Tesla dahsboard. Pexels Image.

Tesla’s growing common stock outstanding has lead to a phenomenon called stock dilution, an effect that reduces the ownership of existing shareholders.

Other than a reduction in ownership, stock dilution also can cause a decline in earnings per share (EPS) due to the increase in the number of stocks outstanding. Furthermore, the dividends per share (provided Tesla pays dividends) will also decrease.

The advantage to equity issuance is that it comes with less risk compared to having more debt.

When Tesla issues more equity to raise cash, it does not have to repay the capital. The disadvantage to equity issuance is that it dilutes the control of the company.

On the other hand, Tesla needs to repay the debt that it borrows, which usually comes with high interest expenses. Let’s look at Tesla’s share outstanding and stock dilution!

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

Tesla Shares Outstanding

B1. Shares Outstanding Numbers

B2. Shares Outstanding Growth Rates

Reason Of Tesla Stock Dilution

C1. Stocks Issuance In Public Offerings

C2. Stocks Issuance For Equity Incentive Awards

C3. Convertible Debts

Effect Of Stock Dilution

D1. Effects Of A Growing Stock Outstanding

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Share Dilution: Share dilution occurs when a company issues additional shares of its stock, resulting in a decrease in the ownership percentage of existing shareholders. Here are the key points to understand about share dilution:

Key Concepts:

1. Increased Number of Shares: When a company issues more shares, the total number of outstanding shares increases.

2. Reduced Ownership Percentage: Existing shareholders own a smaller percentage of the company than they did before the new shares were issued.

3. Impact on Earnings Per Share (EPS): Dilution can lead to a decrease in earnings per share (EPS) because the company’s earnings are now spread over a larger number of shares.

Causes of Share Dilution:

1. Issuance of New Shares: Companies might issue new shares to raise capital for expansion, pay down debt, or fund other corporate activities.

2. Stock Options and Warrants: Employees or investors exercising stock options and warrants can also cause dilution.

3. Convertible Securities: When convertible bonds or preferred stock are converted into common shares, it increases the total share count.

4. Mergers and Acquisitions: When companies acquire other businesses using stock as part of the payment, new shares are issued, leading to dilution.

Effects of Share Dilution:

1. Reduced Voting Power: Existing shareholders have less influence over corporate decisions due to their reduced ownership percentage.

2. Lower Stock Value: Dilution can negatively affect the stock price as the value of the company is spread over a larger number of shares.

3. Impact on Dividends: If a company pays dividends, dilution can mean each share receives a smaller portion of the total dividend payout.

Mitigating Dilution:

1. Share Buybacks: Companies may repurchase their own shares to offset dilution and support the share price.

2. Controlled Issuance: Managing the issuance of new shares to minimize unnecessary dilution.

Understanding share dilution is crucial for investors as it impacts their ownership percentage, voting power, and the overall value of their investment.

Shares Outstanding Numbers

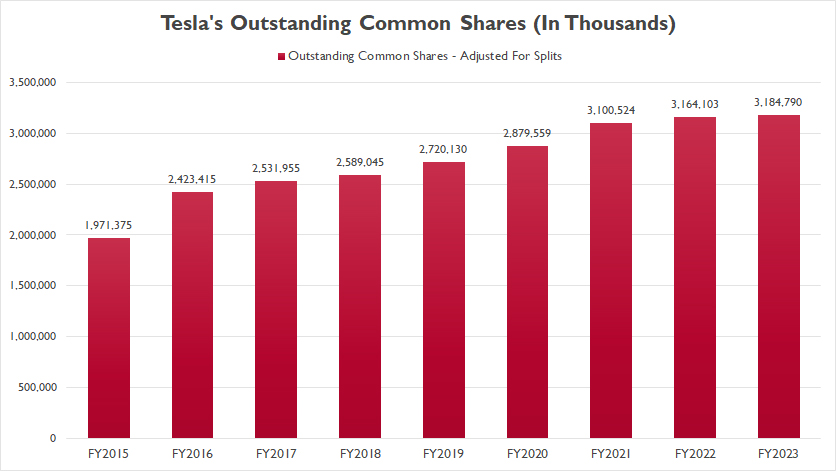

Tesla common stocks outstanding

(click image to expand)

Tesla’s common share outstanding reached 3.18 billion as of the end of fiscal year 2023, a record high in the last ten years.

From 2015 to 2023, Tesla’s common share outstanding has increased by 1 billion units or 61%.

Shares Outstanding Growth Rates

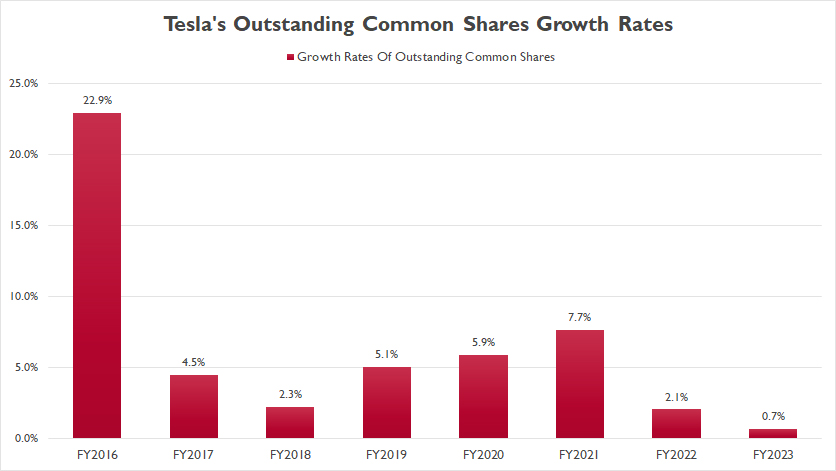

Tesla outstanding stocks growth rates

(click image to expand)

Tesla’s share outstanding grew 23% in 2016, the highest growth rate in stock outstanding ever measured.

The growth of Tesla’s share outstanding seems to have slowed in recent years. On average, Tesla’s share outstanding has increased by 3.5% between fiscal year 2021 and 2023.

In fiscal year 2023, Tesla’s share outstanding grew just 0.7%, the lowest rate since 2015.

Stocks Issuance In Public Offerings

One reason Tesla’s shares outstanding increases is stock issuance by the company in public offerings. The purpose of stock issuance in public offerings is to raise cash from the capital market.

In this aspect, Tesla issues new shares and investors subscribe to these new shares by paying a premium. The premium can be determined according to the stock price in the open market or a pre-determined stock price.

If the pre-determined stock price is lower than that in the open market, Tesla’s share price will fall as soon as the stock issuance takes place. The following examples detail some of Tesla’s stock issuance events.

Stocks Issuance In 2015

- In August 2015, Tesla issued 3 million common stocks to raise $738 million. This event led to the signifncany growth of common stocks outstanding by in 2015.

Stocks Issuance In 2016

- This was a large jump in share count by more than 10% in 2Q 2016. The outstanding shares grew from 134 million in 1Q 2016 to 148 million in 2Q 2016.

- As many as 14 million shares were added in just a single quarter. In May 2016, Tesla issued about 8 million common stocks to the public at $215 per share (before adjusted for split) to raise $1.7 billion of cash.

- In 4Q 2016, Tesla’s common stocks outstanding increased from 150 million to 162 million, an 8% growth from quarter to quarter. The increase was mainly a result of Tesla’s acquisition of SolarCity.

- In 4Q 2016, Tesla issued 11 million common stocks at $185 per share (before adjusted for split) to buy SolarCity. The deal was valued at $2.15 billion.

Stocks Issuance in 2019

- In May 2019, Tesla issued 3.5 million common stocks to raise $850 million. In the same quarter, Tesla also issued about 900k of common stocks for an aggregate value of $207 million to acquire Maxwell Technologies, Inc. The combination of stock issuance and acquisition had caused the common stocks outstanding to increase by nearly 4% in 2Q 2019.

Stocks Issuance in 2020

- In 1Q 2020, Tesla issued more than 3 million common stocks at $767 per share (before adjusted for split) to raise $2.31 billion of cash.

- In 4Q 2020, Tesla issued more than 8 million common stocks to raise $5 billion of cash.

Stocks Issuance For Equity Incentive Awards

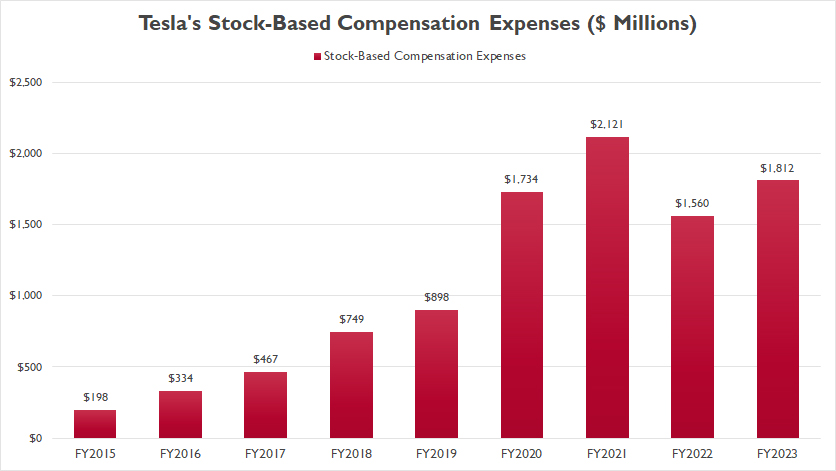

Tesla stock-based compensation expenses

(click image to expand)

Another reason Tesla’s common stocks outstanding increases is the company’s equity incentive awards. As shown in the chart, Tesla’s stock-based compensation expenses have significantly increased over the last ten years.

Under the equity incentive award, Tesla provides for the grant of stock options, restricted stock, RSUs, stock appreciation rights, performance units and performance shares to employees, directors and consultants.

When new common stocks are issued or granted, the company will incur an expense known as stock-based compensation expense.

Stock-based compensation expense is a charge against revenue. In other words, stock-based compensation expense will reduce Tesla’s profitability.

While stock-based compensation is an expense, it’s a non-cash expense, meaning that it does not affect Tesla’s cash flow from operating activities.

Based on the chart above, Tesla’s stock-based compensation expense has risen significantly since 2015, reaching $1.8 billion as of the end of 2023.

Tesla’s stock issuance for equity incentive awards has contributed not just a substancial number of shares outstanding but also stock-based compensation expenses which tend to reduce profitability.

Convertible Debt

In addition to stock issuances in public offerings and for equity incentive awards, another reaons that leads to the increasing shares outstanding is the exercise of the conversion feature of convertible debt.

For your information, Tesla holds a number of convertible debts, according to this article – Tesla’s securities.

As the name implies, convertible debts are available for conversion by their holders to common stocks when Tesla’s stock closing price exceeds an applicable conversion price of the debts.

To simplify things, when Tesla’s stock price hit a certain threshold, say $500 per share, for a number of days in a quarter, the holders have the option to exchange a portion of or even the whole debt for common stocks.

In this case, Tesla will pay cash to settle the principal amount and issue common stocks for the conversion premium. These common stocks issued will certainly increase the outstanding stocks. The question is, how many outstanding stocks have been added?

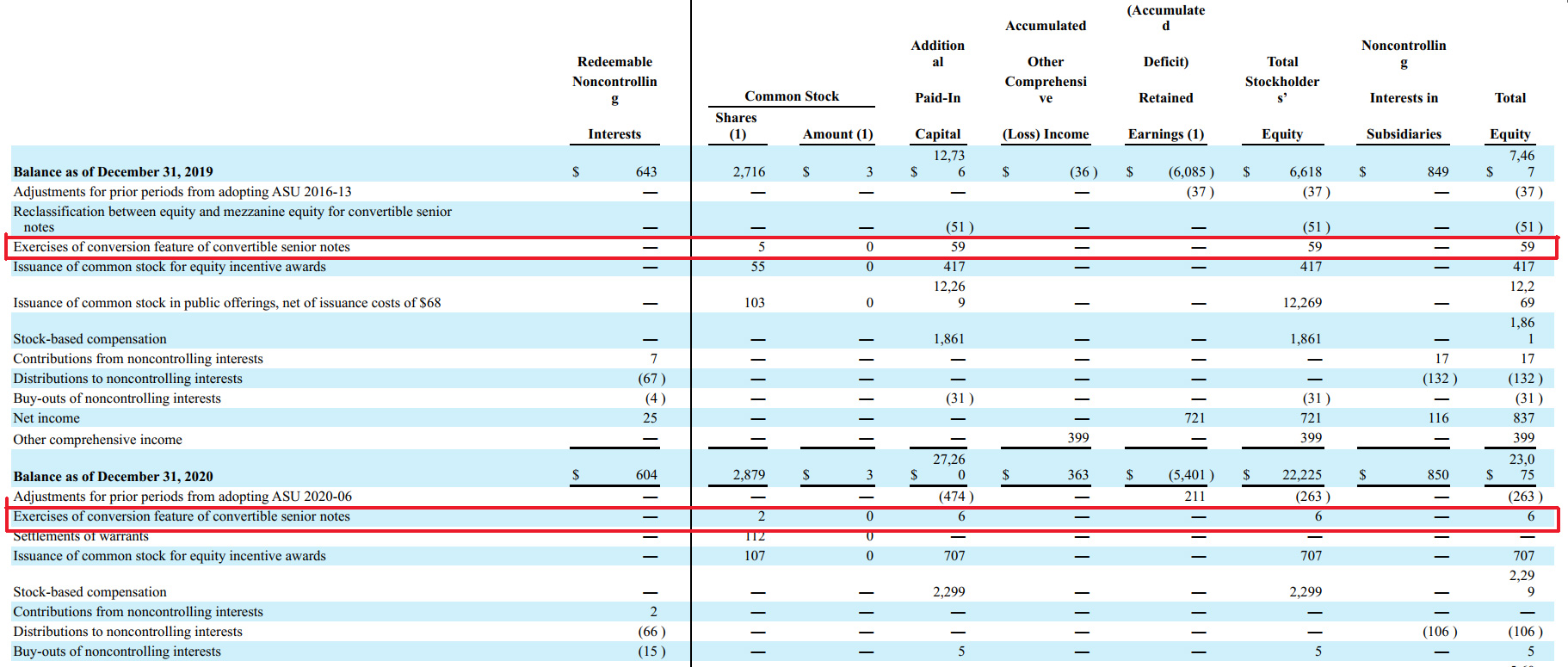

According to the following snapshot that depicts Tesla’s statements of equity, about 2 million shares outstanding or less than 1% of total shares outstanding attributed to convertible debts have been added in 2020 and the amount was about 1 million in 2021.

Tesla outstanding stocks growth attributed to convertible securities

(click image to expand)

The 3 million shares outstanding added seems like a small number. Yes, the effect of the convertible securities on Tesla’s shares outstanding may look like nothing. However, when you add up all the things that had fueled the growth of Tesla’s shares outstanding, the effect has been devastating.

Effects Of A Growing Stocks Outstanding

As mentioned, the effect is stock dilution. What is stock dilution? A definition of stock dilution is available here: stock dilution. Here is an example.

Tesla has 100 shares outstanding, and you own 50 of them. That means your ownership of Tesla is 50% of the company. Later, Tesla launches a public offering and issued 100 more shares. So, the total shares outstanding now have become 200.

You still own the 50 shares, but the percentage of your ownership of Tesla has now become only 25%. Your ownership has dwindled to only a quarter of the company.

Summary

Between 2015 and 2023, Tesla’s common stock outstanding has increased by 60%, reaching a record figure of 3.18 billion shares as of the end of 2023. The result is that stock dilution has been occurring to existing stockholders.

Tesla issued more stocks to raise cash, and this practice has fueled the growth in shares outstanding. Additionally, Tesla also issued stocks to employees, contractors, directors and CEO as part of the company’s equity incentive awards.

However, this practice also led to an increase in shares outstanding. Following the stock issuance, Tesla’s stock-based compensation expense has exploded and reached more than $2 billion in 2021 alone, a record for the company.

Keep in mind that the stock-based compensation expense will reduce the net income and thereby, the earnings per share or EPS. Tesla’s convertible securities also fueled in part the growth of the company’s share outstanding, albeit at a very small amount.

References and Credits

1. All financial figures presented in this article were obtained and referenced from the company’s SEC filings, earnings releases, investors presentations, update letters, quarterly and annual reports, etc., which are available in Tesla Financial Results.

2. Pexels Images.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the full correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!

Is this what will happen to chipotle’s stock when it splits ?

No, stock split is different and does not dilute shares.