Open pit mining. Source: Pixabay

This article presents the revenue, revenue breakdown, profitability, and profit margins of Peabody Energy Corporation (NYSE: BTU).

Investors looking for other statistics of Peabody may find more resources on these pages:

- Peabody global and U.S. coal sales volumes,

- Peabody coal price and profit per ton, and

- Peabody profit breakdown by segment.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. How Does Peabody Energy Generate Revenue?

Consolidated Results

A1. Revenue And Profitability

A2. Profit Margins

Revenue Breakdown – Seaborne Operation

B1. Revenue From Seaborne Mining Operations

B2. Percentage Of Revenue From Seaborne Mining Operations

Revenue Breakdown – U.S. Operation

C1. Revenue From U.S. Mining Operations

C2. Percentage Of Revenue From U.S. Mining Operations

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Seaborne Mining Operation: Peabody Energy’s seaborne mining operations primarily involve the extraction and export of coal to international markets. These operations are mainly located in Australia, where Peabody mines both thermal coal (used for power generation) and metallurgical coal (used in steel production).

Key mines in Australia include the Wambo Underground Mine, Wilpinjong Mine, Centurion Mine, Coppabella Mine, Metropolitan Mine, Middlemount Mine, and Moorvale Mine. These operations have significantly contributed to Peabody’s revenue, especially in the post-pandemic recovery period.

U.S. Mining Operation: Peabody Energy’s U.S. mining operations primarily involve coal mining and distribution across several states.

Their U.S. mines are located in Alabama, Colorado, Illinois, Indiana, New Mexico, and Wyoming. The company’s largest operation in the U.S. is the North Antelope Rochelle Mine in Wyoming (part of the Powder River Basin region), which produced over 62 million tons of coal in 2023.

Peabody Energy focuses on providing coal for electricity generation and steel production. They also market, broker, and trade coal through offices in the U.S. and other countries.

Powder River Basin: The Powder River Basin (PRB) is a major coal-producing region in the United States, primarily located in northeastern Wyoming and southeastern Montana.

Here are some key points about the PRB:

- Coal Production: The PRB is known for its vast reserves of low-sulfur, sub-bituminous coal, which is highly sought after for electricity generation due to its cleaner-burning properties.

- Major Mines: The region is home to some of the largest coal mines in the world, including the North Antelope Rochelle Mine and the Black Thunder Mine.

- Geological Significance: The basin was formed during the Cretaceous period and contains significant coal deposits, as well as oil and natural gas resources.

- Economic Impact: Coal mining in the PRB plays a crucial role in the local economy, providing jobs and contributing to state and federal revenues through taxes and royalties.

Adjusted EBITDA: Adjusted EBITDA stands for Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization. It’s a financial metric used to evaluate a company’s operating performance.

Here’s a breakdown of what it includes and excludes:

- Earnings: The company’s net income.

- Before Interest: Excludes interest expenses.

- Taxes: Excludes tax expenses.

- Depreciation and Amortization: Excludes depreciation and amortization expenses, which are non-cash charges related to the reduction in the value of tangible and intangible assets over time.

- Adjusted: This means that it also excludes certain items that management believes are not reflective of the company’s core operating performance. These can include one-time charges, restructuring costs, litigation expenses, and other non-recurring items.

Essentially, adjusted EBITDA provides a clearer picture of a company’s recurring operating performance by removing the impact of non-operational and non-recurring items.

How Does Peabody Energy Generate Revenue?

Peabody Energy generates revenue primarily through the sale of coal. Their revenue streams are categorized into several segments:

- Seaborne Thermal Coal: This includes coal exported to international markets for electricity generation.

- Seaborne Metallurgical Coal: Coal exported for use in steel production.

- Powder River Basin Coal: Coal mined in the Powder River Basin region, mainly for U.S. electricity generation.

- Other U.S. Thermal Coal: Coal mined in other U.S. regions for domestic electricity generation.

- Corporate and Other: This includes ancillary services and trading activities.

In 2023, Peabody Energy generated a total revenue of approximately $4.95 billion.

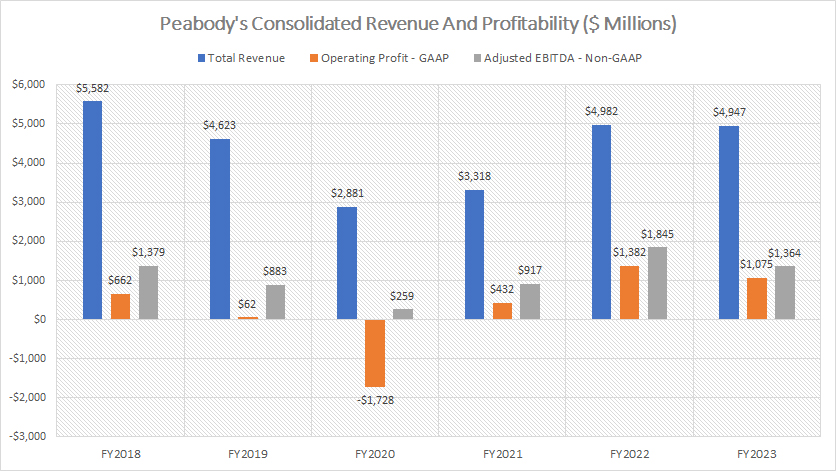

Peabody’s Consolidated Revenue And Profitability

Peabody consolidated revenue and profitability

(click image to enlarge)

You can find the definition of the adjusted EBITDA here: adjusted EBITDA.

Between fiscal 2017 and 2018, Peabody’s total revenue peaked at approximately $5.6 billion. However, the total revenue significantly declined to $2.9 billion in fiscal 2020, largely due to the COVID-19 pandemic.

In the post-pandemic period, Peabody’s total revenue recovered markedly, reaching nearly $5 billion by 2023. Throughout most fiscal years, Peabody Energy has been profitable, except for fiscal 2016 and 2020. Generally, the company has managed to generate positive operating income, hitting $1.1 billion in 2023.

Peabody has consistently reported positive adjusted EBITDA (a non-GAAP measure), reflecting the strong cash earnings generated by the company. In 2023, Peabody reported an adjusted EBITDA of $1.4 billion.

Peabody’s revenue and profitability have been on an upward trend post-pandemic, showcasing the company’s excellent business prospects in a post-pandemic world.

Several factors have led to the significant recovery of Peabody Energy’s revenue and profit post-pandemic. A notable factor includes Peabody’s continuous operational improvement. For example, Peabody has implemented cost-cutting measures and productivity improvements across its operations. This included lowering costs per ton in three out of four segments and creating a leaner corporate structure.

In addition, the company also undertook a comprehensive refinancing transaction that extended debt maturities and preserved operating liquidity. This helped stabilize the company’s financial position and allowed it to focus on operational recovery.

The global coal market recovery is another major factor contributing to Peabody’s improving sales and profitability post-pandemic. In this regard, the global economy has begun to recover from the pandemic, leading to increased demand for electricity and steel production. This, in turn, has boosted demand for Peabody’s coal.

The recovery of the coal market has also bolstered Peabody’s seaborne coal markets. Post-pandemic, seaborne thermal coal markets have shown signs of improvement, with higher prices and increased demand from key markets such as Asia and Europe. The colder weather in these regions has led to higher power generation and, consequently, increased demand for coal.

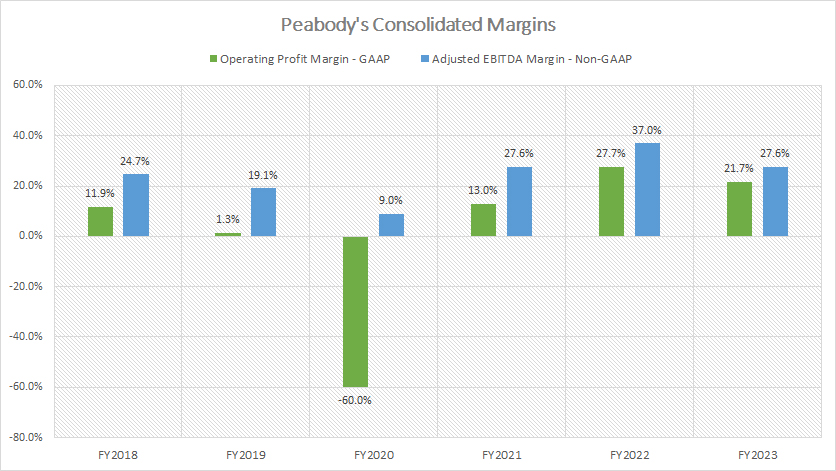

Peabody’s Consolidated Profit Margins

Peabody consolidated margins

(click image to enlarge)

You can find the definition of the adjusted EBITDA here: adjusted EBITDA.

Margin-wise, Peabody’s results had been quite disappointing in most fiscal years. For instance, the company had only managed to record an operating margin of slightly over 10% on a GAAP basis in most fiscal years.

However, since fiscal year 2020, Peabody’s operating margin has been a roll, reaching a record figure of 28% as of 2022 and topped 22% as of fiscal year 2023, illustrating the company’s increasing profitability in the post-pandemic period.

A similar trend applies to the company’s adjusted EBITDA margin, which recovered significantly after 2020, reaching 37% as of fiscal 2022 — a new high over the past seven years. However, in fiscal year 2023, Peabody Energy’s adjusted EBITDA margin declined to 28%, down from 37% the previous year.

On average, Peabody Energy’s operating margin hovered around 21% over the past three years, while the adjusted EBITDA margin averaged 31% during the same period. This trend highlights the coal miner’s consistent financial performance and solid cash earnings capabilities after the pandemic.

While Peabody Energy’s profit margins may not be as impressive as those of some industry leaders, they have been consistently positive, indicating that the company has been profitable. The recovery of the global coal market in recent years has certainly contributed to Peabody’s significant results.

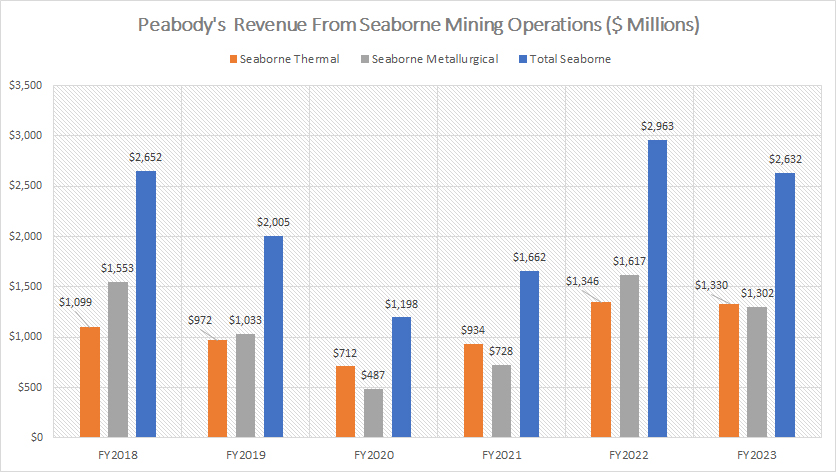

Peabody’s Revenue From Seaborne Mining Operations

Peabody revenue from seaborne mining operations

(click image to enlarge)

You can find the definition of Peabody’s seaborne mining operation here: seaborne mining operation.

Peabody’s seaborne mining operations are primarily located in Australia. Within these operations, Peabody mines two types of coal: thermal coal and metallurgical coal.

Historically, Peabody’s revenue from seaborne metallurgical coal has been slightly higher than from seaborne thermal coal. However, since fiscal 2020, following the pandemic, Peabody’s revenue from seaborne metallurgical mining operations has significantly recovered and overtaken that of thermal coal.

In fiscal 2022, Peabody’s metallurgical coal revenue surged to a record $1.6 billion, compared to $1.3 billion for seaborne thermal coal. In fiscal year 2023, Peabody’s metallurgical coal revenue totaled $1.3 billion, approximately equal to that of thermal coal.

Cumulatively, Peabody Energy’s total seaborne revenue was $2.6 billion in fiscal year 2023, slightly down from the $3.0 billion recorded in fiscal year 2022, but still one of the record figures after the pandemic since 2020.

Peabody’s seaborne mining operations have undeniably rebounded to their pre-pandemic performance, achieving revenues of $3 billion in 2022 and $2.6 billion in 2023. This recovery highlights the significant revenue contribution from these operations, largely fueled by the resurgence in global coal demand during the post-pandemic era.

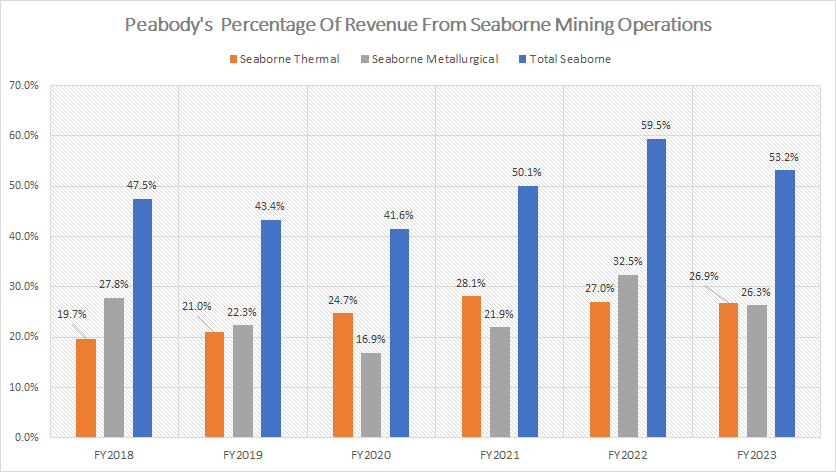

Peabody’s Percentage Of Revenue From Seaborne Mining Operations

Peabody percentage of revenue from seaborne mining operations

(click image to enlarge)

You can find the definition of Peabody’s seaborne mining operation here: seaborne mining operation.

Peabody’s revenue share from seaborne mining operations has significantly increased over the years, reaching a record 60% in fiscal year 2022. In fiscal year 2023, the revenue from seaborne mining operations comprised about 53% of the total, slightly lower than in 2022.

In terms of the breakdown within the seaborne sector, Peabody’s revenue from thermal and metallurgical coal accounted for nearly equal shares in fiscal year 2023, with thermal coal comprising 27% and metallurgical coal making up 26%.

Peabody’s revenue share from seaborne thermal coal has remained relatively stable, averaging around 27% over the past three years. However, the revenue share from seaborne metallurgical coal has significantly increased since fiscal year 2021, reaching an all-time high of 32.5% in fiscal year 2022. In fiscal year 2023, this revenue share declined slightly to 26%.

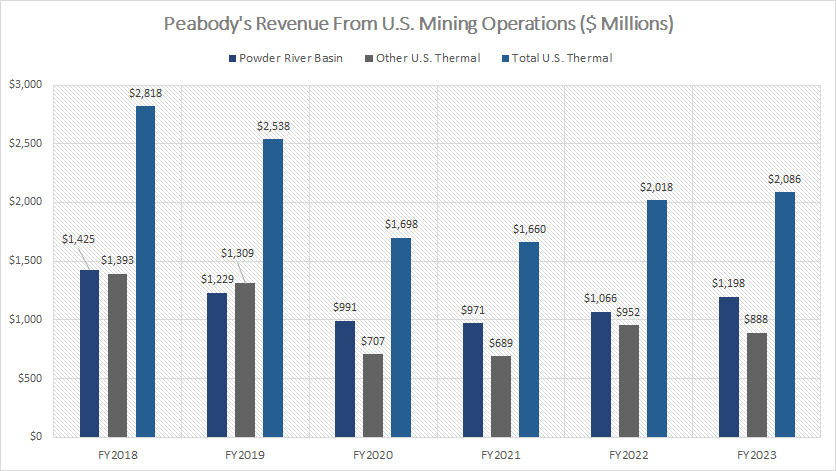

Peabody’s Revenue From U.S. Mining Operations

Peabody revenue from U.S. mining operations

(click image to enlarge)

Peabody’s U.S. mining operations are divided into 2 regions, namely Powder River Basin and other U.S. thermal. Other U.S. thermal mining operations are located primarily in the Western and Midwestern of the U.S.

You can find the definition of Peabody’s U.S. mining operation and Powder River Basin here: U.S. mining operation and Powder River Basin.

Peabody’s revenue from U.S. mining operations used to be much higher than that from seaborne mining operations. In fiscal year 2018, Peabody derived $2.8 billion in revenue from U.S. mining operations, compared to $2.7 billion from seaborne revenue, which we saw in previous paragraphs.

However, revenue from U.S. mining operations has steadily decreased, reaching just $2.1 billion in fiscal year 2023, as shown in the chart above. In contrast, Peabody’s seaborne mining operations generated $2.6 billion in revenue during the same fiscal year, significantly higher than that from U.S. mining operations, as seen in this section: seaborne revenue.

Within its U.S. mining operations, Peabody generates slightly higher revenue from the Powder River Basin segment compared to the other U.S. thermal segment. In fiscal year 2023, Peabody’s revenue from the Powder River Basin reached $1.2 billion, while revenue from the other U.S. thermal sector totaled $900 million.

A similar trend was observed in fiscal year 2022, where Peabody generated slightly higher revenue from the Powder River Basin segment compared to the other U.S. thermal segment. Specifically, Peabody’s revenue from the Powder River Basin reached $1.1 billion, while revenue from the other U.S. thermal segment totaled $1.0 billion.

A notable trend in Peabody’s revenue is the lower earnings from its U.S. mining operations compared to its seaborne counterparts. Several factors have contributed to this discrepancy.

For instance, coal has experienced stronger demand in international markets in recent years. In particular, there is higher demand for seaborne coal in regions like Asia and Europe, leading to increased sales and revenue from seaborne mining operations.

Additionally, the prices for seaborne coal, especially metallurgical coal used in steel production, tend to be higher than for domestic coal. This results in greater revenue per ton for seaborne coal.

Moreover, the U.S. has seen a decline in domestic demand for coal, primarily due to the increased use of natural gas and renewable energy sources. This has negatively impacted Peabody’s revenue from U.S. mining operations.

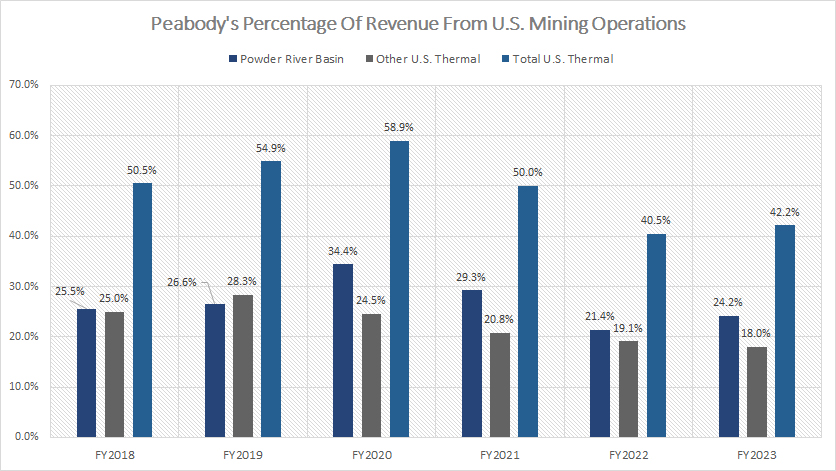

Peabody’s Percentage Of Revenue From U.S. Mining Operations

Peabody percentage of revenue from U.S. mining operations

(click image to enlarge)

Peabody’s U.S. mining operations are divided into 2 regions, namely Powder River Basin and other U.S. thermal. Other U.S. thermal mining operations are located primarily in the Western and Midwestern of the U.S.

You can find the definition of Peabody’s U.S. mining operation and Powder River Basin here: U.S. mining operation and Powder River Basin.

From a percentage standpoint, Peabody’s U.S. mining operations contributed a revenue share of about 42% of the total in fiscal year 2023. This ratio was slightly higher than the 40.5% recorded in previous year.

Compared to seaborne mining operations, the revenue share of Peabody’s U.S. mining operations is slightly lower, illustrating that Peabody’s international market has been more lucrative in recent years.

Within U.S. mining operations, Peabody’s revenue from the Powder River Basin contributed 24% of the total in fiscal year 2023, while the other U.S. thermal segment contributed 18% in the same period. In fiscal year 2022, revenue from the Powder River Basin made up 21.4% of the total, compared to 19.1% from the other U.S. thermal segment.

A significant trend is that the revenue share of Peabody’s U.S. mining operations has declined over the years, reaching one of the record lows of 42% as of fiscal year 2023, as depicted in the chart above.

As mentioned, several factors have contributed to this decline. A significant reason is the much stronger demand in international markets in recent years. Specifically, there has been higher demand for seaborne coal in regions like Asia and Europe, leading to increased sales and revenue from seaborne mining operations.

Additionally, metallurgical coal used in steel production tends to fetch a higher sale price than domestic coal. This results in greater revenue per ton for seaborne coal.

In recent years, the U.S. has seen a significant shift from coal to natural gas and renewable energy sources, which has negatively impacted Peabody’s revenue from U.S. mining operations.

Conclusion

Overall, the stronger demand and higher prices in international markets have led to higher revenue from Peabody’s seaborne mining operations compared to its U.S. mining operations.

Credits and References

1. All financial figures presented in this article were obtained and referenced from Peabody’s annual reports published on the company’s investor relations page: Peabody Investor Center.

2. Pixabay Images.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot guarantee the full correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor financial advice to purchase stock.

If you find the information in this article helpful, please consider sharing it on social media and providing a link back to this article from any website, so that more articles like this one can be created in the future.

Thank you!