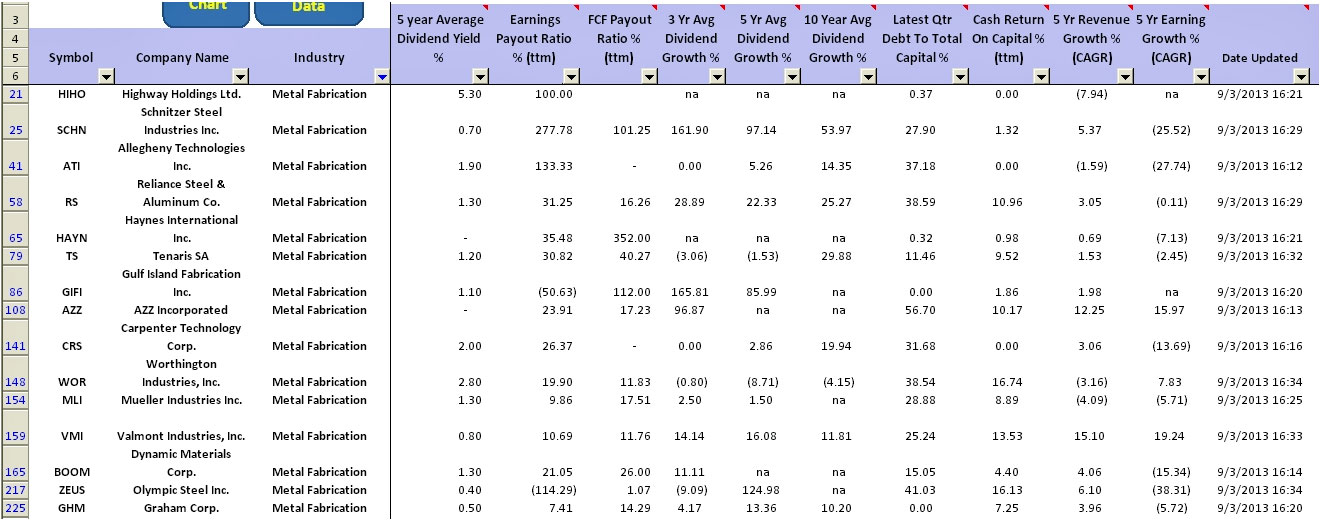

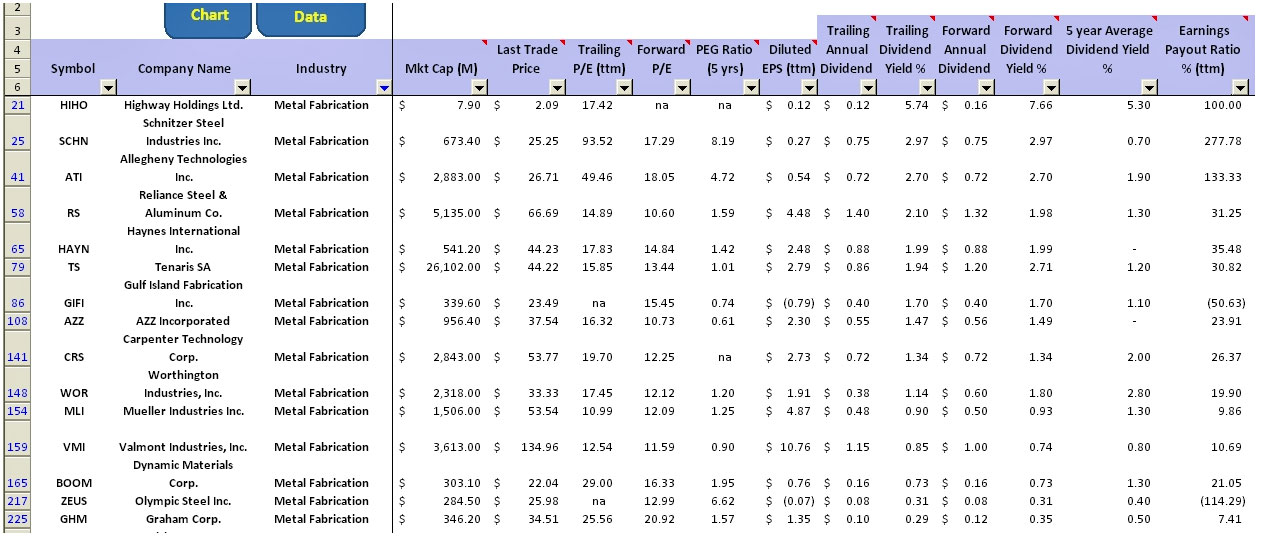

A quick screening in the “Metal Fabrication” industry within the “Industrial Goods” sector showed that HIHO or Highway Holdings Limited emerged on the top with a trailing dividend yield of 5.7% and a forward dividend yield 7.7%. The screening was done on Sept 3rd, 2013 using the Stock Dividend Screener spreadsheet.

The above tables show the screening result for HIHO which was done on September 23, 2013.

A check in Yahoo finance showed that this company is rated a buy dividend stock. I wonder what had triggered a buy rating for this company. The valuation for HIHO as of the date the screening was done wasn’t cheap either. The stock had a trailing PE of 17. I ran some screening using the spreadsheet and the fundamental analysis for dividend wasn’t looking good.

Even though the yield is very attractive at this rate, I found that the dividend might not be sustainable in the long run. A check on a couple of metrics in the spreadsheet showed that the earning and free cash flow payout ratio wasn’t that looking good. The dividend to earning ratio ran into 100% while the dividend to free cash flow ratio showed empty number. A check on the income statement showed that the company has been incurring negative free cash flow for the trailing twelve months. That is the reason the number was empty.

Besides, the metrics “3, 5 and 10 Year Avg Dividend Growth” were not available. That could mean two things. Either the company has only started paying dividend in less than 3 years or the company doesn’t have a history of continuously paying dividend. A check on the metric “5 Year Average Dividend Yield” confirmed that it is the latter. The company has paid dividend but not every single year it had paid the dividend.

The only number among the metrics that had impressed me would be the “Debt to Total Capital” ratio. The company Highway Holdings Limited is having little debt as of the latest quarter. In addition, the company had not been growing meaningfully in the past. The metric revenue and earnings growth ran into negative and empty number respectively.

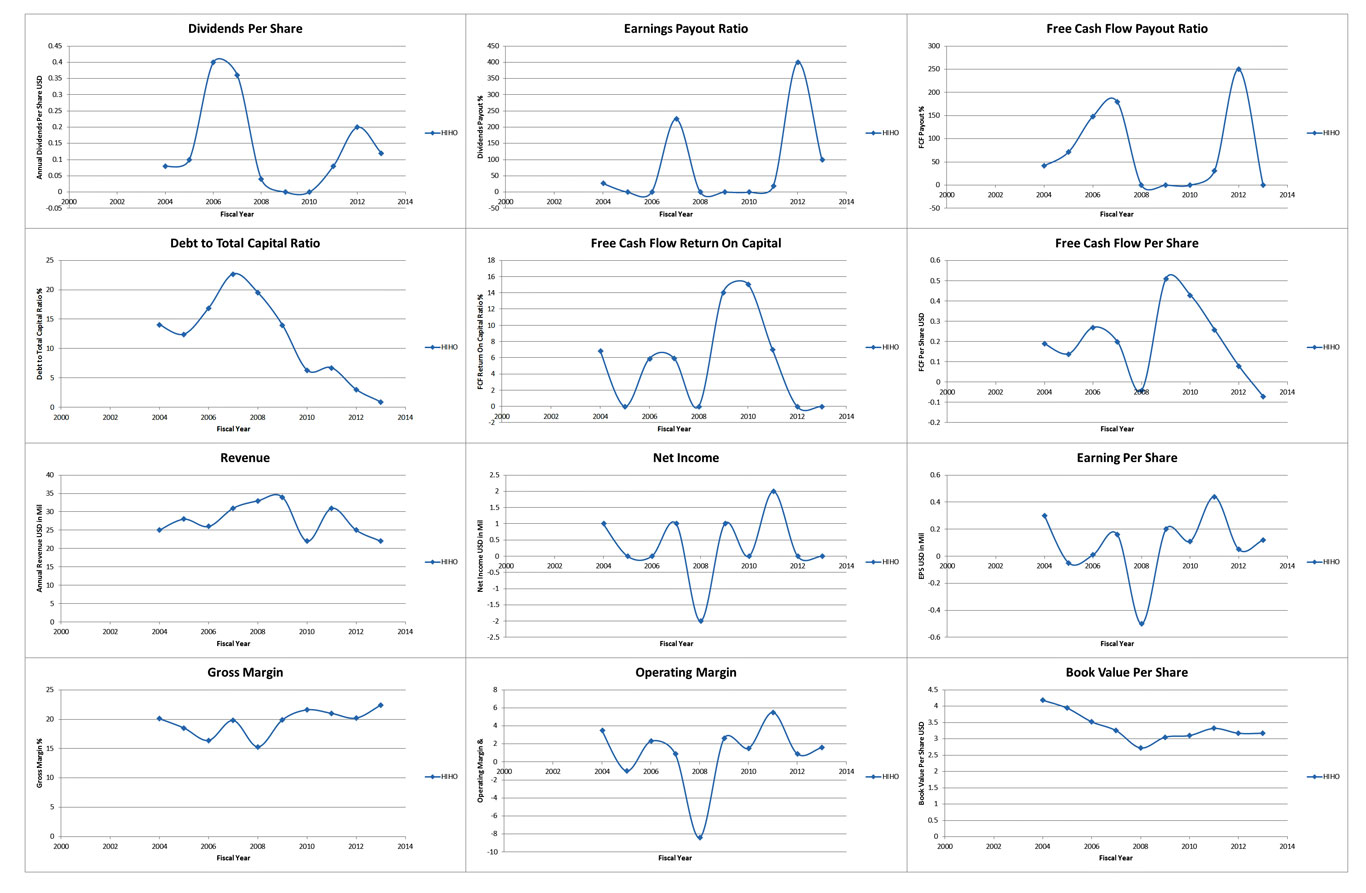

Further investigation into the stock confirmed the above analysis where sales and earnings had not grown for the past 5 years. The following plots show the analysis of the performance of the stock for the past 10 years.

In conclusion, unless there are some short term improvement or catalyst that could enhance sales and profit of the business, I see no reason to dive into HIHO now.