Jack in the Box – Lunch. Source: Flickr

With over 2,000 restaurants primarily in North America, Jack in the Box is one of the largest burger chains in the U.S.

Jack in the Box previously owned Qdoba Mexican Eats, a fast-casual restaurant specializing in Mexican cuisine. In 2018, the company sold the entire subsidiary to Apollo Global Management for $305 million. The transaction, completed in the second quarter of 2018, was conducted entirely in cash.

In March 2022, Jack in the Box acquired Del Taco, a U.S.-based fast-food restaurant chain specializing in Mexican-style cuisine. Following the acquisition, Jack in the Box’s total restaurant count surged to 2,785 units by the end of fiscal year 2024, one of the highest figures ever reported, generating $1.6 billion in sales for the company.

In this article, we will examine Jack in the Box’s revenue, profit margin, and revenue streams in detail. Let’s dive into the specifics!

Investors looking for other statistics about the company may find more information on these pages: Jack In The Box total stores, Jack In The Box same store sales, and Jack In The Box revenue by segment.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

- Company Restaurant Sales

- Franchise Rental Revenues

- Franchise Royalties And Other

- Franchise Contributions For Advertising And Other Services

O2. How Does Jack In The Box Generate Revenue?

Total Revenue And Profit Margin

A1. Total Revenue

A2. Operating Profit Margin

Revenue By Streams

B1. Overview Of Revenue Breakdown

B2. Company Restaurant Sales And Franchise Revenue

B3. Company Restaurant Sales And Franchise Revenue In Percentage

Sales Growth

C1. Growth Rates Of Company Restaurant Sales And Franchise Revenue

Summary And Reference

S1. Summary

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Company Restaurant Sales: Company restaurant sales for Jack in the Box refer to the revenue generated from the company-owned restaurants.

This metric does not include sales from franchised locations. Essentially, it measures the sales performance of Jack in the Box’s directly operated restaurants.

Franchise Rental Revenues: Franchise rental revenues for Jack in the Box refer to the income generated from leasing franchise locations to franchisees. This includes the fees and royalties paid by franchisees to Jack in the Box for the rights to operate under the brand name.

Franchise Royalties And Other: Franchise royalties and other fees for Jack in the Box include:

1. Royalty Fee: Franchisees pay a royalty fee of 5% of gross sales. This fee helps ensure that franchisees have access to the best resources and support to run their businesses effectively.

2. Marketing Fee: Franchisees also pay a marketing fee based upon a percentage of gross sales. This fee covers national advertising and promotional efforts, contributing to the overall brand consistency and growth.

These fees are part of the ongoing costs of maintaining the franchise and supporting its growth.

Franchise Contributions For Advertising And Other Services: Franchise contributions for advertising and other services refer to the fees paid by franchisees to support national advertising, marketing campaigns, and other services that benefit the entire franchise system. This typically includes:

1. Marketing Fee: Franchisees pay a fee, usually around a percentage of gross sales, which goes towards national advertising and promotional efforts.

2. National Advertising Fund: Franchisees may also contribute to a national advertising fund, which helps drive customer traffic and brand awareness through collective marketing efforts.

These contributions are crucial for maintaining brand consistency and supporting the growth of the franchise network.

How Does Jack In The Box Generate Revenue?

Jack in the Box generates revenue through several key streams:

1. Company-Owned Restaurants: Revenue from sales at Jack in the Box-branded restaurants that the company directly operates.

2. Franchise Operations: Income from franchised locations, where franchisees pay fees and royalties to Jack in the Box for the rights to operate under the brand name.

3. Del Taco Revenue: Following the acquisition of Del Taco, revenue from this segment is also included.

4. Drive-Thru Service: A significant portion of revenue comes from the drive-thru service, which provides convenience and speed to customers.

These diverse revenue streams help Jack in the Box maintain a strong financial position and support its growth strategy.

Total Revenue

jack-in-the-box-total-revenue

(click image to expand)

Jack in the Box’s total revenue includes contributions from the Del Taco subsidiary, which the company acquired in 2022.

That said, Jack In The Box generated total revenue of $1.6 billion in fiscal year 2024, roughly 7% lower from a year ago. However, it was up by 7% from 2021.

Since 2017, Jack in the Box has achieved a $500 million, or 45%, increase in total revenue, largely due to organic growth and strategic acquisitions.

In terms of organic growth, the company has experienced steady growth in sales from its existing restaurants, attributed to effective marketing strategies, menu innovations, and customer loyalty programs.

Apart from organic growth, Jack In The Box’s acquisition of Del Taco in 2022 significantly boosted the company’s revenue by adding a substantial number of locations and expanding its market presence.

Operating Profit Margin

jack-in-the-box-operating-profit-margin

(click image to expand)

Jack In The Box generated operating profit margin of just 5% in fiscal year 2024, down significantly from 16.5% in fiscal year 2023.

Since fiscal year 2017, Jack in the Box’s operating profit margin has been declining, reaching a record low in fiscal year 2024.

There are multiple factors contributing to the decline in Jack in the Box’s profit margins. A notable reason is the increasing franchise costs. The company has been experiencing higher costs associated with franchising, including pass-through rent and advertising fees.

In addition to the higher costs associated with franchising, escalating food prices are another factor contributing to the decline in Jack in the Box’s profit margin.

Jack in the Box has also been facing several operational challenges in the post-pandemic period. For example, rising labor costs and supply chain disruptions have pressured the company’s operating margins.

Overview Of Revenue Streams

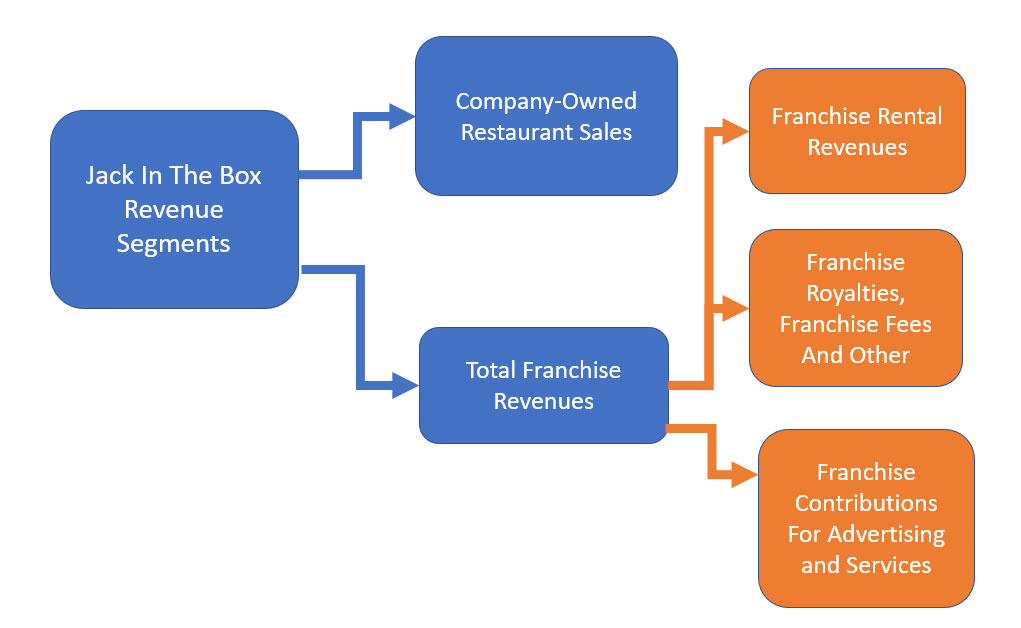

Jack In The Box’s overview of revenue by operations (click to enlarge)

Jack In The Box’s total revenue consists of 2 major categories: company-owned restaurant sales and franchise revenue. You can find the definitions of these revenue streams here: company restaurant sales, franchise rental revenues, franchise royalties, and franchise contributions.

Simply put, company-owned restaurant sales are sales generated by company-owned and operated restaurants. On the other hand, franchise revenue is made up of several segments, including franchise rental revenue, franchise royalties, and franchise contribution for advertising and services.

Jack In The Box does not recognize directly the revenue generated from franchised restaurants as the company does not own them. Instead, Jack In The Box earns royalties, rentals, advertising fees, franchise fees, and other fees from its franchisees.

These are considered leasing revenues and are recurring. Jack in the Box will collect the leasing or franchise revenue as long as franchisees continue to use the Jack in the Box brand name and operate its restaurants.

Company Restaurant Sales And Franchise Revenue

Jack In The Box restaurant sales and franchise revenue (click to enlarge)

You can find the definitions of these revenue streams here: company restaurant sales, franchise rental revenues, franchise royalties, and franchise contributions.

Company restaurant sales are revenues generated by Jack In The Box’s operated restaurants and are recognized when the delivery of food and beverages to customers is completed. These sales can come from Jack In The Box restaurants and Del Taco restaurants.

On the other hand, Jack In The Box’s franchise revenue is made up of several items, including royalties, rental revenue, fees, franchise advertising, services, etc., which we saw earlier. These are recurring sales and are more stable and predictable than company-owned restaurant sales. Similar to company restaurant sales, franchise revenue also can come from Jack In The Box restaurant and Del Taco restaurants.

That said, Jack In The Box derives its revenue primarily from company restaurant sales, as depicted in the chart above. In fiscal year 2024, Jack In The Box’s company restaurant sales reached $700 million, roughly $140 million lower from a year ago. Jack In The Box earned $846 million in revenue from company restaurant sales in fiscal year 2023. In fiscal year 2022, revenue from company restaurant sales was $700 million.

On the other hand, Jack in the Box’s franchise revenue streams have remained relatively stable over the last several years, as shown in the graph above. However, each of Jack in the Box’s franchise revenue streams is much smaller than company restaurant sales. Combined, all franchise revenues are as large as the company restaurant sales.

In fiscal year 2024, Jack in the Box earned $375 million in franchise rental revenue, $238 million from franchise royalties, and $249 million from franchise contributions for advertising and other services. Together, these streams contributed $862 million to the company’s total revenue. You can see that Jack In The Box’s total franchise revenue can be as big as, if not bigger than, its company restaurant sales.

In fiscal year 2023, Jack in the Box earned $365 million in franchise rental revenue, $241 million from franchise royalties, and $241 million from franchise contributions for advertising and other services, which were nearly the same as the 2024 results. Combined, all franchise revenues contributed $847 million in total franchise revenue versus $846 million in company restaurant sales.

Company Restaurant Sales And Franchise Revenue In Percentage

Jack In The Box percentage of restaurant sales and franchise revenue (click to enlarge)

You can find the definitions of these revenue streams here: company restaurant sales, franchise rental revenues, franchise royalties, and franchise contributions.

Jack In The Box’s company restaurant sales of $700 million in fiscal year 2024 accounted for 45% of total revenue, down from 50% in fiscal year 2023. On the other hand, the percentage of Jack In The Box’s franchise revenue was much bigger, reaching 55% of the total in fiscal year 2024.

For each individual franchise revenue, franchise rental revenue accounted for 24% of the total, while revenue from franchise royalties contributed 15%, roughly the same as the portion from franchise contributions.

Although franchise revenue streams are more stable and predictable, their contributions have significantly decreased since fiscal year 2021, as illustrated in the chart above.

For example, the contribution from franchise rental revenue was 30% in fiscal year 2021 compared to 24% in fiscal year 2024. Similarly, franchise royalties contributed 18% in fiscal year 2021 versus 15% in fiscal year 2024. The same trend is observed for franchise contributions.

The decrease in revenue contribution for franchise revenue streams has been attributed to the much faster growth of revenue from company restaurant sales, largely driven by the acquisition of Del Taco in 2022. In this regard, the contribution from company restaurant sales was 34% in fiscal year 2021, which climbed to 48% in fiscal year 2022. This ratio peaked at 50% in fiscal year 2023.

Growth Rates Of Company Restaurant Sales And Franchise Revenue

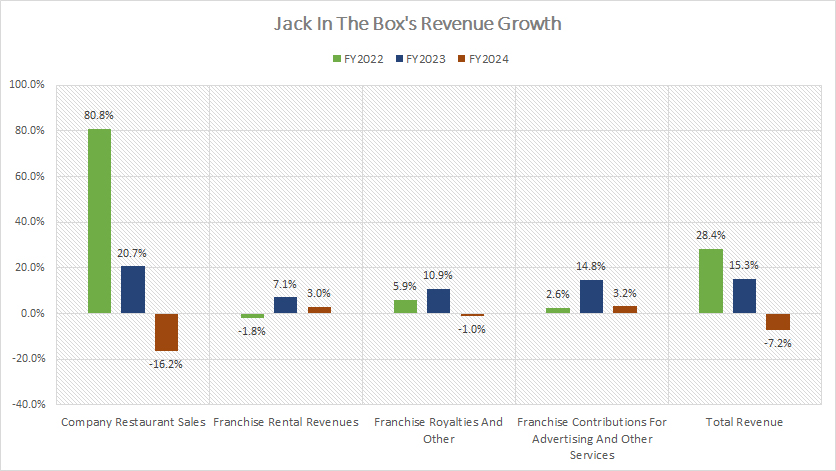

Jack In The Box growth rates of restaurant sales and franchise revenue (click to enlarge)

You can find the definitions of these revenue streams here: company restaurant sales, franchise rental revenues, franchise royalties, and franchise contributions.

Jack in the Box experienced its worst revenue growth in fiscal year 2024, as illustrated in the chart above. The company’s total revenue growth was -7.2% in fiscal year 2024, compared to 28.4% and 15.3% in fiscal years 2022 and 2023, respectively. On average, total revenue growth came in at 12% annually over the last three years.

Jack In The Box’s company restaurant sales decreased by 16% in fiscal year 2024 versus an increase of 81% and 21% in fiscal year 2022 and 2023, respectively.

Franchise revenue performed reasonably well in fiscal year 2024 despite the significant drop in company restaurant sales. For instance, franchise rental revenue increased by 3% compared to the previous year, while revenue from franchise contributions for advertising and other services also climbed at a similar rate.

Franchise royalties and other revenue streams were the only ones to experience a decrease in revenue growth in fiscal year 2024. On average, Jack in the Box’s revenue from franchise royalties has grown by 7% annually since fiscal year 2022, the highest growth rate among all streams within the franchise segment.

The average annual growth rate of revenue from company restaurant sales was 28% over the last three years. During the same period, franchise rental revenues grew 3% annually on average, while revenue from franchise royalties increased by 5% on average per year between fiscal 2022 and 2024.

Summary

In summary, Jack In The Box’s company restaurant sales have grown significantly, driven by strategic acquisitions, while the contribution from franchise revenue streams has decreased comparatively.

Despite a significant drop in company restaurant sales in fiscal year 2024, franchise revenues performed reasonably well.

On the other hand, Jack In The Box has experienced a declining profit margin, primarily due to higher franchise costs, escalating food prices, and post-pandemic operational challenges such as labor costs and supply chain disruptions.

References and Credits

1. All financial figures presented in this article were obtained and referenced from Jack In The Box’s annual reports published in the company’s investors relation page: Jack In The Box’s Investor Relations.

2. Flickr Images.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link back to this article from any website so that more articles like this can be created.

Thank you!