Elon Musk, Tesla Factory, Fremont (CA, USA). Flickr Image.

This article presents the financial health of Tesla (NASDAQ: TSLA). To evaluate the financial health of Tesla, we need to look at the company’s debt, focusing on the debt payment due, and find out whether Tesla has the financial means to meet the upcoming obligation.

Let’s take a look!

Investors looking for other key statistics of Tesla may find more resources on these pages:

- Tesla profit margin breakdown: automotive, energy, and services,

- Tesla vs General Motors: vehicle margin and profit comparison, and

- Tesla debt to equity ratio.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

Debt

A1. Total Debt

A2. Debt Breakdown

Leases

A3. Lease Liabilities

A4. Total Debt + Lease Liabilities

Debt Due, Liquidity, And Credit Rating

D1. Debt And Lease Payment Due

D2. Liquidity

D3. Credit Rating

Summary And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Lease Liabilities: Lease liabilities represent a company’s obligation to make future lease payments under leasing agreements. They arise when a company leases an asset, such as real estate, equipment, or vehicles, for a specific period. These liabilities are typically calculated based on the present value of the unpaid lease payments, discounted using the company’s borrowing rate or a similar rate.

Lease liabilities are reported on the balance sheet as part of the company’s financial obligations, and they are associated with the corresponding right-of-use asset, which reflects the benefit of using the leased asset over time. Accounting standards like IFRS 16 and ASC 842 require companies to recognize lease liabilities for most lease agreements, improving transparency in financial reporting.

Operating Lease: An operating lease is a contractual agreement that allows the lessee (the user) to use an asset without taking on ownership of it. This type of lease is typically short-term and applies to assets such as vehicles, equipment, or office spaces.

Key features of an operating lease include:

- No Ownership Transfer: The asset remains the property of the lessor (the owner) throughout and after the lease term.

- Lease Expenses: Payments made by the lessee are treated as operating expenses on financial statements, rather than being recorded as an asset or liability.

- Maintenance Responsibility: The lessor often remains responsible for the asset’s upkeep and residual value.

Operating leases are commonly chosen by businesses that need flexibility and want to avoid the burden of long-term ownership or liabilities on their balance sheets.

Finance Lease: A finance lease, also known as a capital lease, is a type of lease agreement where the lessee (the user of the asset) effectively takes on the risks and rewards of ownership, even though the legal title of the asset remains with the lessor (the owner). In essence, it functions more like a loan used to purchase an asset rather than a traditional rental agreement.

Key characteristics of a finance lease include:

- Ownership-Like Control: The lessee typically has long-term use of the asset and may eventually gain ownership through an option to purchase.

- Accounting Treatment: In financial statements, the lease is recorded as both an asset and a liability, reflecting the lessee’s obligation to pay for the asset over time.

- Residual Value Risk: Unlike an operating lease, the lessee may bear the risk related to the residual value of the asset at the end of the lease term.

Finance leases are commonly used for significant, high-value assets like machinery, equipment, or vehicles, providing businesses with a way to use such assets while spreading payments over time.

Total Debt

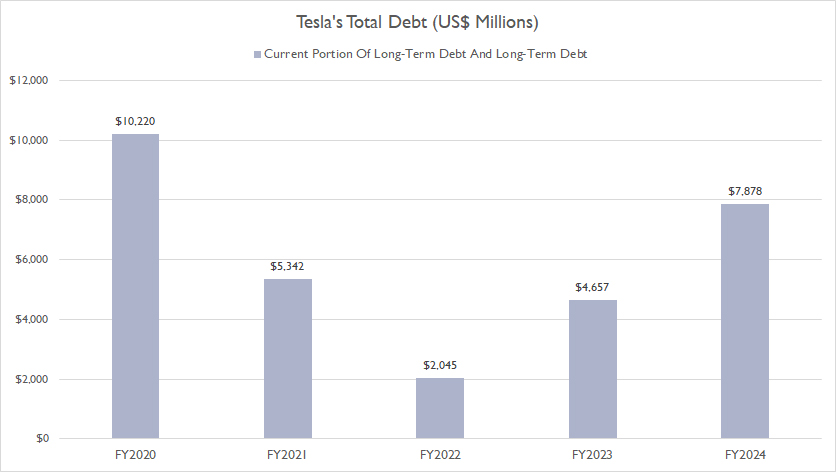

Tesla total debt

(click image to expand)

By the close of fiscal year 2024, Tesla’s total debt surged to $7.9 billion, marking a 68% rise from the $4.7 billion recorded the previous year.

Since 2020, Tesla has seen a significant reduction in its overall debt, which peaked at over $10 billion before dropping to just $2 billion in fiscal year 2022.

However, this trend reversed in fiscal year 2023, with Tesla’s debt escalating sharply. In fact, the company’s debt has quadrupled since 2022, climbing from $2 billion to $7.9 billion in the most recent figures.

Examining Tesla’s debt levels alone provides limited insight. To gain a clearer understanding, we must analyze how much of this debt is due in the future and assess the company’s ability to meet its obligations. Let’s delve deeper!

Debt Breakdown

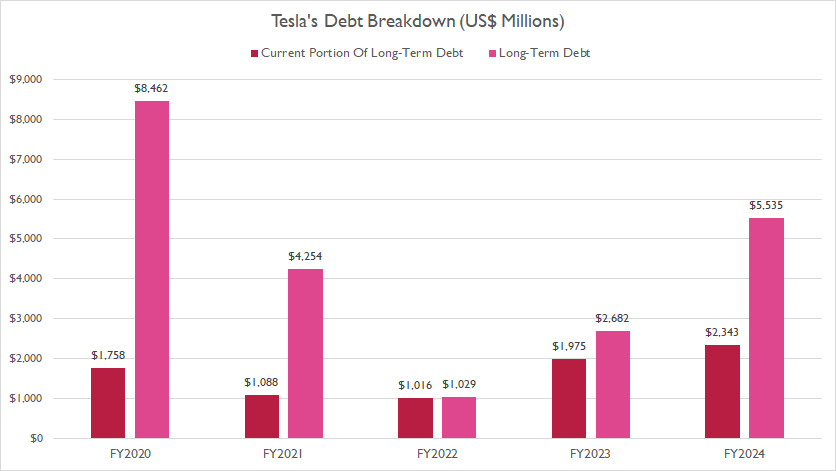

tesla-debt-breakdown

(click image to expand)

Tesla’s debt is composed of two components: the current portion of long-term debt and long-term debt. Notably, the company has no short-term borrowings.

By the end of fiscal year 2024, Tesla reported $2.3 billion in current debt and $5.5 billion in long-term debt.

This means that $2.3 billion of Tesla’s debt is due within the 12 months following the release of its 2024 annual report, dated December 31, 2024.

An important observation is Tesla’s remarkable reduction in long-term debt over the past five years, declining from $8.5 billion in 2020 to $5.5 billion as of the latest figures.

This positive trend signifies improved financial stability, benefiting both the company and its shareholders.

Lease Liabilities

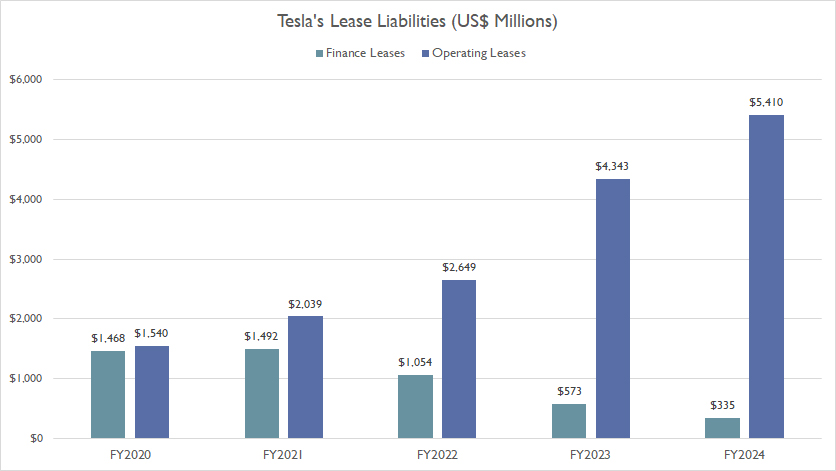

tesla-lease-liabilities

(click image to expand)

You may find more information about Tesla’s lease liabilities here: lease liabilities, operating lease, and finance lease.

In addition to the current portion of long-term debt and long-term debt, Tesla’s financial commitments also include substantial operating and finance leases, as illustrated in the graph above.

By the end of fiscal year 2024, Tesla’s operating lease obligations reached an impressive $5.4 billion, highlighting a steep increase in this category. In contrast, the company maintained a comparatively smaller finance lease obligation of $335 million during the same period.

The data reveals a notable trend: Tesla’s operating lease liabilities have experienced significant growth over time, while its finance lease obligations have steadily declined.

This shift suggests that Tesla may be favoring operating leases for greater flexibility in asset management, as these leases typically avoid the long-term risks associated with ownership-like arrangements found in finance leases.

Understanding these changes in leasing strategies can provide valuable insights into Tesla’s evolving approach to managing its assets and liabilities, helping stakeholders assess the implications for the company’s financial health and operational efficiency.

Total Debt + Lease Liabilities

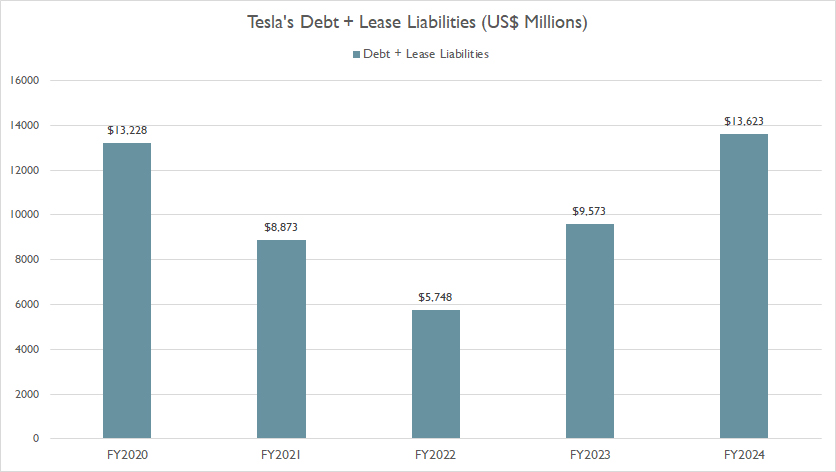

Tesla debt and leases

(click image to expand)

The plots above illustrate the impact of leases on Tesla’s debt levels. You may find more information about Tesla’s lease liabilities here: lease liabilities, operating lease, and finance lease.

Including lease liabilities — both operating and finance leases — Tesla’s total debt has risen significantly, reaching $13.6 billion by the end of fiscal year 2024. This marks an increase of over 40% compared to the previous year.

At this elevated level, Tesla’s total debt, inclusive of lease obligations, has returned to levels comparable to its pre-pandemic highs. This surge highlights the substantial impact of lease liabilities, which have added nearly $6 billion to Tesla’s overall debt burden.

The inclusion of lease liabilities reflects a broader shift in Tesla’s financial structure, emphasizing the growing importance of operating leases in its asset management strategy. While this approach may offer operational flexibility, it also raises questions about the company’s ability to manage and service its expanding debt obligations.

The critical question remains: Does Tesla possess the financial flexibility to meet its debt commitments while maintaining its growth trajectory? Let’s explore further to uncover the company’s capacity to navigate these financial challenges.

Debt And Lease Payment Due

Tesla’s total amount due is based on the results reported in the 2024 annual report.

| Types of Debt | Amount Due In Billions | ||||

|---|---|---|---|---|---|

| 2025 | 2026 | 2027 | 2028 | 2029 | |

| Long-Term Debt | $2.4 | $4.1 | $0.7 | $0.2 | $0.1 |

| Operating Lease | $1.1 | $1.0 | $0.8 | $0.7 | $0.6 |

| Finance Lease | $0.1 | $0.1 | $0.1 | $0.0 | $0.0 |

| Total Due | $3.6 | $5.2 | $1.6 | $0.9 | $0.7 |

In calendar year 2025, Tesla faced a total payment obligation of $3.6 billion, primarily comprising long-term debt and operating lease commitments. This substantial figure underscores the company’s ongoing financial responsibilities.

Looking ahead to calendar year 2026, Tesla’s total payment due was projected to rise to $4.1 billion, again dominated by long-term debt and operating lease obligations.

Over the five-year period from 2025 to 2029, Tesla’s cumulative payment obligations were estimated to reach approximately $7.5 billion. This significant sum reflects the company’s strategic reliance on both debt and lease arrangements to support its growth and operational needs.

The critical question remains: Can Tesla effectively manage and fulfill these substantial financial commitments?

The company’s ability to generate sufficient cash flow, maintain liquidity, and leverage its financial resources will be key to meeting these obligations without compromising its growth trajectory.

Tesla’s financial health could be at risk if the company is unable to meet its cash payment obligations. Let’s delve deeper into Tesla’s liquidity in the next section to assess its capacity to navigate these challenges.

Liquidity

Tesla’s total liquidity is based on the result reported in the 2024 annual report.

| Available Liquidity | USD In Billions | |

|---|---|---|

| Committed Capacity | Available Capacity For 2025 And Onward | |

| Cash & Cash Equivalents | – | $16.1 |

| Short-Term Investments | – | $20.4 |

| Credit Facilities | $5.0 | $5.0 |

| Operating Cash Flow | – | $14.3 (average) |

| Total Liquidity | – | $55.8 |

Tesla’s sources of liquidity include cash and cash equivalents, short-term investments, and credit facilities from banks.

Besides cash, investments, and credit facilities, Tesla generates its cash through operating activities.

Therefore, Tesla was estimated to have a total liquidity of $42 billion (excluding operating cash flow of $14.3 billion) as of the end of fiscal year 2024. With operating cash flow included, Tesla’s total liquidity may reach $56 billion, as depicted in the table above.

This liquidity is available for use in calendar year 2025 and onward. Therefore, with a staggering cash balance and credit facilities of $42 billion, coupled with the cash flow from operating activities, Tesla should have more than enough cash to meet its debt payment due in 2025 and onward.

For example, Tesla’s cash and credit facilities alone were more than enough to meet the cumulative $7.5 billion due over the next five years from 2025 to 2029. More importantly, this liquidity hasn’t even taken into account the cash flow from operating activities.

In short, Tesla has ample liquidity meet its payment obligations from calendar year 2025 to 2029. Tesla’s financial health looks to be in excellent condition.

Credit Rating

Tesla’s credit ratings as of 31 Dec 2024.

| Rating Institutions | Types Of Indebtedness | Outlook | |

|---|---|---|---|

| Long-Term Debt | Short-Term Debt | ||

| Standard & Poor’s | N.A. | N.A. | N.A. |

| Moody’s | N.A. | N.A. | N.A. |

| Fitch | N.A. | N.A. | N.A. |

As of 31 Dec 2024, Tesla did not publish any credit rating regarding its debt obligation in the 2024 annual reports.

Summary

In summary, Tesla’s long-term debt stood at $7.9 billion, with $2.3 billion classified as the current portion, set to mature within the next 12 months.

When accounting for lease liabilities, Tesla’s total debt climbed to $13.6 billion by the end of fiscal year 2024. Nevertheless, the company maintains sufficient liquidity to fulfill its debt and lease commitments for 2025 and the years ahead.

Overall, Tesla’s financial health is robust and shows stability.

References and Credits

1. All financial figures presented were obtained and referenced from Tesla’s quarterly and annual reports published on the company’s investor relations page: Tesla Investor Relations.

2. Flickr Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.

Thank you!

One major advantage of a non-recourse agreement is that once you have

sold the accounts receivable, it is no longer your responsibility.

However, with invoice factoring you usually get access to other services.

Maintain a separate notebook which contains the list of the persons who

are to be billed and for what goods and what amount they have to be billed.