A coal power plant. Flickr Image.

ARLP or Alliance Resource Partners, LP, is another commodity-based company whose stock price has benefitted greatly from the recent commodity boom.

The company’s stock price has been on a tear as of late, with a return totaling more than 500% in just 3 years.

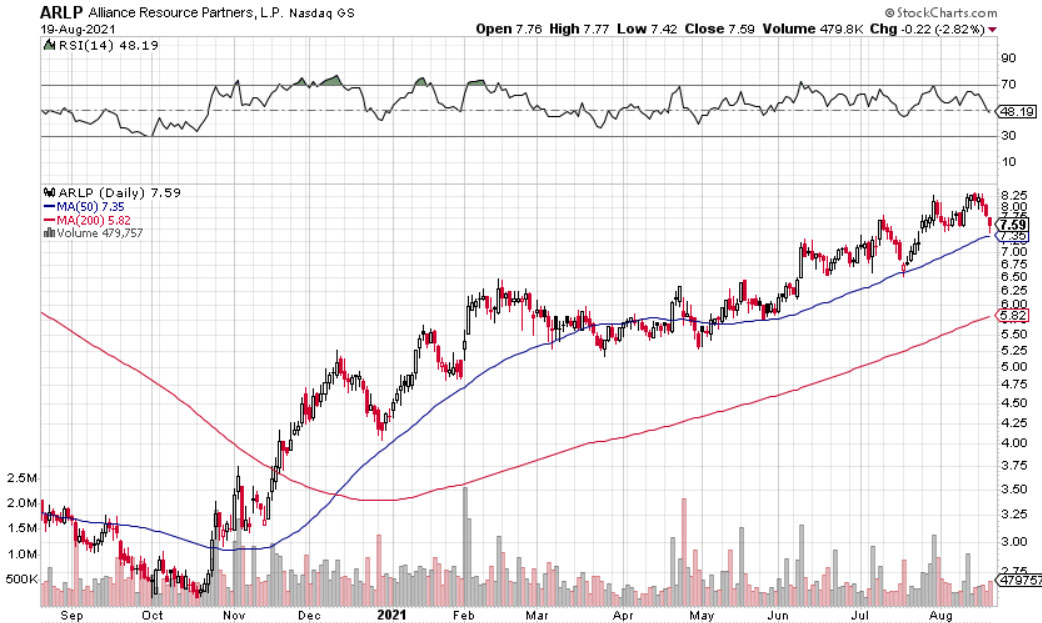

ARLP’s stock price. Source: StockCharts.com

As shown in the snapshot above, ARLP’s stock price was traded at only $3 USD per share at the end of 2020 and was around $18 USD per share as of the time this article was published.

Unlike Peabody (BTU) and Arch Resources (ARCH) whose mining operations have been primarily focused on coal, Alliance Resource Partners is a diversified natural resource company that generates income not only from coal mining but also from oil & gas mineral interests located in strategic regions across the United States.

While ARLP gets its revenue source from multiple channels, its primary source of income is still coming from coal sales.

In fiscal 2022, 2021, and 2020, ARLP’s revenue from coal sales alone contributed more than 90% of the company’s total sales.

Therefore, ARLP is still pretty much a coal company with the majority of its sales coming from coal mining.

In this article, we will look at ARLP’s coal sales volume, including the coal sales by segment, coal royalties, and the profitability of the company’s mining operations.

ARLP’s coal segment profitability is reflected in the adjusted EBITDA and adjusted EBITDA margin provided by the company.

Let’s check them out!

Table Of Contents

Coal Mining Operations Overview

A1. Mine Locations

Coal Sales Volume By Segment

B1. Segment Coal Sales Volume By Year

B2. Segment Coal Sales Volume By TTM

Profitability

C1. Coal Segment Adjusted EBITDA

Margins

D1. Coal Segment Adjusted EBITDA Margins

Summary And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

ARLP’s Locations Of Coal Mining Operations

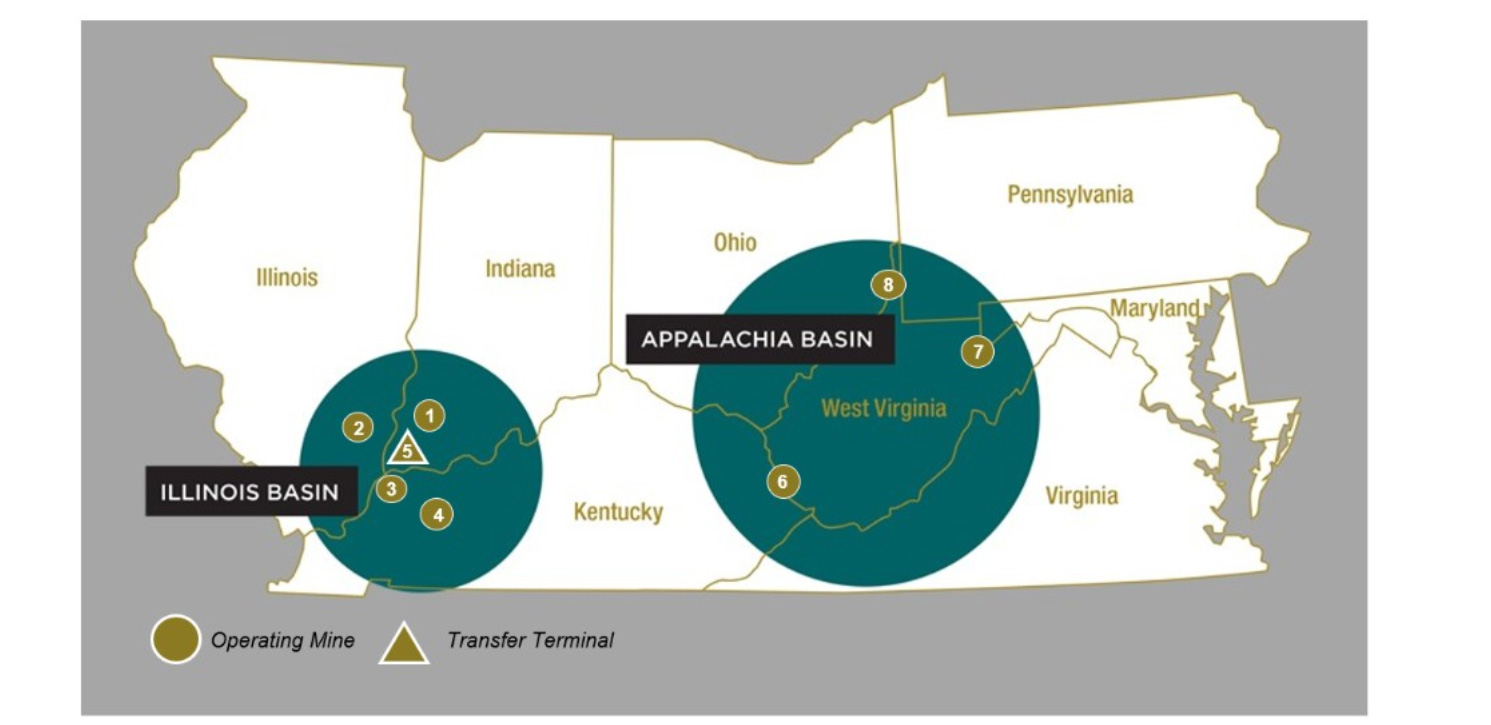

ARLP locations of coal mining operations

(click image to enlarge)

Alliance Resource Partners’ mining complexes are located primarily in the Mideast and Midwest of the United States.

These areas are known as Illinois Basin and Appalachia Basin.

The Illinois Basin alone contains 4 mining complexes and they are: 1. Gibson Complex, 2. Hamilton Complex, 3. River View Complex, and 4. Warrior Complex.

On the other hand, there are 3 mining complexes located within the Appalachia Basin, and they are 6. MC Mining Complex, 7. Mettiki Complex, and 8. Tunnel Ridge Complex.

For your information, these mines are run and operated by Alliance Resouce Partners through its subsidiaries.

The locations of ARLP’s coal mineral interests are slightly different from the snapshot shown above.

That said, the River View Complex is among the most productive in the Illinois Basin, with a coal production capacity topping 10.2 million tons in 2022.

For Appalachia Basin, the Tunnel Ridge Complex produced up to 8.3 million tons of coal in 2022, the largest among all mine complexes in this area.

ARLP’s Segment Coal Sales Volume By Year

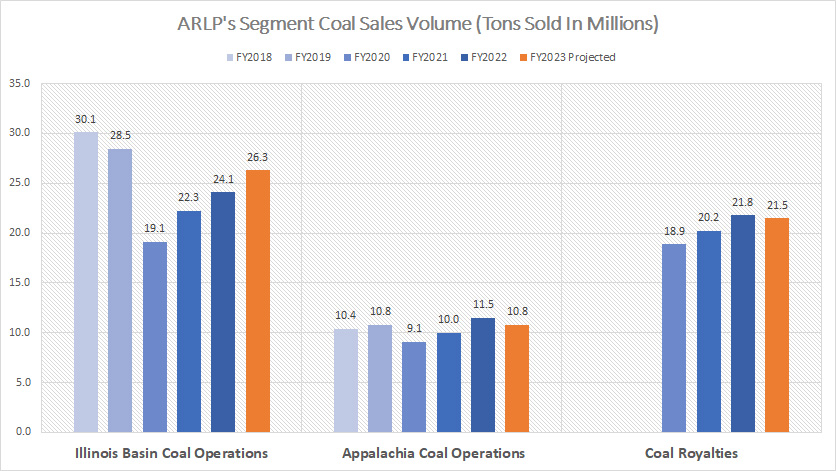

ARLP segment coal sales by year

(click image to enlarge)

Of all the coal operations run by Alliance Resource Partners, the Illinois Basin segment is the largest, boasting a coal sales volume of 24.1 million tons in fiscal 2022, up 8% over 2021.

The Illinois Basin coal sales volume is expected to come to a 4-year high of 26.3 million tons in fiscal 2023.

For the Appalachia segment, it boasted a coal sales volume of 11.5 million tons in fiscal 2022 and is expected to sell 10.8 million tons in fiscal 2023.

Since 2020, ARLP’s coal sales in the Appalachia segment have risen by 26%.

ARLP’s Coal Royalties segment sold 21.8 million tons in fiscal 2022 and the volume is projected to reach 21.5 million tons in fiscal 2023 which is roughly in line with the 2022 result.

ARLP’s Segment Coal Sales Volume By TTM

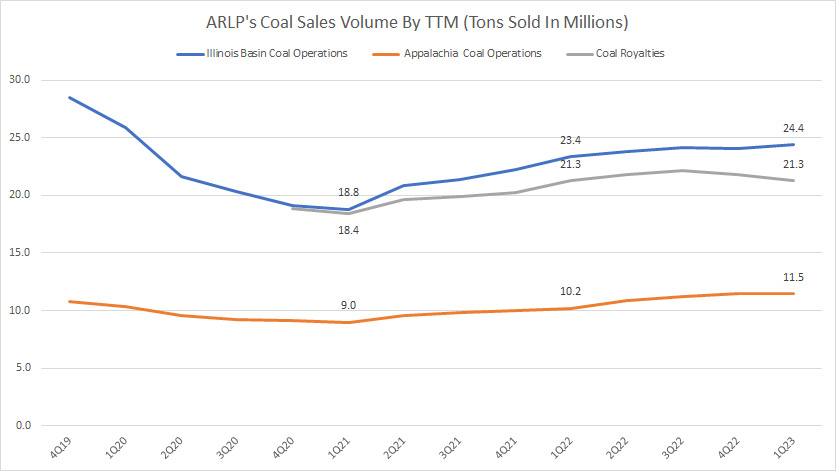

ARLP segment coal sales by ttm

(click image to enlarge)

The TTM plot presented above is a more refined version of the annual chart and is highlighting the trend of ARLP’s coal sales from a more precise perspective.

As seen in the chart, ARLP’s coal sales in all operating segments have significantly recovered from the bottom reported in fiscal 2021.

As of 2023 1Q, ARLP’s coal sales in the Illinois Basin trickled up to a record high of 24.4 million tons while that of Appalachia Basin topped 11.5 million tons, also a new high since 2019.

Similarly, ARLP’s Coal Royalties segment also reported a higher TTM coal sales volume of 21.3 million tons as of 1Q 2023, up 16% in 2 years.

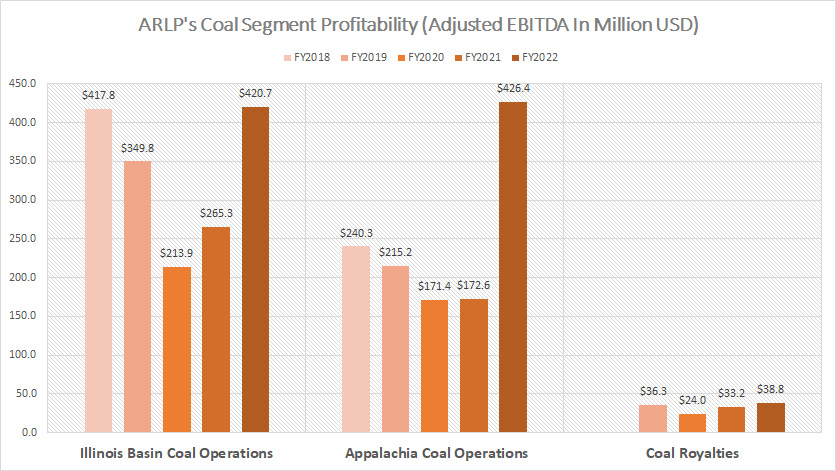

ARLP’s Coal Segment Adjusted EBITDA

ARLP coal segment profitability

(click image to enlarge)

From the perspective of profitability, ARLP’s Illinois Basin and Appalachia segments contribute the largest number of profits to the company.

That said, the adjusted EBITDA from the Appalachia segment surged remarkably in fiscal 2022 to more than $426 million USD, up 146% from a year ago, and has far exceeded all past results.

Equally impressive is the adjusted EBITDA from the Illinois Basin segment which topped $421 million USD in the same period and was up 59% year-on-year.

In addition to running its own mining operations, ARLP also leases some of its coal mineral reserves and resources to its subsidiaries.

Under most standard royalty leases, ARLP grants the lessees the right to mine and sell the company-owned reserves and resources in exchange for royalty payments based on a percentage of the sale price or a fixed royalty per ton of coal mined and sold.

Granted, the profit from the Coal Royalties segment was the smallest, at only $39 million of adjusted EBITDA in fiscal 2022.

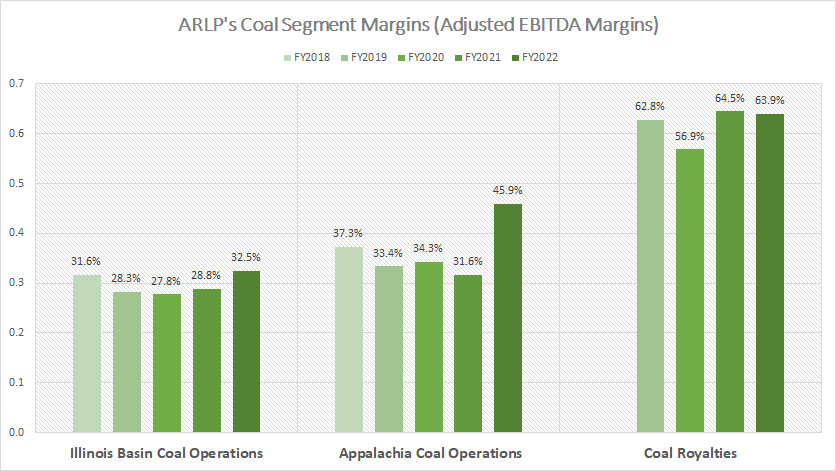

ARLP’s Coal Segment Adjusted EBITDA Margin

ARLP coal segment margins

(click image to enlarge)

Of all segments, ARLP’s Coal Royalties produces the highest adjusted EBITDA margin, topping 64% as of fiscal 2022.

Both the Illinois Basin and Appalachia segments generate nearly the same adjusted EBITDA margins, notably at 32.5% and 45.9% in fiscal 2022.

Although the profit from the Coal Royalties segment is nowhere near the figures generated by the company’s mining operations, its margin is among the best, suggesting that leasing coal mineral interest is probably a much better business idea than extracting coal.

Conclusion

To recap, Alliance Resource Partners’ coal sales have significantly recovered in all segments since hitting new lows in 2020.

In terms of profitability, Alliance Resource Partners makes better money in coal operations which consists of the Illinois Basin and Appalachia segments.

While the Coal Royalties segment derives a much smaller profit, it has a better margin compared to coal operations.

Therefore, ARLP’s Coal Royalties is more profitable than running and operating coal mines on a per-revenue basis.

References And Credits

1. All financial data presented in this article were obtained and referenced from Alliance Resource Partners, LP’s financial statements, earnings releases, annual reports, SEC filings, etc, which are available in ARLP’s Quarterly and Annual Results.

2. Featured images in this article are used under creative commons license and sourced from the following websites: cooling tower and coal power plant.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the full correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!