Inside A Tesla’s Car. Pexels Image.

This article provides a detailed analysis of Tesla’s revenue by country, covering key markets such as the U.S., China, Norway, the Netherlands, and more.

Let’s take a look! You may find related statistic of Tesla on these pages:

- Tesla revenue breakdown and profit margin by segments

- Tesla energy sales and energy profit margin, and

- Tesla sales and production by model.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Why is Tesla’s revenue from the U.S. and China slowing down?

U.S. And China

A1. Revenue From The U.S. And China

A2. Percentage Of Revenue From The U.S. And China

Norway And Netherlands

B1. Revenue From Norway And The Netherlands

B2. Percentage Of Revenue From Norway And The Netherlands

Other Countries

C1. Revenue From Other Countries

C2. Percentage Of Revenue From Other Countries

Growth Rates

D1. YoY Growth Rates Of Revenue From The U.S. And China

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Revenue By Country: Tesla categorizes its revenues by geographic area, determined by the location where its products are sold.

Why is Tesla’s revenue from the U.S. and China slowing down?

Tesla’s revenue slowdown in the U.S. and China can be attributed to several key factors:

-

Increased Competition:

- In both the U.S. and China, Tesla faces growing competition from traditional automakers and new electric vehicle (EV) manufacturers. In China, local EV brands like BYD have gained significant market share, challenging Tesla’s dominance.

-

Production Challenges:

- Tesla has encountered production challenges, such as the redesign of the Model Y, which affected production at its Shanghai Gigafactory. These production adjustments have impacted Tesla’s ability to meet demand.

-

Economic Factors:

- Economic conditions, including inflation and changes in consumer spending, have influenced the demand for Tesla vehicles. In the U.S., economic uncertainties have affected consumer purchasing power.

-

Political and Trade Issues:

- Concerns about a potential China-U.S. trade war have created uncertainties for Tesla’s operations and sales in both countries. Political controversies involving Tesla’s CEO, Elon Musk, have also impacted the company’s reputation and sales.

-

Operational Efficiency:

- TSMC’s focus on manufacturing excellence and continuous improvement has led to high operational efficiency and lower production costs.

- Intel has faced operational challenges and higher costs associated with its integrated design and manufacturing approach.

-

Market Saturation:

- In key markets like California, where Tesla once dominated, the market has become saturated, leading to a decline in sales. Other brands have seen an increase in sales, while Tesla’s numbers have fallen.

-

Seasonal and Cultural Factors:

- In China, seasonal factors such as the Chinese Spring Festival have contributed to a temporary slowdown in sales. Additionally, cultural preferences and shifts in consumer behavior have influenced Tesla’s market performance.

These factors collectively explain the decline in Tesla’s revenue in the U.S. and China. As the EV market continues to evolve, Tesla will need to navigate these challenges and adapt its strategies to maintain its competitive edge.

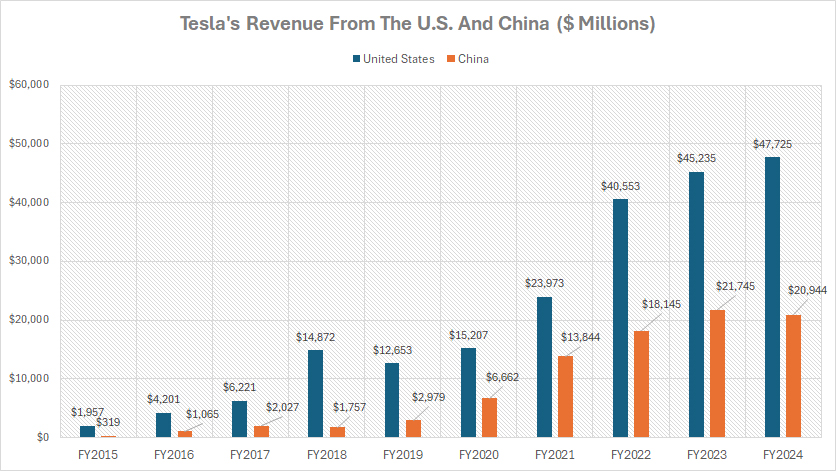

Revenue From The U.S. And China

Tesla-revenue-from-the-US-and-China

(click image to expand)

The definition of Tesla’s revenue categorized by country is available here: revenue by country.

Tesla generates significantly higher revenue from the U.S. than from China, as shown in the accompanying chart. In fiscal year 2024, Tesla’s revenue from the U.S. totaled an impressive $47.7 billion, while revenue from China amounted to $20.9 billion, less than half of the U.S. figure.

A notable trend is the significant increase in revenue streams from both regions over the years. From fiscal year 2019 to 2024, Tesla’s revenue from the U.S. surged by 278%, rising from $12.7 billion to $47.7 billion in five years. This growth reflects the strong demand for Tesla vehicles and the company’s expanding market presence in the U.S.

During the same period, Tesla’s revenue from China experienced an even more remarkable increase of 600%, growing from $3 billion in 2019 to $20.9 billion in 2024. This growth highlights the rapidly expanding electric vehicle (EV) market in China and Tesla’s successful efforts to capture a significant share of this market.

However, Tesla’s revenue from China remained relatively flat in fiscal year 2024 compared to the previous year, indicating potential challenges in maintaining the same growth momentum. In contrast, revenue from the U.S. continued to grow by 6% year-over-year, demonstrating sustained demand and market strength in Tesla’s home country.

Several factors contribute to these trends. For example, the U.S. market has seen consistent demand for Tesla vehicles, supported by government incentives for EV adoption and a growing consumer interest in sustainable transportation.

In China, while the EV market is expanding rapidly, increased competition from local EV manufacturers like BYD and NIO has impacted Tesla’s ability to maintain its growth trajectory.

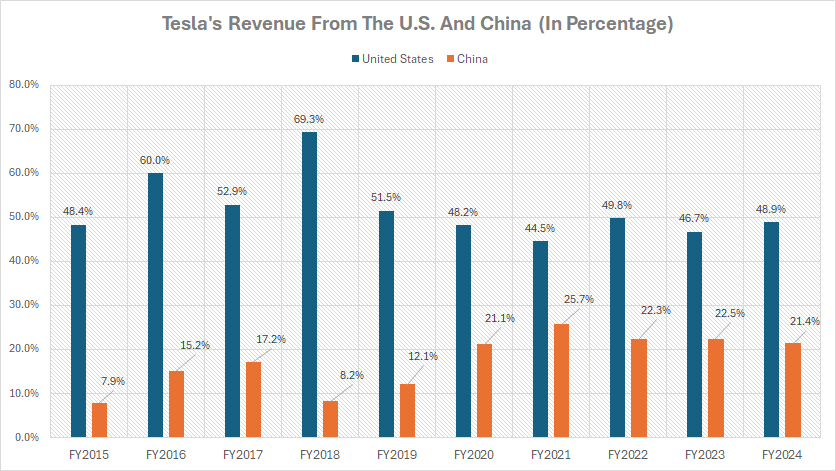

Percentage Of Revenue From The U.S. And China

Tesla-percentage-of-revenue-from-the-US-and-China

(click image to expand)

The definition of Tesla’s revenue categorized by country is available here: revenue by country.

Tesla’s revenue from the U.S. accounts for the majority of its total revenue, reaching 49% in fiscal year 2024. This ratio has remained relatively constant between fiscal years 2015 and 2024, despite experiencing significant fluctuations over this period. Notably, the ratio surged to 69% in fiscal year 2018, marking the highest ratio ever recorded for Tesla’s U.S. revenue.

On the flipped side, Tesla’s revenue from China represents a smaller portion of its total revenue compared to the U.S. In fiscal year 2024, revenue from China comprised just 21% of Tesla’s total revenue, down from the peak ratio of 26% achieved in fiscal year 2021. However, over the longer term, the ratio has shown substantial growth, rising from only 8% in fiscal year 2015 to 21% by fiscal year 2024.

In the U.S., Tesla’s early market entry and strong brand presence have led to widespread adoption, resulting in a consistently high revenue share. However, market saturation in key areas such as California has moderated the growth rate.

In addition, Tesla also faces competition from traditional automakers entering the EV market, but its strong brand and innovation continue to drive revenue.

In China, Tesla initially captured a smaller market share, but aggressive expansion and the establishment of the Shanghai Gigafactory have significantly boosted its revenue share over time.

Similarly, increased competition from local EV manufacturers such as BYD and NIO has posed challenges for Tesla, impacting its ability to maintain high growth rates.

These factors collectively explain the trends in Tesla’s revenue distribution between the U.S. and China. While the U.S. remains the largest market for Tesla, the company’s strategic efforts in China have led to significant growth in this key region.

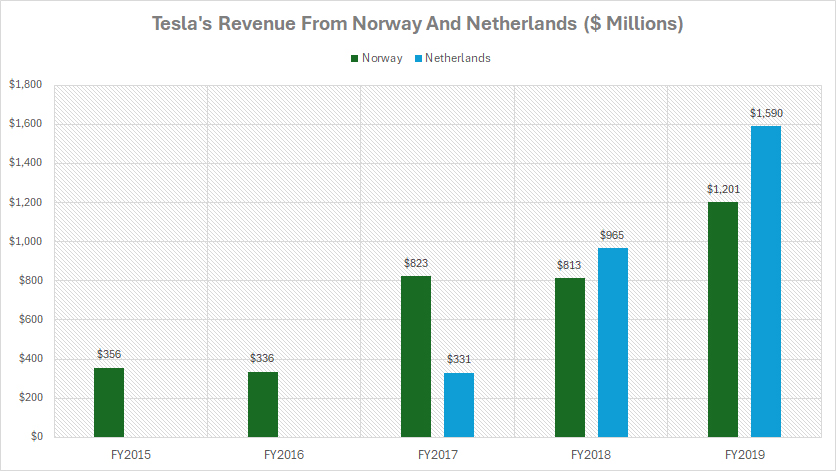

Revenue From Norway And The Netherlands

Tesla-revenue-from-Norway-and-Netherlands

(click image to expand)

The definition of Tesla’s revenue categorized by country is available here: revenue by country.

Tesla has ceased providing a detailed breakdown of its revenue from Norway and the Netherlands starting in fiscal year 2020. The last available revenue data from these regions is from fiscal year 2019.

In fiscal year 2019, Tesla generated a modest amount of revenue from Norway, reaching $1.2 billion. Meanwhile, the company earned slightly higher revenue from the Netherlands, totaling $1.6 billion in the same fiscal year.

Between fiscal years 2017 and 2019, Tesla’s revenue from Norway increased by an impressive 50%. During the same period, the revenue growth from the Netherlands was even more remarkable, soaring by 430%.

The significant growth in these regions can be attributed to several factors. Both Norway and the Netherlands have been early adopters of electric vehicles, driven by strong government incentives, environmental awareness, and supportive infrastructure for EVs. Tesla’s innovative technology and brand appeal have resonated well with consumers in these markets, contributing to the revenue growth.

In addition, Consumers in Norway and the Netherlands have shown a strong preference for environmentally friendly and high-performance vehicles, aligning well with Tesla’s product offerings. The positive reception of Tesla’s Model 3, Model S, and Model X in these markets has driven significant sales and revenue growth.

Despite the lack of recent detailed revenue data from these regions, the impressive growth seen from fiscal years 2017 to 2019 highlights Tesla’s successful penetration into the Norwegian and Dutch markets. Moving forward, the company’s ability to navigate evolving market dynamics, government policies, and consumer preferences will be crucial for sustaining its growth in these key European regions.

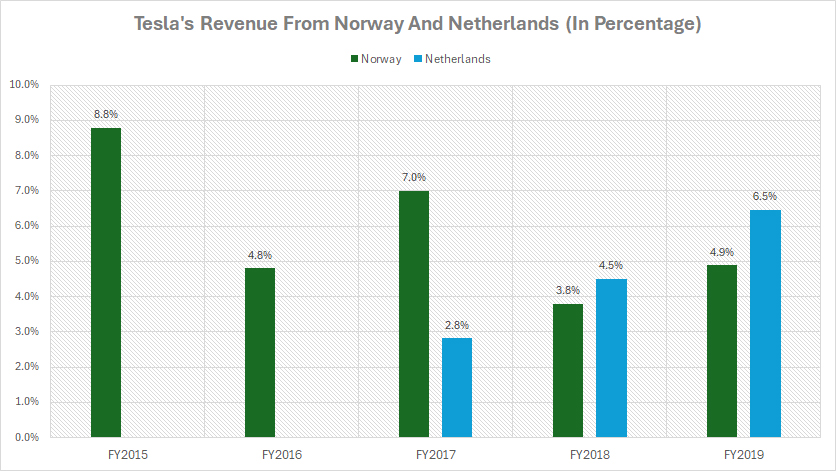

Percentage Of Revenue From Norway And The Netherlands

Tesla-percentage-of-revenue-from-Norway-and-Netherlands

(click image to expand)

The definition of Tesla’s revenue categorized by country is available here: revenue by country.

From a percentage perspective, in fiscal year 2019, Tesla’s revenue from Norway made up just 5% of its total revenue, while its revenue from the Netherlands represented 6.5%.

Although Tesla’s revenue from Norway has tripled since fiscal year 2015, the percentage of total revenue has decreased from 9% to 5% over the five-year period. This decline illustrates the much bigger revenue growth from other regions, which have outpaced the growth in Norway.

In contrast, Tesla’s revenue share from the Netherlands has shown significant growth. The revenue share increased from 3% in fiscal year 2017 to nearly 7% in fiscal year 2019, marking a notable increase in this region.

Tesla’s aggressive market expansion in other regions, particularly in larger markets like the U.S. and China, has led to a higher overall growth rate, overshadowing the growth in smaller markets like Norway.

While Norway has been a pioneer in promoting EV adoption through government incentives, similar policies in other regions have also accelerated Tesla’s growth in those markets. For example, China’s substantial subsidies for EVs have contributed to Tesla’s significant revenue growth in the region.

While both regions have contributed to Tesla’s growth, the larger markets’ rapid expansion and changing competitive landscapes have influenced the revenue shares over time.

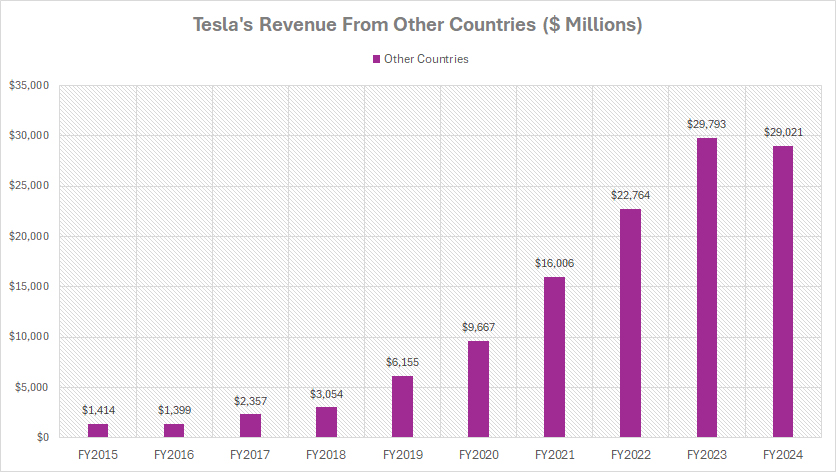

Revenue From Other Countries

Tesla-revenue-from-other-countries

(click image to expand)

The definition of Tesla’s revenue categorized by country is available here: revenue by country.

Tesla’s revenue from other countries reached $29 billion cumulatively in fiscal year 2024, remaining roughly in line with the $29.8 billion recorded in 2023.

Between fiscal years 2020 and 2024, Tesla’s revenue from other countries has experienced substantial growth, nearly tripling from $9.7 billion to $29 billion over the five-year period.

This remarkable increase highlights Tesla’s successful global expansion and its ability to capture new markets outside of its primary revenue sources in the U.S. and China. Several factors have contributed to this impressive growth.

Tesla has aggressively pursued expansion into various international markets, establishing a presence in Europe, Asia-Pacific, and other regions. This strategy has enabled the company to tap into new customer bases and drive significant revenue growth.

The establishment of Gigafactories in different regions, such as the Gigafactory Berlin in Germany and the Gigafactory Shanghai in China, has facilitated localized production and reduced costs. This has allowed Tesla to cater more effectively to regional demand and increase its revenue from other countries.

As Tesla continues to expand its global footprint, its ability to navigate regional market dynamics, regulatory environments, and competitive landscapes will be critical for sustaining and enhancing its revenue performance. The company’s strategic investments in production capacity, innovation, and market development position it well to capitalize on the growing demand for electric vehicles worldwide.

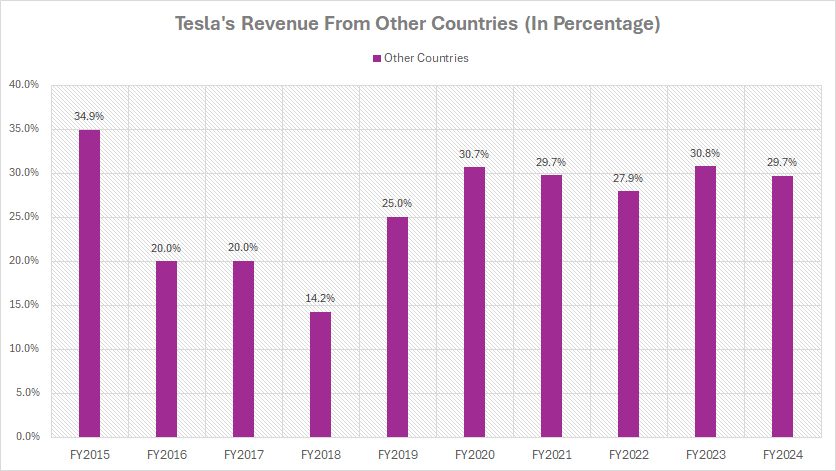

Percentage Of Revenue From Other Countries

Tesla-percentage-of-revenue-from-other-countries

(click image to expand)

The definition of Tesla’s revenue categorized by country is available here: revenue by country.

In fiscal year 2024, Tesla’s revenue from other countries accounted for nearly 30% of the company’s total revenue. This percentage has remained relatively consistent from fiscal years 2020 to 2024, as depicted in the accompanying chart.

Several factors have contributed to this consistent contribution from other countries. Tesla’s strategic efforts to penetrate various international markets have paid off, resulting in a steady revenue stream from regions outside its primary markets in the U.S. and China. The company’s commitment to establishing a global presence has been instrumental in maintaining this stable contribution.

Moreover, the establishment of Gigafactories in different regions, such as Europe and Asia-Pacific, has enabled Tesla to produce vehicles closer to its international customers. This localized manufacturing approach has not only reduced production and shipping costs but also allowed Tesla to cater more effectively to regional demand.

Tesla’s diverse range of electric vehicles, including the Model 3, Model Y, Model S, and Model X, has resonated well with consumers in various international markets. The introduction of new models and continuous innovation have further bolstered Tesla’s appeal and sales globally.

These factors collectively explain the stable and significant contribution of revenue from other countries to Tesla’s total revenue.

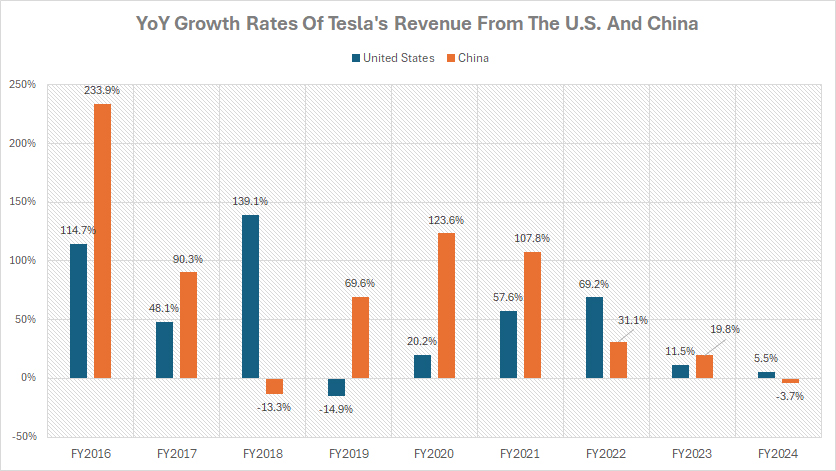

YoY Growth Rates Of Revenue From The U.S. And China

Tesla-growth-rates-of-revenue-from-the-US-and-China

(click image to expand)

The definition of Tesla’s revenue categorized by country is available here: revenue by country.

As depicted in the graph above, Tesla’s revenue growth from the U.S. and China has significantly slowed in recent years. In fiscal year 2024, Tesla’s revenue growth from the U.S. totaled only 5.5%, marking the lowest figure recorded over the past decade, excluding the decline in 2019.

Fiscal year 2023 also saw a sluggish performance, with revenue growth from the U.S. measuring just 11.5%, one of the lowest rates recorded over the past decade.

Similarly, Tesla’s revenue growth in China experienced a decline, down by 4% in fiscal year 2024, compared to a growth rate of 20% in the previous year. This notable slowdown indicates challenges in maintaining the same momentum in key markets.

On average, from fiscal years 2022 to 2024, Tesla grew its revenue by 29% annually from the U.S., reflecting strong, albeit recently slowing, performance. Meanwhile, the average annual growth rate from China was 16%, showcasing significant, yet variable, growth over the period.

Several factors have contributed to this slowdown in revenue growth. In key regions like California, where Tesla has historically dominated, the market has become saturated, leading to slower growth rates. Consumers who are early adopters have already made their purchases, reducing the pool of potential new buyers.

Both the U.S. and China markets have seen increased competition from other electric vehicle (EV) manufacturers. In China, local brands like BYD and NIO have gained market share, while in the U.S., traditional automakers are ramping up their EV offerings.

Economic uncertainties, such as inflation and changes in consumer spending habits, have affected the demand for Tesla vehicles. In the U.S., economic fluctuations have impacted consumer purchasing power, leading to slower growth.

These factors collectively explain the slowdown in Tesla’s revenue growth from the U.S. and China. As the electric vehicle market continues to evolve, Tesla will need to address these challenges and adapt its strategies to sustain and enhance its growth in key markets.

Conclusion

In summary, Tesla’s revenue distribution across different regions highlights the company’s strong global presence and the impact of market dynamics.

While the U.S. remains Tesla’s largest market, recent years have seen a slowdown in revenue growth due to market saturation and increased competition.

Similarly, Tesla’s revenue from China has faced challenges, with a decline in growth rate due to competition from local EV manufacturers and production adjustments.

The significant revenue growth in other countries underscores Tesla’s successful international expansion and ability to capture new markets.

The establishment of Gigafactories in various regions, supportive government policies, and a strong brand presence have contributed to this growth.

Credits and References

1. All financial figures presented were obtained and referenced from Tesla’s annual reports published on the company’s investor relations page: Tesla Update Letters and Presentations.

2. Pexels Images.

Disclosure

We may use the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.