A Tesla electric vehicle production line. Source: Flickr Image.

Tesla may become the next Apple or Google possibly within the next 5 years.

As such, it may seem like a no-brainer to invest in Tesla’s stocks now while the company is still years away from being the next trillion-dollar company.

However, there is a significant risk associated with Tesla’s stocks.

In this article, we are going to list out and discuss several risk factors associated with investing in Tesla’s stocks.

Let’s take a look.

Tesla’s Stock Risk Topics

1. Risk 1: Tesla is way overvalued

2. Risk 2: Tesla is unprofitable without carbon credits

3. Risk 3: Tesla’s stock is volatile

4. Risk 4: Tesla does not pay dividend

5. Risk 5: Tesla’s competition is growing

6. Risk 6: Tesla still needs external fundings

7. Conclusion

Risk 1: Tesla is way overvalued

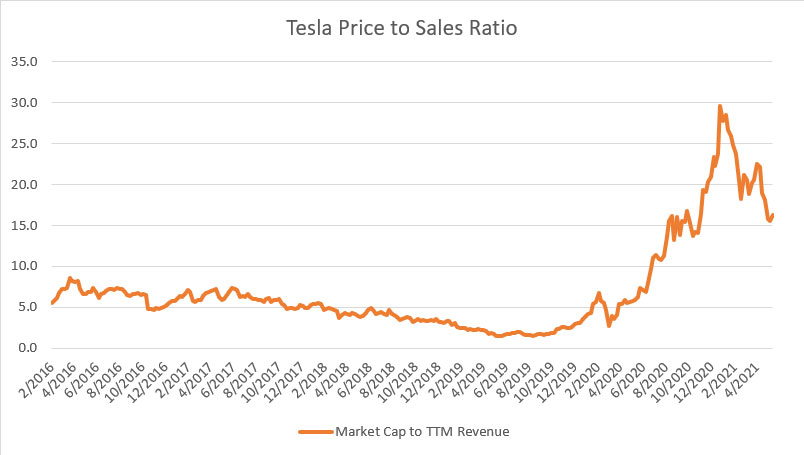

Tesla’s price to revenue ratio

When this article was published, Tesla’s stock was traded at $600 per share, nearly 35% lower than its record high of $900 per share.

While Tesla’s stock has traded down significantly from its prior highs, it was still way overvalued by all measures.

For example, in terms of price to sales ratio, Tesla’s valuation is currently at 16.0X its TTM revenue based on the $600 stock price.

Historically, Tesla’s price to sales ratio averaged only 7.0X from 2016 to 2021.

Therefore, Tesla is currently valued at more than twice its historical valuation from a price to sales perspective.

Additionally, Tesla’s current valuation with respect to TTM gross profit is also at a historical high of 77.0X.

Tesla’s price to gross profit ratio averaged only 35.0X between 2016 and 2021.

Therefore, Tesla’s stock is currently traded at more than twice its TTM gross profit.

Aside from TTM sales and gross profit, Tesla’s stock is also valued at 150.0X and 87.0X of its TTM free cash flow and TTM EBITDA, respectively.

Not to mention Tesla’s price-to-earnings ratio (PE ratio) which is hovering around the 600.0X territory.

I believe there are not many companies out there trading at this PE ratio, even for those who are extremely profitable.

In short, Tesla’s valuation is at a sky-high level by all metrics.

Risk 2: Tesla is unprofitable without carbon credits

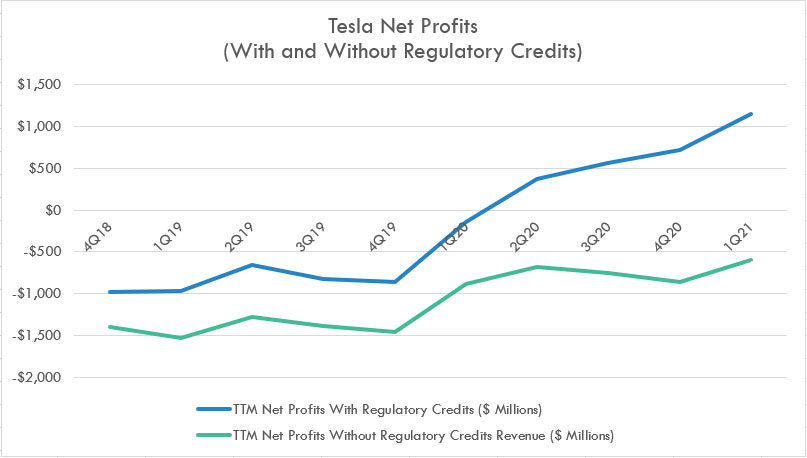

Tesla’s profit with and without carbon credits

While Tesla has recently generated tonnes of profits, they did not come from selling cars as shown in the chart above.

Instead, Tesla’s profits came from the so-called regulatory or carbon credits.

For your information, Tesla’s sales from carbon credits alone totaled $1.5 billion in FY2020.

Year to date, Tesla earned more than $500 million in revenue from carbon credits and is projected to make $2 billion in sales from carbon credits by the end of FY2021.

While the sales of carbon credits do not pose any harm in any way to Tesla or the environment, they are controversial to the company’s bottom lines.

First of all, carbon credits do not have any costs of sales, meaning that whatever Tesla earned from them goes straight to its bottom lines.

If Tesla makes $2 billion in sales from carbon credits, this $2 billion will directly contribute to its net income as seen from the chart above.

Therefore, carbon credits are extremely profitable since they exist out of thin air and will be here to stay as long as automakers producing fossil fuel vehicles still exist.

Secondly, while carbon credits will be here to stay in the foreseeable future, they will not stick around forever, meaning that they will still go away someday when electric vehicles become fully mainstream.

In other words, carbon credits revenues are not sustainable in the long haul.

If Tesla keeps relying on regulatory credits for profits, the company will incur heavy losses when a large chunk of sales that come from regulatory credits vanishes.

Additionally, Tesla’s stock will also be extremely dangerous if its businesses need to rely on regulatory credits for profits.

In this aspect, there is certainly something wrong with Tesla’s businesses if they can’t even produce a decent profit without depending on carbon credits revenue.

Risk 3: Tesla’s stock is volatile

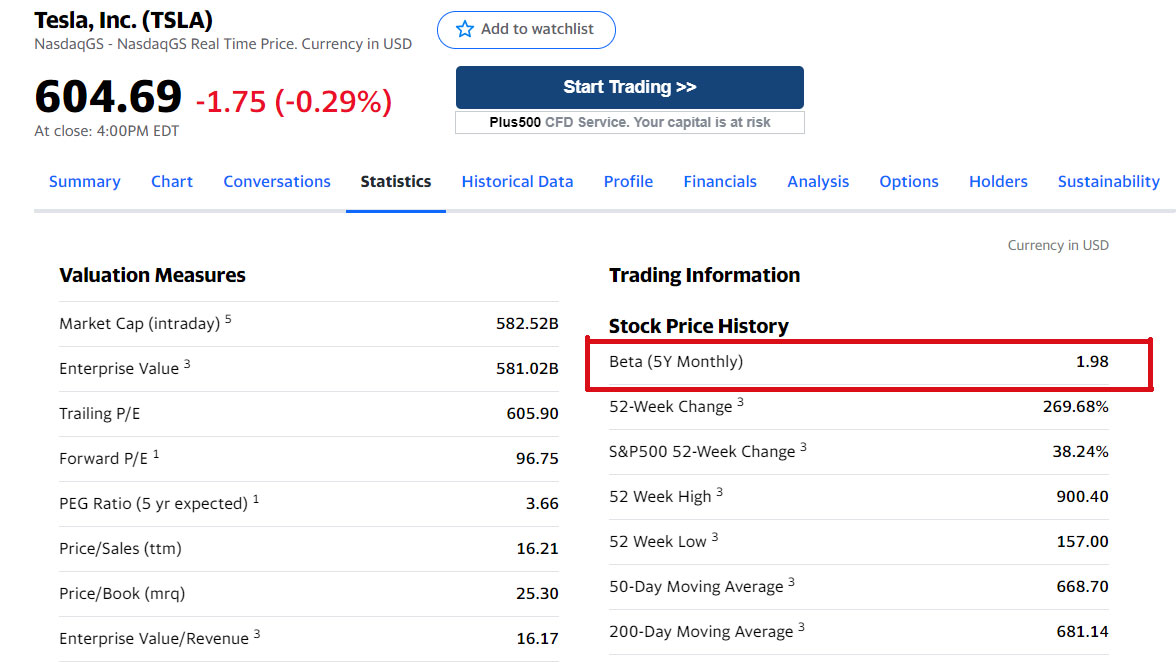

Tesla’s stock statistics

There is no doubt that Tesla’s stock is volatile.

As seen from the snapshot above, Tesla’s stock has a beta of 1.98, an extremely volatile territory.

From a comparison perspective, Apple has a beta of only 1.20 and Amazon has an even lower beta of 1.15.

Additionally, both Ford and GM have a beta of only 1.17 and 1.36, respectively.

While the stocks of these companies are still volatile compared to the overall market, they are not as volatile as Tesla’s stock.

Tesla’s stock price history

Based on Tesla’s 52-week stock price history above, Tesla’s stock could swing in an extremely large margin within a month, notably more than 10%.

For example, between Aug and Sept 2020, Tesla’s stock has gained 66% whereas the stock has tumbled more than 20% between Feb and March 2021.

The volatility of Tesla’s stock has to do with its sky-high valuation as discussed in prior paragraphs.

There are a lot of expectations being priced in at the current stock price.

Therefore, if there is a slight chance that Tesla failed to meet these expectations, the stock will tumble dramatically.

As an investor, if you can’t stomach the risk and the volatility, Tesla’s stock is not for you.

Tesla’s stock is even more dangerous if you are looking for short-term gain.

As discussed, Tesla’s stock could tumble more than 10% in a matter of several days.

So, think twice before piling up on Tesla’s stocks with your hard-earned money.

Risk 4: Tesla does not pay a dividend

While most major automakers such as General Motors and Ford pay dividends, it’s a different story when it comes to Tesla.

For your information, Tesla has never declared nor paid any dividends since its IPO in 2010.

Consistent losses and negative free cash flow over the years have deprived Tesla of its ability to pay out any dividends now and in the foreseeable future.

Furthermore, Tesla also carries a substantial amount of debt.

The respective debt covenants may restrict Tesla from distributing profits, if there is any, in the form of dividends.

Therefore, investors who are looking for a stable dividend income will definitely find Tesla’s stock uninvestable.

Not until the company can consistently and meaningfully make a profit and generate a substantial amount of free cash flow, existing shareholders can only hope for a capital gain in Tesla’s shares instead of a dividend payout from the company.

Risk 5: Tesla’s competition is growing

Ford F-150 Full Electric

Tesla is facing multiple assaults from competitors that come with much more resources, including Ford, General Motors, Volkswagen, etc.

Unlike Tesla, they are profitable automakers with much bigger profits and are generating free cash flow many times higher than that of Tesla.

What makes them a formidable competitor is that they do not need to rely on the capital market to raise cash for the transition to a full EV player.

Their internal business operations are able to generate sufficient working capital as well as a free cash flow to fund the expansion.

That said, these fearsome automakers can easily take on Tesla and break its monopoly on the EV market in a matter of a year.

Additionally, these automakers have recently unveiled stunning and sophisticated electric vehicles that are meant to take on Tesla and capture the growing EV market.

For example, the multiple new models from GM and Ford are as good as if not better than Tesla’s current models.

While Tesla has recently unveiled the Model Y and Cybertruck and already started the production of these models in the U.S. and China Gigafactories, they have yet to be proven as a game-changer.

Although Tesla is still leading the EV race, it’s too early to count on it as the winner.

Risk 6: Tesla still needs external fundings

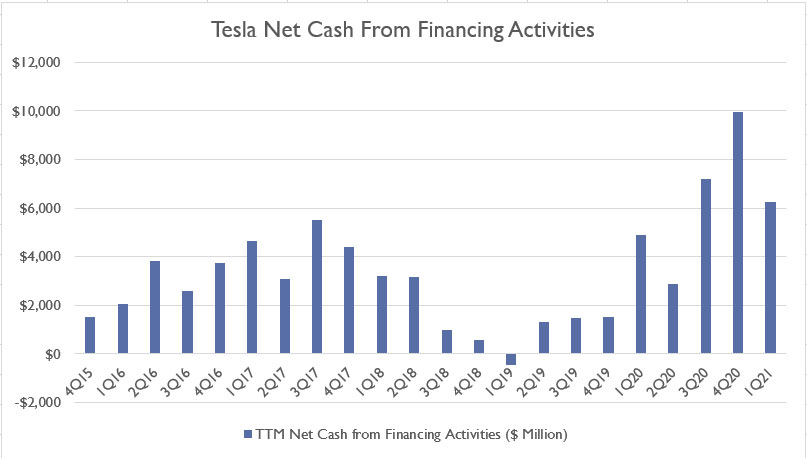

Tesla’s net cash from financing activities

When it comes to doing business, capital or precisely, cash is king.

Unfortunately, Tesla has little of it.

According to this article – Tesla’s capital raise, Tesla has been unable to generate sufficient free cash flow to expand its operations.

While the company has been free cash flow positive in recent quarters, it was far from enough for business expansion.

As a result, Tesla has been consistently resorting to the capital market to raise cash as seen from the chart above.

In the above chart, Tesla’s net cash from financing activities has been entirely positive from a TTM perspective.

In other words, Tesla has been raising cash through debt and/or equity over the years.

While a capital raise through external sources is a normal business practice, it’s a very risky move if Tesla does it very often.

Firstly, a capital raise through debt borrowings will result in higher interest expenses.

As a result, Tesla may not be able to service the growing interest expenses and repay the debt if businesses deteriorate as a result of competition or economic slowdown.

Secondly, Tesla’s existing shareholders will be highly diluted if the company constantly issues equity to raise cash.

For your information, Tesla has been issuing equity in recent quarters to raise cash and hence, the never-ending growth of Tesla’s stocks outstanding.

Well, as long as the capital market is available to Tesla, the company will most likely be fine.

If the capital market dries up or refuses to extend financial assistance to Tesla for whatever reasons, the company will be in a deep hole.

Conclusion

Tesla has been a great company and in fact, one of the best in class in the automobile industry.

The company has been producing some of the best electric vehicles in the world, one that always turns heads wherever they are.

However, a great company does not necessarily mean a great investment, especially for Tesla.

There are many aspects that potential investors need to look at such as profitability, cash flow and business prospects before deciding on the investment.

For a growth company like Tesla, there are many risk factors associated with buying its stocks and these risk factors have been laid out in the discussions above.

From the discussion, defensive investors especially retirees who are concerned with volatility, and are interested only in dividend income, should probably take a pass on Tesla’s stocks.

References and Credits

1. All financial figures in this article were obtained and referenced from Tesla’s annual and quarterly filings available in Tesla Quarterly and Annual Reports.

2. Featured images in this article are used under creative commons license and sourced from the following websites: Yasunari Goto.

Other articles that you might be interested:

Disclosure

Readers, investors, analysts, bloggers, visitors, researchers, writers, or academicians are highly encouraged to use, copy, quote, distribute, duplicate, modify, edit, upload, download, share and link any materials on this webpage such as the charts, snapshots, texts, paragraphs, etc. in your websites, research papers, essays and so on.

You can credit back to this page by a link or a mention of the website. Thanks for sharing!