This article analyzes and reviews the Public Advantage Growth Equity Fund (PAVGEF).

For your information, the PAVGEF is a unit trust fund managed by Public Mutual Berhad in Malaysia.

The fund invests primarily in equities or stocks of companies based in Malaysia.

The following is a list of topics in this article.

Enjoy!

Public Advantage Growth Equity Fund (PAVGEF) Topics

1. Fund Summary

2. Cash Distribution And Unit Split

3. Asset Allocation – Malaysia Equities

4. Asset Allocation – Foreign Equities

5. Asset Allocation – Total

6. Cash And Deposits (Liquid Assets)

7. Top 10 Equity Holdings – Malaysia

8. Top 10 Equity Holdings – Foreign

9. Unit Price Vs Benchmark

10. Review Summary

11. Reference And Credits

12. Disclosure

Fund Summary

The following summary is obtained from the annual report for the financial year ended 30 Sept 2022.

Category

Equity

Investment Objective

To achieve capital growth over the medium to long-term period by investing in a diversified portfolio of stocks.

Launch Date

08 Sep 2015

Distribution Policy

Incidental

Risk Level

Very High – 5 (on a scale of 1 – 5)

Volatility

Very High – 20.8 By Lipper Analytics

Size

MYR16 million (USD3.6 million based on an exchange rate of USD1 = MYR4.5) as of the end of the financial year ended 30 September 2022.

Shariah Compliant

No

Sales Charge

Up To 5%

Expenses

1.74% Of Fund NAV On Average From 2020 To 2022

Performance

Average annual return for the following years ended 30 September 2022.

| Years | Average Annual Return (%) |

|---|---|

| 1 Year | -18.96 |

| 3 Years | 5.47 |

| 5 Years | 0.26 |

| 10 Years | – |

Annual total return for the financial year ended 30 September.

| Years | Annual Total Return (%) | FTSE Bursa Malaysia (FBM) KLCI (%) |

|---|---|---|

| 2022 | -18.96 | -9.31 |

| 2021 | 19.44 | NA |

| 2020 | 20.27 | NA |

| 2019 | -12.65 | NA |

| 2018 | -0.39 | NA |

In 2022, the Public Advantage Growth Equity Fund (PAVGEF) underperformed the FTSE Bursa Malaysia (FBM) KLCI index by nearly 10%.

For example, for the financial year ended 30 Sept 2022, the fund registered a return of -18.96% compared to -9.31% for the FBM KLCI reported in the same period.

The respective total return of -18.96% is calculated based on a cumulative return of equity and money market which came in at -16.59% and -0.15%, respectively, as well as an expense ratio of 2.52%, for the financial year ended 30 Sept 2022.

According to the PAVGEF’s annual report, the underperformance was primarily due to the lower return recorded in Technology and Industrial equities over the rise of interest rates during the financial year under review.

As such, the fund has almost switched out of the Technology and Industrial sectors as of the end of the fiscal year which is 30 Sept 2022.

Other performance data for the financial year ended 30 September.

Unit Prices (MYR) => prices quoted are ex-distribution

| As at 30 September | |||

|---|---|---|---|

| 2022 | 2021 | 2020 | |

| Highest NAV per unit for the year | 0.3283 | 0.3346 | 0.2960 |

| Lowest NAV per unit for the year | 0.2546 | 0.2762 | 0.1716 |

Net Asset Value (NAV) and Units In Circulation (UIC) as at the end of the financial year

| As at 30 September | |||

|---|---|---|---|

| 2022 | 2021 | 2020 | |

| Total NAV (MYR’000) | 16,073 | 18,450 | 17,054 |

| UIC (in ’000) | 62,776 | 58,384 | 61,544 |

| NAV per unit (MYR) | 0.2560 | 0.3160 | 0.2771 |

Total Expense Ratio

| As at 30 September | |||

|---|---|---|---|

| 2022 | 2021 | 2020 | |

| Total Expense Ratio (%) | 1.76 | 1.66 | 1.80 |

Portfolio Turnover Ratio

| As at 30 September | |||

|---|---|---|---|

| 2022 | 2021 | 2020 | |

| Portfolio Turnover Ratio (time) | 1.08 | 1.73 | 1.63 |

Cash Distribution And Unit Split

| Declaration Date | |||||

|---|---|---|---|---|---|

| 2022 | 2021 | 2020 | 2019 | 2018 | |

| 09-30 | 09-30 | 09-30 | 09-30 | 09-28 | |

| Net Distribution Per Unit (Cent In MYR) | NA | 1.50 | 1.00 | 0.50 | 0.50 |

| Net Distribution To Net Income Ratio (%) | NA | 28% | NA | NA | NA |

| Net Distribution To Cash Flow From Operations Ratio (%) | NA | 53% | NA | NA | NA |

| Unit Split | NA | NA | NA | NA | NA |

The Public Advantage Growth Equity Fund (PAVGEF) has been able to declare cash distribution without fail since 2018.

For your information, the ratio of cash distribution to net income earned after taxation in fiscal 2021 was only 28%, leaving plenty of room, in terms of retained earnings, for the increment of the net asset value (NAV) of the fund in fiscal 2021 from fiscal 2020.

However, in 2022, the fund incurred heavy losses which amounted to as much as MYR3.7 million. This figure is made up of a realized loss of MYR0.83 million and an unrealized loss of MYR2.88 million.

Therefore, the fund was unable to declare any cash distribution to investors in 2022 due to the incurred loss.

Also, the Public Advantage Growth Equity Fund (PAVGEF) has not initiated any unit split in the past 5 years since 2018.

In short, the Public Advantage Growth Equity Fund (PAVGEF) is a well-managed fund in which a cash distribution was initiated when the fund made money and refrained from doing so when it incurred losses.

In addition, the fund also did not pay out the entire net income earned and cash generated in fiscal 2021, as seen in the ratio of the cash distribution to net income and cash flow which is calculated at 28% and 53%, respectively.

For your information, the net income after taxation earned in 2021 was MYR3.1 million and the respective cash generated in 2021 was MYR1.6 million.

In return, the earnings and cash left from 2021 can be used to make opportunistic investments in the following year 2022 when the prices of most assets are depressed.

Asset Allocation – Malaysia Equities

| As at 30 September (% of NAV) | |||

|---|---|---|---|

| 2022 % | 2021 % | 2020 % | |

| Sectors | |||

| Basic Materials | 13.7 | 5.9 | 3.8 |

| Communications | 2.3 | 4.8 | – |

| Consumer, Cyclical | 13.3 | 15.2 | 9.4 |

| Consumer, Non-Cyclical | 20.7 | 13.0 | 13.7 |

| Diversified | – | 7.5 | 9.5 |

| Energy | 4.1 | – | – |

| Financial | 18.3 | 4.8 | 7.3 |

| Industrial | 3.0 | 24.6 | 29.9 |

| Technology | 1.2 | 10.5 | 6.5 |

| Total | 76.7 | 86.3 | 80.1 |

Based on the above table, we can see that the Public Advantage Growth Equity Fund (PAVGEF) has shifted to a defensive portfolio in 2022 from prior years.

For example, equities in the sector Financial, Consumer Non-Cyclical, and Basic Materials are 3 of the biggest holding of the fund in 2022, at 18.3%, 20.7%, and 13.7%, respectively.

The equities in these 3 sectors are primarily dividend payers and consist of mega-cap companies.

Prior to 2022, the fund invested primarily in growth stocks such as in sector Industrial, Consumer Cyclical, and Technology.

However, the Public Advantage Growth Equity Fund (PAVGEF) has significantly reduced its holding in these sectors, specifically in the Technology sector.

As of 2022, the fund holds only 1.2% of equities in the Technology sector, a significant drop from the 10.5% reported in 2021.

At the same time, the percentage of equities in the sector Industrial has declined from 24.6% reported in 2021 to just 3.0% in 2022.

Moreover, the fund increased significantly its position in Basic Materials, Consumer Non-Cyclical, and Financial in 2022, due primarily to the rise of interest rates.

In short, the fund is capitalizing on a rising commodities and interest rate environment as of 2022 by increasing its equity positions in the Basic Materials, Consumer Non-Cyclical, and Financial sectors.

Another note worth mentioning is that the fund has significantly reduced its holdings in Malaysia equity as seen in the table above.

The percentage of Malaysian equity in the fund has declined from 86.3% reported in 2021 to just 76.7% reported in 2022.

The reason for the decline may have been attributed to the fact that the fund manager of the Public Advantage Growth Equity Fund (PAVGEF) is expecting a less bullish environment in Malaysia equity in 2022 compared to 2021.

Asset Allocation – Non-Malaysia Equities

| As at 30 September (% of NAV) | |||

|---|---|---|---|

| 2022 % | 2021 % | 2020 % | |

| Countries | |||

| Hong Kong | 2.9 | 5.8 | 6.7 |

| Singapore | 9.0 | – | 2.9 |

| Thailand | 2.6 | 1.4 | – |

| United States | 1.5 | 7.3 | 10.1 |

| Total | 16.0 | 14.5 | 19.7 |

In terms of foreign equity holdings, the Public Advantage Growth Equity Fund (PAVGEF) has increased a significant portion of equities in Singapore in 20222 compared to prior years.

In 2022, the fund’s position in Singapore equities has soared to 9% compared to 0% in the prior year.

The significant increment in Singapore stocks in the fund can be seen as a sign of a very bullish environment in the republic in 2022 and beyond.

On the other hand, the fund is seeing a less bullish environment in the U.S. in 2022 and beyond as the holdings of equity in America have dipped considerably to only 1.5% in the same year.

In addition, the fund also expects a bear market in Hong Kong considering that the equity holding in this country has been reduced by 50% in 2022 compared to 2021.

Asset Allocation – Total

Change In Portfolio Exposures

| As at 30 September | |||

|---|---|---|---|

| 2022 % | 2021 % | Change (%) | |

| Investment Type | |||

| Equity and equity-related securities | 92.6 | 96.3 | -3.7 |

| Money market | 7.4 | 3.7 | +3.7 |

The equity portfolio of the Public Advantage Growth Equity Fund (PAVGEF) has dipped by 3.7% from 96.3% reported in 2021 to 92.6% reported in 2022.

In contrast, the cash holding or money market position of the fund has increased by 3.7% to reach a total percentage of 7.4% as of Sept 30, 2022.

In other words, the fund is having more cash in 2022 than in 2021.

In my opinion, the rise in cash in the fund is an opportunistic move especially in 2022 when the price of Malaysia equity has been depressed throughout the year.

When the market is consolidating, the fund may be able to pick up some valued blue-chip stocks which will provide higher returns in the future.

Cash And Deposits (Liquid Assets)

| As at 30 September | ||

|---|---|---|

| 2022 (MYR’000) | 2021 (MYR’000) | |

| Liquid Assets | ||

| Deposits With Financial Institutions | 572 | 602 |

| Cash At Banks | 549 | 107 |

| Total Net Assets | ||

| Net Asset Value (“NAV”) | 16,073 | 18,450 |

| Ratio Of Total Cash To NAV (%) | 7.0 | 3.8 |

As discussed in prior discussions, the Public Advantage Growth Equity Fund (PAVGEF) held a considerable amount of cash as of 2022.

The sizable cash position is also reflected in the balance sheet as shown in the table above.

As seen, as of 30 Sept 2022, the total cash to NAV ratio totals 7.0%, nearly 2X higher than that of 2021.

This shows that the fund has switched to a rather defensive holding and is preparing to make an opportunistic buying of undervalued equity.

The large cash position in 2022 may also indicate an unfavorable outlook for the Malaysian equity market in 2022 and beyond.

Top 10 Equity Holdings – Malaysia

| As at 30 September 2022 | ||

|---|---|---|

| Fair Value (MYR’000) | Percent Of NAV (%) | |

| Equity Securities – Malaysia Only | ||

| Petronas Chemicals Group Berhad | 1,510 | 9.4 |

| CIMB Group Holdings Berhad | 1,334 | 8.3 |

| Genting Malaysia Berhad | 1,052 | 6.5 |

| Hong Leong Bank Berhad | 865 | 5.4 |

| Genting Berhad | 833 | 5.2 |

| KL Kepong Berhad | 830 | 5.1 |

| RHB Bank Berhad | 745 | 4.6 |

| IOI Corporation Berhad | 735 | 4.6 |

| Press Metal Aluminium Holdings Berhad | 687 | 4.3 |

| Genting Plantations Berhad | 677 | 4.2 |

| Total | 9,268 | 57.7 |

In terms of equity holdings for Malaysian companies, the equity of Petronas Chemicals Group Berhad contributed 9.4% of NAV or MYR1.5 million as of 30 Sept 2022, making it the largest holding of the fund.

At 8.3% of NAV or MYR1.3 million, the CIMB Group Holdings Berhad was the 2nd largest holding in the fund.

Genting Malaysia Berhad equity topped the 3rd place at 6.5% of NAV or MYR1.1 million.

A note worth mentioning is that 9 out of the top 10 equity holdings in the fund are companies making up the FTSE Bursa Malaysia (FBM) KLCI index which consisted of the 30 largest companies by full market capitalization listed on the Bursa Malaysia Main Market.

As a result, the fund should track closely the FTSE Bursa Malaysia (FBM) KLCI index, meaning that the fund will rise when the FBM KLCI index rises and vice versa.

Also, the top 10 equity holdings of the Public Advantage Growth Equity Fund (PAVGEF) alone contributed nearly 60% of the fund’s total NAV, making it a highly risky and volatile investment as the fund is largely depending on the return of these equities and thus, the overall economy of Malaysia.

Top 10 Equity Holdings – Foreign

| As at 30 September 2022 | ||

|---|---|---|

| Fair Value (MYR’000) | Percent Of NAV (%) | |

| Equity Securities – Foreign | ||

| Singapore Airlines Limited | 626 | 3.9 |

| United Overseas Bank Limited | 464 | 2.9 |

| Tencent Holdings Ltd | 472 | 2.9 |

| Bangkok Bank Public Company Limited | 419 | 2.6 |

| Bumitama Agri Ltd | 353 | 2.2 |

| Sea Limited – ADR | 234 | 1.5 |

| Total | 2,568 | 16.0 |

In terms of foreign equity holdings, as much as 16% of NAV in the Public Advantage Growth Equity Fund (PAVGEF) was foreign stocks.

Of all 16%, Singapore Airlines Limited made up roughly 3.9% of the portfolio, making it the largest holding among foreign equity in the fund.

Both United Overseas Bank Limited and Tencent Holdings Ltd contributed about 2.9% of NAV each within the fund.

In addition, the fund held equity of mostly Singaporean companies in its foreign equity portfolio.

In short, with only 16% of NAV, the Public Advantage Growth Equity Fund (PAVGEF) has limited exposure to foreign equity.

Unit Price Vs Benchmark

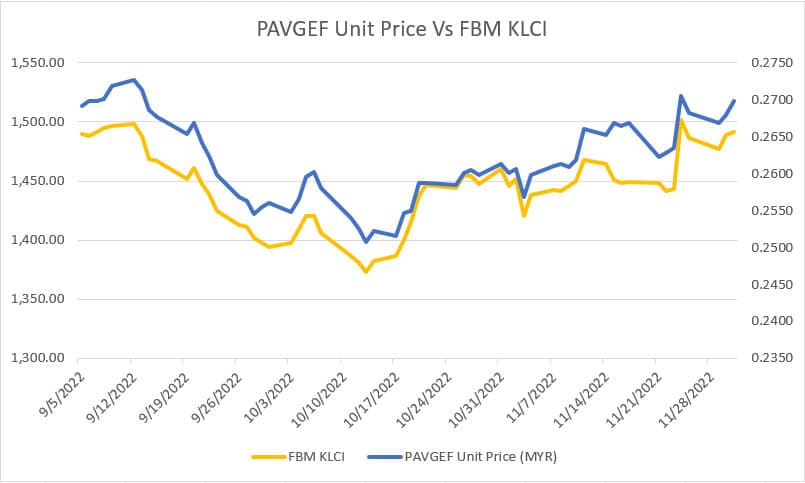

PAVGEF Unit Price Vs FBM KLCI Index

The chart above shows the plots of the Public Advantage Growth Equity Fund (PAVGEF) unit price and the FBM KLCI index.

As seen, both plots are having a close correlation.

In other words, when the FBM KLCI rises, so will the PAVGEF unit price and vice versa.

The correlation between the 2 plots is expected because nearly 60% of the fund’s NAV is comprised of Malaysian equity.

And, of the top 10 Malaysian equity holdings in the fund, 9 of them are a component of the FBM KLCI index.

For your information, the FTSE Bursa Malaysia KLCI (FBM KLCI) comprises the 30 largest companies by full market capitalization listed on the Bursa Malaysia Main Market.

In short, the PAVGEF unit price correlates closely with the FBM KLCI volatility.

However, what we do not know is how much the unit price of the fund will go up or go down when the FBM KLCI rises or drops by 1 point.

Let’s move on to find out.

Positive Changes

| Positive Changes | |||

|---|---|---|---|

| FBM KLCI Changes | PAVGEF Unit Price Changes (Cents) | Ratio | |

| Date | |||

| 12/1/2022 | 2.71 | 0.0019 | 0.000701 |

| 11/30/2022 | 11.84 | 0.0010 | 0.000084 |

| 11/24/2022 | 58.38 | 0.0070 | 0.000120 |

| 11/23/2022 | 2.21 | 0.0007 | 0.000317 |

| 11/17/2022 | 0.94 | 0.0004 | 0.000426 |

| 11/11/2022 | 18.47 | 0.0042 | 0.000227 |

| 11/10/2022 | 3.55 | 0.0010 | 0.000282 |

| Average | – | – | 0.000242 |

The table above shows the correlation between the FBM KLCI and PAVGEF unit prices in an upward direction.

Based on the 90-day data between Sept and Nov 2022, the average ratio came in at 0.000242.

In other words, when the FBM KLCI rises 1 index point, the PAVGEF uni price will rise by about MYR0.000242 on average.

On a scale of 10-index points, the PAVGEF uni price rises by about MYR0.00242 or MYR0.24 cents on average.

Negative Changes

| Negative Changes | |||

|---|---|---|---|

| FBM KLCI Changes | PAVGEF Unit Price Changes (Cents) | Ratio | |

| Date | |||

| 11/29/2022 | -9.58 | -0.0013 | 0.000136 |

| 11/25/2022 | -15.34 | -0.0023 | 0.000150 |

| 11/21/2022 | -1.36 | -0.0046 | 0.003382 |

| 11/16/2022 | -2.16 | -0.0004 | 0.000185 |

| 11/14/2022 | -4.21 | -0.0009 | 0.000214 |

| 11/03/2022 | -31.23 | -0.0038 | 0.000122 |

| 11/01/2022 | -14.46 | -0.0012 | 0.000083 |

| Average | – | – | 0.000352 |

The table above shows the correlation between the FBM KLCI and PAVGEF unit prices in a downward direction.

Based on the 90-day data between Sept and Nov 2022, the average ratio came in at 0.000352.

In other words, when the FBM KLCI falls 1 index point, the PAVGEF unit price will fall by about MYR0.000352 on average.

From a 10-index points perspective, the unit trust fund will fall by about MYR0.00352 or MYR0.35 cents on average.

Therefore, the Public Advantage Growth Equity Fund (PAVGEF) unit price is more sensitive to a market fall as the negative ratio is much higher than the positive ratio as shown in both tables above.

If you are holding the PAVGEF, watch out for a market downturn as the unit price of the fund will decline much faster than that during a market rise.

In short, the Public Advantage Growth Equity Fund (PAVGEF) has a lower resistance toward capital preservation during a market downturn.

Review Summary

As of Sept 30, 2022, the Public Advantage Growth Equity Fund (PAVGEF) registered an annual return of -18.96% compared to a return of -9.31% for the FBM KLCI.

The lower performance of the fund is expected as we have seen that the unit price of the fund is more sensitive toward a market fall compared to when the market rises.

Overall, the fund has been well-managed as it quickly switched out of lower-return equities to a more defensive portfolio as of Sept 30, 2022, to capitalize on the rise of interest rates and commodities.

Also, the fund will pay out a cash distribution when it registered a positive return but refrained from doing so when it incurred a loss in a financial year.

In addition, the fund held a much higher cash position as of Sept 30, 2022, and this is seen as a good move during a market downturn to take advantage of undervalued equity.

References and Credits

1. All financial information in this article was obtained and referenced from the following links:

a) Public Mutual Unit Trust Fund

b) FBM KLCI index

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor advice to purchase a security. The Public Advantage Growth Equity Fund (PAVGEF) is not in any way sponsored, endorsed, sold, or promoted by StockDividendScreener.com.

Therefore, StockDividendScreener.com shall not be liable (whether in negligence or otherwise) to any person for any error in this article.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future. Thank you!