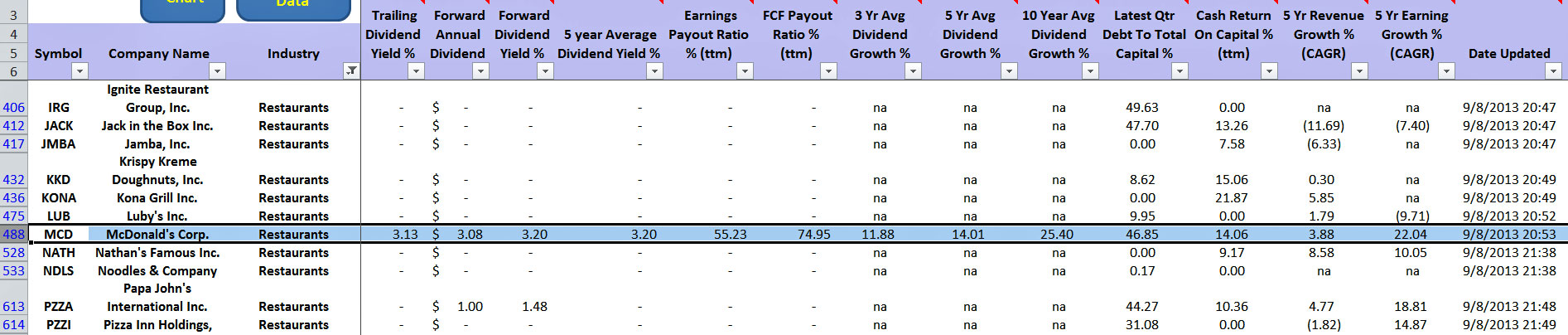

If you look at some of the dividend aristocrats and you analyze their financial based on the above-mentioned metrics, you will find some very impressive results. For example, McDonald Corporation has generated a free cash flow return on capital of 14% for the past 12 months and the rate is consistently above 10% for the past 10 years. It’s definitely a cash machine. It’s for this reason that McDonald Corporation is able to make that sweet dividend payment continuously and even increase the payment year over year. The annual rate of dividend growth for the past 5 years is 14% and this number is even more impressive for the 10-year period which stands at 25%!

PS: These data and plots are taken from Stock Dividend Screener spreadsheet.

McDonald Corporation is considered cream of the crops among the dividend paying stocks. If you are serious in dividend investing, you should look for companies that have this kind of cash return and growth rate and this effort can easily be done with the Stock Dividend Screener tool.