Crypto analytics. Pixabay image.

Coinbase Global (NASDAQ: COIN) is a leading cryptocurrency exchange platform that allows users to buy, sell, and store various cryptocurrencies.

Although Coinbase is primarily a service provider, it has invested in cryptocurrencies and accumulated a decent number of crypto assets.

This article provides regular updates on the market value of the crypto assets owned by Coinbase, offering an insightful view of the performance of these assets over time.

For your information, Coinbase holds several categories of crypto assets which serve different purposes. For example, crypto assets held include crypto assets for investment, crypto assets for operations, crypto assets as collaterals, and borrowed crypto assets.

Only the crypto assets held for investment are presented in this article.

Let’s take a look!

Investors interested in Coinbase’s trading volume may find more resources on this page: Coinbase trading volume by crypto assets.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Coinbase Crypto Holdings

O3. Why Does Coinbase Invest In Cryptocurrency?

Crypto Asset Market Value

A1. Market Value Of Crypto Assets Held For Investment

Market Value Of Crypto Assets By Type

B1. Bitcoin, Ethereum, And Other Crypto Assets Held For Investment

B2. Bitcoin, Ethereum, And Other Crypto Assets Held For Investment In Percentage

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Crypto Asset: Any digital asset built using blockchain technology, including cryptocurrencies, stablecoins, and security tokens.

Fair Value: Fair value or market value is the estimated price at which an asset is bought or sold when both the buyer and seller freely agree on a price.

Coinbase Crypto Holdings

Coinbase stated in its annual reports that its crypto investment policy allows it to invest up to 10% of its net income into a diversified portfolio of crypto assets.

Coinbase also said that it does not use customer crypto assets as collateral for any loan, margin, rehypothecation, or other similar activities without their consent, to which Coinbase or its affiliates are a party. In other words, Coinbase will never use customers’ funds or any assets for investment in cryptocurrencies without their consent.

Over time, Coinbase has amassed a sizable amount of crypto assets for different purposes, which include investment, operational, collateral, etc. As of the end of fiscal Q1 2024, Coinbase’s total crypto holdings were valued at roughly US$2 billion – measured at fair market value, according to the 1Q 2024 10-Q report.

Coinbase crypto holdings are categorized into several types: investment, operational, collateral, and borrowed. The investment category comprises the largest portion, valuing at over US$1.5 billion as of the end of fiscal Q1 2024, according to the 1Q 2024 10-Q report.

Within the investment category, Coinbase said that it views its crypto asset investments as long-term holdings and does not plan to engage in regular trading of crypto assets.

On the other hand, Coinbase uses the crypto holdings for operational purposes to fulfill customer transactions and corporate expenses denominated in cryptocurrency.

Coinbase’s crypto assets are measured in two methods: at cost and fair value.

At-cost refers to the actual cost of acquiring the crypto assets at the time of purchase. This is the value that is presented in the balance sheet after accounting for any asset impairment if there is any.

On the other hand, fair value is based on quoted market prices for one unit of each crypto asset reported on its platform at 11:59 pm Coordinated Universal Time (UTC) on the last day of the respective period multiplied by the quantity of each crypto asset held, according to Coinbase.

Why Does Coinbase Invest in Cryptocurrency?

Coinbase invests in cryptocurrency for several strategic reasons. First, it allows them to deepen their expertise and understanding of the market dynamics, which is crucial for their operations and the development of new services. By investing, Coinbase can better anticipate market trends, understand the value proposition of different cryptocurrencies, and innovate in ways that align with where the market is headed.

Additionally, investments in cryptocurrency can serve as a key revenue stream and a way to diversify their income. Given the volatility of the cryptocurrency market, having investments spread across different assets can help stabilize their financial performance and leverage growth opportunities within the market.

Moreover, Coinbase’s investments in cryptocurrency can also be seen as a vote of confidence in the crypto ecosystem. By actively participating in the market, they support the growth and stability of the cryptocurrency space, fostering trust among users and encouraging wider adoption.

Finally, investing in cryptocurrency allows Coinbase to potentially influence the development and governance of certain blockchain projects. This can be strategically important for them to ensure that the ecosystem evolves in a way that is compatible with their business model and the interests of their users.

Through these investments, Coinbase aims to strengthen its position in the cryptocurrency market, enhance its service offerings, and contribute to the overall growth and maturity of the cryptocurrency ecosystem.

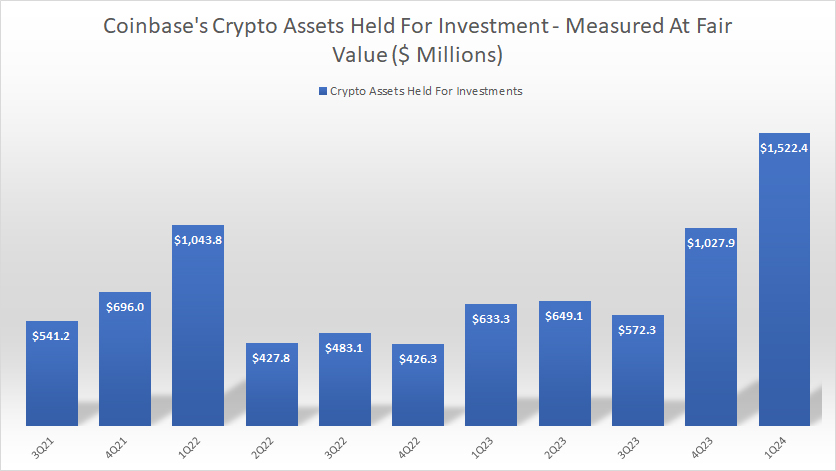

Market Value Of Crypto Assets Held For Investment

Coinbase-crypto-assets-held-for-investment-at-fair-value

(click image to expand)

At fair value or market price, Coinbase’s crypto holdings held for investment were worth US$1.5 billion as of the end of fiscal Q1 2024, more than double the value measured a year ago, according to the company’s 1Q24 10-Q report.

The significant rise in the fair market value of Coinbase’s crypto assets held for investment has been driven primarily by the recent positive market sentiment in the crypto market, leading to higher prices of various cryptocurrencies.

Bitcoin, Ethereum, And Other Crypto Assets Held For Investment

Coinbase-bitcoin-ethereum-and-other-crypto-assets-held-for-investment-at-fair-value

(click image to expand)

Within the crypto assets held for investment, Coinbase’s Bitcoin holdings were among the largest, with a fair market value reaching over US$650 million as of the end of fiscal Q1 2024, according to the company’s 1Q24 10-Q report.

On the other hand, Coinbase’s Ethereum holdings were worth only half of its Bitcoin holdings as of 1Q 2024, totaling US$350 million, according to the same report.

Coinbase’s other crypto assets held for investments were valued at over US$500 million as of 1Q 2024, which was much higher than the value measured a year ago.

All crypto assets held for investment by Coinbase have significantly increased in fair market value over the last several quarters, driven primarily by the rise in prices across all major cryptocurrecies such as Bitcoin and Ethereum.

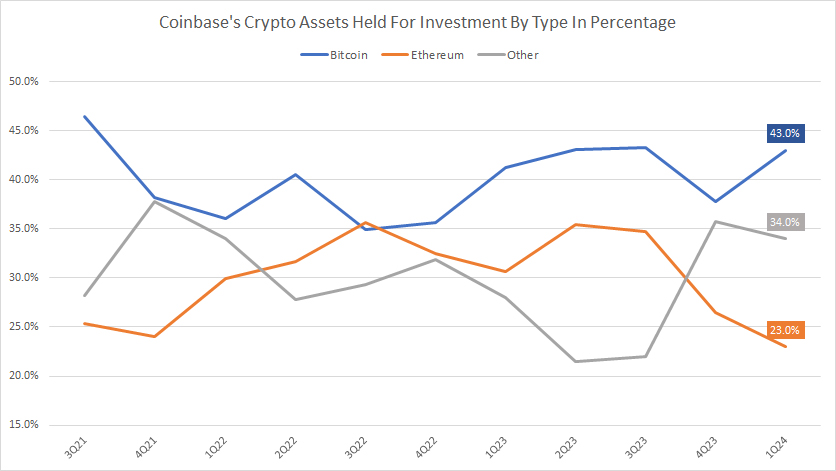

Bitcoin, Ethereum, And Other Crypto Assets Held For Investment In Percentage

Coinbase-bitcoin-ethereum-and-other-crypto-assets-held-for-investment-at-fair-value-in-percentage

(click image to expand)

Coinbase’s Bitcoin holdings held for investment accounted for 43% of its total crypto assets held for investments as of fiscal Q1 2024, while Ethereum made up 23% in the same period.

Other cryptocurrencies comprised 34% of the total market value of Coinbase’s crypto assets held for investment as of fiscal 1Q 2024.

The percentage of all cryptocurrencies within Coinbase’s portfolio has remained relatively stable for all periods shown.

Conclusion

Coinbase held a significant amount of crypto assets for investment, totaling over $1.5 billion at fair market value as of 1Q 2024.

However, the value of the crypto holdings was relatively small compared to Coinbase’s market capitalization of over $50 billion, only 3% of the company’s market valuation as of May 2024.

Despite the relatively small crypto holdings for investment, the values of Coinbase’s crypto assets have significantly grown in recent periods, driven primarily by the rising prices across all major cryptocurrencies.

Credits and References

1. All financial figures presented in this article were obtained and referenced from Coinbase Global, Inc.’s annual and quarterly filings, earnings reports, news releases, shareholder presentations, webcast, etc., which are available in Coinbase Investor Relations.

2. Pixabay images.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link to this article from any website so that more articles like this can be created.

Thank you!