Mahindra Genio 2.2 CRDe 4×4. Flickr Image.

Mahindra or M&M Limited is one of the biggest automakers in India.

Some of the firm’s largest rivals include Tata Motors and Maruti Suzuki.

While Mahindra is publicly traded on the BSE and NSE, it is actually a wholly-owned subsidiary of the Mahindra Group.

Mahindra is particularly well-known for its commercial vehicles and tractors in India. In addition, Mahindra has also been gaining progress in the passenger vehicle market, especially in the utility vehicle market.

All told, in this article, we will look at Mahindra’s market share in the domestic market of India.

Aside from the total market share, we also will look at the market share breakdown based on vehicle category which include the commercial and passenger vehicle segments.

Since Mahindra also has sizable tractor sales in India, the market share of the firm’s farm equipment sector also will be looked upon in this article.

Let’s take a look!

Investors interested in Mahindra vehicle sales by segment and tractor sales may find more information on these pages here – M&M vehicle sales India and M&M tractor sales India.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Mahindra Automotive Sector Overview

Consolidated Results

Commercial Vehicle Results

B1. Commercial Vehicle Market Share

B2. Commercial Vehicle Market Share By Category

Passenger Vehicle Results

C1. Passenger Vehicle Market Share

C2. Passenger Vehicle Market Share By Category

3-Wheelers Results

D1. 3-Wheeler Total Market Share

D2. Electric 3-Wheeler Market Share

Farm Equipment Sector

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Light Commercial Vehicle: A light commercial vehicle (LCV) is a motor vehicle designed primarily for carrying goods or specialized equipment rather than passengers.

These vehicles typically have a gross vehicle weight (GVW) — which includes the vehicle’s weight plus the maximum load weight — of up to 3.5 metric tons.

Examples of light commercial vehicles include vans, pickup trucks, and small lorries or trucks. They are often used by businesses for local deliveries and by tradespeople to transport tools and equipment.

Medium And Heavy Commercial Vehicle: Medium Commercial Vehicles (MCVs) are a category of vehicles designed primarily for the transport of goods.

Their gross Vehicle Weight (GVW) typically ranges from over 3.5 metric tons to around 16 metric tons. These vehicles can include larger vans, small trucks, and minibuses. They are suited for moderate cargo loads and are often used for regional deliveries and transportation needs.

On the other hand, heavy Commercial Vehicles (HCVs) are designed to handle the heaviest loads in commercial transport, with a GVW of over 16 metric tons. This category includes large trucks, tractor-trailers, and buses.

HCVs are essential for long-haul transportation, extensive cargo deliveries, and heavy-duty tasks. They are built to carry significant weight, including bulky goods and machinery, and in the case of buses, a large number of passengers over long distances.

Three Wheeler: Three-wheelers refer to vehicles characterized by their three-wheel configuration, with either two wheels at the front and one at the rear (delta configuration) or one wheel at the front and two at the rear (tadpole configuration).

These vehicles can be powered by various means, including internal combustion engines or electric motors. Three-wheelers come in several forms, including motorcycles with a sidecar, motorized tricycles designed for cargo or passenger transport, and modern enclosed designs aimed at energy efficiency and reduced emissions for urban commuting.

They offer a unique blend of the agility of motorcycles with the added stability and load-carrying capability of an additional wheel, making them a versatile choice for personal and commercial use.

Mahindra Automotive Sector Overview

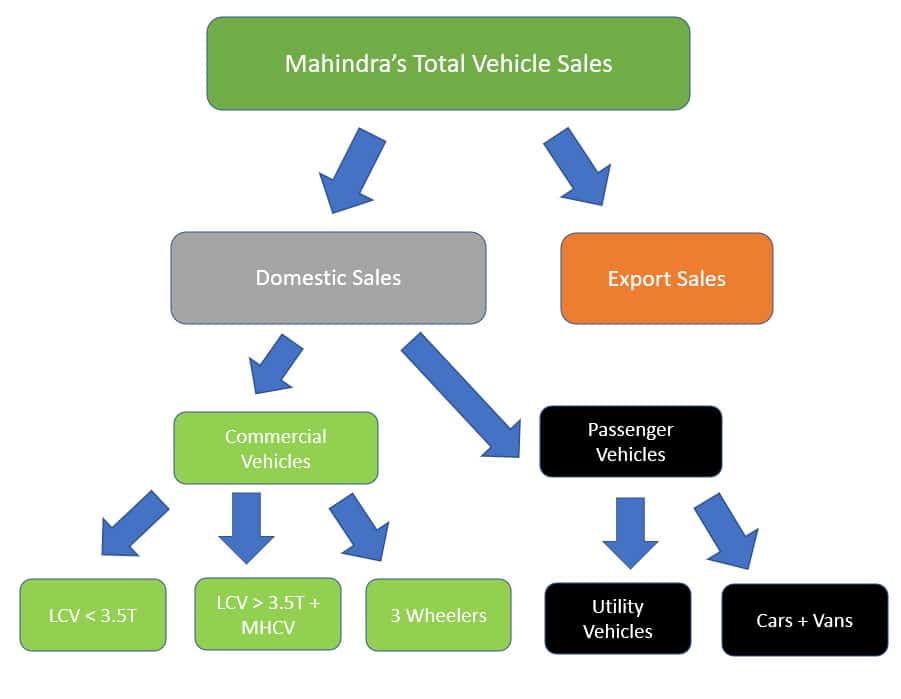

Mahindra’s vehicle sales breakdown

(click image to expand)

Mahindra’s vehicle sales are divided into 2 major categories and they are domestic and export sales as shown in the diagram above.

Domestic vehicle sales are further broken down into commercial and passenger vehicles.

Under the commercial vehicle segment, Mahindra’s vehicle sales consist of light commercial vehicles (LCV), medium and heavy commercial vehicles (MHCV), and 3-wheelers.

3 wheelers include the all-electric version and are a type of small vehicle that is similar to a motorbike but has 3 wheels instead of 2.

The definition of Mahindra’s LCV, MHCV, and 3-wheelers is available here: LCV, MHCV, and 3-wheeler.

On the other hand, Mahindra’s passenger vehicle segment is made up mainly of utility vehicles, cars, and vans.

Total Market Share

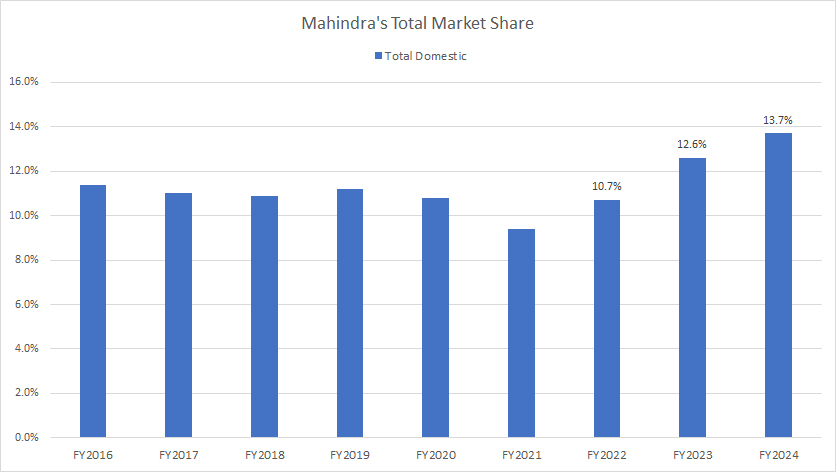

Mahindra’s domestic market share

(click image to expand)

Mahindra’s domestic market share is defined as the company’s total sales divided by the total industry volume.

That said, according to the chart above, Mahindra’s total market share in India has greatly improved in post-pandemic periods.

As seen, Mahindra’s total market share in India has increased from 10.7% in FY22 to as much as 13.7% as of FY24.

Prior to FY22, Mahindra had an average market share of less than 11% and this figure dropped below 10% in FY21, due largely to the disruption triggered by the COVID-19 pandemic.

In post-pandemic time, Mahindra’s market share in India has steadily recovered, illustrating the improving domestic automobile industry.

Commercial Vehicle Market Share

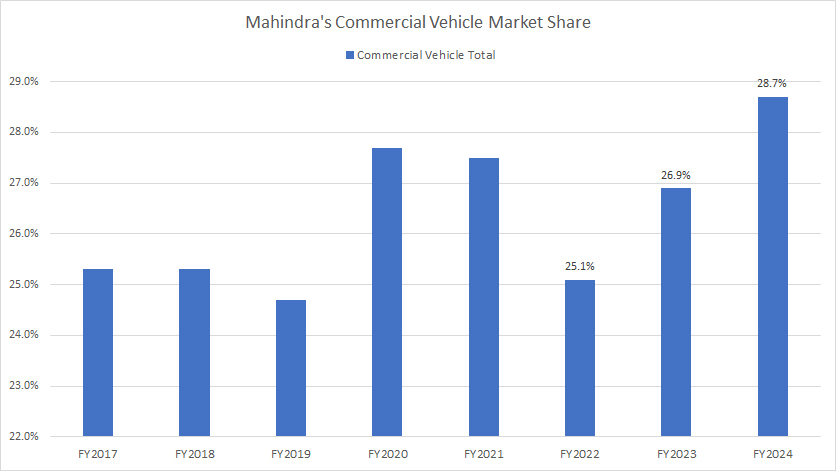

Mahindra’s commercial vehicle market share

(click image to expand)

Mahindra’s commercial vehicle market share improved modestly in FY24 to 28.7% from 26.9% reported in FY23.

As of FY2024, Mahindra’s market share of commercial vehicle in India totaled 28.7%.

Commercial Vehicle Market Share By Category

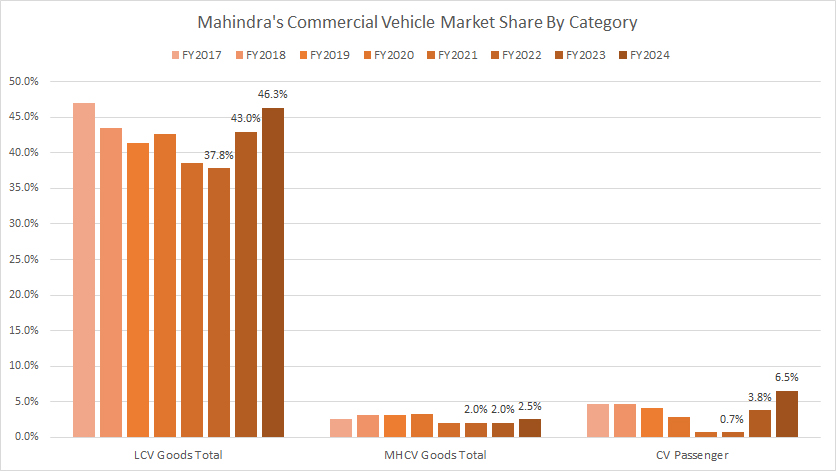

Mahindra’s commercial vehicle market share breakdown

(click image to expand)

Mahindra’s commercial vehicles market share is broken down into 3 major categories, namely LCV Goods Total, MHCV Goods, and CV Passenger. The definitions of these are available here: LCV and MHCV.

Of all commercial vehicles sold by Mahindra, the LCV Goods commands the highest market share for the company, at 46% in FY24.

Prior to FY24, Mahindra’s market share in the LCV segment had declined below 40% but this figure had remarkably recovered in post-pandemic times.

In other commercial vehicle segments which include the MHCV Goods and CV Passenger, Mahindra had very little market share and sold very few vehicles under these segments.

For example, Mahindra’s market share in the MHCV Goods category was only 2.5% in FY24 while the market share in the CV Passenger category came in at only 6.5% in the same period.

In addition, the company’s market share in the MHCV Goods segment has remained relatively low over the last several years.

On the other hand, although market share was small in the CV Passenger category, it has recovered from 0.7% in FY22 to as much as 6.5% as of FY24.

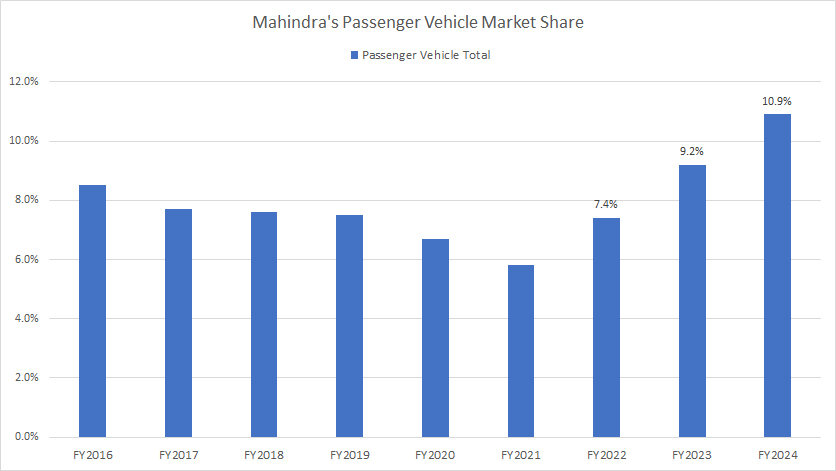

Passenger Vehicle Market Share

Mahindra’s passenger vehicle market share

(click image to expand)

Although Mahindra achieves massive success in the commercial vehicle segment, the company has not been very successful in the passenger vehicle segment.

As seen in the chart above, Mahindra’s total market share in the passenger vehicle segment totaled only 10.9% as of FY24, only about one-third of the figure in the commercial vehicle sector.

Despite the underachievement in the passenger vehicle segment, Mahindra’s market share in this category has significantly improved in post-pandemic times. For example, the latest result in FY24 even surpassed the pre-pandemic levels.

As seen, Mahindra’s 10.9% market share in the passenger vehicle sector was a record figure over the past 8 years and was a significant jump from the 6% recorded in FY21.

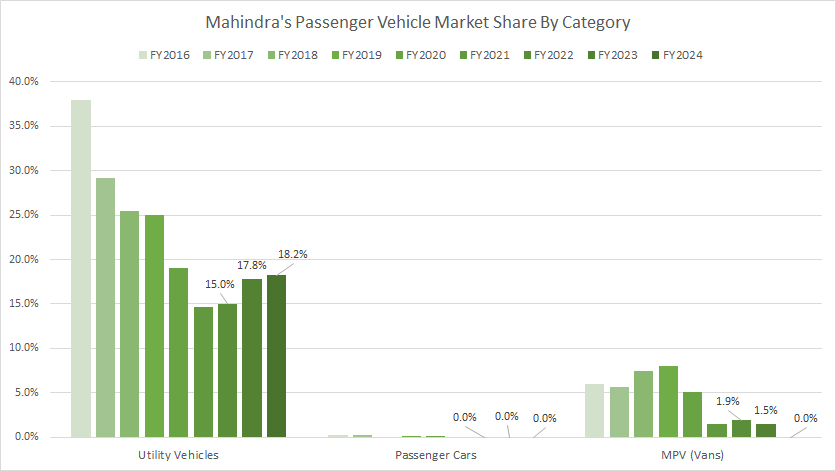

Passenger Vehicle Market Share By Segment

Mahindra’s passenger vehicle market share breakdown

(click image to expand)

Mahindra’s passenger vehicle segment is categorized into 3 segments and they are utility vehicles, passenger cars, and MPVs (vans).

Of all the passenger vehicle segments, the utility vehicle segment commands the highest market share in India for the company, reportedly at 18.2% as of FY24.

Although Mahindra’s utility vehicle market share has been on the rise over the last several years, the latest result showed that it was still less than half of the level reported back in FY14.

Therefore, in a span of 10 years, Mahindra’s market share in the utility vehicle segment has declined from 41.7% to only 18.2%.

For other passenger vehicle sectors, Mahindra has an even lower market share.

For example, Mahindra literally has zero market share in the passenger car segment while the market share for MPVs also totaled less than 1% as of FY24.

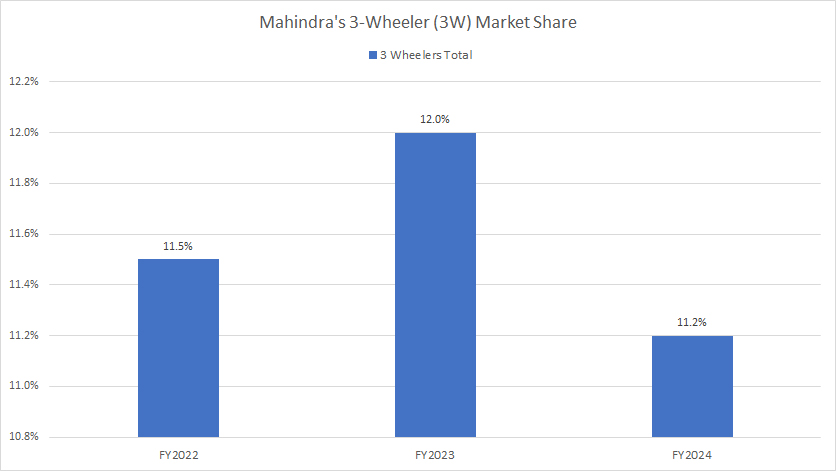

3-Wheeler Total Market Share

Mahindra’s 3 wheeler market share

(click image to expand)

Mahindra claimed to have a 11% market share for 3-wheelers in India in FY24 compared to the 12% reported in FY23.

The following quote is extracted from the company’s FY23 annual report regarding its 3-wheeler market share in India:

-

“In the Last Mile Mobility (LMM) segment, your Company sold 58,626 passenger and goods three-wheelers, a growth of 94%, with a market share of 12% in F23 vs 11.5% in F22.

Your Company has a wide range of offerings inclusive of electric, CNG, diesel, and petrol products with the latest addition being the all-new cargo electric three-wheeler Zor Grand electric.

The Zor Grand is superior in performance, mileage, and overall earning potential, and has been widely accepted by customers across the country.”

Apparently, the 3-wheeler market share figure covers all types of 3-wheelers that run on electric batteries, compressed natural gas (CNG), diesel, and gasoline.

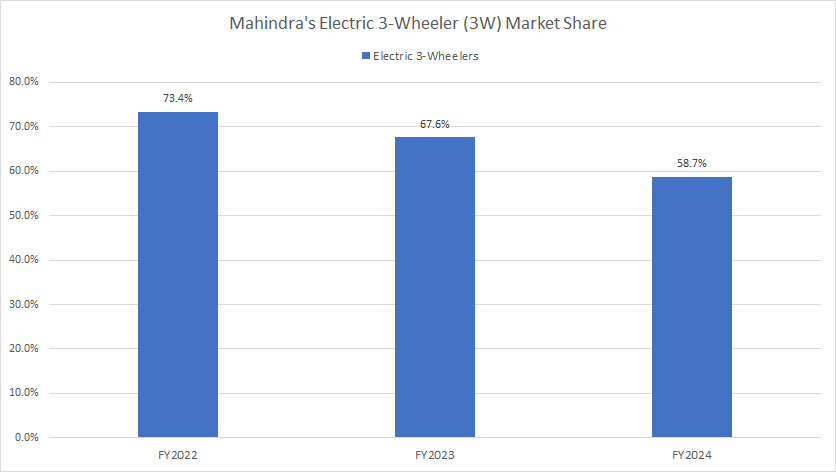

Electric 3-Wheeler Market Share

Mahindra’s electric 3 wheeler market share

(click image to expand)

For the electric version of the 3-wheelers, Mahindra has an even higher market share.

As seen in the chart above, Mahindra claimed to have a market share of as much as 58.7% in FY24 for the electric 3-wheeler in India.

Prior to FY24, Mahindra’s market share for the electric 3-wheeler in India was even higher at 73.4% and 67.6% in FY2023 and FY2022, respectively.

This figure shows that Mahindra had successfully commanded nearly three-quarters of the electric 3-wheeler market in India.

Despite the high market share, the figure dropped slightly to 58.7% as of FY2024.

The following quote is extracted from the company’s FY24 annual report regarding its electric 3-wheeler market share in India:

- “Your Company is India’s #1 EV 3W player with market share of 58.7% in 3W EVs (as per SIAM).”

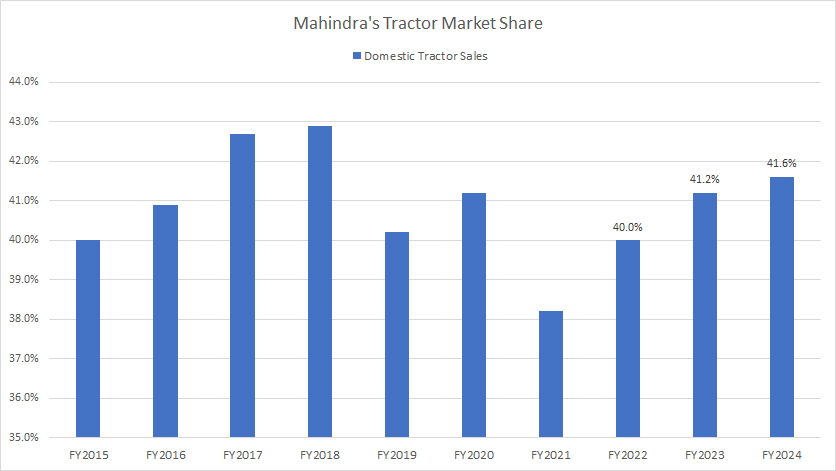

Tractor Market Share

Mahindra’s domestic tractor market share

(click image to expand)

Mahindra commands a relatively high market share in the farm equipment sector in India.

That said, Mahindra’s market share for tractors in India totaled as much as 41.6% in FY24, a rise of 0.4 percentage points over FY23.

This market share figure was achieved across a variety of brands such as Mahindra, Swaraj, and Trakstar.

This figure has remained roughly unchanged over the years, illustrating the solid competitive position of Mahindra within the farm equipment sector in India.

According to the FY24 annual report, Mahindra has continued to remain the number 1 leader in India in the farm equipment sector at a 41.6% market share.

Moreover, Mahindra has retained its market leadership position in the farm equipment sector in India for the 41 consecutive year as of FY24.

The following quote is extracted from the company’s FY24 annual report regarding its tractor market share in India:

- “Farm has been resilient in a declining industry and has gained market share of 40 bps to 41.6%. We have been able to retain the position of market leader for the 41 consecutive year.”

Conclusion

In conclusion, Mahindra appears to have had a good year in FY24, with market share figures reaching record highs across most vehicle segments.

Credits And References

1. All financial data presented in this article was obtained and referenced from Mahindra’s earnings releases, annual reports, investors letters, presentations, news releases, etc., which are available in M&M’s Investor Relation.

2. Featured images in this article are used under Creative Commons licenses and sourced from the following websites: Mahindra Genio 2.2 CRDe 4×4 and Mahindra Moto GP bike.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the full correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!