Counting cash. Pexels Image.

Snap has gone public for more than 5 years after completing its IPO in March 2017. However, the company has never declared or paid any cash dividends since its public listing.

The following excerpt extracted from the 2023 annual report shows what Snap has said about its dividend policy:

-

Dividend Policy

We have never declared or paid cash dividends on our capital stock. We intend to retain all available funds and future earnings, if any, to fund the development and expansion of our business, and we do not anticipate paying any cash dividends in the foreseeable future.The terms of our Credit Facility also restrict our ability to pay dividends, and we may also enter into credit agreements or other borrowing arrangements in the future that will restrict our ability to declare or pay cash dividends on our capital stock.

Therefore, Snap’s stock does not look like paying dividends anytime soon. For now, Snap’s existing and future shareholders can only gain from the price appreciation of the company’s common stocks.

While Snap has never been a dividend-paying stock, that does not mean that the company will never pay a cash dividend in the future.

Since dividends are paid out of profits and cash, Snap may consider paying a cash dividend if the company can make a decent profit and produce a sizeable free cash flow.

As we all know, Snap operates in the social media space and this industry is highly lucrative as they are asset-light and do not need to run a factory to make money. Most social media companies, including Meta, Pinterest, and Twitter, are extremely profitable and generate tonnes of cash.

In addition, most social media companies, including Snap, have little to no debt and usually are minimally leveraged according to this article: Snap’s Net Debt And Debt To Equity Ratio.

Therefore, the possibility of Snap paying a cash dividend in the future is quite realistic to some extent. That said, in this article, we are exploring the possibility of Snap paying a cash dividend based on several factors.

So, let’s look at the following scenarios.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. What Does It Take For Snap Inc. To Become A Dividend Payer?

Favorable Factors

F1. A Growing DAU

F2. An Increasing ARPU

F3. Rising Revenue In All Regions

F4. Snap Can Service Its Debt

Unfavorable Factors

U1. Snap Is Unprofitable

U2. Poor Cash Flow

U3. Increasing Deficit

U4. Growing Debt Level And Leverage

Summary And Reference

S1. Summary

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Average Revenue Per User: Average Revenue Per User (ARPU) is a crucial metric social media companies use to measure the revenue generated per user or account. It is calculated by dividing the company’s total revenue by the total number of users or accounts over a specific period.

ARPU helps these companies understand their monetization effectiveness and track financial performance over time. It also provides insights into user engagement and the value derived from each user, guiding strategies for advertising, subscription models, and other revenue-generating activities.

Adjusted EBITDA: Adjusted EBITDA stands for Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a financial metric that companies use to evaluate their operating performance.

Unlike standard EBITDA, adjusted EBITDA removes the effects of non-operational or one-time expenses and incomes to provide a clearer picture of a company’s underlying operational performance.

his adjustment might include eliminating items such as restructuring costs, stock-based compensation, gains or losses from asset sales, and other non-recurring expenses or revenues. By making these adjustments, stakeholders can get a more accurate view of a company’s operational efficiency and profitability, facilitating better comparisons between periods and across companies.

Accumulated Deficit: An accumulated deficit in the balance sheet refers to a situation where a company’s total accumulated losses exceed its total accumulated profits. This figure appears under the shareholders’ equity section of the balance sheet and indicates that the company has generated more losses than profits over its history.

Essentially, it’s a negative balance in the retained earnings account, showing that the company has spent more money than it has earned during its operation up to that point in time. Accumulated deficits can be an important indicator of a company’s financial health and its ability to sustain operations in the long term.

What Does It Take For Snap Inc. To Become A Dividend Payer?

For Snap Inc. or any similar company to transition into a dividend-paying entity, several steps and considerations are typically involved. These include:

1. **Sustained Profitability**: A fundamental prerequisite for paying dividends is consistent and sustainable profitability. Snap Inc. would need to demonstrate an ability to generate profits over consecutive quarters and years, ensuring that it has a reliable earnings stream from which dividends can be paid.

2. **Healthy Cash Flow**: Beyond profitability, strong and positive cash flows are crucial. This means that Snap Inc. must efficiently manage its operating, investing, and financing cash flows, ensuring enough liquidity to cover dividend payments without compromising operational needs or growth investments.

3. **Financial Stability**: Establishing a solid financial foundation with a manageable level of debt is important. High debt levels can divert cash flow to interest and principal payments, limiting the funds available for dividend distribution. A strong balance sheet gives the company flexibility in managing its capital allocation.

4. **Strategic Reserves**: Companies often build up their reserves before initiating dividends to maintain dividend payments during less favorable economic times. This reserve acts as a buffer to support consistent dividend payments, contributing to the company’s reputation for reliability among investors.

5. **Board Approval and Dividend Policy**: The decision to start paying dividends requires the company’s board of directors approval. The board would also need to establish a dividend policy outlining the company’s approach to dividend payouts, including the payment frequency and determining the dividend amount.

6. **Regulatory Compliance and Shareholder Communication**: Ensuring compliance with regulatory requirements related to dividend payments is essential. Additionally, effectively communicating the dividend policy and payments to shareholders helps manage expectations and maintain investor relations.

7. **Market Position and Competitive Landscape**: A strong market position and competitive advantage can provide the revenue growth and stability needed to support ongoing dividend payments. For Snap Inc., this could also mean diversifying revenue streams and enhancing its Average Revenue Per User (ARPU).

Transitioning to a dividend-paying company is a significant decision that reflects a company’s maturity, financial health, and long-term commitment to returning value to shareholders. For Snap Inc., careful consideration of these factors, along with strategic planning and execution, would be critical steps in becoming a dividend-paying entity.

All said, let’s look at the numbers to see if Snap Inc. has the necessary means to initiate a dividend!

A Growing DAU

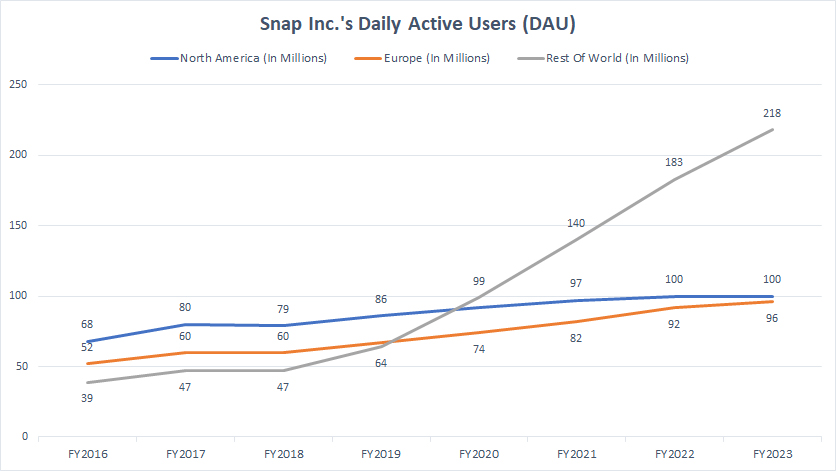

Snap’s daily active users

A growing DAU or daily active user is probably one of the most important factors in supporting a dividend coming from Snap Inc. For your information, the DAU metric measures users’ engagement on Snapchat.

Therefore, the higher the DAU number, the more engaged the users are on Snap’s social media platforms, and therefore, the more money Snap will make.

As we all know, Snap revenue streams come primarily from advertising impressions being displayed on its social media platforms – Snapchat.

An increasing number of users and growing engagement on its platforms would allow Snap to display more advertisements and make more money.

The good news is that Snap’s DAU has been increasing in all regions, as shown in the chart above. It now has more active users internationally than its North America and Europe regions.

An Increasing ARPU

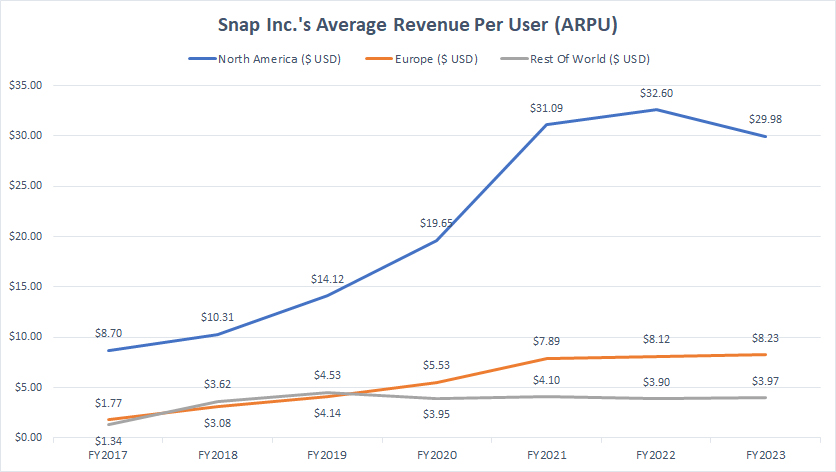

Snap’s revenue per user

Another important metric that could possibly increase the chance of a dividend coming from Snap is the ARPU or average revenue per user.

As the name implies, the ARPU measures the revenue per user earned. You can also find a detailed definition of ARPU here: ARPU.

Therefore, the higher the ARPU, the more revenue Snap will collect for a user on its platforms.

As shown in the chart above, Snap’s ARPU has been increasing across all regions in the world and Snap’s North America region has done particularly well compared to other regions.

The increasing revenue per user for Snap bodes well for the company as it means that Snap’s revenue will certainly rise in accordance with the growing ARPU.

Again, Snap’s growing ARPU can certainly help to make the case for a cash dividend coming from the company a reality.

Rising Revenue In All Regions

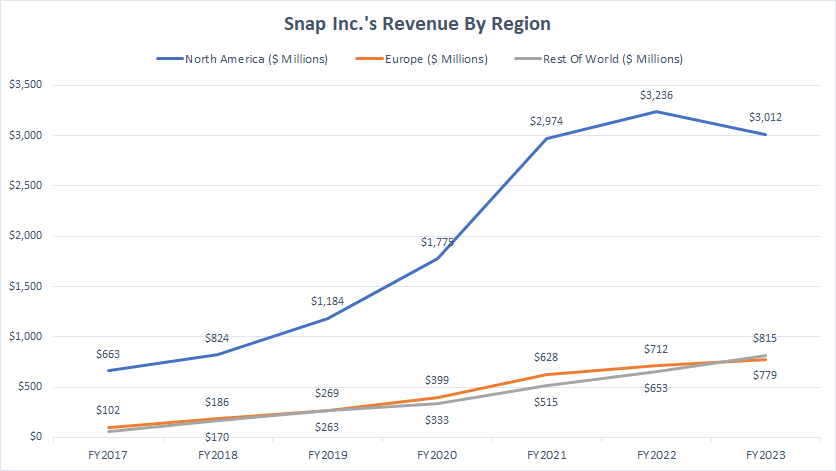

Snap’s revenue by region

The growing DAU coupled with the increasing ARPU has enabled Snap to grow its revenue in all regions as shown in the chart above.

As seen, Snap’s revenue in all regions has been on the rise since 2017, and it exceeded $3 billion as of 2023, one of the new highs since 2017.

While the rising revenue may not guarantee a dividend, it certainly increases the chance of a cash dividend coming from Snap.

Snap Can Service Its Debt

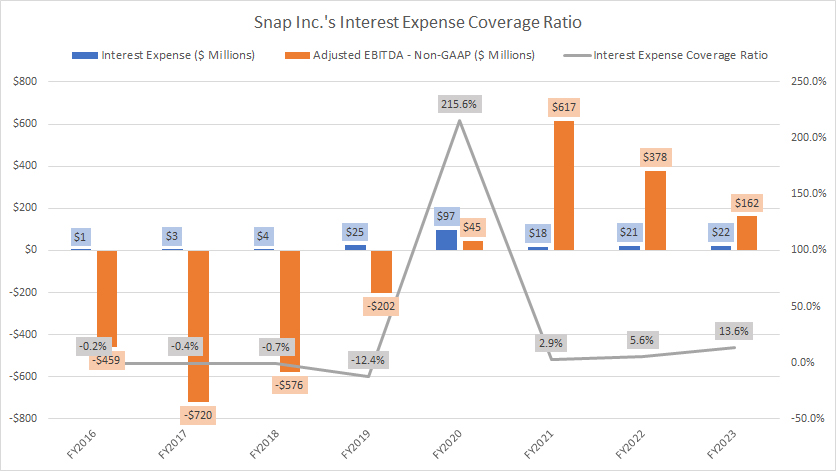

Snap’s interest expense coverage ratio

* Interest expense and adjusted EBITDA are obtained from Snap’s earnings releases.

* EBITDA stands for earnings before interest, taxes, depreciation and amortization.

* Snap’s fiscal year begins on Jan 1 and ends on Dec 31.

Although Snap’s debt levels reached a record high in fiscal year 2023, its interest expense made up only a tiny fraction of its adjusted EBITDA, as shown in chart above. You may find detailed explanation of the adjusted EBITDA here: adjusted EBITDA. Snap’s debt level can be seen here: Snap’s debt.

As seen, Snap’s interest expense with respect to the adjusted EBITDA has averaged less than 10% over the last three years. The latest ratio came in at 14% as of 2023.

At less than 10% of the adjusted EBITDA, Snap can easily cover the payment of its interest expense.

Since debt servicing is not a drag on the company’s financial health, it adds to another reason that Snap should initiate a capital return to shareholders in the form of cash dividends.

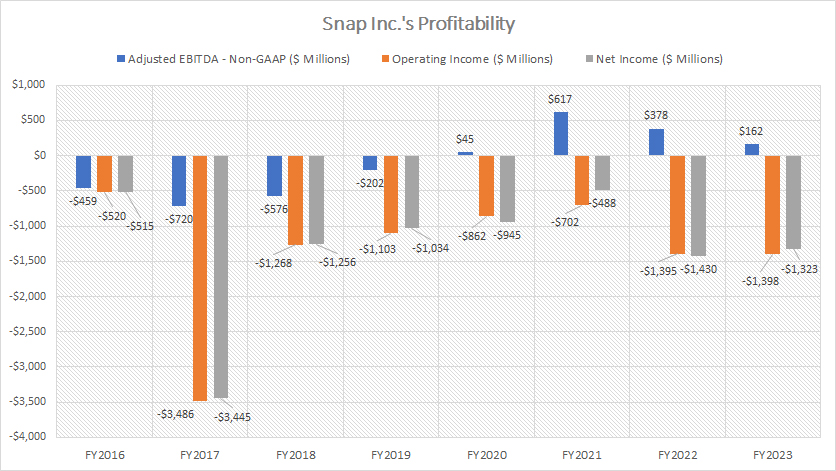

Snap Is Unprofitable

Snap’s profitability

* Operating income, net income, and adjusted EBITDA are obtained from Snap’s earnings releases.

* EBITDA stands for earnings before interest, taxes, depreciation, and amortization.

* Snap’s fiscal year begins on Jan 1 and ends on Dec 31.

As illustrated in the chart above, Snap has never turned a profit, except for the adjusted EBITDA. You may find detailed explanation of the adjusted EBITDA here: adjusted EBITDA.

However, in terms of operating income and net income, Snap Inc. has never produced a positive operating and net profit.

Snap Inc.’s persistent losses is a drag on its financial health, and thereby affecting its ability to initiate and sustain a cash dividend.

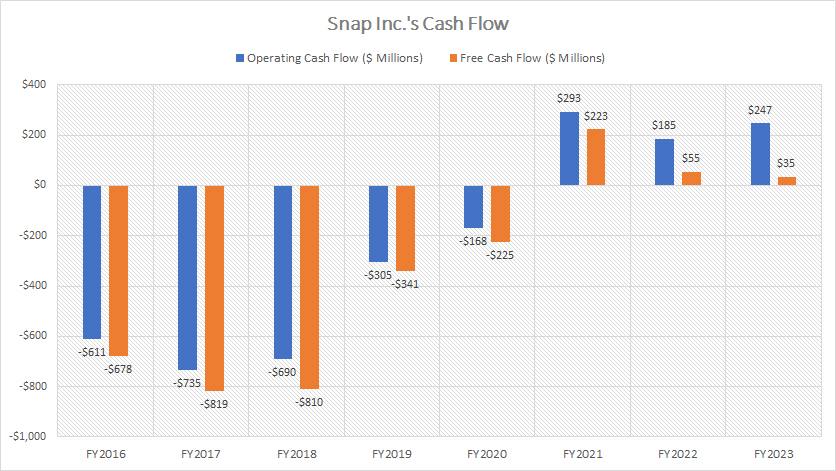

Poor Cash Flow

Snap’s cash flow

* Operating cash flow and free cash flow are obtained from Snap’s earnings releases.

* Snap’s fiscal year begins on Jan 1 and ends on Dec 31.

Apart from being unprofitable, Snap Inc. has poor cash flow, as shown in the chart above.

Although Snap has managed to produce positive operating and free cash flow in the last three years, they are mediocre.

With a free cash flow that has averaged just $100 million since fiscal year 2021, Snap’s capital return will not mean anything compared to the company’s market capitalization of $26 billion as of May 2024.

Even if Snap pay out its entire free cash flow of $100 million, the dividend yield can only amount to 0.4%, which is terrible in today’s high interest environment.

In this case, it may be better off for Snap Inc to keep its cash for investment for future growth and paying off its debt.

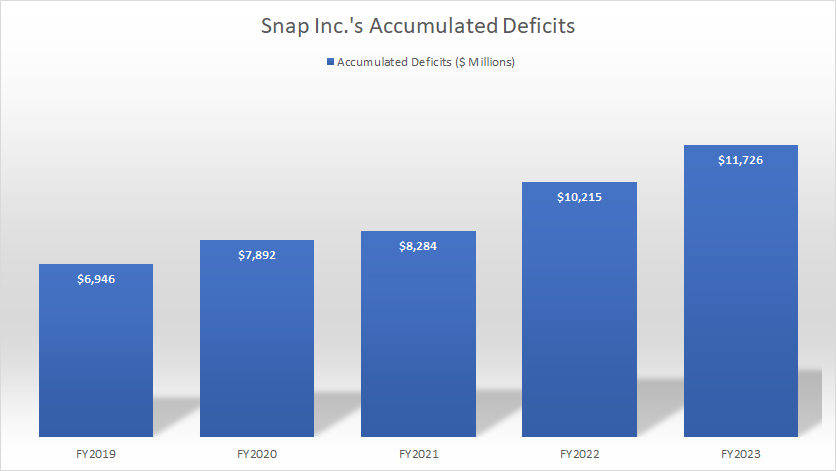

Increasing Deficit

Snapchat-accumulated-deficits

(click image to expand)

* Snap’s fiscal year begins on Jan 1 and ends on Dec 31.

Since Snap has been having losses, it has never retained any profits. Instead, it has been accumulating deficits, as shown in the chart above. The definition of Snap’s accumulated deficit is available here: accumulated deficit.

Since 2019, Snap’s accumulated deficit has significantly risen, reaching a record high of $11.7 billion in fiscal year 2023. It has nearly doubled since 2019, highlighting the deepening losses the company has been experiencing.

If Snap were to declare a cash dividend, it will only aggravate the deficits, making the number to become larger.

Therefore, Snap’s growing accumulated deficits are certainly a drag on the company’s financial health, and its ability to pay and sustain a dividend.

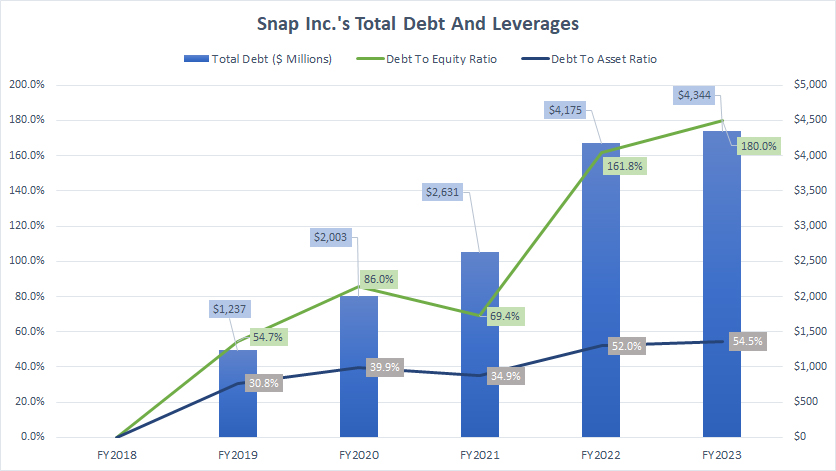

Growing Debt Level And Leverage

Snap’s debt and leverage

* Snap’s total debt is the sum of all short and long-term debt as well as operating lease liabilities which can be obtained from Snap’s balance sheets.

* Snap’s fiscal year begins on Jan 1 and ends on Dec 31.

While Snap has been capable of servicing its indebtedness, its debt level and leverages have grown significantly over the years, as shown in the chart above.

As seen, Snap’s total debt, inclusive of operating leases, was at a record high of $4.3 billion USD as of 2023, an increase of more than 200% from 2019. As Snap’s total debt has risen, its leverage also has significantly trended up in accordance with the rising debt level.

For example, Snap’s debt-to-equity ratio reached a massive 180% as of 2023, a record high since 2019. At this level of leverage, Snap carried about $1.80 dollar of debt for every $1.00 dollar of equity.

Similarly, Snap’s total debt reported in 2023 made up 55% of the company’s total assets. In other words, the majority of Snap’s assets were actually financed by debt.

At these levels of ratios, Snap is soaked in high debt levels and high leverages.

Besides, certain credit agreements and debt arrangements may restrict Snap from paying a dividend when leverages cross certain thresholds.

Therefore, if Snap ever wants to consider returning cash to shareholders, it must keep its debt and leverage at a reasonable level.

Conclusion

As of 2023, Snap Inc., the parent company of the popular social media platform Snapchat, has not announced or paid cash dividends on its common stock. Since its initial public offering (IPO) in 2017, Snap Inc. has focused on growth and reinvesting its earnings back into the company to fund development, expansion, and innovation.

This strategy is common among tech companies, especially those in growth phases, where the potential for reinvestment returns exceeds the value that would be generated by paying dividends to shareholders.

Investors in Snap Inc. typically look for value through stock price appreciation rather than seeking income through dividends.

Please leave your comments below.

References and Credits

1. All financial figures presented in this article were obtained and referenced from Snap’s filings, quarterly and annual reports, webcasts, investor presentations, earnings releases, etc., which are available in Snap Inc. Shareholder Information.

2. Pexels Images.

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!