Tesla Motors in Menlo Park. Source: Flickr

Is Tesla making a profit?

This is probably one of the most asked questions about Tesla.

Investors considering buying Tesla’s stocks may want to see profitability before jumping on the bandwagon.

The reason is that a profitable company could pay out a dividend and buy back shares which is less risky.

It’s no exception for Tesla (NASDAQ:TSLA).

If Tesla is profitable and foresees a much better outlook, the company would probably pay a dividend and/or buy back its shares, just like what its peers are doing.

That said, in this article, we will explore Tesla’s profitability from the perspective of several measures.

Table Of Contents

Consolidated Results

A1. Gross Profit

A2. Operating Profit

A3. Pre-Tax Profit

A4. Net Profit

Non-GAAP Results

B1. Adjusted EBITDA

Per Share Results

Per Car Results

D1. Profit Per Car

Per Employee Results

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

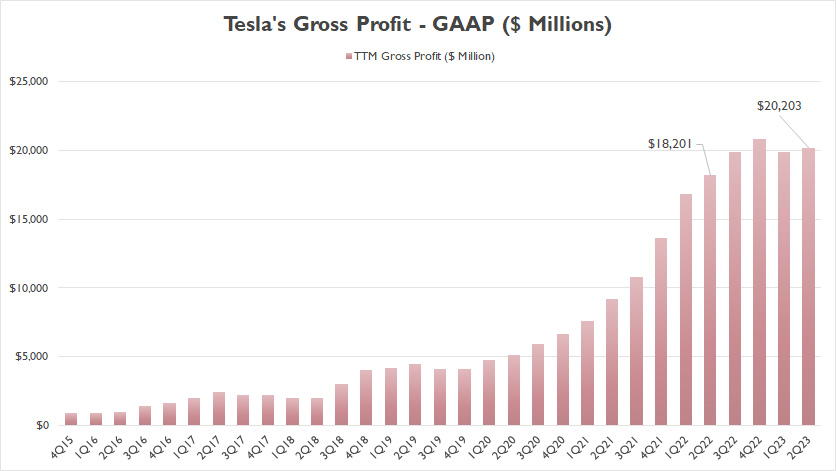

Gross Profit

Tesla gross profit

(click image to expand)

Tesla achieved a gross profit of $20,000 as of 2Q 2023 on a TTM basis, roughly 11% higher than the figure reported in the same quarter a year ago.

Tesla’s growth in gross profit has been phenomenal since fiscal 2020.

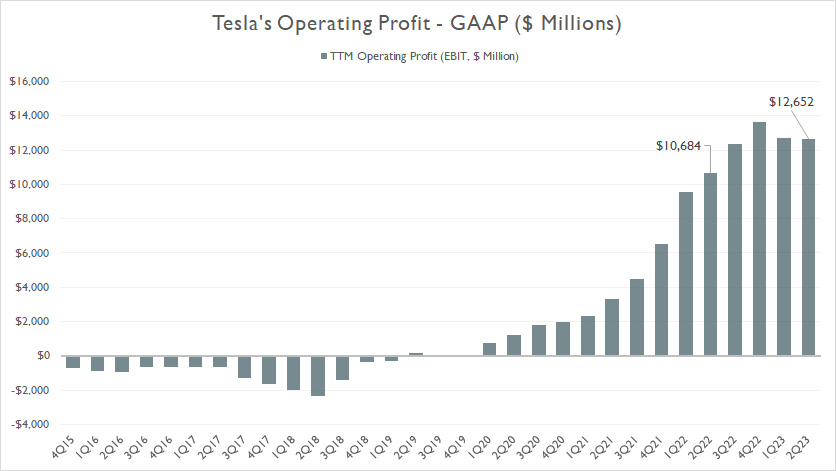

Operating Profit

Tesla operating profit

(click image to expand)

Tesla achieved a similar success in operating profit.

As shown in the chart above, Tesla’s operating profit grew at an even higher growth rate, notably at 20% year-on-year to $12.7 billion as of 2Q 2023 on a TTM basis.

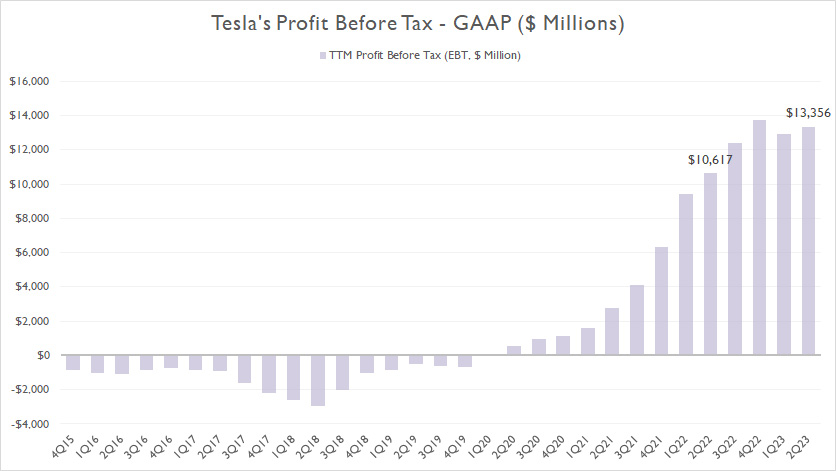

Pre-Tax Profit

Tesla pre-tax profit

(click image to expand)

Tesla’s pre-tax profit surged to $13.4 billion as of 2Q 2023 on a TTM basis, one of the new highs since fiscal 2022.

Year-over-year, Tesla’s 2Q 2023 result represents a growth rate of 26%.

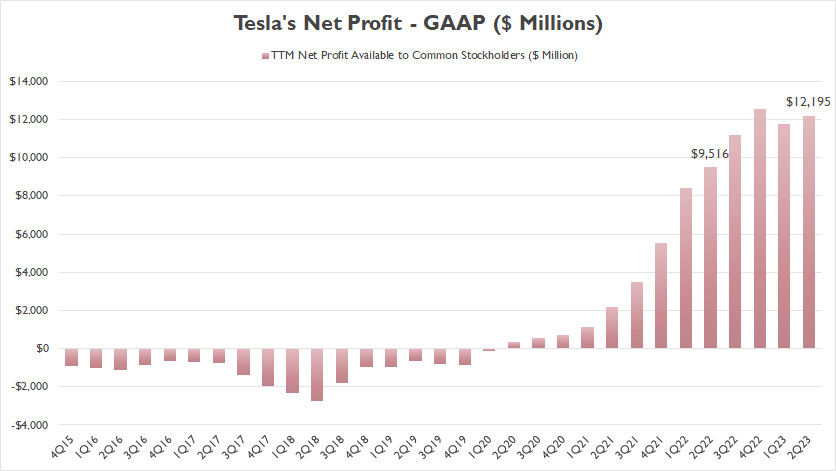

Net Profit

Tesla net profit

(click image to expand)

Tesla produces impressive net profit.

Accordingly, Tesla’s net profit swelled to as much as $12.2 billion as of 2Q 2023 on a TTM basis, up by a massive 28% from the same quarter a year ago.

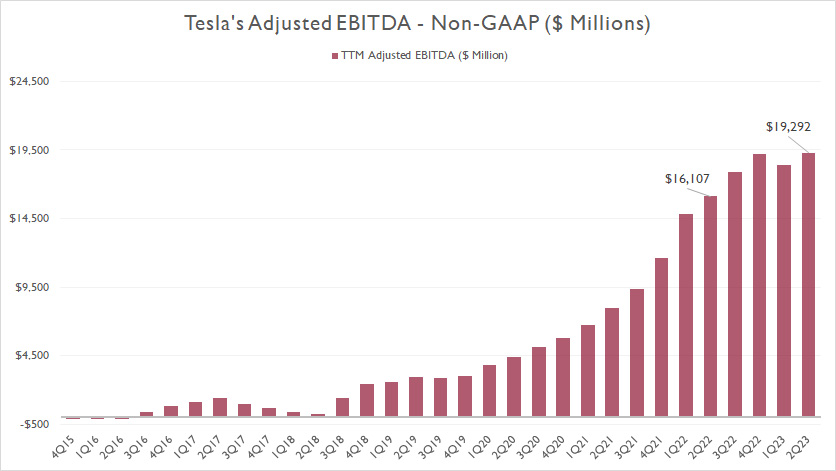

Adjusted EBITDA

Tesla net profit

(click image to expand)

As a non-GAAP measure, the adjusted EBITDA tells an even more compelling result.

As seen in the chart above, Tesla achieved an adjusted EBITDA of nearly the same level as its gross profit as of the latest quarter, illustrating an impressive cash-earnings capability of the company.

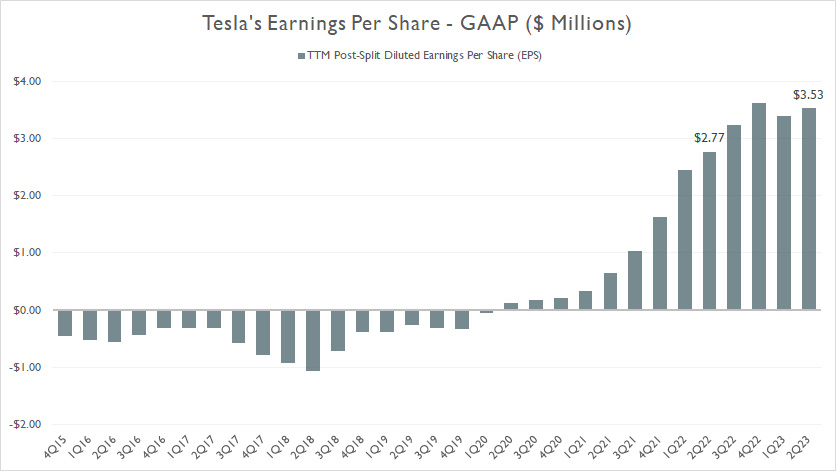

Earnings Per Share

Tesla EPS

(click image to expand)

Tesla’s earnings per share or EPS reached an important milestone of $3.53 as of 2Q 2023 on a TTM basis, a record figure in the last few years.

An even more incredible success is the fact that Tesla has flipped from an unprofitable company to a highly profitable one since fiscal 2020.

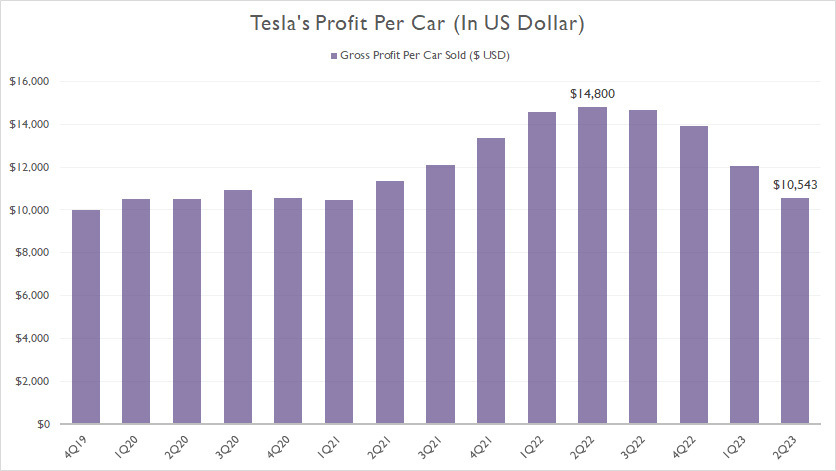

Profit Per Car

tesla-profit-per-car

(click image to expand)

Tesla’s profit per car is illustrated by the gross profit per car presented in the chart above.

This measure is calculated based on only the automotive sales revenue excluding regulatory credit and automotive leasing revenue and involves only vehicles delivered not subject to lease accounting.

That said, Tesla’s profit per car has significantly declined in recent quarters after topping nearly $15,000 in 2022.

As of 2Q 2023, Tesla attained a profit per car of roughly $10,500 on average on a TTM basis.

Despite the decline, Tesla’s profit per vehicle is still pretty impressive by all measures.

An even more impressive achievement is the consistent profit per car numbers since fiscal 2019.

As seen, Tesla’s profit per car has never been lower than $10,000 for all periods shown in the plot.

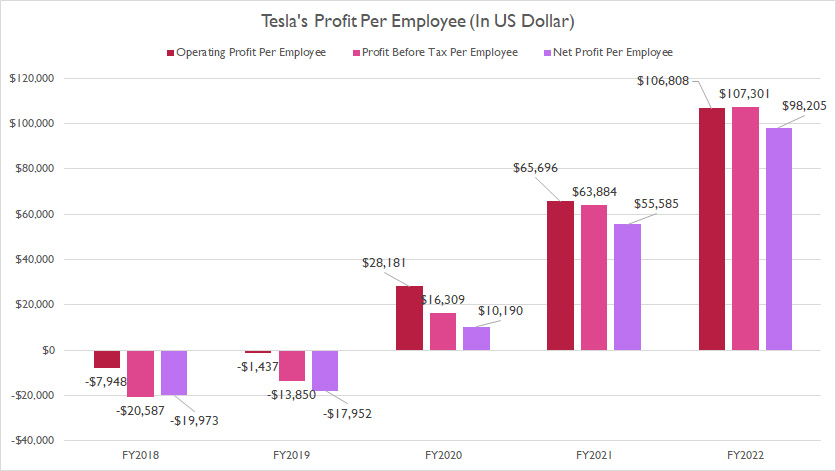

Profit Per Employee

Tesla EPS

(click image to expand)

Tesla’s profit per employee is illustrated by several measures, namely operating profit per employee, pre-tax profit per employee, and net profit per employee.

For your information, Tesla employed approximately 128,000 full-time staff globally as of the end of fiscal 2022.

In fiscal 2022, Tesla’s profit per employee reached more than $100,000, nearly double the number measured in fiscal 2021.

In short, each employee generates roughly $100,000 of profit for Tesla on average.

An interesting fact is that Tesla has only started to become profitable since fiscal 2020.

Summary

Tesla is not only a profitable company but a highly profitable one.

References and Credits

1. All financial figures presented in this article were obtained and referenced from the company’s SEC filings, earnings releases, investors presentations, update letters, quarterly and annual reports, etc., which are available in Tesla Annual and Quarterly Results.

2. Featured images were used under Creative Common Licenses and obtained from Wesley Fryer and Thomas Hawk.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the full correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!

Great write up. Why not also discuss the gains from bitcoin sales and ev-credits? That would help address all the nay-sayers and negative articles claiming that Tesla loses money on every car they sell. thanks!