The share price of McDonald Corporation (MCD) has been a laggard in both 2012 and 2013. The stock has appreciated less than 10% in 2012 and less than 5% in 2013. These figures are substantially way below the S&P500 figure of around 25%.

But that doesn’t stop McDonald’s Corporation from being a dividend aristocrat. There is no doubt that McDonald’s Corporation has been paying dividend continuously for more than 30 years. And the best thing about MCD is that the dividend payout has been growing year after year even though the stock price stays relatively flat for the past 2 years.

To get a glimpse of how the stock performs in terms of dividend, I used the Dividend Stock Screener spreadsheet to compare the stock with its peers in the same sector and industry.

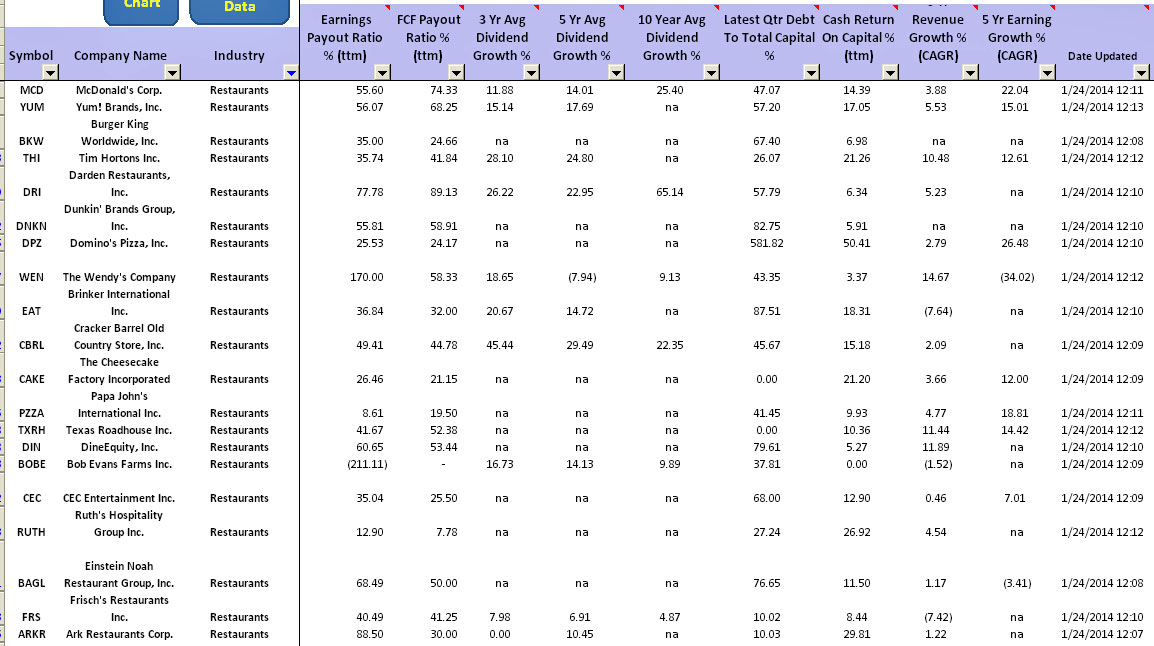

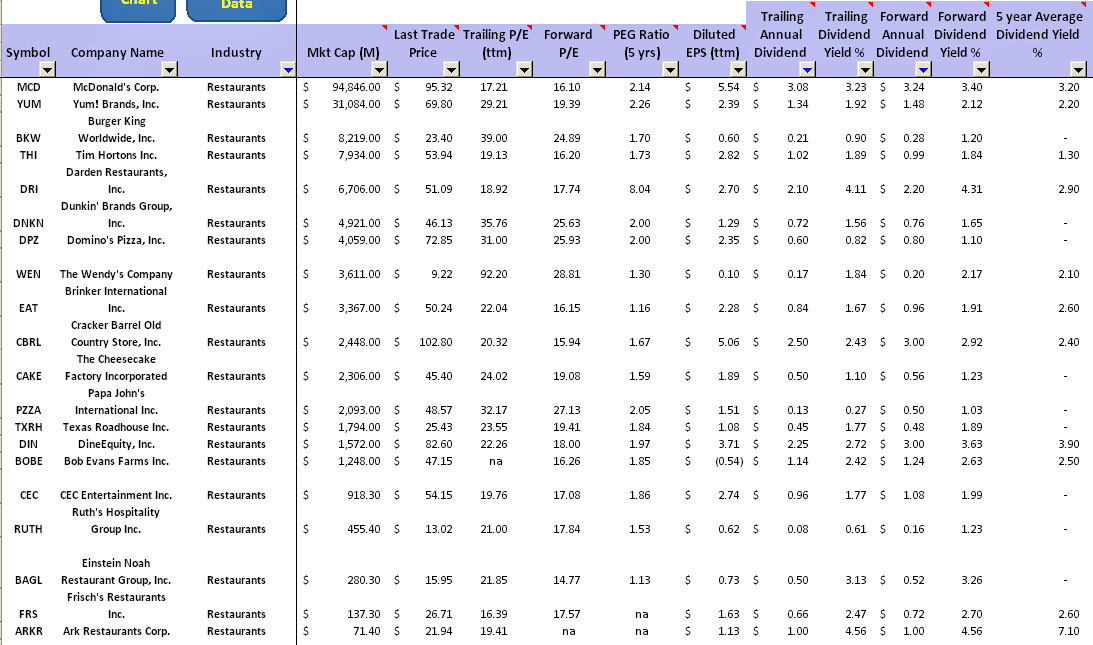

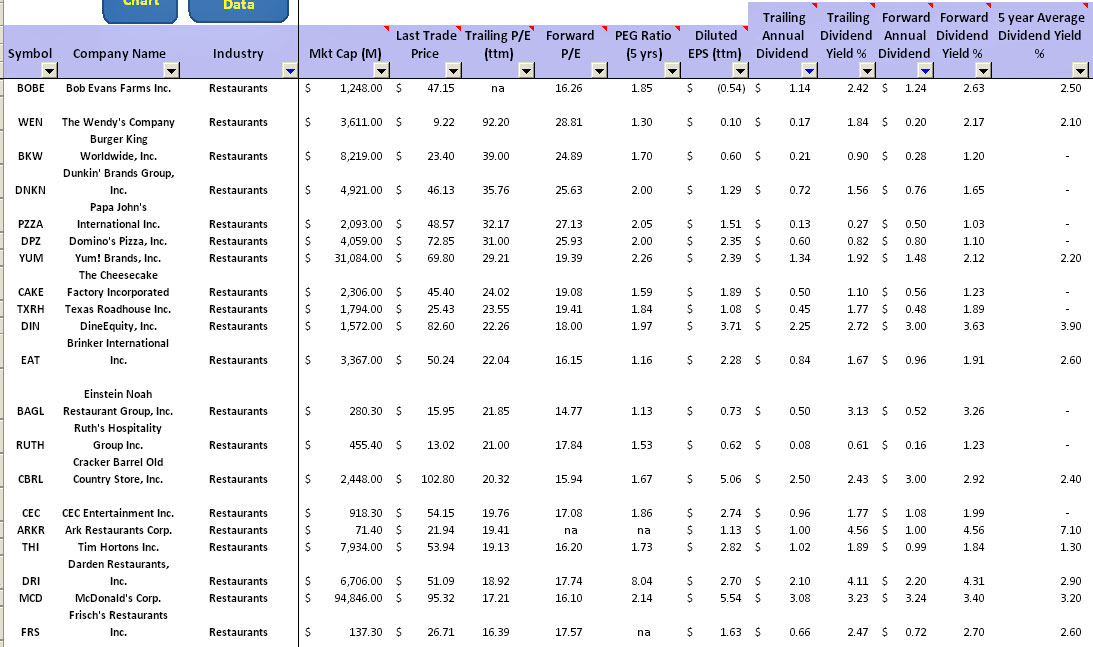

The following snapshots show the screening result of MCD which was done on Jan 24, 2014. I have filtered out stocks that aren’t paying dividends in the restaurant industry.

From the above two tables, we can see that McDonald’s Corporation is the biggest company in terms of market capitalization, which comes close to 95 billion. The next biggest right after MCD would be Yum! Brands (YUM), which comes to 31 billion in market cap.

When it comes to dividend yield, MCD is within the top 5 companies in the restaurant industry that has a trailing and forward dividend yield of 3.23% and 3.4% respectively. The average 5-years dividend yield for MCD is 3.2%. Only a handful of stocks in this industry have been paying dividends for more than 5 years and MCD is no doubt one of them.

To see how the dividend growth for MCD performed over the past 3 years, we looked at the column “3 Yr Avg Dividend Growth %”. The average dividend growth rate for MCD for the past 3 years is 12%.

The figure has surprisingly put McDonald’s Corp at the bottom within the industry for companies that have been paying dividends for the past 3 years, beating only Frisch’s Restaurant (FRS) and Ark Restaurant Corp. (ARKR).

The best stock having the highest average dividend growth (45%) for the past 3 years goes to Cracker Barrel Old Country Store (CBRL).

If we stretch the period to 5 years, the “5 Yr Avg Dividend Growth %” column shows that MCD has increased its dividend at a rate of 14% in average. Again, MCD has not been that impressive in growing its dividend. There are better companies in the restaurant industry with far better dividend growth rates.

If we stretch the period up to 10 years, the column “10 Yr Avg Dividend Growth %” shows that MCD is the king in dividend growth, having a figure of 25.4%. Only a handful of companies have paid dividend for the past 10 years and MCD is clearly the winner here, second only to Darden Restaurant (DRI), which has an astounding dividend growth rate of 65%.

From the above simple analysis with the Dividend Stock Screener spreadsheet, we can clearly see that MCD has been having decreasing dividend growth rate and the figure shows that the recent 3 years have been the worst for McDonald Corp.

The average dividend growth rate of 12%, 14% and 25% for 3, 5 and 10 years periods respectively shows that majority of the growth of the business actually occurred in the past and the worst is that the business has been slowing down in the latest 3 year period.

It’s no wonder that the share price of MCD has been flat in the past 3 years. If I remember correctly, MCD has not been able to meet analyst expectation in terms of earnings and revenue growth for the past few quarters.

From the screening result, there are actually better stocks with higher dividend growth rate. For example, Cracker Barrel Old Country Store (CBRL) is clearly one of them. Besides, The Wendy’s Company (WEN) has been having impressive result for the past 3 years. If I remember correctly, WEN share price has appreciated more than 100% in the past 3 years, probably more than that.

If you ask me whether MCD is a good investment as of now, I would definitely say no. But one thing for sure is that the valuation for MCD is the lowest among the dividend paying stocks in the restaurant industry. MCD is currently having a trailing and forward PE of around 17 and 16 respectively.

In conclusion, MCD is no doubt one of the few dividend aristocrats but that maybe is in the past. For the past 3 years, McDonald has been suffering in terms of revenue and earnings growth, with competitors taking away its market share, making it one of the worst performing stocks ever.