Crypto trading. Pexels image.

This article presents the breakdown of Coinbase Global, Inc. (NASDAQ: COIN)’s subscription and services revenue.

Coinbase’s subscription and services segment primarily focuses on generating revenue beyond traditional transaction fees. There are several revenue streams coming from this segment, including stablecoin revenue, blockchain rewards, custodial fee revenue, among others.

More information about these revenue streams are available here: Coinbase’s subscription and services revenue.

For other key statistics of Coinbase Global, you may find more information on these pages:

- Coinbase revenue by country: U.S. and International,

- Coinbase financial health, and

- Coinbase revenue sources: transaction and subscription.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. What contributes to the significant growth of Coinbase’s subscription and services revenue?

Consolidated Results

A1. Subscription And Services Revenue

A2. Percentage Of Subscription And Services Revenue To Total

A3. YoY Growth Rates Of Subscription And Services Revenue

Subscription Revenue Breakdown

B1. Revenue From Stablecoin, Blokchain Rewards, and Interest & Finance Fee Income

B2. Revenue From Custodial Fee and Other Income

Subscription Revenue Breakdown In Percentage

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Stablecoin Revenue: Coinbase’s stablecoin revenue is primarily derived from the interest earned on the reserves backing the stablecoin USDC (USD Coin). This revenue stream depends on two key factors:

- USDC’s Market Capitalization: The larger the market cap of USDC, the more reserves are held, which can generate higher interest income.

- Interest Rates: The revenue is influenced by prevailing interest rates, as the reserves are often held in interest-bearing accounts or investments.

Coinbase’s economic partnership with Circle, the co-creator of USDC, plays a significant role in determining the specifics of this revenue-sharing arrangement. This stablecoin revenue has become an important part of Coinbase’s strategy to diversify its income sources beyond trading fees.

Blockchain Rewards: Coinbase’s blockchain rewards comes from its staking services, where users participate in blockchain networks to earn rewards.

Coinbase facilitates this process by pooling user assets and managing the technical aspects of staking. In return, users receive a portion of the rewards generated, while Coinbase retains a fee for providing the service.

This revenue stream is influenced by factors such as:

- The number of users participating in staking programs.

- The types of cryptocurrencies supported for staking.

- The reward rates offered by blockchain networks.

Blockchain Rewards revenue is a key part of Coinbase’s strategy to diversify its income sources and provide value-added services to its users.

Custodial Fee: Coinbase’s custodial fee is a charge applied for securely storing digital assets on behalf of institutional clients through its Coinbase Custody service.

This service is tailored for large-scale investors, such as hedge funds and financial institutions, offering features like:

- Cold Storage: Assets are stored offline for maximum security.

- Regulatory Compliance: Coinbase Custody operates as a fiduciary under New York State banking law, ensuring adherence to strict regulations.

- Audit Trails: Provides detailed records for transparency and accountability.

- Staking Options: Clients can earn rewards on staked assets without compromising security.

The fee structure typically includes:

- Setup Fee: A one-time charge for initiating the service.

- Monthly Custodial Fee: Often calculated as a percentage of the assets under custody (e.g., 10 basis points or 0.10% per month).

This service is designed to provide institutional clients with a secure and compliant way to manage their cryptocurrency holdings.

Interest & Finance Fee Income: Coinbase’s interest & finance fee income primarily stems from the interest earned on customer fiat balances and other financial activities. Here’s a breakdown:

Interest on Fiat Balances:

- Coinbase earns interest on the cash balances held in customer accounts. These funds are typically deposited in interest-bearing accounts or invested in low-risk financial instruments.

Margin Lending:

- Coinbase offers margin trading services, allowing users to borrow funds to trade cryptocurrencies. The interest charged on these loans contributes to finance fee income.

Other Financial Services:

- This may include fees from lending or other financial products offered to institutional or retail clients.

This revenue stream is part of Coinbase’s strategy to diversify its income sources and provide additional financial services to its users.

What contributes to the significant growth of Coinbase’s subscription and services revenue?

The significant growth of Coinbase’s subscription and services revenue can be attributed to several key factors:

- Diversification of Revenue Streams: Coinbase has expanded beyond transaction fees by offering services like staking (blockchain rewards), custodial solutions, and interest income. These provide more stable and recurring revenue sources.

- Increased Adoption of Staking: As more users participate in staking programs, Coinbase benefits from the fees it charges for facilitating these services.

- Growth in USDC Stablecoin Usage: The rising adoption of USDC has led to higher interest income from the reserves backing the stablecoin.

- Institutional Client Growth: An increase in institutional clients has boosted revenues from custodial fees and advanced trading platforms like Coinbase Prime.

- Introduction of Subscription Services: Offerings like Coinbase One, which provides benefits such as zero trading fees and enhanced staking rewards, have attracted more users.

- Higher Interest Rate Environment: Rising interest rates have positively impacted the interest income earned on customer fiat balances and USDC reserves.

These factors collectively contribute to the robust growth of Coinbase’s subscription and services segment, making it a critical part of the company’s strategy to reduce reliance on volatile trading fees.

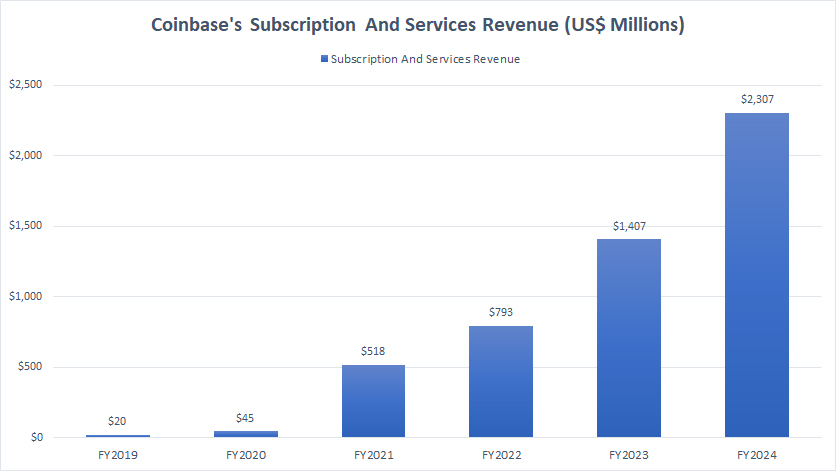

Subscription And Services Revenue

coinbase-subscription-and-services-revenue

(click image to expand)

Coinbase’s subscription and services revenue consists of several streams. The definition of these revenue sources are available here: subscription and services revenue.

Coinbase’s subscription and services revenue surged to an impressive $2.4 billion in fiscal year 2024, representing a remarkable 64% growth compared to the $1.4 billion reported in 2023. This robust performance underscores the company’s success in diversifying its revenue streams and reducing dependency on volatile trading fees.

Over the last five years, the growth of Coinbase’s subscription and services segment has been nothing short of extraordinary. In 2020, this segment contributed a modest $45 million in revenue. By 2024, it had skyrocketed past the $2 billion mark, reflecting a compound annual growth rate (CAGR) of over 125%. This rapid expansion highlights Coinbase’s ability to capitalize on emerging trends and evolving user demands.

Key drivers of this growth include the increasing adoption of blockchain staking programs, greater institutional use of custodial services, rising interest income fueled by higher interest rates, and the expanding ecosystem of stablecoins, particularly USDC. Moreover, the introduction of subscription-based offerings like Coinbase One has further fueled revenue growth by locking in users seeking premium benefits and lower trading costs.

The exponential rise of this segment illustrates Coinbase’s strategic pivot towards a more sustainable and diversified business model in the rapidly evolving cryptocurrency landscape.

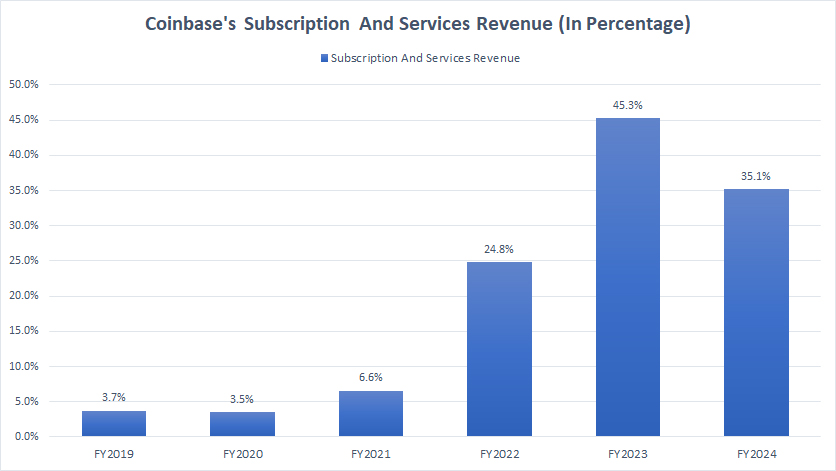

Percentage Of Subscription And Services Revenue To Total

coinbase-subscription-and-services-revenue-in-percentage

(click image to expand)

Coinbase’s subscription and services revenue consists of several streams. The definition of these revenue sources are available here: subscription and services revenue.

In fiscal year 2024, Coinbase’s subscription and services revenue accounted for 35% of the company’s total revenue, marking a decline from the 45% share recorded in 2023. This shift reflects a proportional rebound in trading-related revenues amid fluctuating market conditions. Despite this decline, the segment remains a critical contributor to Coinbase’s overall revenue mix.

Looking back to fiscal year 2022, the subscription and services segment made up 25% of total revenue, demonstrating significant growth compared to 7% in fiscal year 2021. This jump underscores Coinbase’s strategic shift toward diversifying its income streams during periods of reduced trading activity.

Over the past three years, the subscription and services segment has averaged a 35% share of total revenue, a dramatic increase when compared to its historical average of just 5%. This underscores how the segment has transformed into a cornerstone of Coinbase’s revenue model, providing greater stability amid the inherent volatility of cryptocurrency trading.

The consistent growth of this segment highlights Coinbase’s focus on capturing new revenue opportunities, such as blockchain staking, stablecoin income, and interest-earning services, while addressing the evolving demands of both retail and institutional clients.

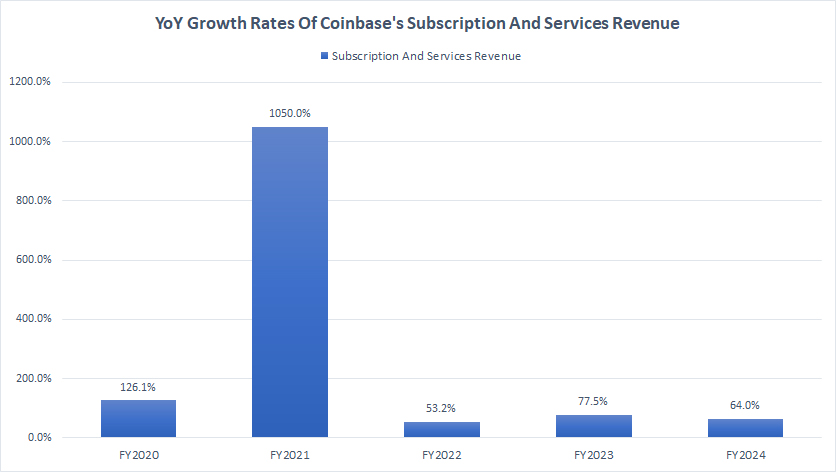

YoY Growth Rates Of Subscription And Services Revenue

coinbase-subscription-and-services-revenue-growth

(click image to expand)

Coinbase’s subscription and services revenue consists of several streams. The definition of these revenue sources are available here: subscription and services revenue.

In fiscal year 2024, Coinbase’s subscription and services revenue achieved an impressive 64% growth, a slight moderation compared to the 77.5% increase recorded in 2023. This steady expansion highlights the resilience and scalability of the segment, which continues to play a crucial role in Coinbase’s revenue diversification strategy.

Over the three-year period from fiscal year 2022 to 2024, the segment maintained an average annual growth rate of 65%, reflecting its consistent upward trajectory. This remarkable performance underscores Coinbase’s ability to capture emerging opportunities in the cryptocurrency space through innovative offerings like blockchain staking, custodial services, and subscription models.

Since 2020, Coinbase’s subscription and services segment has demonstrated sustained and exponential growth. In that year, the segment contributed a modest $45 million, but by 2024, it had surpassed $2 billion in revenue. This represents a profound transformation, as Coinbase successfully shifted from being heavily reliant on transaction fees to a more diversified and stable revenue model.

The segment’s consistent growth is driven by several key factors which we saw in earlier discussions. Combined, these elements position Coinbase’s subscription and services segment as a cornerstone of its long-term growth strategy and a stabilizing force in its overall revenue mix.

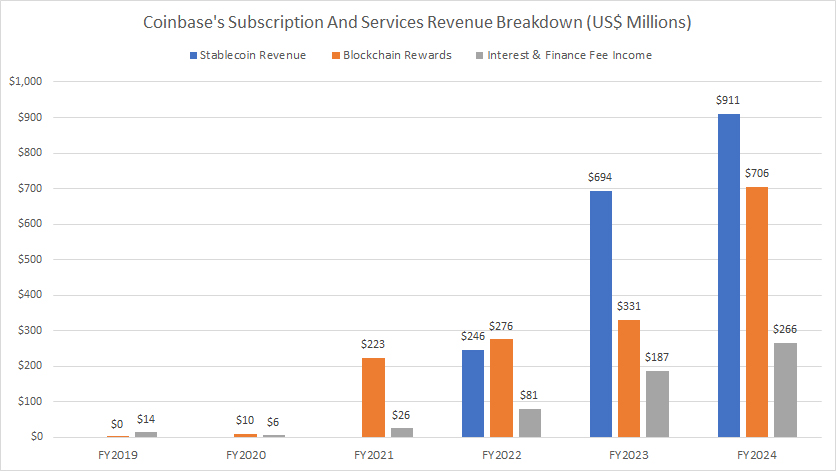

Revenue From Stablecoin, Blokchain Rewards, and Interest & Finance Fee Income

coinbase-subscription-and-services-revenue-breakdown-1

(click image to expand)

Coinbase’s subscription and services revenue consists of several streams. The definition of these revenue sources are available here: subscription and services revenue.

Among the various revenue streams within Coinbase’s subscription and services segment, stablecoin revenue stands out as the largest contributor. In fiscal year 2024, stablecoin revenue reached an impressive $911 million, marking a growth of more than 30% compared to $694 million in 2023.

This growth reflects the increased adoption of stablecoins like USDC and the interest earned from their reserves. Looking further back, Coinbase generated only $246 million in stablecoin revenue in 2022. Over this two-year period, the figure has nearly quadrupled, hitting a record high of $911 million in 2024.

The segment also benefitted significantly from the rising popularity of blockchain rewards, primarily driven by staking services. In 2024, blockchain rewards revenue climbed to a record $706 million, more than doubling from the $331 million recorded in 2023.

Since 2022, when blockchain rewards revenue stood at $276 million, this stream has seen an extraordinary 155% increase. This surge is fueled by the growing user base participating in staking programs and Coinbase’s capability to support multiple blockchain networks.

Additionally, interest and finance fee income has experienced robust growth over the years. In 2022, this revenue stream contributed a modest $81 million. By 2024, it had increased more than threefold, reaching $266 million. This remarkable rise underscores the strong demand for services like margin lending and the increased interest income from fiat balances in a higher interest rate environment.

Together, these three revenue streams underline the consistent and diversified growth of Coinbase’s subscription and services segment, which has emerged as a stable and increasingly dominant part of the company’s overall revenue mix.

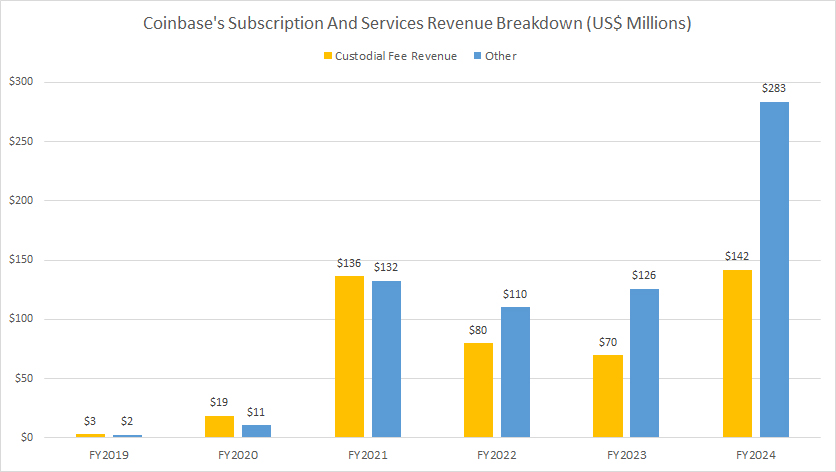

Revenue From Custodial Fee and Other Income

coinbase-subscription-and-services-revenue-breakdown-2

(click image to expand)

Coinbase’s subscription and services revenue consists of several streams. The definition of these revenue sources are available here: subscription and services revenue.

The custodial fee and other income are additional revenue streams within Coinbase’s subscription and services segment. While these streams contribute to the segment’s overall performance, they remain relatively small compared to the dominant contributors, such as stablecoin revenue, blockchain rewards, and interest and finance fee income.

A key observation is that the custodial fee revenue has experienced notable fluctuations over the years. In fiscal year 2024, custodial fee revenue reached $142 million, showing a strong recovery compared to the $70 million reported in 2023.

In 2022, custodial fee revenue amounted to $80 million, reflecting a dip from $136 million in 2021. This variability underscores the challenges and dependency of custodial fee revenue on institutional client activity and market conditions. Despite its growth in 2024, it remains a smaller component of the segment overall.

Other Income within the subscription and services segment, however, has emerged as a more significant contributor. In fiscal year 2024, other income reached an impressive $283 million, underscoring its growing importance within the segment.

This revenue source encompasses various miscellaneous streams, potentially including additional fees or unique services not captured under Coinbase’s primary revenue categories.

While these two streams trail behind the heavyweights of stablecoin revenue, blockchain rewards, and interest income, they reflect Coinbase’s continuous effort to diversify its offerings and create supplementary revenue channels. The relatively smaller scale of these streams also highlights the broader success of Coinbase’s core subscription and services strategy.

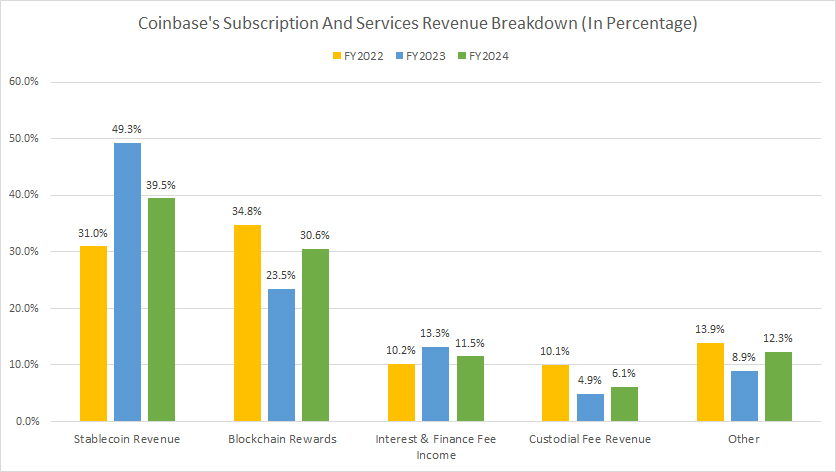

Percentage Of Revenue From Stablecoin, Blokchain Rewards, Interest & Finance Fee Income, And Custodial Fee

coinbase-subscription-and-services-revenue-breakdown-in-percentage

(click image to expand)

Coinbase’s subscription and services revenue consists of several streams. The definition of these revenue sources are available here: subscription and services revenue.

Coinbase’s stablecoin revenue remains the largest contributor to its subscription and services segment, accounting for 40% of total revenue in fiscal year 2024. Over the three-year period from fiscal year 2022 to 2024, stablecoin revenue has consistently maintained an average share of 40%, underscoring its critical role in driving the segment’s growth. This dominance reflects the widespread adoption of USDC, alongside the favorable interest rate environment that has amplified earnings on USDC reserves.

Blockchain rewards revenue, primarily driven by staking services, represented 31% of total subscription and services revenue in fiscal year 2024, solidifying its position as the second-largest contributor. On average, blockchain rewards have comprised 30% of the segment’s revenue over the same three-year period. The steady growth in this stream highlights increased user participation in staking programs and Coinbase’s ability to support an expanding range of supported blockchain networks.

Interest and finance fee income ranks as the third-largest revenue source, making up 11.5% of the total subscription and services revenue in fiscal year 2024. Its three-year average share stood at 12%, reflecting a relatively consistent contribution. This revenue stream benefits from rising interest rates and growing demand for financial products like margin lending and interest-bearing fiat balance services.

Custodial fee revenue, while critical for institutional clients, accounted for just 6% of total subscription and services revenue in fiscal year 2024, making it the smallest contributor to the segment. Over the period from fiscal year 2022 to 2024, custodial fees maintained an average share of 7% of the total segment revenue. The fluctuations in custodial fees align with market conditions and shifts in institutional client activity, yet their recovery in 2024 reflects Coinbase’s ongoing appeal to large-scale investors.

Together, these revenue streams illustrate a well-balanced and diversified income model within Coinbase’s subscription and services segment. The stable dominance of stablecoin revenue and blockchain rewards highlights the company’s ability to adapt and thrive amid a rapidly evolving cryptocurrency landscape, while smaller streams like interest income and custodial fees enhance the overall stability of this segment.

Conclusion

Essentially, Coinbase’s subscription and services segment reflects a well-executed strategy to build a diversified, stable revenue base. By capitalizing on trends like staking, stablecoin adoption, and interest income, Coinbase is mitigating the impact of cryptocurrency market volatility. The segment’s growth trajectory highlights its critical role in Coinbase’s long-term business model transformation, catering to both retail users and institutional clients. It’s a model that promises resilience and scalability in an evolving digital economy.

Credits and References

1. All financial figures presented were obtained and referenced from Coinbase Global, Inc.’s annual reports published on the company’s investor relations page: Coinbase Investor Relations.

2. Pixabay images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.