Cryptocurrency. Pixabay image.

Coinbase Global (NASDAQ: COIN), one of the world’s largest cryptocurrency exchanges, has grown rapidly since its inception in 2012.

With its headquarters in San Francisco, the company has expanded to serve customers in over 100 countries.

As of 2024, Coinbase has over 3,000 employees across its various offices, making it one of the largest employers in the blockchain and cryptocurrency industry.

The company prides itself on its diverse and talented workforce, which primarily includes engineers, designers, marketers, and customer support specialists.

This article provides regular updates on Coinbase’s employee count, offering an insightful view of the impact of employees on the company’s continued success.

Let’s take a look!

Please use the table of contents to navigate this page.

Table Of Contents

Overview

O2. Is Coinbase A Good Company To Work At?

Total Number Of Employees

A1. Employee Count

Growth Of Employees

A2. Employee Growth

Revenue

Profit

C1. Operating Profit Per Employee

C2. Net Profit Per Employee

C3. EBITDA Per Employee

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Adjusted EBITDA: Adjusted EBITDA stands for Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization. It’s a financial metric used by companies to evaluate their operating performance.

This metric adjusts the standard EBITDA figure to exclude non-recurring, irregular, or one-time expenses or incomes to provide a clearer picture of a company’s ongoing operational profitability.

Adjustments may include items like restructuring costs, stock-based compensation, unrealized gains or losses, and other non-cash items.

These adjustments aim to present a more accurate reflection of a company’s core earnings and financial health, facilitating better comparison across periods and with other companies.

Coinbase uses the Adjusted EBITDA to evaluate its ongoing operations and for internal planning and forecasting purposes. It believes that Adjusted EBITDA may be helpful to investors because it provides consistency and comparability with past financial performance.

Is Coinbase A Good Company To Work At?

Assessing whether Coinbase is an excellent company to work for can vary based on individual experiences and what one values in a workplace. However, many employees and reviews highlight several aspects:

1. **Innovation and Growth**: As a leading platform in the cryptocurrency space, Coinbase is at the forefront of blockchain and digital currency innovation. This environment can offer exciting opportunities for professional growth and learning.

2. **Compensation and Benefits**: Coinbase is known for offering competitive salaries and benefits. These may include equity options, comprehensive health benefits, and a focus on work-life balance, which many employees find attractive.

3. **Company Culture**: The company culture is often described as dynamic, with a strong emphasis on inclusion, diversity, and support for personal development. However, as with any rapidly growing company, the work environment can be fast-paced and demanding.

4. **Remote Work Flexibility**: Coinbase has embraced a remote-first approach, offering flexibility in work locations. This arrangement can be a significant advantage for those seeking flexibility in their work environment.

5. **Market Position and Stability**: Working for a company that plays a crucial role in the cryptocurrency market can be exhilarating. However, market volatility means that employees should be prepared for ups and downs in the industry.

Glassdoor, an employee review platform, may provide a more nuanced view of what working at Coinbase is like. Experiences can vary widely depending on one’s role, team, and personal expectations.

Employee Count

Coinbase-total-employees

(click image to expand)

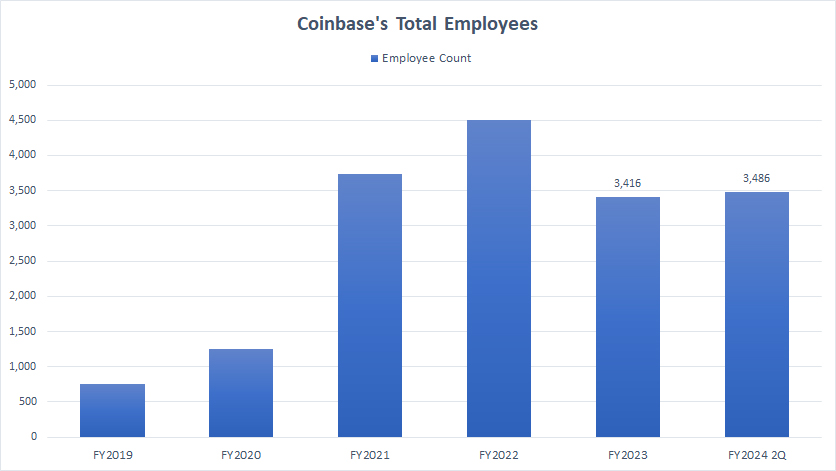

Coinbase’s total employees reached 4,500 by the end of fiscal 2022, the highest number ever recorded, before declining to 3,500 as of 2Q 2024.

Since fiscal 2019, Coinbase’s total number of employees has increased by 500%, reaching its peak at 4,500 by the end of fiscal 2022.

In 1Q 2023, Coinbase announced and completed a restructuring, named “2023 Restructuring”, impacting approximately 21% of the Company’s headcount.

The 2023 Restructuring was intended to manage the Company’s operating expenses in response to the ongoing market conditions impacting the economy and ongoing business prioritization efforts.

As a result, approximately 950 employees in various departments and locations were terminated.

As of 2Q 2024, Coinbase’s employee count declined to 3,500, down 24% over 2022.

Despite the significant decrease in employee count, Coinbase’s total number of employees in fiscal 2Q 2024 was still 172% higher than the figure recorded in 2020.

Employee Growth

Coinbase-employees-yoy-growth-rates

(click image to expand)

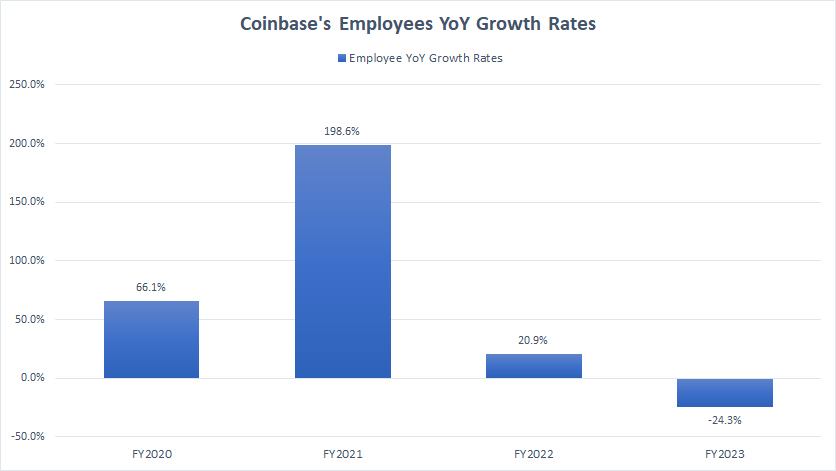

Coinbase’s growth of employees has significantly slowed since fiscal year 2022. In fiscal year 2023, Coinbase registered a decline in total number of employees, down 24.3% year-over-year.

Coinbase registered the most growth in employee count in fiscal year 2022, up by a massive 199%.

Revenue Per Employee

Coinbase-revenue-per-employee

(click image to expand)

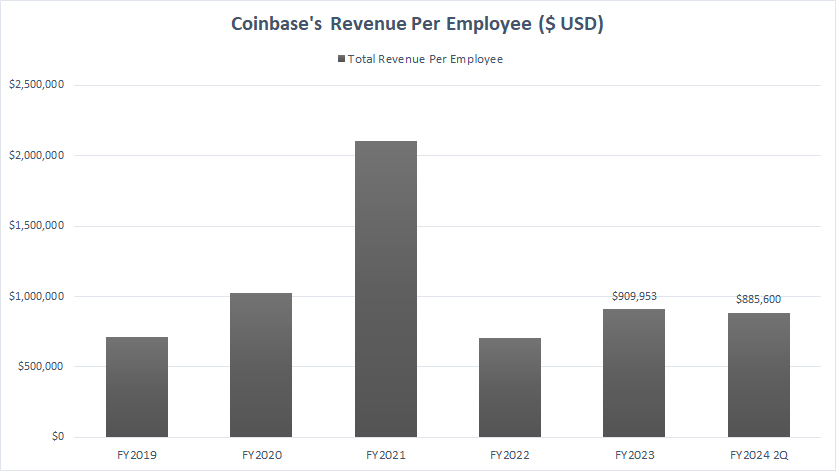

Coinbase earned approximately US$885,600 in revenue per employee in the first two quarters of 2022, one of the lowest figure ever measured since 2019.

In fiscal 2022, Coinbase earned US$708,250 in revenue per employee, down significantly from the US$2.1 million in revenue per employee measured in fiscal 2021.

Despite the significant employee cut in fiscal year 2023, Coinbase’s revenue per employee was still considerably lower than the peak in fiscal year 2021.

Coinbase achieved its peak revenue per employee of US$2.1 million in fiscal 2021.

Operating Profit Per Employee

Coinbase-operating-profit-per-employee

(click image to expand)

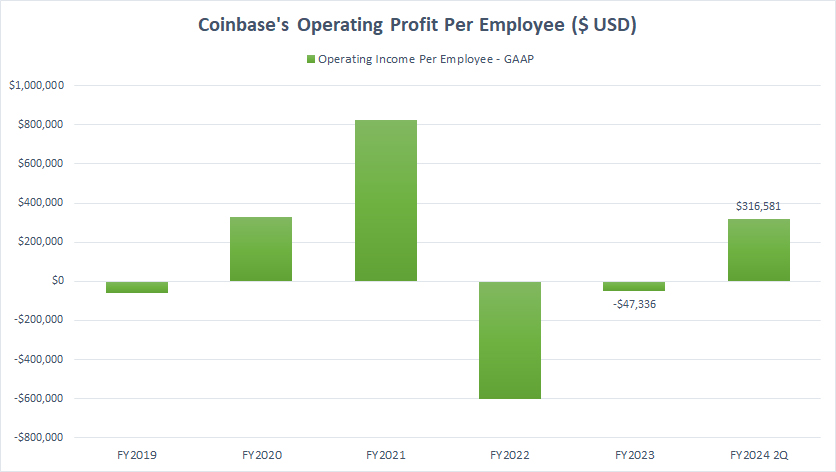

In this section, Coinbase’s profit per employee is measured according to the operating profit, a GAAP measure extracted from the company’s income statement.

As presented in the chart, Coinbase’s operating profit per employee has significantly declined after peaking at over US$800,000 in fiscal 2021, reaching US$316,600 in the first two quarters of 2024.

In fiscal year 2023, Coinbase’s operating loss per employee was much smaller than in 2022, reaching -US$47,000 versus -US$600,000 in 2022.

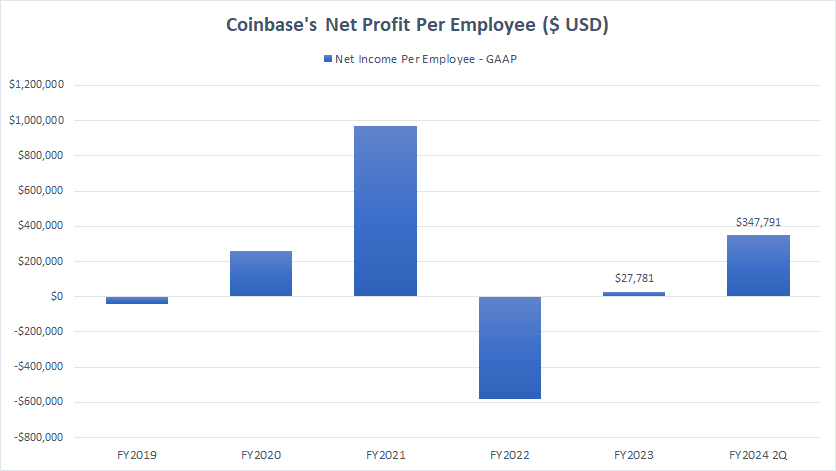

Net Profit Per Employee

Coinbase-net-profit-per-employee

(click image to expand)

In this section, Coinbase’s profit per employee is measured according to the net profit, a GAAP measure extracted from the company’s income statement.

Coinbase’s net profit per employee was approximately US$347,800 as of the first two quarters of 2024.

In fiscal 2023, Coinbase’s net profit per employee totaled US$28,000 versus a net loss per employee of nearly -US$600,000 reported in fiscal 2022.

Coinbase achieved its peak net profit per employee of nearly US$1,000,000 in fiscal year 2021.

The primary concern is that Coinbase’s net loss per employee will get much worse going forward.

Judging from the result as of the first two quarters of 2024, Coinbase’s net profit per employee has significantly recovered, from having a loss to making a profit per employee since 2022.

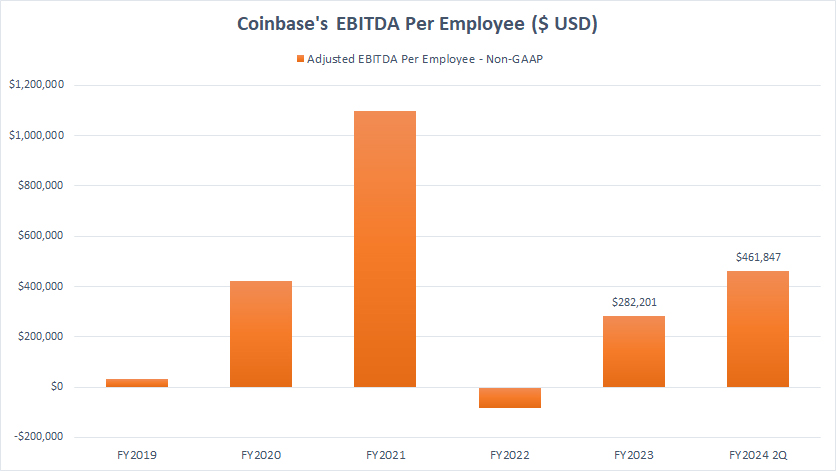

EBITDA Per Employee

Coinbase-ebitda-per-employee

(click image to expand)

The definition of Coinbase’s EBITDA is available here: adjusted EBITDA.

In this section, Coinbase’s profit per employee is measured according to the adjusted EBITDA, a non-GAAP measure extracted from the company’s annual report.

Coinbase’s adjusted EBITDA per employee recovered to US$462,000 as of the first two quarters of 2024, significantly outperforming the EBITDA loss in 2022, which total about -US$50,000.

In fiscal 2023, Coinbase’s EBITDA per employee measured at US$282,000, a significant improvement from the loss incurred in 2022.

Coinbase achieved its peak profit per employee in fiscal year 2021, having an EBITDA per employee of US$1.1 million, a record figure since 2019.

Conclusion

To recap, Coinbase had 4,500 employees as of the end of fiscal 2022. This figure declined to 3,500 as of 2Q 2024.

In 2023, Coinbase reported revenue of US$3.1 billion. This translates to a revenue per employee of approximately US$910,000 in 2023.

Furthermore, Coinbase has been profitable for several years, with a net income of US$3.6 billion in 2021. This translates to a profit per employee of approximately $972,000 in 2021.

However, the company’s profitability per employee took a dive in 2022, down to -US$582,000, the worst figure ever measured since 2019.

As of 2024, Coinbase’s revenue and profit per employee recovered significantly from the slump in 2022, thanks to the company’s ability to attract and retain top talent as well as the recovering crypto market.

Credits and References

1. All financial figures presented in this article were obtained and referenced from Coinbase Global, Inc.’s annual and quarterly filings, earnings reports, news releases, shareholder presentations, etc., which are available in Coinbase Investor Relations.

2. Pixabay images.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link to this article from any website so that more articles like this can be created.

Thank you!