Tesla Model 3 ready for delivery. Source: Flickr

The life or death of Tesla (NASDAQ: TSLA) depends entirely on the rate of return generated by its business. If the generated rate of return is greater than the cost of borrowed capital or owners’ funds, then the business will be viable.

Otherwise, Tesla would have no long-term future. In this sense, the business would not be sustainable in the long run.

The rate of return mentioned is also called “return on investment”. It’s the single most important concept in assessing the viability of a business.

To further illustrate, the investment of a business usually refers to the assets acquired by the business.

In general, a business acquires assets by using funds drawn from the financial markets and they are usually in the forms of stockholders’ equity and/or borrowed capitals.

Stockholders’ equity is the owners’ fund and is contributed by business owners such as investors who buy Tesla’s stocks.

On the other hand, borrowed capitals are basically loans or debts such as bonds that companies issue to the capital market to raise cash.

Whichever way the business chooses to raise funds to acquire the assets, there is a price to pay. The price to be paid here would be the interest rate of the loans or the rate of return of equity demanded by stockholders.

Since Tesla has done quite several stock offerings and debt issuance in the past, it will have to pay back its shareholders and creditors.

For creditors, Tesla can pay them back by using the operating surplus derived from the efficient use of its assets. For shareholders, Tesla can reward them in the form of cash dividends or share buybacks when there is a surplus in net profit.

The measure of this operating surplus with respect to the underlying assets or the measure of the net profit with respect to equity produces the return on investment or ROI.

If this return on investment is greater than the costs of capital, notably debt, Tesla’s business will be viable and sustainable in the long run. Similarly, if the return on investment is greater than the costs of equity, Tesla’s stock price will increase over time.

On the other hand, if the long-term rate of return of the business is consistently less than the market rate, the business will not survive for long.

In this case, Tesla will have to continuously go back to the capital market for more funds to sustain the business. Similarly, if Tesla’s generated rate of return on equity is consistently below the market rate, its stock price will decrease over time.

In this article, we will focus on the return on investment or ROI of Tesla. But what exactly is the return on investment?

As mentioned, it is the measure of operating surplus with respect to the underlying assets or the measure of net profit with respect to equity.

Specifically, “return on total assets (ROTA)” and “return on equity (ROE)” are exactly the 2 metrics that we need to analyze Tesla’s return on investment or ROI.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

Profitability

B1. Operating Income

B2. Net Income

Return On Investment

C1. Return on Total Assets

C2. Return On Equity

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Return On Total Assets (ROTA): The return on total assets is arguably the most important measurement in assessing a company’s ROI. It can be derived from the equation below:

ROTA = (EBIT / Total Assets ) X 100%

From the equation above, EBIT stands for earnings before interest and taxes. In other terms, the EBIT is also referred to as the operating income.

It’s the profit after all operating cost and expense is deducted from revenue, but before interest and taxes are accounted for.

As seen from the equation, ROTA relates the operating aspect of the company to total assets. It is a measure of the operating efficiency of the company.

In general, there are 3 main operating variables the ROTA equation is assessing, namely total revenue, total expenses, and total assets.

By analyzing the 3 main operating variables, ROTA provides a comprehensive analysis of management efficiency in managing the company assets to generate the required operating surplus.

Of course, a higher ROTA ratio reflects better management efficiency in utilizing all the assets.

Return On Equity (ROE): While ROTA measures the operating efficiency, return on equity (ROE) looks at how that operating efficiency is translated into benefits to stockholders. ROE can be derived from the equation below:

ROE = (EAT / Stockholders’ Equity ) X 100%

From the equation, EAT stands for earnings after tax. It’s also referred to as the net income or net profit. Net income is the profit after all operating expenses, interest payments, and taxes are accounted for.

Similar to ROTA, ROE is also arguably one of the most important ratios that measure the efficiency of a business in driving values for shareholders.

The higher the ratio, the better the return to shareholders. You may notice that ROE is a ratio that is largely driven by ROTA. Without a good ROTA, a company finds it almost impossible to generate a satisfactory ROE.

Operating Income

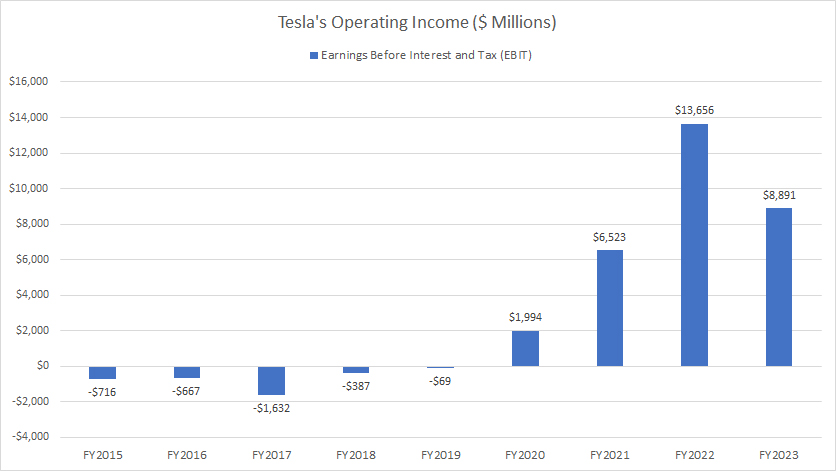

Tesla’s operating income (EBIT)

(click image to expand)

The operating income or earnings before interest and tax (EBIT) is one of the required variables in the measurement of ROTA as discussed in the above equation.

For Tesla, its operating income or EBIT had been mostly negative before fiscal 2020, illustrating that the company had operated at a loss. However, Tesla’s operating income has started to turn positive post-2020 and even risen steadily throughout fiscal 2020.

As of fiscal year 2023, Tesla’s operating income reached $8.9 billion versus $13.7 billion the previous year, a record figure since 2015. In short, Tesla has been making profit from an operational perspective since the beginning of 2020 according to the plot above.

Keep in mind that the operating income has yet to take into account other costs of doing business, including interest expenses and taxes.

Net Income

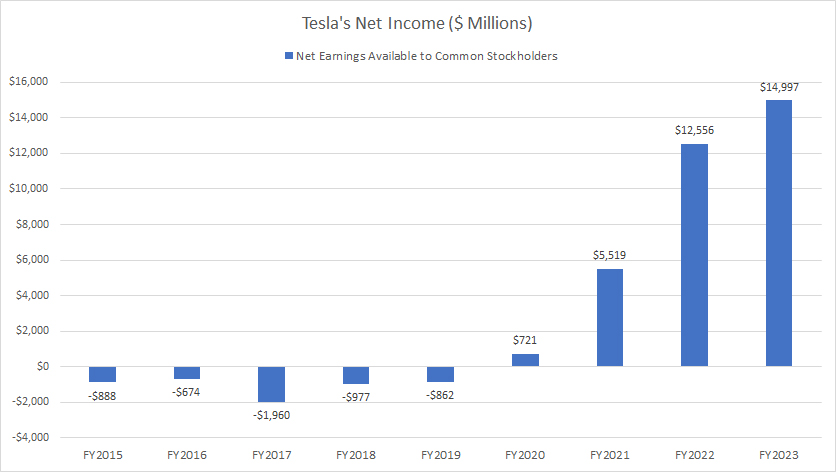

Tesla’s net income (EAT)

(click image to expand)

Similar to operating income, the net income or earnings after tax (EAT) is one of the required components in the calculation of return on equity (ROE).

Tesla’s net income has the same trend as its operating income where negative figures dominated the entire period before fiscal 2020. On average, Tesla incurred a net loss of $1 billion annually before 2020.

However, Tesla’s net income has slowly improved post-2020 and even increased steadily throughout 2020. As of fiscal year 2023, Tesla’s net income clocked $15 billion, a record profit since 2015.

At this level of profit, Tesla is making money and tonnes of it.

Return On Total Assets (ROTA)

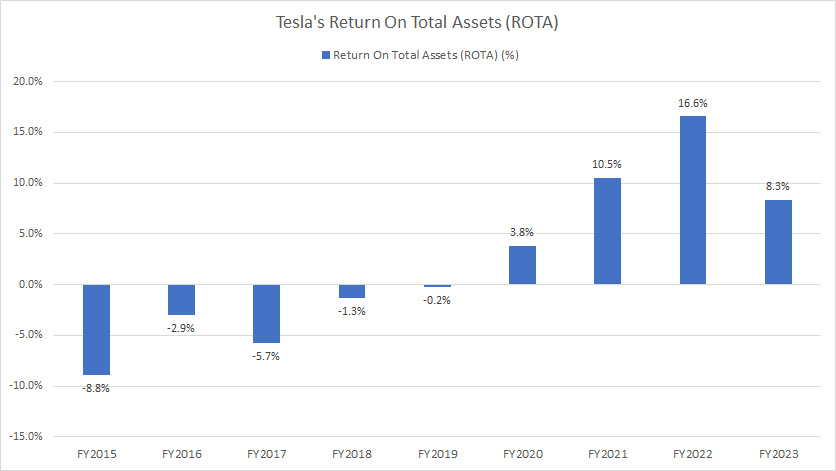

Tesla’s return on total assets (ROTA)

(click image to expand)

The definition of ROTA is available here: return on total assets. Since we already have the data for Tesla’s operating income, we can proceed to measure the ROTA which is shown in the chart above.

According to the chart, Tesla’s return on total assets had been mainly negative before fiscal 2020. The outcome is expected since the company’s operating income or earnings before interest and tax (EBIT), as discussed earlier, has been dominated by negative figures before fiscal 2020.

Tesla’s negative ROTA means that the company’s asset base did not generate enough operating surplus which Tesla could use to repay creditors. In this case, Tesla would have probably borrowed more capital or raised more cash from equity to repay creditors.

However, Tesla’s fortune slowly changed starting in fiscal 2020 when its ROTA increased and reached as much as 8% as of fiscal 2023. Tesla’s growing ROTA indicates the the success of the company in deriving an operating surplus from its asset base which the company could use to pay creditors.

Since fiscal 2020, Tesla has been having a growing ROTA, but it does not necessarily mean that the company’s internal rate of return has exceeded that of the borrowed capital.

In this aspect, with a ROTA exceeding 10% on average, Tesla’s internal rate of return should be able to exceed that of borrowed capital. As a result, Tesla has been able to repay its debt and reduce its indebtedness in the past several years as seen in this article: Tesla net cash from financing activities and Tesla debt.

On the other hand, if the cost of capital was higher than Tesla’s internal rate of return, Tesla’s long-term viability would be in question as the company’s internal rate of return would be insufficient to cover the cost of capital. In short, with a ROTA of 14%, Tesla should be able to sustain the business in the long run.

Return On Equity (ROE)

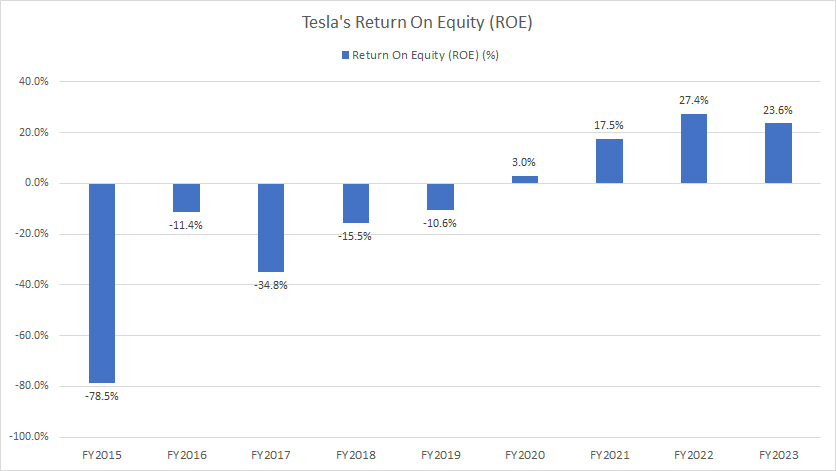

Tesla’s return on equity (ROE)

(click image to expand)

The definition of ROE is available here: return on equity. Similar to the ROTA chart, Tesla’s ROE has also been dominated by negative figures before fiscal 2020.

At a negative rate of return, Tesla had been unable to derive a surplus from its net profit to reward shareholders. If Tesla’s negative rate of return had consistently persisted, its share price would have been worth a lot less now.

Fortunately, Tesla has managed to reverse all that post-fiscal 2020, as reflected by the increasing positive return on equity. As of fiscal year 2023, Tesla managed to achieve an ROE of a massive 24%, suggesting that the company has been able to derive a significant surplus of net profit.

With an ROE of 24%, Tesla’s rate of return should be much greater than the rate of return demanded by shareholders. If the rate of return demanded by shareholders is 10%, Tesla’s stock price will be projected to grow over time provided that the company can keep its ROE at this rate going forward.

Tesla will have to consistently achieve an ROE at this rate going forward to sustain an increasing stock price. In general, the ROE ratio reflects the rate of return to shareholders. A strong ROE brings success to the company and results in a higher share price. This is what we have been seeing since 2020.

Furthermore, a good ROE enables a company to have easier access to new funds – almost certainly at a lower rate – to enable the company to grow even further and generate greater profits given a suitable market condition. The cycle will subsequently lead to higher share prices and bring greater wealth to stockholders.

Conclusion

In summary, Tesla’s return on investment, or ROI can be analyzed by looking at the internal rate of return generated by the business.

The internal rate of return can be derived by the measure of operating surplus with respect to the underlying assets or the surplus from net profit with respect to the equity that produces it.

The 2 most commonly used approaches to measuring the rate of return of a business are Return on Total Assets (ROTA) and Return on Equity (ROE).

ROTA measures the operating efficiency of a business while ROE looks at how that operating efficiency is translated into profits for its shareholders. Tesla’s ROTA reaches 8% as of fiscal 2023 while ROE reaches 24% in the same period.

Tesla will have to consistently generate a greater rate of return to sustain the business. In short, Tesla has a good return on investment.

References and Credits

1. All financial figures presented in this article were obtained and referenced from Tesla’s annual reports published in Tesla Investor Relations.

2. Flickr images.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the full correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!

Great summary of ratio analysis, plus I seem to agree with the conclusion you come up with.

Also read your post of stock dilution over the years which match your statement of tesla being on “life support”. Makes me wonder which tools and valuation models wall street analysts are using to justify such high price targets with little explicit positive fundamentals to rely on.

Thanks for the feedback. I would love to hear what readers have to say. Please do not hesitate to pinpoint and criticize if you found any mistake or discrepancy in the article.

Yes, “life support” is certainly a good way of explaining it.

Similar to the term “outpatient care” that was used by another author to describe parents paying for their adult children’s financial obligations year in and year out with no end in sight.

So, in summary…based upon financial facts…it appears that the stock price has a good percentage of “irrational exuberance” embedded within.

Although I wish all the best to Tesla, it’s interesting to note that any mainstream company that dared to put up such a long string of red numbers would see their stock price get hammered immediately with calls for some or all of the C-suite to resign.