Deere & Company, with a stock ticker DE, together with its subsidiaries, manufactures and distributes agriculture and turf, and construction and forestry equipment worldwide.

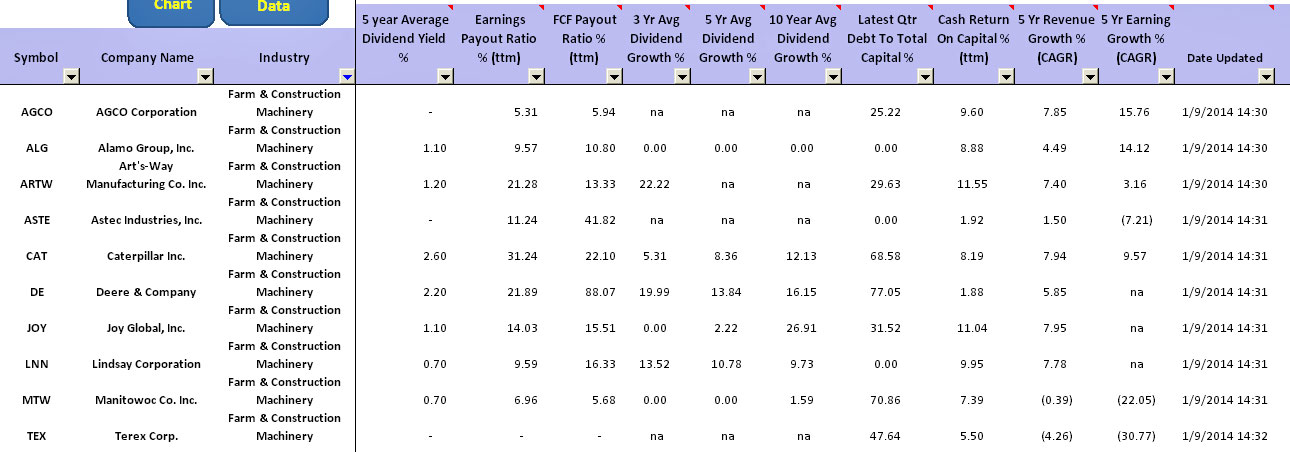

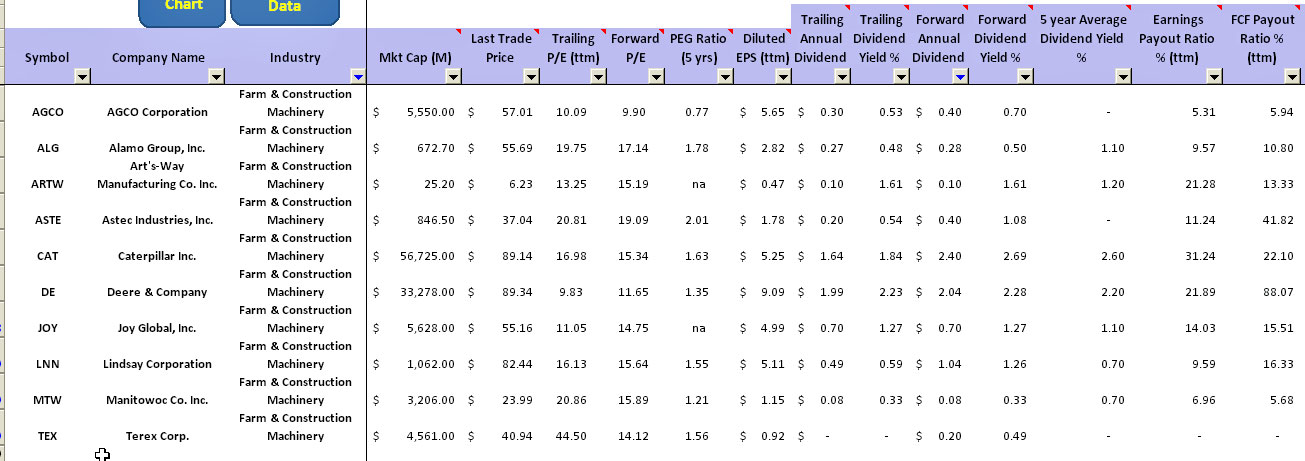

The company is a dividend paying company and it has been paying out dividend continuously for at least the past 10 years. From the following snapshot which shows the dividend stock screening result of DE, the column “10 Year Average Dividend Growth %” shows that Deere has been growing its dividend at an impressive average yearly rate of 16% for the past 10 years.

Pleas note that this column will show “na” if the company has stopped paying out dividend even for a single year.

For the past 3 years, the average yearly dividend growth rate is an astounding 20%! In addition, you can also see from the above table that the past 5 years average dividend yield is around 2.2% per year. The projected forward dividend yield as of Jan 9th 2014 shows that the company will pay out a dividend yield of 2.3% in 2014. With these results, Deere is one of the top dividend paying stocks within the “Farm & Construction Machinery” industry. The closest company that pays the same dividend yield as DE would be Caterpillar (CAT) within the same industry.

To find out Deere‘s dividend performance compared to its peers, we look at a couple of metrics available in the stock dividend screener spreadsheet.

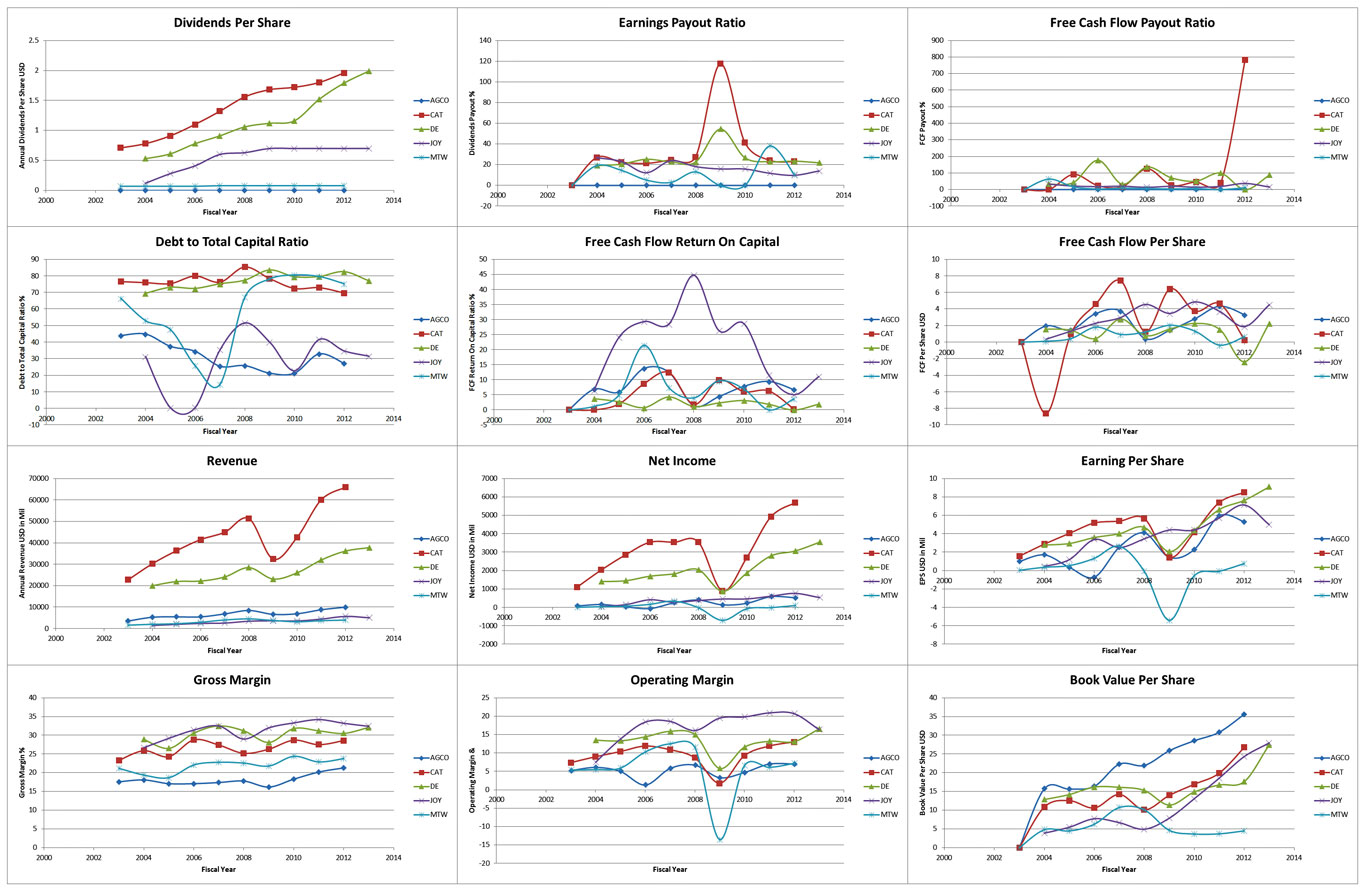

First we look at the dividend to earnings payout ratio. For DE, it’s having one of the highest payout ratio in the same industry, second to CAT only. In terms of dividend to free cash flow payout ratio, Deere is ranked the highest, with a FCF payout ratio of as high as 88% for the recent quarter. The lower these numbers get, the better in terms of dividend sustainability in the future.

Besides, DE is carrying a decent amount of debt. The “Debt to Total Capital %” figure shows that out of the total capital, 77% of it is made up of debt. And DE has the highest leverage in the same industry compared to its peers. Also, when it comes to free cash flow return with respect to total capital, DE has the lowest figure compared to its peer in the same industry. These figures show that the dividend performance of DE isn’t that impressive.

To be able to grow and sustain its dividends, DE needs to grow its revenue. At an average growth rate of a mere 5% for the past 5 years, Deere may not be able to grow its dividend if it’s not generating enough free cash flow to sustain the dividend payout in the future.

On the bright side, Deere has one of the highest gross and operating margins in the “Farm & Construction Machinery” industry, comparable with Caterpillar. You can see from the following snapshot that shows the past 10 years plot of gross and operating margin of DE and its respective peers. From the plot, the operating margin has been improving in the past 5 years.

One thing worth mentioning is that Deere is currently one of the lowest valued stocks in terms of trailing and forward PE in the same industry. Now maybe is a good time to initiate a small position. I am confidence that in the short term, DE stock valuation will catch up soon with its peers.

In conclusion, there is no doubt that DE is a solid dividend paying stock. It has grown its dividend at an double-digit rate for the past 10 years. There might be some difficulty in the short term for Deere especially in the construction and equipment section of its business. But going forward, I believe Deere will have a bright future in view of the improvement in its agricultural business. There will always be demand for farm crops and I believe the demand will only grow in the future in line with world population growth. As such, the growth of demand for farm commodity will eventually translate to the growth of demand for Deere agriculture’s products.