Bank notes. Pixabay image.

This article presents the operating expenses of Coinbase Global, Inc. (NASDAQ: COIN).

These expenses include various costs, such as employee salaries and benefits, office rent and utilities, marketing and advertising, legal and professional services, technology and software, regulatory compliance, and other general administrative expenses.

Coinbase’s operating expenses consume a significant portion of its revenue and profit. Since 2022, Coinbase’s operating expenses have exceeded its net revenue, leading to losses for the company.

Therefore, understanding Coinbase’s operating expenses can give valuable insights into its financial well-being and long-term viability.

Investors concerned with Coinbase’s debt may find more information on this page: Coinbase debt amount, payment due and credit rating.

Let’s take a look.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Breakdown Of Coinbase Operating Expenses

O3. How Does Coinbase Spend Its Money

Results By Year

B1. Operating Expenses By Year

B2. Growth Rates Of Operating Expenses By Year

B3. Operating Expenses To Net Revenue Ratio

B4. Operating Expenses To Total Revenue Ratio

Results By Quarter

C1. Operating Expenses By Quarter

C2. Operating Expenses By TTM

C3. YoY Growth Rates Of Operating Expenses

Results By Category

D1. Operating Expenses By Type

D2. Growth Rates Of Operating Expenses By Type

Ratio By Category

D3. Operating Expenses By Type To Total Expenses Ratio

D4. Operating Expenses By Type To Net Revenue Ratio

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Total Revenue: Coinbase’s total revenue equals net revenue plus other revenue. Here is the equation for Coinbase’s total revenue:

Total revenue = Net revenue + Other revenue

Net revenue: Coinbase’s net revenue equals transaction revenue plus the subscription and services revenue. Here is the equation for the net revenue:

Net revenue = Transaction revenue + Subscription and services revenue

Coinbase’s transaction revenue is derived from transaction fees applied to spot trades executed by consumer and institutional customers on its trading platforms.

On the other hand, Coinbase’s subscription and services revenue is made up of several categories, including stablecoin revenue, blockchain rewards, interest income, custodial fee revenue, etc.

Investors interested in a comprehensive breakdown of Coinbase’s revenue may find more information on this page: Coinbase revenue breakdown.

Breakdown Of Coinbase Operating Expenses

Most of Coinbase’s operating expenses are from technology and development, general administration, transactions, and sales and marketing.

The following paragraphs explain each component of Coinbase’s operating expenses.

Transaction Expense

Coinbase defines transaction expenses as costs incurred to operate its platform, process crypto asset trades, and perform wallet services.

For example, these costs include account verification fees, miner fees for processing transactions on blockchain networks, fees paid to payment processors, and crypto asset losses due to transaction reversals.

Additionally, transaction fees include rewards paid to Coinbase users for staking activities.

Technology And Development

Coinbase defines expenses related to personnel, infrastructure, and development of its platform, including new products and services and acquired technology, as part of the technology and development costs.

Sales And Marketing

Sales and marketing expenses include costs associated with acquiring and retaining customers, advertising and marketing, and employee-related fees.

General And Administrative

General and administrative expenses refer to the costs incurred to support Coinbase’s business, including personnel-related fees for executive, customer support, compliance, finance, human resources, legal, and other support operations.

These expenses include software subscriptions for support services, facilities, and equipment, depreciation, amortization of acquired customer relationship intangible assets, gains and losses on disposal of fixed assets, legal reserves and settlements, and other general overhead.

How Does Coinbase Spend Its Money

Coinbase is a popular cryptocurrency exchange platform that allows users to buy, sell, and trade various digital currencies. As a cryptocurrency exchange provided, Coinbase generates revenue from various sources, such as transaction fees, exchange fees, and other fees associated with its services.

In terms of spending, Coinbase allocates its resources towards maintaining and expanding its platform, developing new products and services, marketing and advertising campaigns, and hiring and retaining talented employees.

Additionally, Coinbase invests a portion of its revenue into research and development, partnerships, and acquisitions to further improve its offerings and stay competitive in the market.

Overall, Coinbase’s spending focuses on providing a secure, user-friendly, and reliable platform for customers to access and trade cryptocurrencies easily.

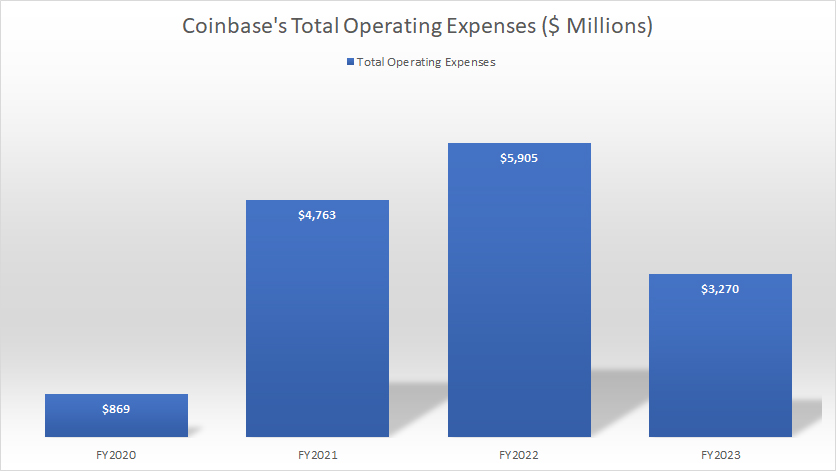

Operating Expenses By Year

Coinbase-operating-expenses-by-year

(click image to expand)

Coinbase’s operating expenses decreased from US$5.9 billion to US$3.3 billion in fiscal year 2023, marking the first drop in four years.

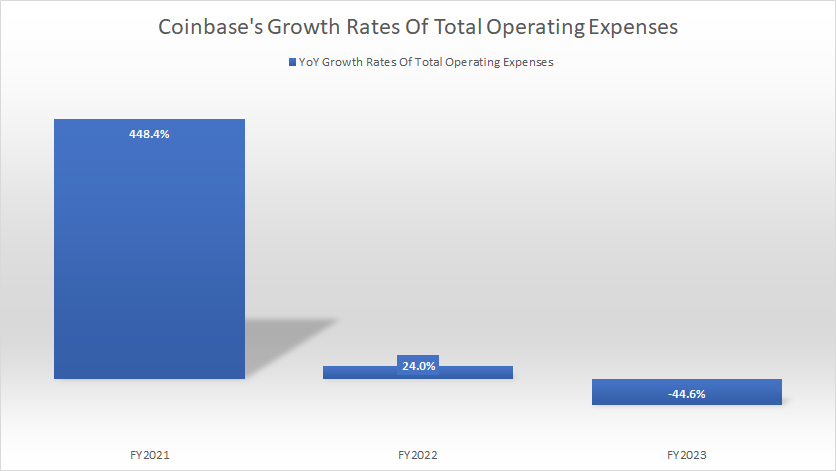

Growth Rates Of Operating Expenses By Year

Coinbase-growth-rates-of-operating-expenses-by-year

(click image to expand)

Coinbase saw a significant increase in its total operating expenses of 448% and 24% in fiscal year 2021 and 2022, respectively. However, in fiscal year 2023, the company managed to reduce its total operating expenses by 45% compared to 2022.

This indicates that the cost-cutting measures taken by Coinbase have effectively slowed down the growth of its total operating expenses in recent years.

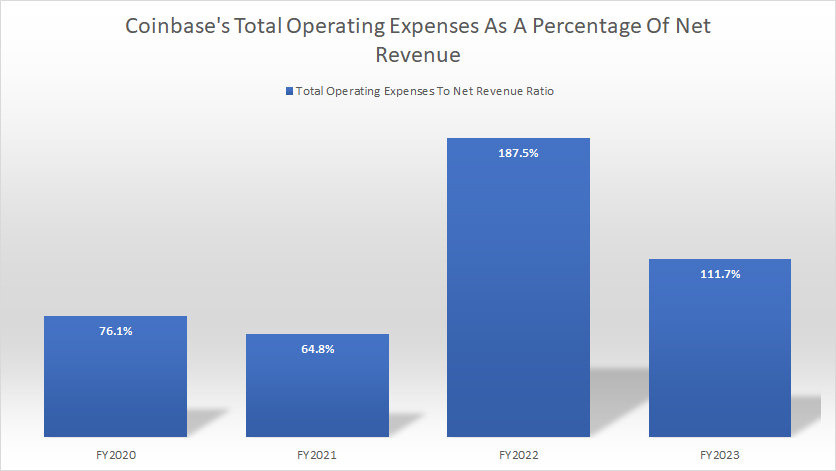

Operating Expenses To Net Revenue Ratio

Coinbase-operating-expenses-by-year-to-net-revenue-ratio

(click image to expand)

The definition of Coinbase’s net revenue is available here: net revenue.

Coinbase experienced a significant increase in operating costs compared to its net revenue in fiscal 2022. The company’s percentage of total operating expenses to net revenue was 187.5%, which means its operating cost was far higher than its net revenue.

However, in fiscal 2023, Coinbase was able to reduce this ratio to 111.7%, indicating a significant decrease in its total operating expenses. While this was an improvement, the total operating expenses still exceeded the net revenue.

For your information, Coinbase incurred an operating loss of up to US$2.7 billion in fiscal 2022. In fiscal 2023, the operating loss reduced to $162 million.

It’s worth noting that before 2022, the ratio of total operating expenses to net revenue was much lower. It was only 64.8% and 76.1% in fiscal 2021 and 2020, respectively, which suggests that the company’s operating expenses were more in line with its net revenue during those years.

Operating Expenses To Total Revenue Ratio

Coinbase-operating-expenses-by-year-to-total-revenue-ratio

(click image to expand)

The definition of Coinbase’s total revenue is available here: total revenue.

With respect to the total revenue, Coinbase’s operating expenses ratio was slightly lower. In fiscal 2023, Coinbase’s operating expenses to total revenue ratio was 105.2%, a significant decrease from 184.9% in 2022.

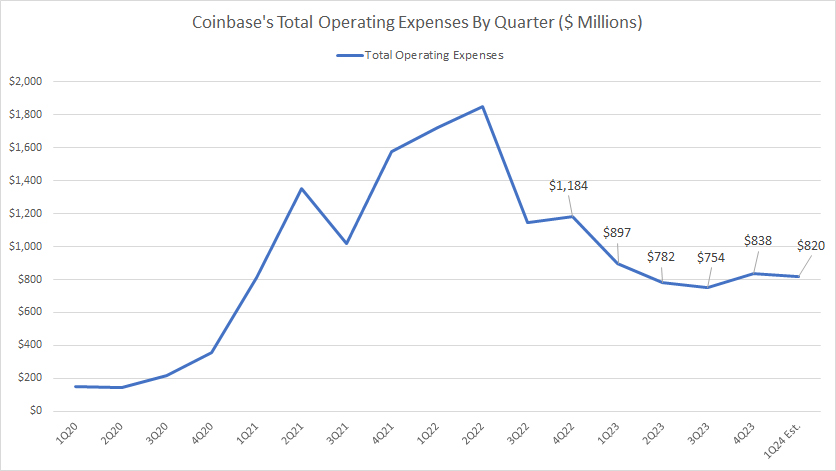

Operating Expenses By Quarter

Coinbase-operating-expenses-by-quarter

(click image to expand)

Coinbase has reported a significant decrease in its quarterly total operating expenses for the last several quarters compared to the periods prior to 2023.

In Q2 2023, Q3 2023, and Q4 2023, Coinbase recorded total operating expenses of $782 million, $754 million, and $838 million, respectively.

According to the guidance provided, Coinbase may spend approximately $820 million in total operating expenses in 1Q 2024.

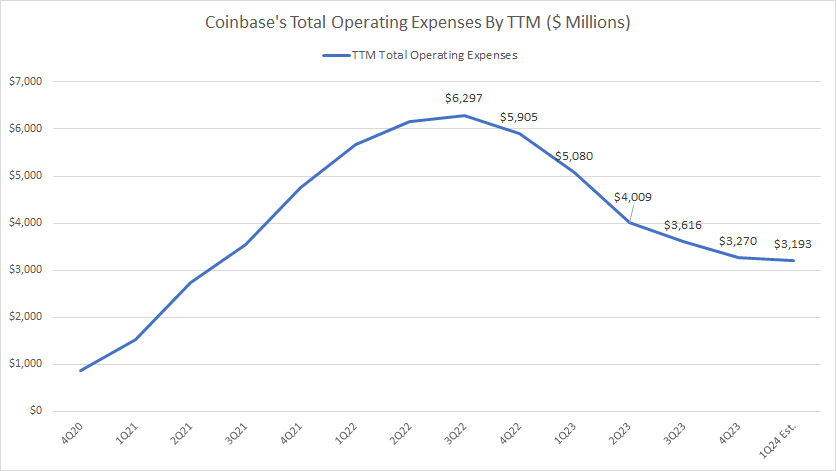

Operating Expenses By TTM

Coinbase-operating-expenses-by-ttm

(click image to expand)

The TTM plot of Coinbase’s total operating expenses shows a smoother trend than the quarterly plot. It is clearly visible that the company’s total operating expenses have been decreasing since 2022.

On a TTM basis, the expenses peaked at over US$6 billion in 3Q22 and have been decreasing since then.

As of 4Q 2023, Coinbase’s TTM operating expenses had reached the lowest level of US$3.3 billion since 2022. The expenses are expected to remain relatively the same in 1Q 2024.

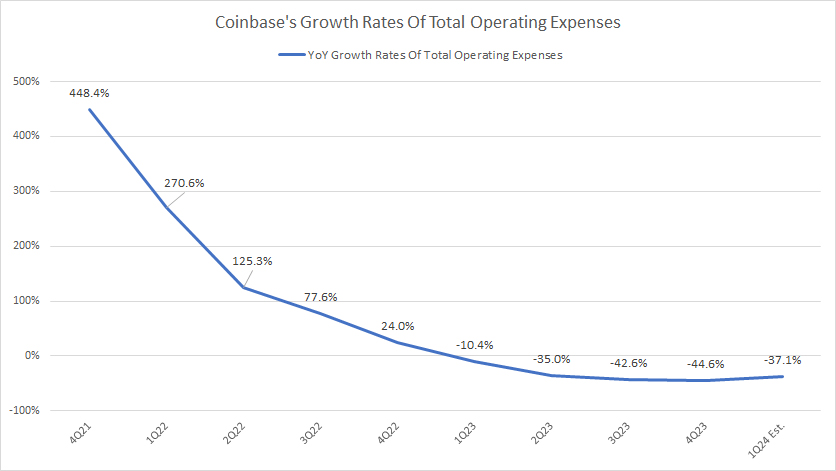

YoY Growth Rates Of Operating Expenses

Coinbase-growth-rates-of-operating-expenses-by-ttm

(click image to expand)

The chart above depicts the decline in Coinbase’s total operating expenses growth.

Starting from the beginning of 2023, the expenses have started to reduce and are estimated to further decrease by 37% in 1Q 2024.

This is due to the company’s aggressive efforts to cut down its expenses, which have significantly reduced total operating expenses.

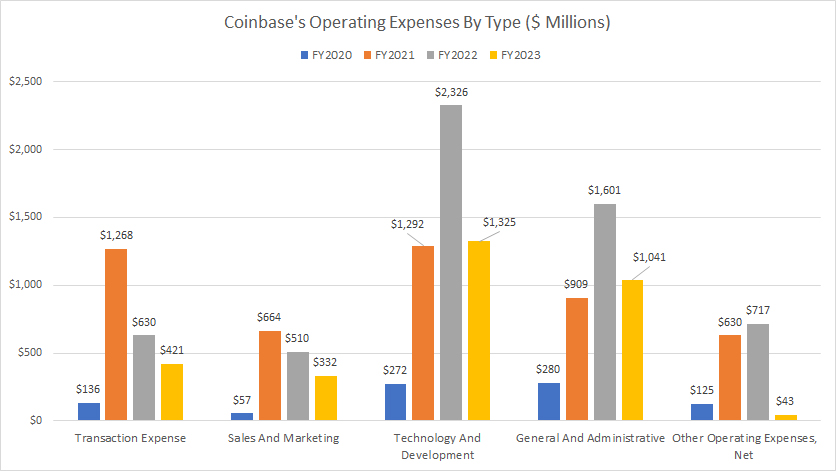

Operating Expenses By Type

Coinbase-operating-expenses-by-type

(click image to expand)

As discussed earlier, Coinbase’s operating expenses are categorized into several types, such as transaction-related, sales and marketing, technology and development, general and administrative, restructuring, and other expenses. The definitions of each expense type are available here: operating expenses breakdown. Coinbase’s restructuring expenses are insignificant and are not presented in the chart above.

That said, Coinbase’s Technology And Development cost accounts for most of the company’s total operating expenses, totaling over $1.3 billion in 2023. However, this figure was reduced by almost half from $2.3 billion in 2022, reflecting the company’s aggressive cost-cutting measures. Coinbase’s Technology And Development spending of $1.3 billion in 2023 is more aligned with the result in 2021.

Coinbase spends substantially on General And Administrative expenses. This expense category has increased considerably from $280 million in fiscal year 2020 to $1.6 billion in 2022 but is significantly reduced in 2023. As seen, Coinbase’s General And Administrative expenses were down 35% in 2023 to $1.0 billion.

Transaction expenses, which include fees paid to miners and validators, were $1.3 billion in 2021, the highest among all categories at that time. However, these expenses decreased significantly in the following years, with $630 million in 2022 and $421 million in 2023. The decrease in transaction expenses may have to do with the decline in the company’s trading volumes.

Lastly, Coinbase spent $664 million on Sales and Marketing in 2021. However, in 2022, this expense decreased to $510 million and further went down to $332 million in 2023. This expense decrease could suggest that the company has reduced its efforts to expand its customer base and increase brand awareness through various marketing channels.

In short, Coinbase’s cost-cutting measures have impacted all categories of its operating expenses.

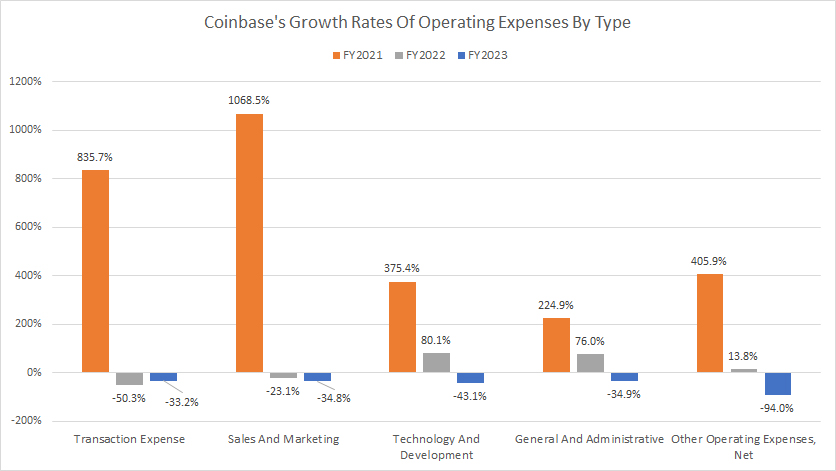

Growth Rates Of Operating Expenses By Type

Coinbase-growth-rates-of-operating-expenses-by-type

(click image to expand)

All categories of Coinbase’s operating expenses have experienced a decrease since 2022. The fiscal year 2023 marks the company’s most intense operating expense cutting, with all categories affected, as shown in the chart above.

As seen, Coinbase’s Technology And Development expenses were cut by 43% in 2023, while General And Administrative expenses were down 34.9% year-over-year.

Transaction and Sales And Marketing expenses have decreased consecutively for two years starting in 2022.

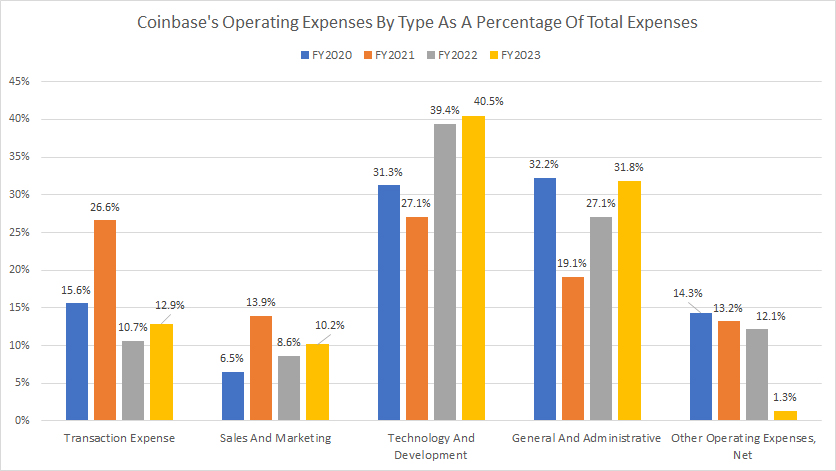

Operating Expenses By Type As A Percentage Of Total Expenses

Coinbase-operating-expenses-by-type-to-total-expenses-ratio

(click image to expand)

Starting in the fiscal year 2020, Coinbase has been investing the majority of its operating expenses in Technology and Development. In 2023, this category of expenses accounted for 40.5% of the company’s total operating expenses, which is slightly higher than 39.4% in 2021 but significantly more than 27.1% in 2020.

Coinbase allocates a substantial amount of resources on General And Administrative. This category of expenses accounted for 31.8% of the total operating expenses in fiscal 2023, up from 27.1% in 2022 and a massive increase from 19.1% in 2021. The latest ratio indicates that the spending on General And Administrative in 2023 is more aligned with the allocation in 2020.

Coinbase’s transaction cost consumed just 12.9% of its total operating expenses in fiscal 2023, slightly higher than 10.7% in 2022 but a significant decrease from 26.6% in 2021. In 2021, Coinbase’s transaction cost ratio was the highest among all expense types. Overall, the allocation of spending for this expense type has come down.

Coinbase spent only 10.2% of its total operating expenses on Sales And Marketing in 2023. This ratio rose slightly from 8.6% in 2022 but was much lower than 13.9% in 2021. Overall, the resource allocation on this particular expense has increased somewhat.

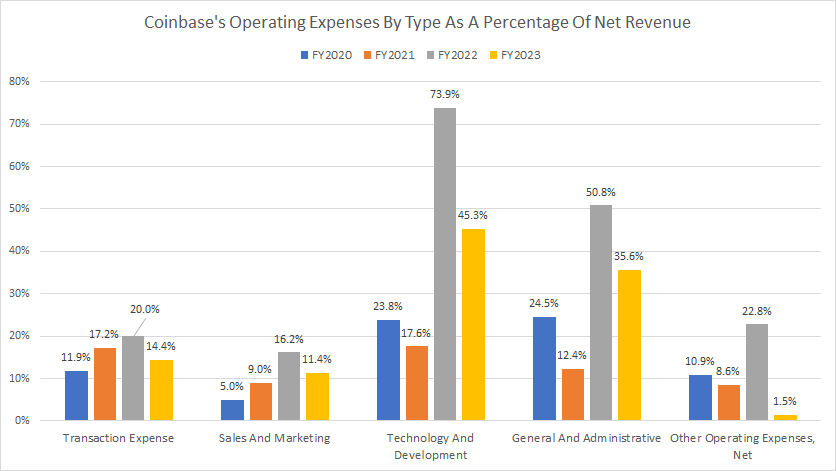

Operating Expenses By Type As A Percentage Of Net Revenue

Coinbase-operating-expenses-by-type-to-net-revenue-ratio

(click image to expand)

Coinbase’s Technology And Development expenses consume the largest portion of its net revenue, totaling 73.9% and 45.3% in fiscal years 2022 and 2023, respectively. The definition of Coinbase’s net revenue is available here: net revenue.

Followed by Technology And Development are the General and Administrative expenses, which amounted to 50.8% and 35.6% in 2022 and 2023, respectively. These ratios represent a significant rise over the 12.4% in 2021.

Coinbase’s Transaction and Sales And Marketing expenses accounted for 14.4% and 11.4% of its net revenue in 2023, down considerably from the ratios in 2022.

Despite the considerable decrease in the ratio of the Technology And Development expense category, it still consumes the highest portion of the net revenue compared to other expense types.

Conclusion

Coinbase, a cryptocurrency exchange company, has seen its operating expenses rise significantly in recent years.

However, the expense growth rates have considerably slowed since the fiscal year 2022, suggesting the company’s austerity measures to reduce expenses to produce a profit.

For your information, Coinbase has incurred operating losses since fiscal year 2022, amounting to billions of dollars.

Coinbase’s cost-cutting measures have impacted all expense types, particularly the Technology and development category, whose spending was reduced by $1 billion in 2023 from 2022.

Regardless, Coinbase’s Technology and Development expenses to net revenue and total expenses ratios remain the highest among all expense categories, demonstrating its unwavering commitment to innovation and staying ahead of the curve in the fast-paced cryptocurrency industry.

Credits and References

1. All financial figures presented in this article were obtained and referenced from Coinbase Global, Inc.’s annual and quarterly filings, earnings reports, news releases, shareholder presentations, etc., which are available in Coinbase Investor Relations.

2. Pixabay images.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link to this article from any website so that more articles like this can be created.

Thank you!