Tesla supercharger rally. Source: Flickr Image.

The accounts receivable is an important current asset in a company’s balance sheet.

It’s not only a metric that tells about the credit policy of a company but also an indicator of the growth of the company.

It’s no exception for Tesla (NASDAQ:TSLA).

In Tesla’s balance sheet, the accounts receivable is the 2nd largest asset after cash and was even bigger than the inventory in fiscal 1Q 2021.

In this article, we are going to look at Tesla’s accounts receivable to find out how this current asset has changed over the years.

In line with the company expanding operation, we should be seeing an expanding account receivable which should grow steadily along with the revenue growth.

In addition, we will also examine several accounts receivable metrics, including the accounts receivable to sales ratio, accounts receivable to current assets ratio, accounts receivable turnover ratio and days sales outstanding.

These ratios generally measure the health of Tesla’s account receivable as well as the efficiency of the company in payment collection.

By digging into these ratios, we can find out about Tesla’s credit policy in addition to how efficiently the company collects cash from credit sales.

Let’s go!

Tesla’s Accounts Receivable Topics

1. Accounts Receivable Breakdown

2. Accounts Receivable Chart

3. Accounts Receivable to Sales Ratio

4. Accounts Receivable To Current Asset Ratio

5. Days Sales Outstanding

6. Accounts Receivable Turnover Ratio

7. Conclusion

Tesla’s Accounts Receivable Breakdown

According to Tesla’s financials, its accounts receivable primarily includes the following items:

- 1. Amounts related to sales of powertrain systems.

- 2. Sales of energy generation and storage products.

- 3. Receivables from financial institutions and leasing companies offering various financing products to Tesla customers.

- 4. Sales of regulatory credits to other automotive manufacturers.

- 5. Maintenance services on vehicles owned by leasing companies.

Tesla mentioned that the company does not carry significant accounts receivable related to vehicle sales as customer payments are normally due prior to vehicle delivery.

As a result, most transactions related to vehicle sales are cash transactions.

Nevertheless, some receivables do come from vehicle sales but the amounts are not expected to be significant.

My opinion is that the accounts receivable for vehicle sales should be mostly coming from payments owed by financial institutions for approved financing arrangements between Tesla’s customers and the financial institutions.

It may take only a couple of days for Tesla to get these payments when the customers opt for a loan to buy the company products.

However, for other products such as regulatory credits sales, Tesla may take a longer time to collect the payments as reflected in the following days sales outstanding.

Chart of Tesla’s Accounts Receivable

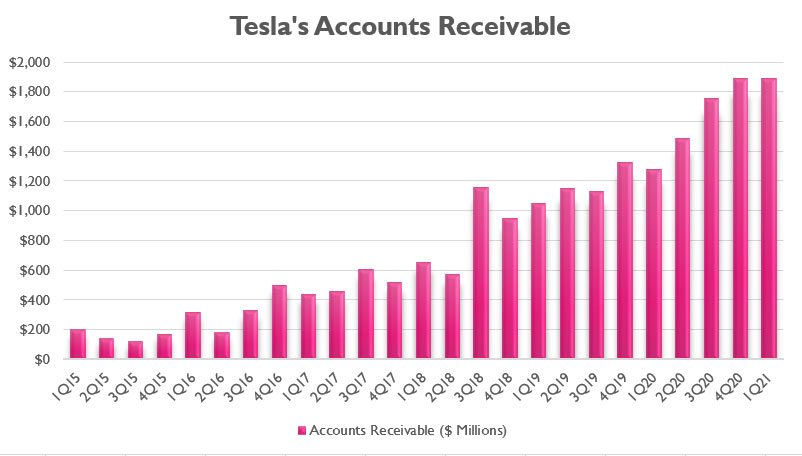

Tesla’s accounts receivable

The chart above shows Tesla’s quarterly accounts receivable for the period from 2015 to 2021.

As shown in the chart above, Tesla’s accounts receivable has been on a rise, reaching as much as $1.9 billion as of Q1 2021.

Back in fiscal 2015, Tesla reported an account receivable of only $200 million, which was a far cry from the latest figure.

For perspective, Tesla’s accounts receivable has grown more than 800% in the last 6 years.

Tesla’s impressive growth in accounts receivable has been mainly driven by business expansion. As the company’s revenue grew over the years, so did the accounts receivable.

Looking at the accounts receivable alone does not tell us much about Tesla’s financial well-being.

As such, we need to look at other ratios, including the accounts receivable to sales ratio which measures the amount of accounts receivable with respect to revenue.

Let’s move on.

Tesla’s Accounts Receivable to Sales Ratio

Tesla’s accounts receivable to revenue ratio

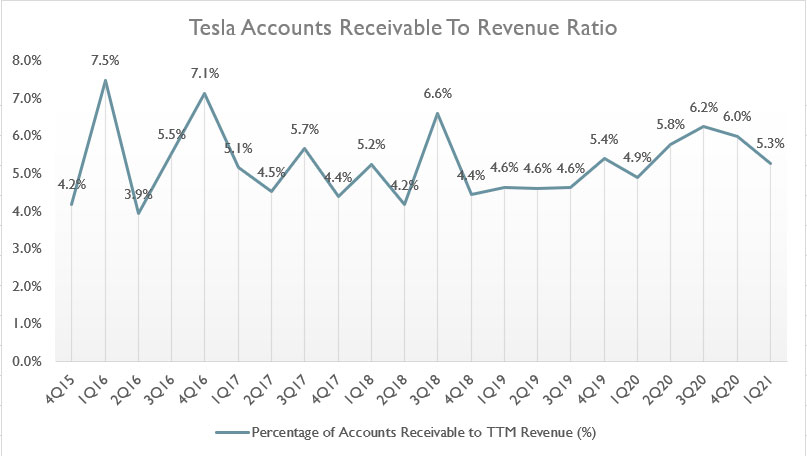

The chart above represents Tesla’s accounts receivable to TTM revenue ratio expressed in percentage.

A higher percentage indicates that more sales are made on credit.

An increasing ratio could potentially lead to short-term liquidity problem since most revenues are tied up in accounts receivable, thereby slowing down the cash conversion cycle for the company.

In general, a low account receivable to sales ratio is almost always favorable which means more cash is available for the company.

As seen from the chart above, Tesla’s ratio has remained relatively stable at less than 10% over the 6-year period.

On average, Tesla’s accounts receivable to sales ratio is roughly 5% between 2015 and 2021.

At only 5% of sales, Tesla doesn’t seem to have any liquidity issue with its accounts receivable as most sales are done in cash transactions.

As discussed, Tesla makes most of its sales with cash, we should expect that the company accounts receivable to revenue ratio to be reasonably low.

The chart above shows that the ratio has been consistently low at an average ratio of just 5% for the past 6 years.

In short, we can safely conclude that Tesla’s account receivable has been reasonably low with respect to sales and does not pose any threat to the company’s liquidity.

Tesla’s Accounts Receivable To Current Asset Ratio

Tesla’s accounts receivable to current assets ratio

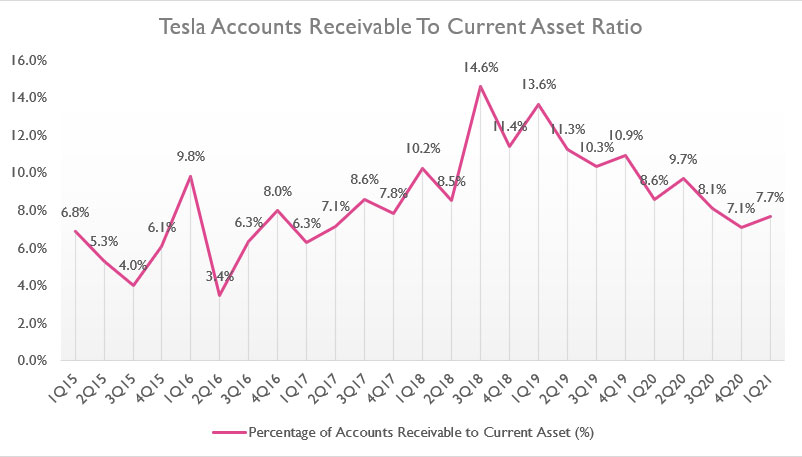

Another ratio that is worth taking a look at is the accounts receivable to current asset ratio which is shown in the chart above.

Generally, current asset equals working capital.

This ratio measures how much working capital is locked up in account receivables.

A high ratio indicates that too much working capital is tied up in accounts receivable and this means less cash is available to the company and this may lead to a liquidity problem.

As seen from the chart, Tesla’s accounts receivable to current assets ratio had steadily trended upward to nearly 15% in fiscal 3Q 2018.

However, the ratio has since declined and reached only 8% as of fiscal 2021 1Q.

While Tesla’s account receivable to the current assets ratio had trend upward in the past, it was still reasonably low at less than 20% of current assets.

Besides, the ratio has since declined and trended downward to only 8% in the latest quarter.

Again, we can safely conclude that Tesla accounts receivable has been reasonably low with respect to total current assets and does not affect the company’s short-term liquidity.

Tesla’s Days Sales Outstanding

Tesla’s days sales outstanding

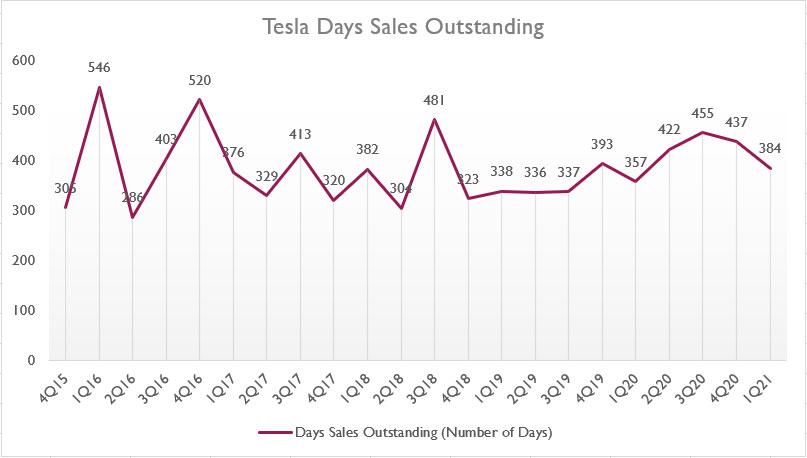

Another ratio that most investors and analysts pay close attention to when analyzing accounts receivable is the days sales outstanding ratio.

The days sales outstanding ratio measures the number of days the company collects its payments from credit sales.

The formula used to arrive at the days sales outstanding number in the chart above is shown below:

DSO = (Accounts Receivable / TTM Credit Sales) X 365 Days

The ratio in the chart above is expressed in days.

Tesla’s TTM credit sales can be derived from the accounts receivable to TTM revenue ratio which we saw earlier.

In this case, Tesla’s percentage of credit sales is around 5% on average as discussed earlier.

From the chart, Tesla’s days sales outstanding looks reasonably consistent over the shown period and have been between 300 and 500 days range.

On average, Tesla’s days sales outstanding clocks in at 384 days for the period between fiscal 2015 and fiscal 2021.

What this figure means is that Tesla takes, on average 384 days, to collect payments from vendors after credit sales.

My opinion is that Tesla’s days sales outstanding of 384 days (more than 1 year) is quite long considering that the company takes more than 1 year to collect the payments after credit sales.

As of 1Q 2021, Tesla’s days sales outstanding of 384 days was in line with the average figure.

Besides, Tesla’s ratios have been quite stable in recent quarters.

While the ratio has trended higher to 455 days in fiscal 3Q 2020, it slowly came down in subsequent quarters, indicating that the company credit policy has not changed much despite having the COVID-19 disruptions lately.

Nonetheless, we will keep track of the ratio from quarter to quarter so that we can get to it before it gets out of hand.

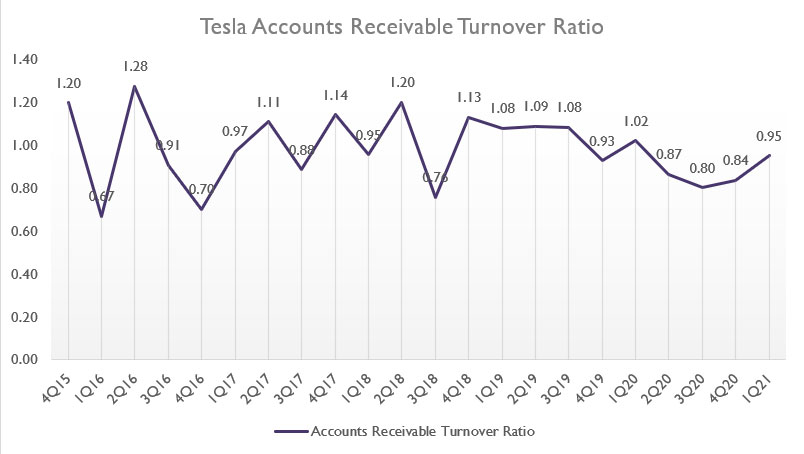

Tesla’s Accounts Receivable Turnover Ratio

Tesla’s accounts receivable turnover ratio

Another ratio that is as important as all the others is the accounts receivable turnover ratio.

This ratio is basically the same as the days sales outstanding except that this ratio measures the number of times the accounts receivables have turned for a given period.

The measured period here can be in quarters or years.

The higher the numbers, the better the company is at collecting payments.

For example, if the receivable turnover ratio is 10 in a year, it means that the accounts receivable have turned over 10 times in a year.

The accounts receivable turnover ratio is actually the reverse of the days sales outstanding.

The formula used to arrive at the accounts receivable turnover ratio is as follow:

AR Turnover Ratio = TTM Credit Sales / Accounts Receivable

All told, the ratio looks pretty much flat over the shown period and has slightly fluctuated between the 0.70 and 1.30 range.

On average, Tesla’s accounts receivable turnover ratio is around 0.98 on a trailing 12-month basis.

What the figure means is that Tesla managed to turn the accounts receivable over at about 1 time in a year on average.

In other words, Tesla manages to collect payments only 1 time on average within any single year.

As of Q1 2021, Tesla’s account receivable turnover ratio of 0.95 was in line with the average, showing that the company credit policy has not changed much even during the age of the COVID-19 pandemic.

Conclusion

Tesla’s accounts receivable keeps on increasing year on year and quarter over quarter, and have reached $1.9 billion as of fiscal Q1 2021.

Tesla’s expanding accounts receivable has to do with the slow collection period of the company which takes about 1 year on average as seen in the days sales outstanding ratio.

For Tesla’s accounts receivable turnover ratio, the company only managed to collect 1 time for its credit sales on average from a trailing 12-month perspective.

While Tesla has been slow in collecting its payments from credit sales, the ratio of its accounts receivable to TTM revenue has been small, at only 5% on average.

As such, Tesla’s increasing accounts receivable should not be an issue for the company considering that only 5% of its total sales are tied up as accounts receivable or 8% of total current assets.

References and Credits

1. All financial figures in this article were obtained and referenced from Tesla’s quarterly and annual reports which can be found in: Tesla Investor Relations.

2. Featured images in this article are used under creative commons license and are sourced from: Todd Van Hoosear.

Other Stock Analysis That You May Enjoy

Disclosure

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

“My opinion is that the accounts receivable for vehicle sales should mostly come from payments owed by financial institutions for approved financing arrangements between Tesla’s customers and the financial institutions. It may take only a couple of days for Tesla to get these payments when the customers opt for a loan to buy the company products.”

Tesla does not have a financing subsidiary like most auto manufactures and sells its vehicles directly not through dealerships. If you look at the balance sheets of the major dealership groups, like the two largest, AutoNation Inc. and Penske Automotive Group you will also find high account receivables. AutoNation’s Q2 2020 10-Q shows receivables equal to 13.5 calendar (not sales) days of average revenue and 19.1% of current assets. Penske’s Q1 10-Q, 11.2 days and 11.4%.

The reason for the high receivables is because it takes far more than a couple of days for dealers in the United States to receive the proceeds of loans from financial institutions that are financing auto purchases. This is so big a thing for auto dealers that they have a special type of accounts receivable just for it called “Documents in Transit”. Before a lender will make the payment it must be in possession of the vehicle title and lien (the lien is printed on the title). For a new vehicle the process starts with the dealer presenting a Manufacturer’s Certificate of Origin, a paper document (although often machine readable), to a state motor vehicle agency. Even in the best of times these agencies are not terribly quick. Dealers do get preferential treatment but still face long waits. During the COVID emergency the DMV situation got much worse. Here in Connecticut the current wait time for the DMV to issue a title for dealers using its online system is 21 days. There are many states that now use an electronic lien title system that transmits the lien and title to the lender overnight. In the other states the titles are mailed. Once the lender has the title and lien, only then is the payment made. In the old days that payment was made by check printed overnight and mailed the next business day but these days it may be electronic.

I know something about this because I supported accounting systems for dealership associations in the 1970s and was the lead developer for a bank that was a major issuer of auto loans of the pilot Electronic Lien Transfer System with a state DMV in the 1990s.