Tesla’s logo on a dealership building. Source: Flickr

As the saying goes, cash is the lifeline of a business. It’s no exception for Tesla.

To find out if Tesla (NASDAG:TSLA) need a capital raise, investors just need to look at the company’s cash flow.

There are several parts associated with the cash flow statements where investors can take a look and they are: (1) cash flow from operation, (2) cash flow from investing activities and (3) cash flow from financing activities.

In this article, we will explore Tesla’s cash flow by going into detail the 3 different parts of the cash flow statements.

Let’s move on!

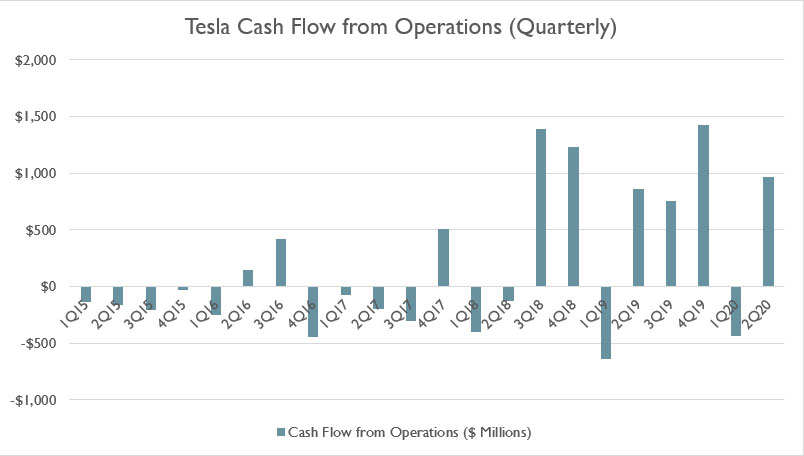

Tesla’s Operating Cash Flow (Quarterly)

Tesla operating cash flow (quarterly)

The chart above shows Tesla’s quarterly cash flow from operations over the past 5 years from 2015 to 2020.

From the first look, it may seem that Tesla’s core operations have only been consuming cash instead of producing cash over the last 5 years, as cash flow from operations has been mostly negative. For example, cash flow was mostly in the red before 2017.

However, the company seems to be turning around starting in 2018 when cash produced from operations turned positive in 2 consecutive quarters, resulting in a net operating cash flow of as much as $2 billion in the entire year.

Operating cash flow further improved in 2019 and 2020 when Tesla managed to produce positive operating cash flow in multiple quarters, resulting in net operating cash flow of more than $2.4 billion in 2019, a 20% improvement compared to 2018.

In 2Q 2020 quarter alone, Tesla managed to generate close to $1 billion of operating cash flow, suggesting that the company has further improved its business operations.

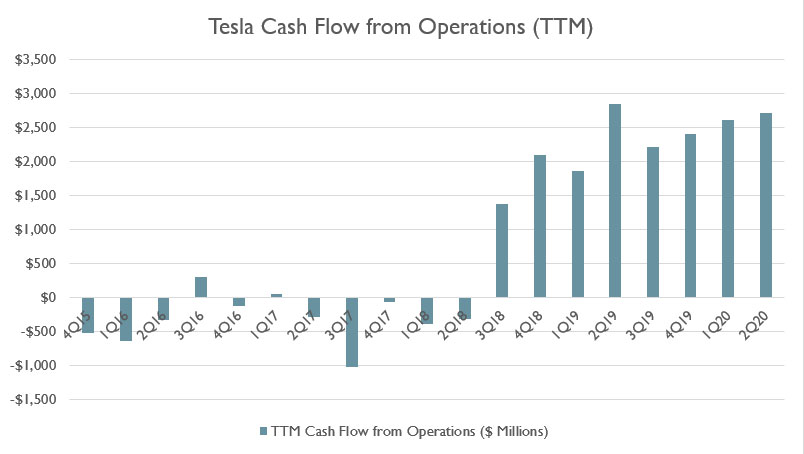

Tesla’s Operating Cash Flow (TTM)

Tesla operating cash flow (ttm)

The chart above shows Tesla’s operating cash flow on a trailing 12-months (TTM) basis.

From a TTM standpoint, the trend of the plot above further reinforces the quarterly results that Tesla’s business operations have indeed been improving, particularly during 2019 and 2020.

As seen in the chart above, Tesla generated more than $2.5 billion in operating cash flow as of Q2 2020 on a TTM basis.

However, positive operating cash flow does not necessarily mean that the cash is enough to pay for expenses such as capital expenditure which is crucial for the expansion of the business.

Capital expenditure or CAPEX is a form of investment in fixed assets such as factories, plants, equipment and tools to support the future expansion of the business.

Therefore, we will need to look at the company’s cash flow from investing activities which primarily tracks cash transactions in capital expenditures.

Tesla’s Cash Flow from Investing Activities

Cash flow from investing activities is primarily related to capital expenditure.

As briefly mentioned, capital expenditure (CAPEX) is the expansion of the company’s operational capability and is driven primarily by the increase in fixed or long-term assets such as property, plant and equipment in Tesla’s case.

For example, the construction of Gigafactory 1, Gigafactory 2, Tesla Factory, Gigafactory Shanghai and the purchase, as well as the upgrade of machinery, are all part of Tesla’s capital expenditure.

Having said so, capital expenditure is crucial for Tesla’s future expansion and without it, the company will not be able to grow further.

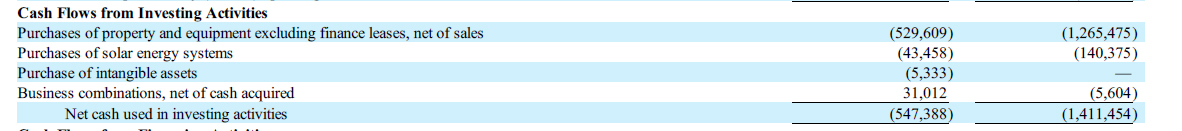

The following snapshot shows Tesla’s cash flow from investing activities:

Tesla Cash Flow for Capital Expenditures

As seen from the snapshot, the purchase of property and equipment makes up a large part of the cash flow from investing activities.

Other than spending cash on factories and tools, the company also spends on other investments such as solar energy systems and business acquisition as shown in the snapshot.

These are also crucial investments that will enable the company to expand even further in the future.

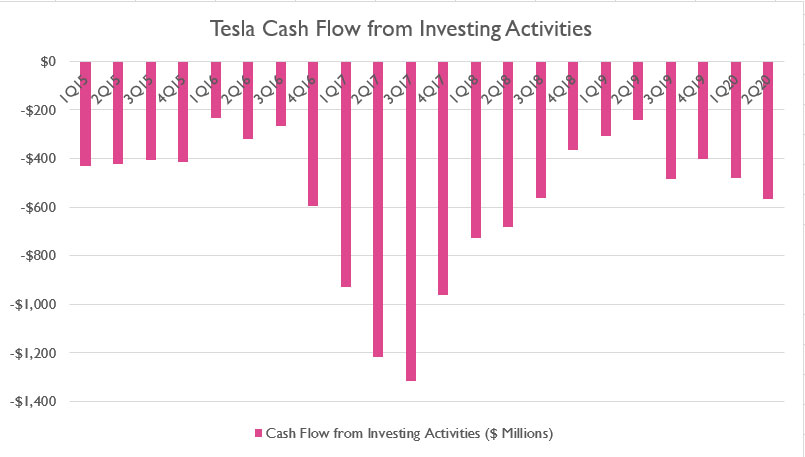

While we have seen that Tesla managed to produce positive operating cash flow close to $1 billion in 2Q 2020 alone, the cash generated did not mean anything if it failed to cover the said investing activities as depicted in the chart below.

Tesla cash flow from investing activities

The chart above shows Tesla’s cash flow from investing activities and in order for Tesla to succeed and prosper, the cash flow from operations must be able to cover the above cash outflow from investing activities.

The figures in the chart above are negative because investing activities consume cash instead of producing them.

A point worth mentioning is that Tesla’s cash outflow from investing activities during 2017 totaled more than $4 billion, which was the largest in the past 5 years.

Between 2019 and 2020, Tesla’s cash outflow from investing activities has been reduced to roughly $500 million per quarter, possibly due to cost-cutting initiatives carried out by the company.

From the investing chart alone, we can’t tell whether Tesla’s operating cash surplus was enough to cover the cash outflow for investing activities and whether an external capital injection was brought in to support it.

That said, we will look at Tesla’s free cash flow.

In general, free cash flow is a product of deducting cash flow from investing activities from operating cash flow.

Here is the formula that is used to calculate the free cash flow:

Free cash flow = Operating cash flow – Cash flow from investing activities

A positive free cash flow implies that the company has a cash surplus as a result of efficient business operations that produce enough operating cash flow to cover the required investments for future growth.

A company can freely use the free cash flow for other purposes such as pay down debt and reward investors in the form of dividends or share buyback.

As you can see, positive free cash flow is a very important milestone that every company must strive to achieve.

With that said, I have created the following chart that tracks Tesla’s free cash flow.

Chart of Tesla’s Free Cash Flow (Quarterly)

Tesla free cash flow (quarterly)

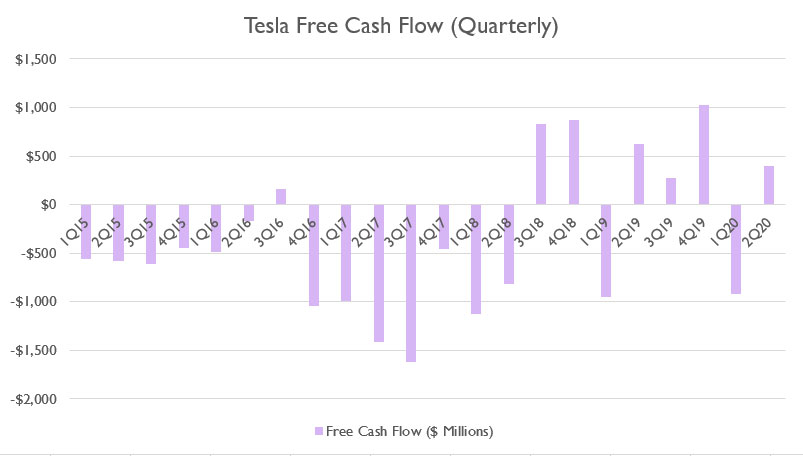

The chart above keeps track of Tesla’s quarterly free cash flow for the last 5 years from 2015 to 2020.

Based on the chart, Tesla’s free cash flow has always been in the red, from 2015 to 2018 in particular.

The turnaround came in 2018 when Tesla managed to successfully produce positive free cash flow in multiple quarters, with some of them totaling as much as $1 billion.

In 2020 2Q, Tesla generated a positive free cash flow of about $400 million, good enough for a company that has consistently run into cash deficit in previous years.

Chart of Tesla’s Free Cash Flow (TTM)

Tesla free cash flow (ttm)

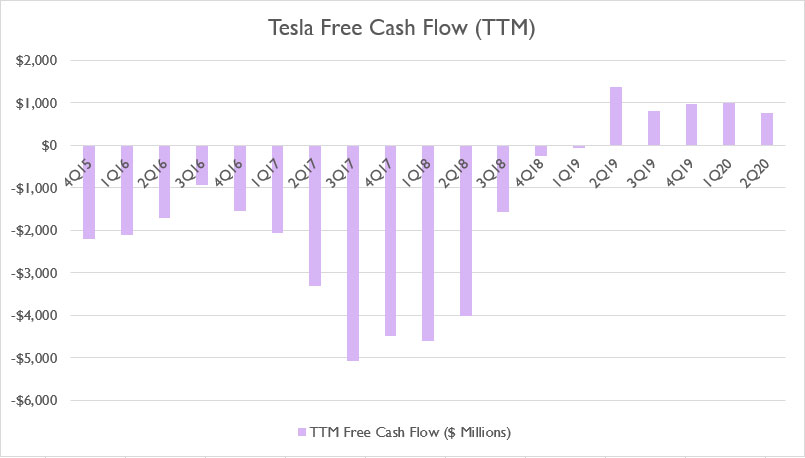

From a trailing 12-months (TTM) perspective, the trend is quite clear that Tesla managed to flip from being negative free cash flow to positive free cash flow starting in 2019.

Throughout 2019 and 2020, Tesla generated a TTM free cash flow of close to $1 billion in every single quarter, illustrating that perhaps, the company’s fortune has reversed from being a cash-burning machine to a cash cow now.

While the $1 billion TTM free cash flow is great, the amount may not be sufficient to cover Tesla’s future cash flow usage.

Here is a simple analysis that can quickly determine Tesla’s future cash flow requirements.

Tesla’s Projected Cash Flow Requirements

Tesla revenue to current asset ratio

The table above shows Tesla’s TTM revenue to average current assets ratio for the past 5 years from 2015 to 2020. At the bottom of the table, it gives an average ratio of 1.87.

The ratio says that Tesla requires $1 dollar of current assets to generate $1.87 dollars of revenue.

Tesla’s projected sales growth is about 10% on a quarterly basis for the TTM revenue.

Therefore, if Tesla were to do sales of about $28 billion in the next quarter, Tesla needs about $15 billion in current assets.

As of 2Q 2020, Tesla’s current assets totaled more than $15 billion, which means Tesla already has this amount of current assets to support the sales of about $28 billion for the next quarter.

How about the quarter after that? Using the same calculation, Tesla needs about $16.5 billion in current assets to generate about $31 billion of sales on a TTM basis.

In other words, Tesla will be short of $1.5 billion in current assets or working capital by 4Q 2020 from the existing amount.

The shortfall of $1.5 billion has to come from somewhere, either from Tesla’s generated free cash flow or external capital raise.

As of 2Q 2020, Tesla only managed to produce an average amount of $250 million in free cash flow per quarter based on the $1 billion TTM free cash flow.

From this analysis, Tesla’s existing free cash flow generation is far from sufficient to support the company’s future expansion.

Tesla’s Cash Flow from Financing Activities

Tesla cash flow from financing activities

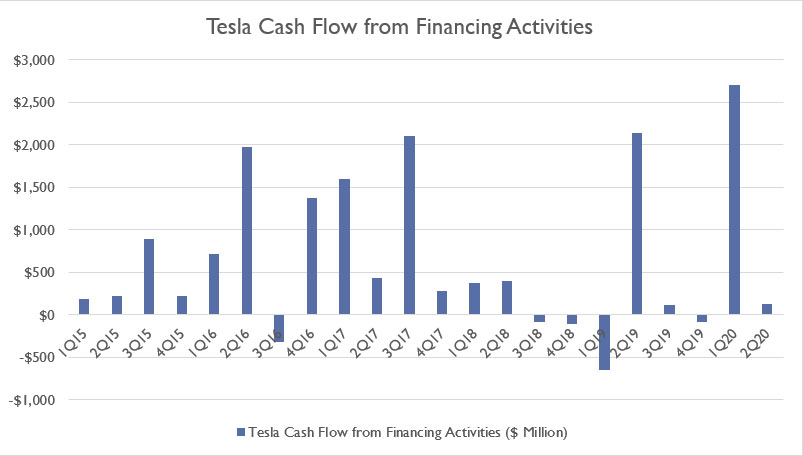

Since Tesla’s free cash flow is far from enough for future expansion, the company has to rely on capital raise to cover the shortfall in working capital.

To this end, Tesla can issue debt or equity or both to raise capital, and these activities are tracked in the cash flow from financing activities as shown in the chart above.

To quickly summarize, cash flows from financing activities are primarily related to debt issuance and repayment. Aside from debt-related activities, this section also covers cash inflow from the issuance of equity.

Moreover, cash outflow will also be shown here for such activities as shares buyback and dividends payout.

According to the above chart, Tesla’s most recent capital raise occurred in 1Q 2020, in which the company managed to secure a net amount totaling more than $2.5 billion.

Conclusion

Does Tesla need a capital raise? The answer is an obvious yes because the company’s existing free cash flow is just too little to support the company’s future expansion.

In fact, I bet that Tesla will be consistently raising capital every fiscal year.

In short, Tesla needs to raise capital to not only survive but expand.

References and Credits

1. All financial data on this page were obtained and referenced from Tesla’s quarterly and annual filings which can be found in the company’s website: Tesla Investor Relations.

2. Featured images in this article are used under creative commons license and sourced from the following websites: Maurizio Pesce and Niall Kennedy.

Popular posts for a good read:

- Ratio of Tesla operating expenses to revenue

- Will Tesla go bankrupt in 2021?

- Tesla revenue recognition from automotive sales and leasing

- GM most profitable business segments

- Tracking GM total inventory and finished products inventory

Disclosure

Readers, investors, analysts, bloggers, visitors, researchers, writers, or academicians are highly encouraged to use, copy, quote, distribute, duplicate, modify, edit, upload, download, share and link any materials on this webpage such as the charts, snapshots, texts, paragraphs, etc. You can credit back to this page by a link or a mention of the website. Thanks for sharing!